Comments (3)

Beth Foreman

Very interesting, thanks for sharing

Joey Hasslinger

Good analysis

Sarah Readshaw

Must read

Over the past few months I revisited nearly everything I thought I knew about money and banking, and in particular, central banks. There are lots of strong opinions with respect to how and why they impact the investment markets and economy. As a macro-minded investor, these are crucial issues. As an Integrating Investor, there was only one way to get my arms around it—to dig in. I found that the Federal Reserve’s (Fed) impact is more indirect than I previously believed. Surprisingly, both Austrian and Keynesian perspectives support this.

In Part 1 of this series I presented an Austrian-inspired view of banking. I described lending decisions as occurring on a micro-level. Hence, a top-down approach to monetary policy is significantly, informationally disadvantaged and impossibly doomed. In Part 2, I incorporated Hyman Minsky’s and L. Randall Wray’s—post-Keynesians—work into that perspective. I found that the Fed doesn’t create money; only private banks can. I also re-conceptualized banking as a carry trade.

Despite conflicting in many ways, both economic schools of thought acknowledge that a central monetary authority is irrelevant with respect to money creation. Combining them shows that profit motives and risk tolerances of private bankers interacting with businessmen, entrepreneurs, and citizens drive the economy and money supply.

This begs the questions: If the Fed doesn’t print money, what on earth does it do? What’s the connection to higher leverage levels? And most importantly, should I even care as an investor?

Piecing it all together, I found a link between the Fed, fiat currency, and elevated leverage. While it’s far from a proof, there is a logical thread: Cheap liquidity.

(Those interested in skipping straight to the punchline can click here.)

The Fed doesn’t create money; confusing I know. In fact, it doesn’t even print currency (the U.S. Treasury does)! The Fed is a “banker’s bank.” It interacts with private banks via the reserve accounts they hold with it. These commercial bank reserves are the only touchpoint between the Fed and the rest of the economy.

The Fed’s mandate is to promote certain political and economic goals. Realistically, it can only try to influence decisions made by private banks by adding and subtracting reserves to accounts that are held with it. This is accomplished by targeting the Federal Funds Rate (FFR), setting the interest it pays on excess reserves (IOER), and purchasing and selling U.S. Treasuries (UST) and mortgage backed securities (MBS) in its System Open Market Account (SOMA) which is more commonly called Quantitative Easing (QE).

Whichever actions it takes, the Fed cannot create new assets in the market. It can only swap the types of investment vehicles available to banks. For every reserve addition (subtraction) there must be a corresponding sale (purchase) of an investable asset made by the account holder. In a financial system dominated by collateralized borrowing, reserve levels simply don’t impact lending decisions all that much.

“How is that possible? I thought in a fractional reserve system base money had to grow for credit to expand?

The answer is structural. The financial deregulation that began in the early 80s (significantly, the abolition of regulation Q) and the consequent development of repo markets fundamentally changed the transmission mechanism of monetary policy. Collateral lending is now king. Today, length of collateral chains and haircut rates—neither of which are determined by the Fed—define the upper bounds of the money supply, not base money and reserve requirements.”

Mark Dow, THERE IS ZERO CORRELATION BETWEEN THE FED PRINTING AND THE MONEY SUPPLY. DEAL WITH IT.

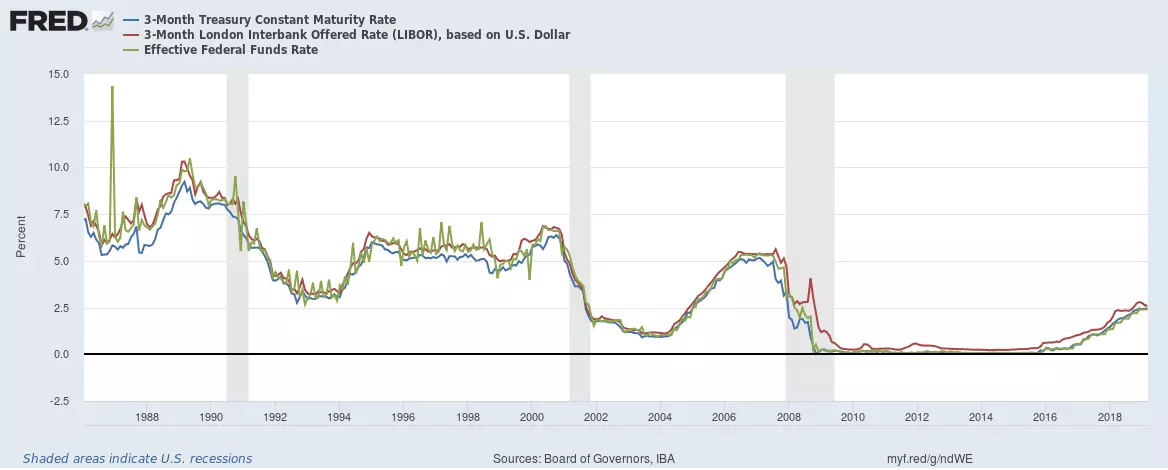

While the Fed’s impact on bank lending is significantly less than in the past, it does have some influence over more commonly used short-term lending rates. There’s an undeniable link between the FFR, IOER and other money market rates (such as repo rates and LIBOR). In order to maintain the FFR in the targeted range, the Fed buys and sells short-dated USTs in the open market. Various risk, liquidity, and regulatory characteristics ensures that a loose link remains between them all.

