Comments

- No comments found

To discover the ideal time to initiate a trade and timeframe to trading currencies, FX traders employ a range of tactics and approaches apart from grasping the essentials of learning various forex definitions.

Market researchers and investors are continually refining and enhancing tactics in order to develop new methodological approaches for analysing foreign market fluctuations. Various trading strategies are determined by the timeline and duration of the trade. As a consequence, time is always a major concern when trading forex, and it is an important factor that new traders usually overlook. Position leverage, the complexities of various currency pairings, and the implications of anticipated and unexpected media releases in the market are just a few of the examples.

Source: IG

Day trading is the technique of initiating and exiting a position in a given marketplace during a single session. Day traders take positions and exit them on the same day, eliminating the chance of crucial overnight fluctuations. They end their trade with a specified price at the conclusion of the day. Because trades are typically held for hours or minutes, enough time is required to study the markets and check holdings periodically during the day. Day traders, like scalpers, rely on numerous tiny profits to gain profits.

The trader's vulnerability to greater systemic risk is limited by day trading. Furthermore, because trades are not carried through the daily FX closure, there are no rollover expenses. Day trading techniques are less expensive to execute since stop losses are much lower than multi-day approaches.

The trader is prone to intraday turbulence during day trading. Short-term instability can be influenced by current events or anticipated economic figures, resulting in unforeseen losses.

Source: Visual Capitalist

Position trading is a long-term approach that might take several weeks, days or even years to implement. Long-term macroeconomic patterns of distinct economies are frequently used by position traders to develop their tactics. They also use low leverage and small transaction sizes in the hopes of benefitting from huge price fluctuations over time. The position trade can be placed in any of the primary liquid currencies due to the wide range of factors. Many G7 currencies, along with emerging market favourites, are included in this category.

To determine optimal entry and exit positions, such traders are much more prone to use fundamental analysis in conjunction with technical analysis. This sort of trading may need higher tolerance and endurance on the part of traders, and it may not be suitable for people looking to make a quick gain in a day-trading environment.

Since the trader is positioned to profit from significant trends, position trading has the opportunity to generate revenue. The trader is primarily interested in the market's macro trend, not in short-term price volatility. To retain profitability with this trading strategy, both entry and exit positions do not have to be accurate.

Position trading techniques need the trader holding open positions for a long time. This takes up risking investment, raising the opportunity cost of the transaction.

Source: Trading Startegy Guides

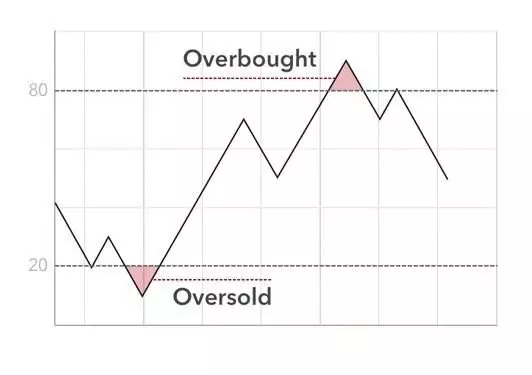

Scalping is an intraday trading method that tries to generate profitable profit margins by taking tiny profits repeatedly. Trades are carried out following a strict structure meant to protect an edge's integrity. Financial exposure and systemic risk are controlled by regularly applying a competitive edge on limited periods.

Scalping tactics involve the implementation of tight stop losses, removing the likelihood of financial disaster.

Order slippage is increased by the use of tiny profit objectives and tight stop losses.

Source: BabyPips

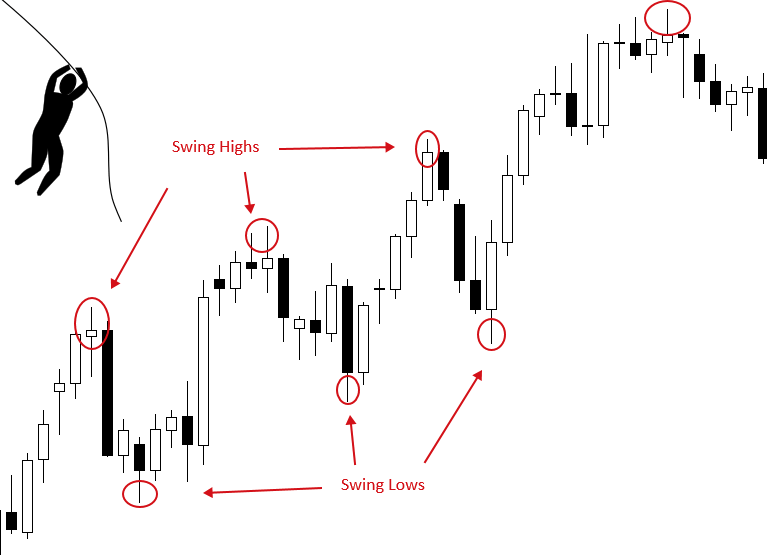

Unlike day traders, swing traders seek to benefit from a market opening by expecting a shift in direction to assist their position. Swing traders will seek to profit on swings or highs and lows of the prices over a prolonged period of time. This is done to eliminate some of the unpredictable price changes that might occur in intraday trading.

Swing trading techniques allow traders to remain in the market amid intraday fluctuations.

Swing trades are much more costly since stop losses are substantially larger than in intraday techniques.

To choose an FX trading approach effectively, one must first perform a thorough and honest self-assessment. One’s level of expertise, resource availability, and key goals are among the most notable considerations to be successful in forex.

Leave your comments

Post comment as a guest