At first glance, it would appear that the climate for investing in Asia is not favorable.

Overseas funds are pulling out of six major Asian emerging equity markets at a pace unseen since the global financial crisis of 2008 – withdrawing US$19 billion from India, Indonesia, the Philippines, South Korea, Taiwan and Thailand so far this year, according to data compiled by Bloomberg.

However, many emerging-market investors and analysts have praised Asian economic fundamentals, pointing to world-leading growth rates and political stability. There is a good reason to be optimistic: Bank of America Merrill Lynch expects some of the regional currencies, including the baht and the Philippine peso, to appreciate slightly by the end of the year. Six of 10 best-performing emerging currencies so far this year are in Asia

“What investors are missing is that an environment of slow growth in rate increases in the US, combined with a fair level of economic growth in Asia, provides a positive backdrop for investment [in Asia],” says Ms Virginie Maisonneuve, former Chief Investment Officer at Eastspring, the Asian asset management business of insurer Prudential. Ms Maisonneuve was responsible for all of its investment capabilities, its dealing function and the client portfolio management team.

“In Asia, we're seeing opportunities not only in private equity but also in infrastructure. Another area to pay attention to is multi-asset … Countries and sectors that offer value are China and South Korea, and we see financials across the Asia-Pacific-ex Japan region as attractively valued (sector trading at 1.6 times price-to-book ratio).”

There are three major things to consider when you want to choose Asia to set up your business: talent, consumer product and services, and innovation. Access to human resources is another major reason to consider. In Asia, it is relatively easier to find new and younger talent. We also see the growth of the trend to access venture capital and wealthy company offices.

The growth of the middle class in Asia is extremely high. It grows more rapidly than it is in the western countries. The birth rate in Asia is also higher. That said, the consumption in Asia is higher than it is in the western countries.

These days in Asia, middle-class has more money to fund a start-up in innovation as the younger generation taking over the workforce is more innovative and think out of the box.

Another major factor is millennials, a generation to whom we are seeing huge assets being transferred.

It’s estimated the total wealth amassed by high-net-worth individuals was US$58.7 trillion, with the largest share from Asia-Pacific individuals, placing them in a good position to make a positive impact.

Millennials compose an increasingly large part of the working population and 58 percent of them are based in Asia. This team-oriented generation wants to work for and invest in companies they believe are doing good. There is a growing trend where the next generation of high-net-worth individuals actively contribute to the social enterprise and philanthropic scene in Asia.

The philanthropic impulse in this generation looks like one that will persist. For evidence of this, we can look at events such as the second annual Unleash Innovation Lab, a gathering of aspiring entrepreneurs at Nanyang Technological University's The Wave sports hall, Singapore. The conference saw a thousand millennials aged 19 to 35 from 106 countries come up with innovative solutions to global issues like climate change, economic inequality and sustainable consumption.

Family is another factor behind the younger Asian generation's desire to do good. "Family philanthropy can help to foster family cohesion while instilling the family's values over the generations," said Ms Susan Sy, head of philanthropy advisory for South-east Asia at UBS Global Wealth Management.