However, the Fed’s reach is limited. Market participants negotiate all other interest rates. The spread between these and the FFR (and now IOER) varies over time. The Fed’s ability to influence longer-dated UST rates is even less direct that one would expect, QE notwithstanding.

Various short-term lending rates are correlated to FFR. However, deviations frequently occur.

“A hike in the Fed’s policy rate will directly impact rates on short-term Treasuries, but the effect on long-term Treasuries is less predictable.”

Miguel Faria e Castro and Asha Bharadwaj, Rising Rates Impact Borrowing Costs for the U.S. Government, Too

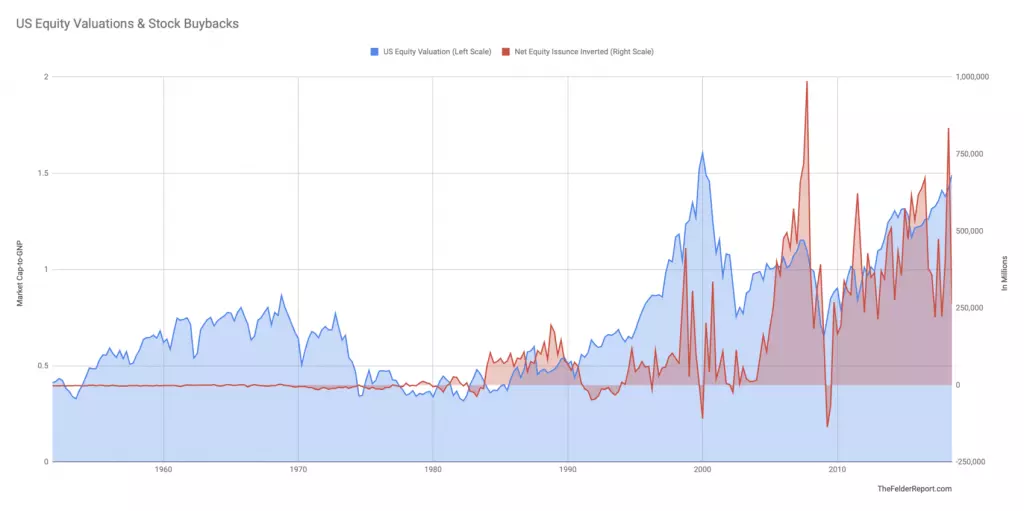

Then there is QE, of course. QE was nothing magical. The Fed simply swapped $4 trillion of newly created reserves for an equal amount of USTs and MBSs. The money supply was not increased, which is likely why runaway inflation never materialized. Economic growth also failed to accelerate as policymakers expected. QE simply didn’t do much of anything. That said, I do believe that it contributed to financial asset inflation by changing the supply/demand dynamics in certain markets. To be sure it other factors—such as $4 trillion of stock buybacks—also played a part in equity markets.

“The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices”

Source: Jesse Felder, If This Isn’t Stock Manipulation, I Don’t Know What Is

Hence, it became clear to me that the Fed’s monetary tools are, strictly speaking, “carrots.” It cannot print money, ease credit conditions, or dictate prosperity. At best, the Fed can hope to incentivize the activities of private market participants by creating profitable arbitrage opportunities within the FFR market. Motivating, to be sure; but outcomes are not guaranteed. It’s telling that the Fed (and other central banks) have failed to achieve their stated inflation targets for nearly a decade.

The Fed can only directly impact reserve levels. Reserves are not, however, “raw material” for lending. Rather, banks hold reserves for liquidity (and regulatory) purposes. Since reserves are immediately convertible into cash, swapping USTs for reserves shortens banks’ asset portfolios. Thus, strictly speaking, the Fed can only influence the cost of liquidity for banks.

Central banks function as a lender of last resort, and the Fed is no different. Technically speaking, any institution can fulfill this role. However, fiat currency erects an insurmountable barrier against private competition. That’s right; the Fed has an unfair, competitive advantage—virtually no cost of funds.

The Fed’s cost of capital is literally that of a keystroke. It can purchase (sell) assets from member banks at will by simply crediting (debiting) their reserve accounts. The Fed need not fund itself at all! It literally plays by a separate set of rules.

In times of stress, private banks’ cost of capital increases dramatically. Borrowing costs rise when risk appetites fall. The Fed, however, is not subject to this reality. Hence it is uniquely positioned as the lowest cost provider of liquidity.

“While the first central banks were created to provide government finance, they gradually discovered that their position at the apex gave them the ability to function as lenders of last resort.”

