Comments

- No comments found

The near-collapse of algorithmic stablecoin TerraUSD is just one more example of crypto-based financial alchemy doomed to failure and why DeFi returns are anything but “riskless.”

There are no two more sexy words to an investor than “passive income,” except perhaps for “risk-free returns,” though technically the latter is three words (to be pedantic).

Which is why Luna, UST and Anchor Protocol rode a wave of speculation to become multi-billion dollar cryptocurrency projects with marquee backers.

Both “passive income” and “risk-free returns” were being touted by a combination of Terraform Labs, Anchor Protocol and TerraUSD, which were all “coincidentally” owned, created and run by the same people.

To understand what’s been keeping the crypto-set up at night these past weeks, it’s first necessary to understand what stablecoins are and the role they play in the cryptocurrency industry.

Early on in the development of cryptocurrencies, price volatility made it impractical for traders to hold on to them when waiting for fresh opportunities to re-enter the market.

At the time, there were few practical and expeditious fiat currency rails to enter and exit cryptocurrency trades easily, which is where the initial demand for stablecoins came about.

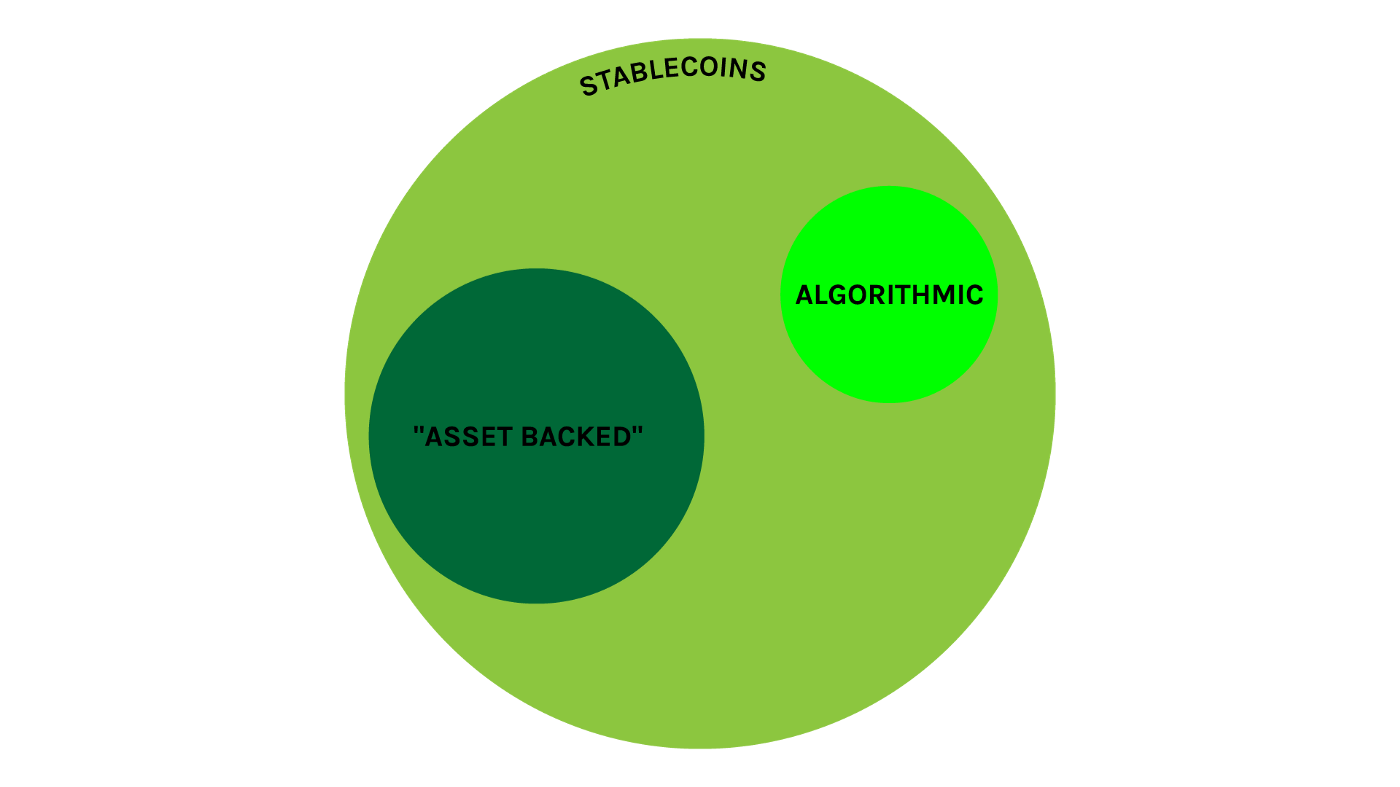

All “asset backed” and “algorithmic” stablecoins are stablecoins, but “asset backed” and “algorithmic” stablecoins are mutually exclusive.

The first stablecoin ever created was Tether, or USDT, which became an overnight hit for traders looking for a respite from the volatility of cryptocurrencies.

While it’s beyond the scope of this article to discuss the controversies surrounding Tether, of which there are plenty, in a nutshell, USDT promised to be backed 1-to-1 by dollars in a bank account.

Anyone holding USDT could swap their USDT for “real” dollars whenever they wanted to, but in practice, would use it to buy more cryptocurrencies or sell the USDT to other cryptocurrency traders who wanted it.

USDT falls under the category of stablecoins that are “asset backed” and the inverted commas is intentional, because it’s not at all clear that USDT is backed 100 cents in the dollar.

Other stablecoin issuers soon followed, including USDT’s main rival, USDC, which is run by Circle and has audited dollar deposits in a bank account.

Without a digital dollar issued by the U.S. Federal Reserve, these “asset backed” stablecoins became the backbone of cryptocurrency trading, forming the most common trading pairs with other tokens.

But “asset backed” stablecoins are anathema to blockchain purists, for whom decentralization is everything.