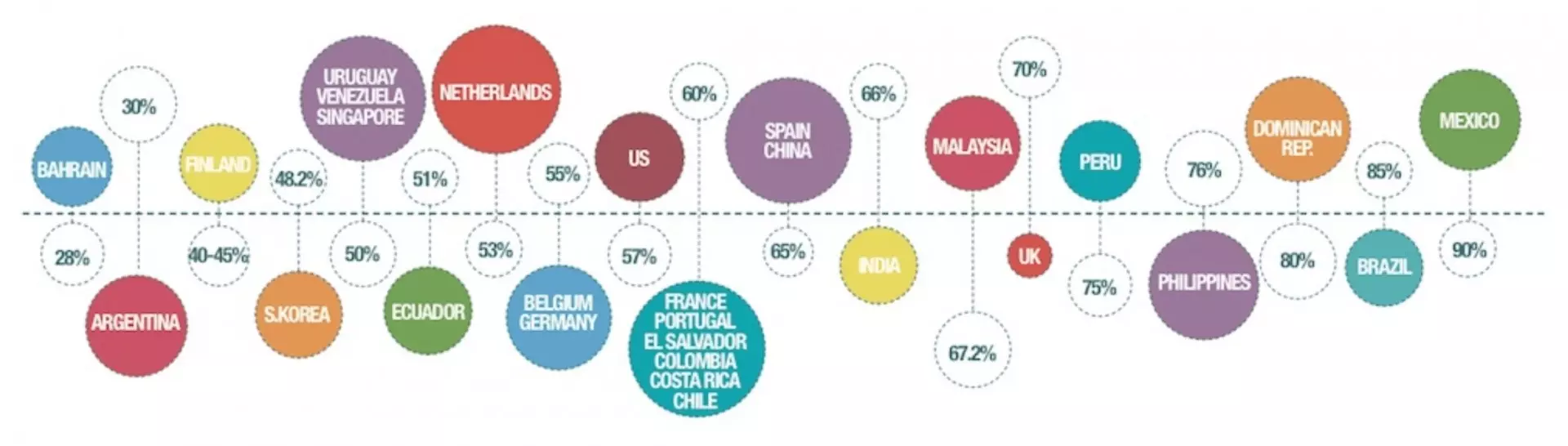

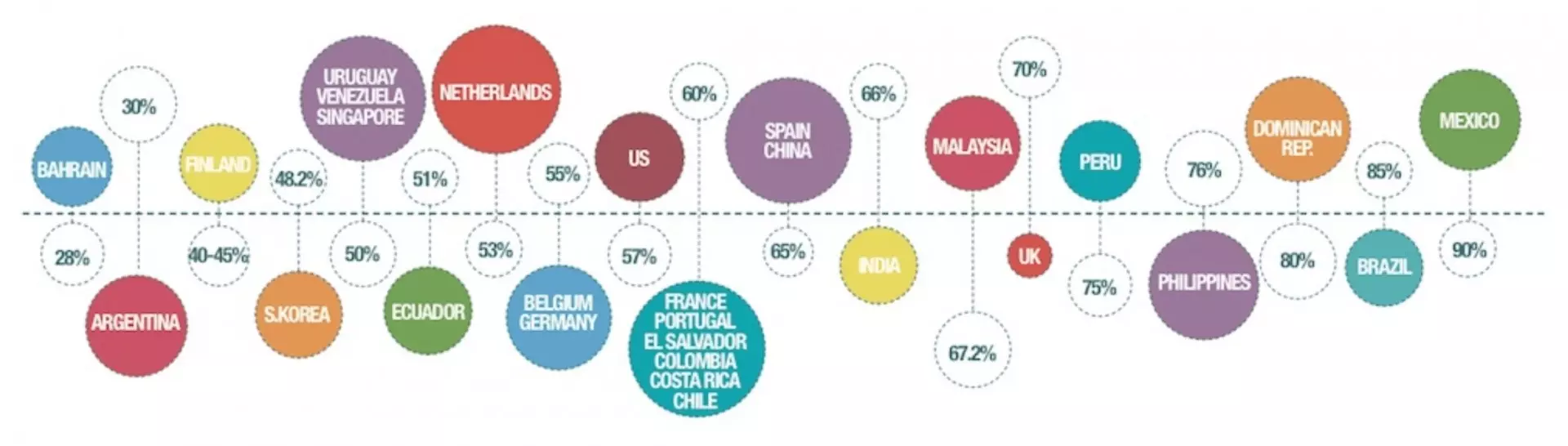

Above is the percentage of the workforce employed by family businesses

Family businesses are also deep-rooted in Asian cultures with Japan having the oldest family business in the world, presently run by the 40th generation. This region also boasts of a high concentration of family businesses at about 85 percent. These family businesses contribute 34 per cent to the Asian GDP by employing 57 per cent of the workforce. Two-thirds of India’s GDP and 90 per cent of the gross industry output are contributed by family business in India.

Certain technology and innovation embraced faster in Asia as there is no infrastructure issue. It is also important to focus on Asia's ability to benefit from the shifts in the use of artificial intelligence (AI) in specific sectors as it is key to its long-term competitiveness beyond current trade frictions. With China positioned to be a strong leader in this space, the region should be well placed overall.

Through innovation, firms are able to create entirely new products or services that catapult them to a category of high-growth companies with an opportunity to be market leaders giving them a competitive advantage if the competitors are unable to keep pace with them. Age of the firm plays a significant role towards the tendency to be innovative. Since innovation is an important strategy to grow and to gain competitive advantage, all firms choose this strategy, albeit, at varying degrees of intensity. Although there is a general belief that younger firms do not have the capacity to innovate when compared to older firms, it is seen in several studies that younger firms undertake greater risks to be more innovative compared to older firms.

More things to consider are the culture, how people negotiate and what they care about. Different countries have a different perspective on things they value. For instance, in China, the priority goes from price to value to relationship. In Indonesia, it goes from relationship to price to value. The Japanese do well in Indonesia because they have the similar mindset. It is all about trust and the relationship you've built with the people you know.

People in the US have a different mindset where the priority is value then relationship then price. Price is not the most important. It is more about the value. People pay more for quality. They have somebody they trust to negotiate.

Many eastern countries want to enter the western market by offering higher quality product and services. India operates in the western world to achieve profit. However, the complexity is when US-based companies have to abide by the local law.

There are plentiful opportunities here in Asia ripe for the picking. Taken from the Enterprise Singapore site:

Enterprise Singapore sees opportunities for Singapore companies in three categories:

- First, in platforms: e-commerce marketplaces have grabbed most of the attention but other verticals, such as education, entertainment and healthcare, remain underdeveloped.

- Second, in supporting services: online commerce and services require many of the same services as the real economy. These include payments, insurance, logistics and fulfillment, fraud detection, marketing and customer service.

- Third, in supporting infrastructure: the digital economy depends on many brick & mortar services, such as fulfillment centres for e-commerce, data centres and logistics infrastructure.

But what opportunities exist? Are they opportunities worth pursuing? Is there a gap in spending, resources, technology? Not enough cyber talent, technological innovation. Enterprise Singapore and Entrepass, as well as other sources of grant money, support Singapore is quickly becoming an innovation hub within the the region, but you need someone on the ground who understand the culture and has existing knowledge.

Leave your comments

Post comment as a guest