Comments

- No comments found

Do you live in a condominium and are you worried about potential property damage?

Finding the answer will help you prepare a separate policy, such as earthquake insurance, in case a natural disaster causes severe damage and you don’t get coverage for condo insurance.

Condominium insurance or HO6 policy is a type of insurance that covers damage to your condo. This includes the condo’s outdoor features, grounds, and building. Think of it as similar to homeowners’ insurance. Having a HO6 policy is not mandatory. However, many mortgage lenders will not offer you a loan if you do not provide proof of condo insurance.

Your condo association will cover costs for damage to the unit’s exterior and shared amenities like gyms, tennis courts, swimming pools, or common areas, like the parking lot, elevator, lobby, and so on. Furthermore, while condo insurance pays for replacements or reparations of your possessions, your belongings don’t need to be inside your unit for coverage. You also get covered if your items get stolen from your car, hotel room, or storage unit.

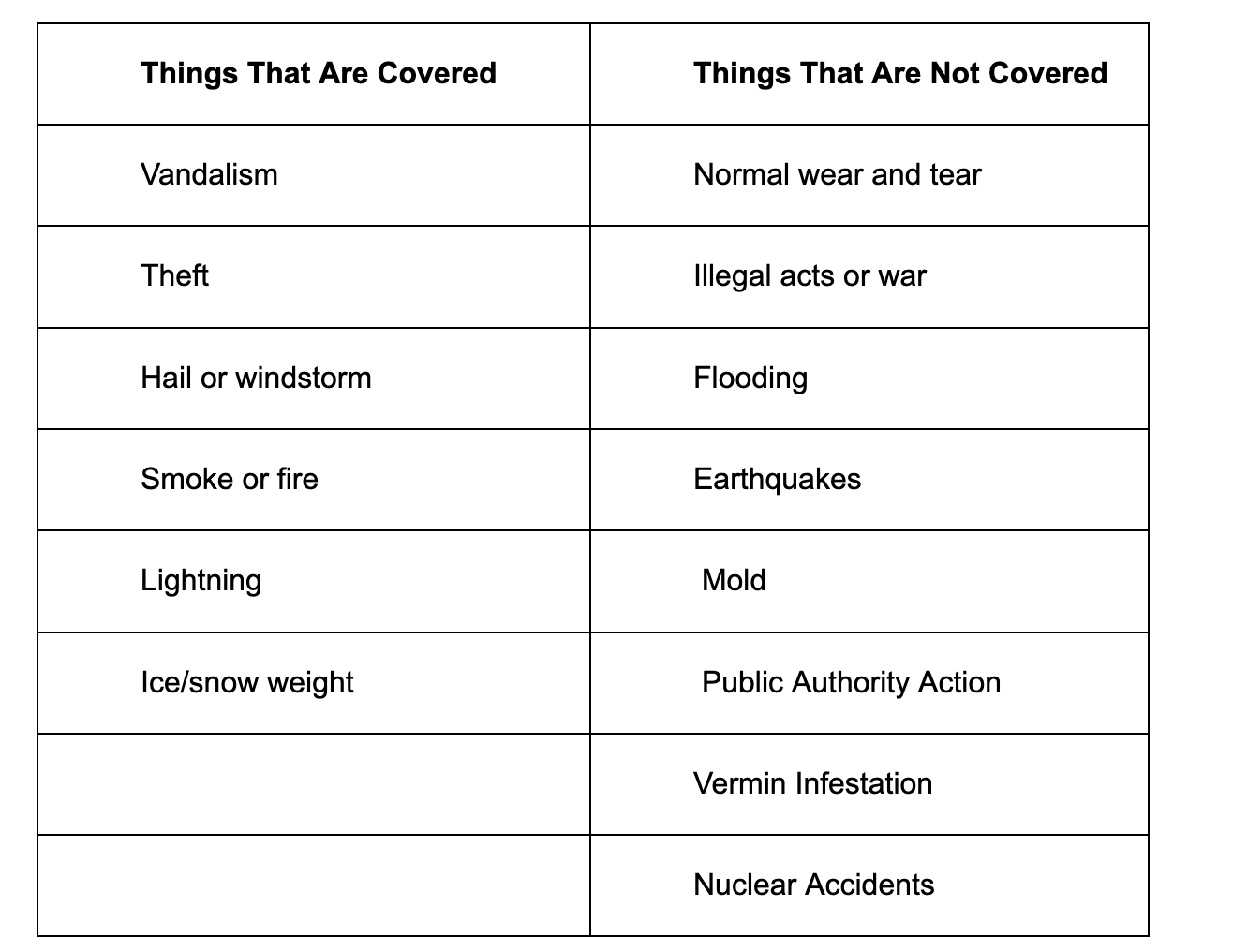

When it comes to situations where the loss, theft, or damage to your belongings isn’t covered, you will have to pay for them out of pocket unless you get separate insurance for those scenarios.

Let’s take a look at the events that your condo insurance doesn’t cover:

If you live in an earthquake-prone area, you’ll need a separate insurance policy for earthquakes. In this situation, you can opt for traditional earthquake insurance, which covers any damage resulting from this natural disaster. The value of the lost items will be assessed, and you’ll receive compensation for that specific amount.

If you live in an area that is at risk of nuclear accidents, nuclear plant companies should offer liability insurance. This helps reimburse any damage if a disaster occurs.

In areas prone to experiencing heavy rainfall and overflowing rivers and creeks, you need to look into an individual flood insurance policy. The good news is that you can get this additional insurance coverage from the Federal Emergency Management Agency.

Keep in mind that some policies do not cover floods and water damage caused by overflowing sump pumps, backed-up drains, or sewer lines. So, read the contract carefully and get an insurance policy offering optional coverage for this type of damage.

If you did anything illegal and a public authority must enter your condo, the condo association will not be responsible for any damage caused if the army or national officers must breach the home. So, it’s crucial to avoid getting involved in anything illegal, cooperate with the authorities, and not resist arrest.

As part of your agreement, it’s your responsibility to keep everything in good condition to prevent damage and extend the life of your belongings. This can easily be done through maintenance work.