Because “asset backed” stablecoins are usually issued by a centralized entity like a company or cryptocurrency exchange, they are thought to be more susceptible to interference, especially by government authorities.

Enter the algorithmic stablecoin.

An algorithmic stablecoin works on the basis that instead of relying on a centralized intermediary to issue a stablecoin backed by assets, smart contracts can be used to achieve the same effect..

The principle behind algorithmic stablecoins is simple.

A decentralized blockchain protocol will issue an algorithmic stablecoin whose value is pegged 1-to-1 with something like the U.S. dollar, but underlying that algorithmic stablecoin will be another cryptocurrency or combination of cryptocurrencies.

The other cryptocurrency will have a variable value and trade freely in the open market, except that smart contracts will automatically manage the supply and demand of that cryptocurrency to attempt to maintain the algorithmic stablecoin’s fixed peg.

Trying to maintain a fixed peg with a floating underlying asset isn’t new — countries have been messing around with their national currencies for years to attempt to achieve very much the same thing.

During the 1997 Asian Financial Crisis, Thailand, Indonesia and South Korea, all of which were cesspools of crony capitalism at the time (and to some extent still are), maintained fixed exchange rates with the dollar, while nursing massive current account deficits.

These fixed pegs encouraged Thai, Indonesian and South Korean borrowing, leading to excessive exposure to foreign exchange risk.

Because these pegs were artificially maintained, they were prime targets for an attack and hedge funds bet that the central banks of these countries didn’t have enough to keep supporting these fixed pegs.

Basically, these central banks would borrow in dollars to buy back their own currencies to prop up the value of their currencies to maintain the peg.

Ultimately, the Thai baht, Indonesian rupiah and South Korean won all but collapsed in the wake of assaults on their currencies and the International Monetary Fund stepped in to initiate a US$40 billion program to stabilize these currencies.

At its core, the value of a currency relative to another is a function of a multitude of factors, including that country’s interest rates, economic stock and political stability.

By artificially maintaining a fixed peg with a currency like the dollar, Thailand, Indonesia and South Korea were effectively painting themselves into a corner, and these pegs would eventually break when their central banks ran out of other currencies to fix those pegs.

