Comments

- No comments found

Big data mainly influences investment management via return predictions, volatility forecasts, market valuations and excess trading volumes.

The buzz around big data and its success stories have added enough to the technology’s credibility for asset managers to look at big data in investment as an effective technique to manage their portfolios.

Investment management refers to the handling of financial assets and other investments—not only buying and selling them. Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax services and duties, as well.

The financial sector, once skeptical about the use of technology to manage money, has now realized that big data analytics is more than just ‘educated guesses’. Decisions prescribed by big data analytics are a blend of mathematics and statistical models designed to predict the most probable future trends. Such insights into the forthcoming developments in markets are of immense value to asset managers who are now looking at the viability of big data in investment. Further, in this article, we analyze the role that big data will play in investment management and the prospects of big data in investment.

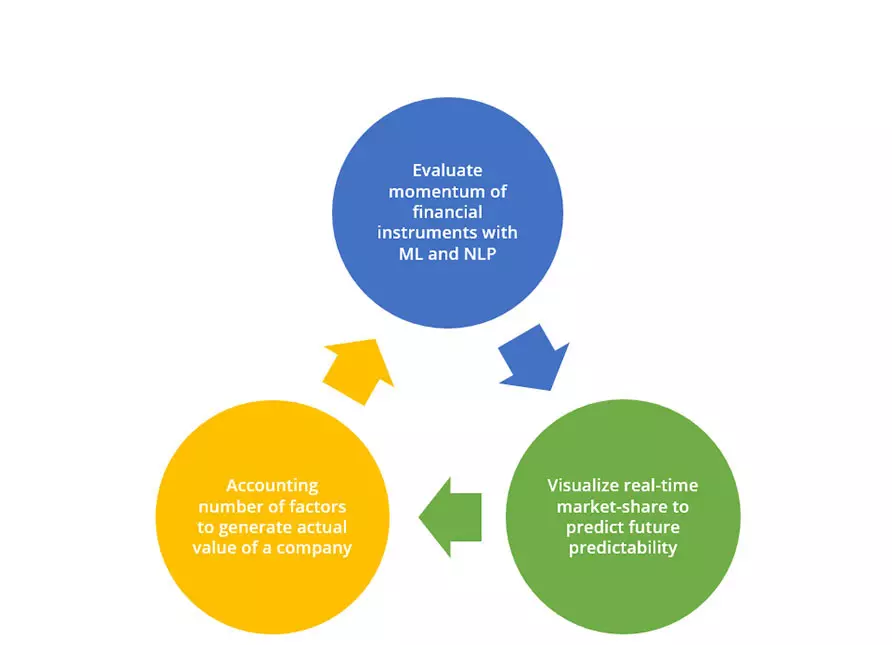

Big data tools can be designed to evaluate a financial instrument’s momentum based on factors that are difficult to take into account using conventional analysis. Much of the data that is very complex, such as email data, meeting notes, social media sentiments, and proprietary web content, hold immense weight in determining the momentum of stock prices. With machine learning and natural language processing applications, we can create structured datasets sourced from complex data. Big data analytics can then drive valuable insights from the structured data and volatile market variables to predict price movements.

Analysts today are aware of the fact that a company’s valuation depends on more than just it’s financial numbers and statements. Environment, corporate, and social factors have a growing influence on the company valuation. Big data techniques can bring into consideration large sets of data from social media, news, and events, and political factors while computing valuation of the business. These techniques could present the company valuation in real-time, based on the dynamic volatility of data at the source. These valuation figures can then be charted to point out profitable investment opportunities.

As e-commerce is gaining pace, web-traffic is becoming an important measure of market-share. More and more companies are increasing their reach of business by shifting business transactions online, either through an independent portal or a common payment gateway. Big data techniques can be used to analyze factors such as web-traffic more efficiently and help bring out accurate visualizations of real-time market-share. These models predict the future revenue patterns of a company and can thereby suggest profitable investments.

Industry-leading investment houses, such as Goldman Sachs, have recognized that big data can play a role in investment. They are now looking at data sources that can provide them with reliable information about markets across the globe. The asset managers at Goldman Sachs are leveraging big data techniques to gain an intellectual edge in emerging markets without having to employ local analysts in different countries. However, despite employing algorithms to analyze markets, Goldman Sachs does not let computers shoot trade by themselves. Portfolio managers are still taking insights from big data applications as prescriptions and then determining the profitability of an investment advice based on their own market experience and knowledge.

In conclusion, big data in investment is currently being adopted as a predictive tool to help asset managers make wiser decisions than before.

However, shortly, we can expect certain funds that rely entirely on big data recommendations.

It will be interesting to see how these funds fare in the market and the effect they will have on the market.

Naveen is the Founder and CEO of Allerin, a software solutions provider that delivers innovative and agile solutions that enable to automate, inspire and impress. He is a seasoned professional with more than 20 years of experience, with extensive experience in customizing open source products for cost optimizations of large scale IT deployment. He is currently working on Internet of Things solutions with Big Data Analytics. Naveen completed his programming qualifications in various Indian institutes.

Leave your comments

Post comment as a guest