For example, you can regularly clean the oven, refrigerator fan and coils, dryer vent, dishwasher filter, washing machine, and other appliance parts to prevent malfunctioning and increase lifespan.

The lack of coverage also applies to renovating your house because the interior has deteriorated. If you want condo renovations, you must pay for the work from your own pocket, so don’t rely on the policy.

Maintaining the overall good condition of the condo is your responsibility as the owner. When water damage is not properly dealt with, mold problems appear, making this your fault.

The same is true of vermin infestation. It generally occurs because of long-term buildups, and you are considered responsible for them. So, when you notice any mold or vermin, you should immediately fix the damage, and failing to do so will not grant you access to reimbursements.

Cyberattacks and identity theft are always a considerable risk. In this scenario, getting add-on insurance can help monitor your credit report for any fraudulent activity and notify you of any suspicious changes.

Even if your condo insurance covers some items in certain conditions, you should know that some policies also have limits. For instance, there may be restrictions on art, jewelry, and several other valuables. If your jewelry gets stolen and totals $13,000 in value, your policy may limit the coverage to $2,000, in which case $11,000 will not be covered.

Even if your condo insurance covers some items in certain conditions, you should know that some policies also have limits. If a pipe bursts in your condo and causes water damage, coverage is usually limited, with some insurance policies not covering the destruction in certain scenarios. While sudden damage is covered, you will not get reimbursed if the problem is caused by poor condo maintenance. Most policies could cover the damage caused by the water, but you’ll have to handle the cost of replacing the problematic pipe.

Similarly, limits exist for mass damage to buildings or areas in accidents such as fire or flood.

Your building could have $500,000 worth of damage and your condominium association's insurance may only cover $300,000. Condo owners will then have to pay the remaining amount themselves when rebuilding their condo.

In this case, there is also additional insurance that will cover the amount of damage that is not enough for you.

So, what do you do when you want to ensure full coverage for all types of damage in your condo? The answer is getting additional condo insurance for earthquakes, floods, and cyberattacks. Also, make sure you take care of your appliances in order to extend their life. Supplemental coverage will give you the financial security you need as you enjoy life in your apartment.

Leave your comments

Post comment as a guest