History is replete with examples of countries artificially attempting to maintain fixed pegs with another currency, only to clean out their coffers in the process and not all of them were flaky emerging markets.

In 1992, the United Kingdom maintained a fixed peg between the pound and Germany’s deutsche mark under the Exchange Rate Mechanism (ERM), even though the monetary policies needed by both countries was dramatically different.

The U.K. was coming out of a recession and needed a loose monetary policy and low interest rates to stimulate growth, but these were artificially held high to maintain the pound’s peg as Germany, which was staving off high inflation, kept borrowing costs elevated.

By the spring of 1992, it became apparent to many currency traders that the U.K. didn’t have enough resources to keep the pound artificially high to and the massive selloff in pounds forced a painful devaluation.

Algorithmic stablecoins attempt to do what whole countries with their entire economic stock haven’t been able to — create a fixed peg with a floating underlying.

The mechanics behind TerraUSD are similar to many other algorithmic stablecoins and nothing short of financial alchemy — the equivalent of smelting copper into gold.

TerraUSD (UST) maintains its 1-to-1 peg with the dollar through an underlying cryptocurrency Luna, both of which are issued by Terraform Labs.

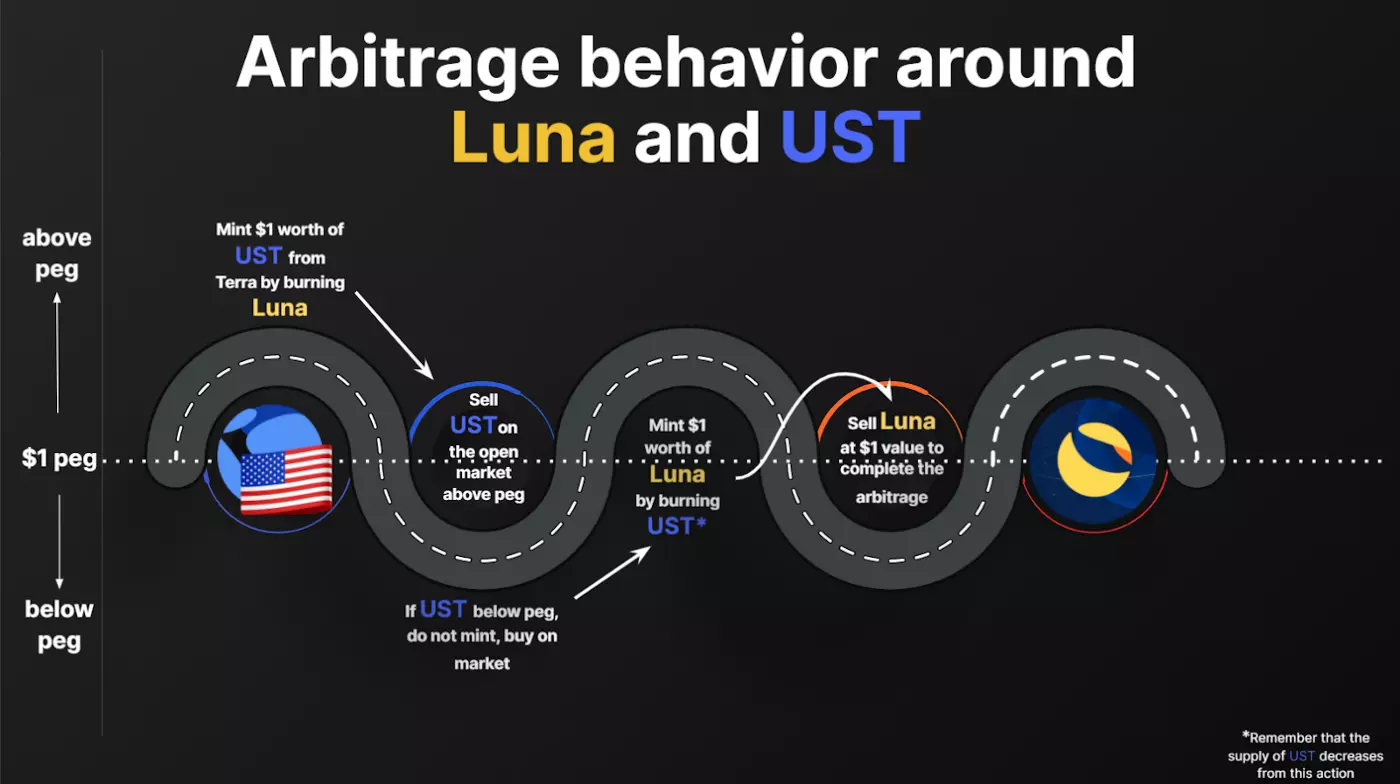

If UST falls below US$1, arbitrageurs (automated and human) are incentivized to swap UST for US$1 worth of Luna, which removes UST from circulation in an attempt to increase its price and recover the peg.

Conversely, if the price of UST goes above US$1, these same arbitrageurs act in reverse, removing Luna tokens from circulation and swapping them to new units of UST.

But wait, there’s more.

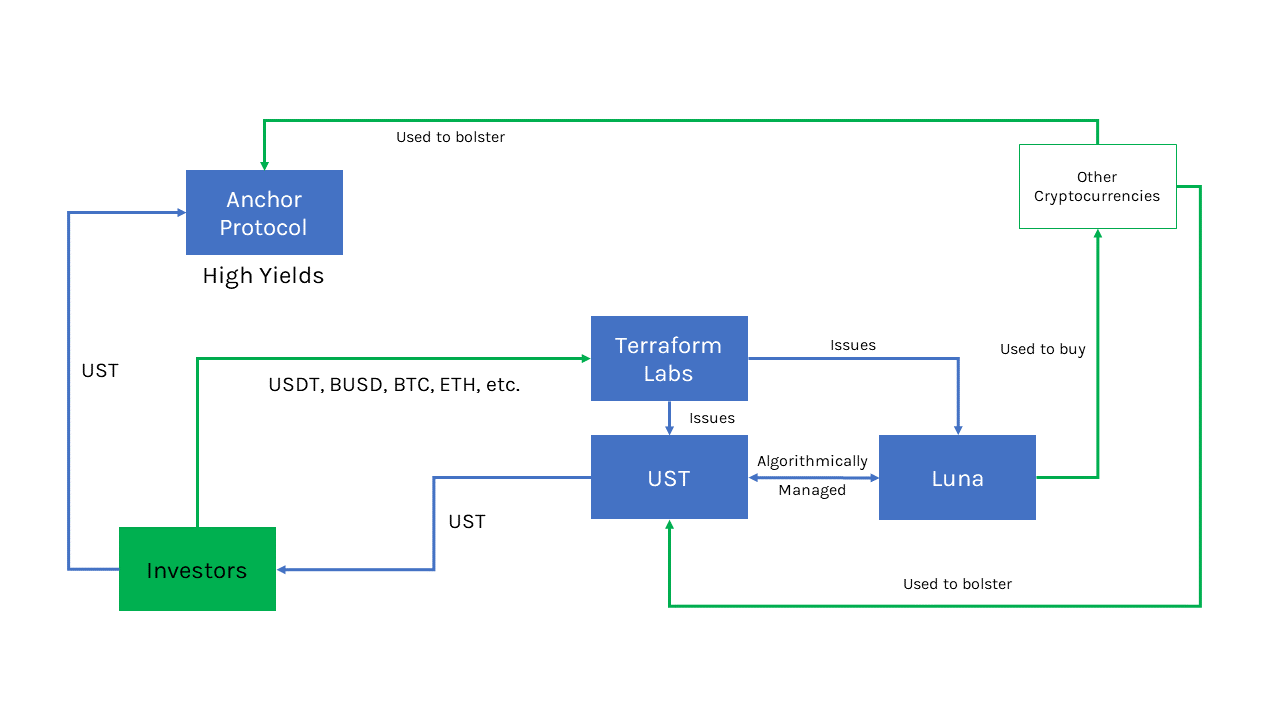

To generate demand for UST, Anchor Protocol (which is also owned by Terraform Labs) offered ridiculous yields of almost 20% on UST deposits on its decentralized lending platform.

By enticing investors with such high yields (typical dollar bank deposits provide less than 1% of interest) Anchor Protocol would stoke demand for UST, a stablecoin with over US$18 billion in market cap (at the time).

For every new UST created, US$1 worth of Luna tokens would be taken out of circulation, or “burned” to use crypto parlance.

As demand for UST increases, more Luna would be taken out of circulation which would in theory help its price to increase because you can always redeem UST for Luna.

If Luna’s price is $50, then anyone can redeem it for 50 UST. Similarly, 50 UST can be redeemed for 1 Luna (Note: Not 50 Luna — Luna’s price is variable).

How Anchor Protocol pays such high yields is by lending UST to borrowers, as well as through staking rewards on its collateral.

But in March, it was noticed that Anchor Protocol was depleting its yield reserves at a faster pace to pay out its promised yields — demand exceeded the reserves available to pay out those yields.

In the same way that investors are drawn to a Ponzi scheme from the high regular payouts that eventually run out, depositors were drawn to Anchor Protocol to deposit UST, to earn those high yields.

Remember, the blockchain is transparent, so investors can see what’s left in smart contracts to pay out yield and concerns that Anchor Protocol’s reserves would be depleted were soon met with a US$450 million injection of UST.

But where did that UST come from?

By Terraform Labs and its partners converting Luna to UST of course, in other words, taking from something that was “created” to pay off something that never existed (the yields).

Confused?

Terraform Labs creates demand for UST through the Anchor Protocol, by offering high yields (almost 20%) on UST deposits.

This demand for UST indirectly increases demand for Luna by reducing the amount of circulation of Luna because the more UST there is, the less Luna there is.

Enter the speculators.

Since 1 UST will always buy you $1 worth of Luna, speculators are betting that as demand for UST increases, the amount of Luna available decreases, which ought to increase its price.

The problem of course is when Terraform Labs and its partners uses some of that Luna to swap into UST or buy other cryptocurrencies to shore up reserves in Anchor Protocol.

Swapping Luna for UST or using it to buy Bitcoin to pay off the yields of Anchor Protocol is exactly what it sounds like — a Ponzi scheme.

Even Do Kwon, the man behind Terraform Labs alluded to Luna and UST’s “Ponzi-esque” qualities.

Speaking with Bloomberg, Kwon noted,

“If UST were to keep growing, LUNA price has to higher than now.”

Which begs the question, “why?”

Why does Luna’s price need to be higher?

To support demand for UST of course.

The higher Luna’s price, the less is needed to swap for UST to pay out those insane yields on Anchor Protocol out of the Anchor Protocol Reserve.

Because if Anchor Protocol lowers its yields on UST deposits, demand for UST would fall (there is hardly any organic demand for UST outside of earning unrealistic yields on Anchor) and if demand for UST falls, it could slip its peg.

If UST slips its peg, the price of Luna would then fall, because arbitrageurs would swap UST for Luna and then sell Luna to realize the arbitrage — a self-perpetuating downwards spiral.

And if all of this sounds like a Ponzi scheme, that’s because it was structured as one from the very beginning (hopefully unintentionally).

In mid-March, a US$1 billion Luna token sale was undertaken to acquire Bitcoin for UST’s reserves, on top of indications that those reserves could grow to include US$10 billion worth of Bitcoin.

But why would an algorithmic stablecoin need reserves when it’s not an “asset backed” stablecoin?

Kwon himself proffered an explanation to Bloomberg,

“Having third party reserve assets to meet short-term demand in redemption of UST can be quite valuable.”

Why the need for third party assets?

Because there’s only so much Luna that can be conjured out of thin air to buy other more valuable cryptocurrencies before uncomfortable questions about Luna’s inherent value (there is none) start being raised.

Legendary investor Warren Buffett once famously said,

“Only when the tide goes out do you discover who’s been swimming naked.”

The same way that the 2008 Financial Crisis exposed Bernard Madoff’s US$65 billion Ponzi scheme, the past few weeks have done the same for UST, Anchor Protocol and Luna, culminating over the last weekend.

As financial markets got roiled, cryptocurrencies were hit hard and as Luna slid in value, a classic run on UST was all but inevitable and the algorithmic “stablecoin” (parenthesis mine) lost its dollar peg.

The death spiral looked something like this:

A broader bear market lead to a selloff in Luna.

UST holders fear a peg break, regardless of Anchor Protocol’s yields and so they start to sell their UST, forcing the algorithms to mint more Luna at a time when the market is already bearish.

Too many sellers find too few buyers and Luna loses its value.

Because UST derives its value from Luna, it loses its peg even further, forcing more Luna to be minted.

Ad infinitum until both UST and Luna go to zero except for the Luna Foundation Guard.

As Luna fell and UST slipped its peg, Kwon and the Luna Foundation Guard (because only something that sounds like a Marvel franchise will save Luna now), a consortium of the biggest cryptocurrency players including Jump Crypto, Three Arrows and Defiance, intervened to shore up Luna and UST.

Instead of being required to mint Luna to arbitrage UST’s price, there was now the option to swap UST to Bitcoin instead, but that just adds fuel to the fire.

Bitcoin itself is volatile and adding it to the reserves to prop up UST would just take the rest of the cryptocurrency market down with Luna, UST and Anchor Protocol.

Because that gives the impression that the yields at Anchor Protocol are sustainable (they are not) and more UST chases more unsustainable yields, which needs Terraform Labs to raise more investment to prop up the scheme.

At its lowest point this past week, UST, the supposed “stablecoin,” was trading at US$0.225.

In a nutshell, UST is an algorithmic stablecoin backed by Luna, but Luna itself is backed by nothing other than speculation that demand for this token will exceed supply.

The goal of Terraform Labs of course was that UST would take off as a widely used stablecoin well before the Luna Foundation Guard or other superheroes of the cryptoverse ran out of money to support it.

Luna and UST are being propped up by Bitcoin and other cryptocurrencies which Terraform Lab’s founders and closest associates purchased with the Luna that they printed out of thin air, paid for by Luna speculators.

In other words, using new investor monies to pay off other investor’s returns by way of Anchor Protocol’s yields.

Yeah, probably not a Ponzi scheme.

Disclaimer: This article is for informational purposes only and does not constitute a recommendation or investment advice. You should not construe any such information or other material as legal, tax, investment, trading, financial, or other advice. Please seek a professional financial advisor before making any investment decision. We are not responsible for and do not endorse or accept any responsibility for the availability, contents, products, services or use of any third party website as stated in our privacy policy.

Patrick is an innovative entrepreneur and a lawyer passionate about cryptocurrencies and the business world. He is the CEO of Novum Global Technologies, a cryptocurrency quantitative trading firm. He understands the business concerns of founders and business people helping them to utilise the legal framework to structure their companies to take advantage of emerging technologies such as the blockchain in order to reach greater heights. His passion for travel, marketing and brand building has led him across careers and continents. He read law at the National University of Singapore and graduated with Honors in the Upper Division and joined one of Singapore’s top law firms, Allen & Gledhill where he was called to the Singapore Bar as an Advocate & Solicitor in 2005. He created Purer Skin, a skincare and inner beauty company which melds the traditional wisdom of ancient Asian ingredients such as Bird's Nest with modern technology. In 2010, his partner and himself successfully raised $589,000 from the National Research Foundation of Singapore under the Prime Minister’s Office. He has played a key role in the growth of Purer Skin from 11 retail points in Singapore to over 755 retail points in Singapore and 2 overseas in less than a year. He taught himself graphic design, coding, website design and video editing to create the Purer Skin brand and finished his training at a leading Digital Media Company.

Leave your comments

Post comment as a guest