L. Randall Wray, The Origins of Money and the Development of the Modem Financial System

No private bank can compete with the Fed. A bank’s most important attribute is its cost of capital. Private institutions are structurally disadvantaged to the Fed. Thus, the Fed is the ultimate provider of liquidity to the financial system by fiat!

Let’s face it, free stuff is always abused. Liquidity is no different. This got me thinking.

In an asset-based currency regime, the Fed would compete for base currency—say, gold for example—with all other banks. Since the Fed could no longer conjure funds out of thin air, it would have a cost of funds, just like any other bank. Also, its monopoly access to base currency would be eliminated. Thus, the Fed becomes just another bank—like Clark Kent in Superman II.

A tie to the physical, productive world ensures that currency production follows economic production. After all, all production in an economy is monetary production. Mismatches between output and circulating currency create harmful inflation and deflation. A market-derived money price helps to promote stability. Base currency producers would only increase the supply when economic conditions warranted. How would they know? The market price would exceed the cost of production. To borrow an excerpt from Part 1:

“To be sure, the decentralized banking regimes predating the 1900’s were far from perfect. Honestly though, they performed surprisingly well (notably in Scotland, Canada, and the antebellum period in the U.S.). The severity of the periods’ bank runs and panics are largely overstated by critics. In fact, they were often caused by some form of banking regulation: The prohibition against branching inhibited banks from diversifying risk; competition was restricted by chartering; government bond reserve requirements disrupted capital bases. Critics also conveniently forget that private markets resolved most issues themselves, including the Panic of 1907.”

In a fiat currency regime, base currency is virtually free and limitless. The Fed conjures reserves at the cost of a keystroke. Thus, it is always economical for the Fed to swap reserves for yielding assets (i.e. USTs and MBSs). Economics do not dictate decisions. Rather, committees (and politics) do. This not only subjects the accessibility to liquidity to abuse and mistakes, but also creates perverse incentives.

While proponents of central banking cite this as an advantage, the evidence is underwhelming at best in the U.S. Furthermore, the two worst financial crises in U.S. history—the Great Depression and the recent financial crisis—both occurred under the Fed’s purview and followed periods characterized by low interest rates and asset bubbles. Perhaps cheap liquidity played a role.

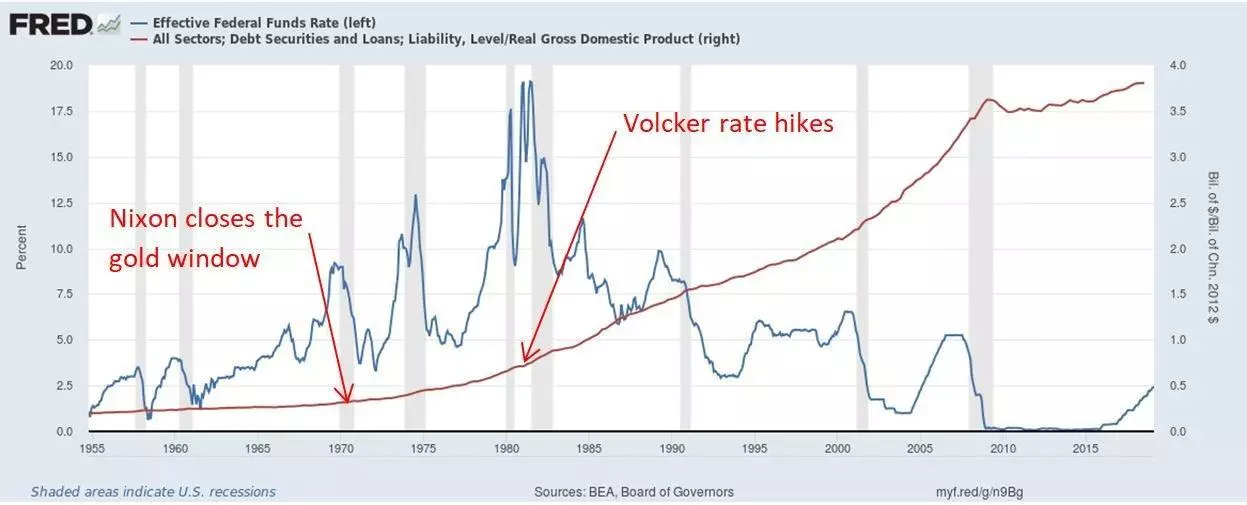

The amount of leverage in the U.S. economy appears to have exponentially increased since the dollar became a fiat currency. This is particularly true over past the 40 years during the FFR’s secular decline since Paul Volcker famously “broke the back of inflation.” Fed activism also increased over this timeframe. First came the “Greenspan put”, followed by the “Bernanke put”, the “Yellen put”; just recently the “Powell put” was birthed. These monikers connote the Fed’s interest in attempting to prop up investment markets.

The ratio of debt-to-GDP accelerated in the age of fiat currency. It ever-so-briefly paused when Volcker increased the FFR, but resumed the upward trajectory once rates fell again.

It’s highly debatable whether or not any Fed governor can manipulate investment markets. More certain is that secularly falling interest rates create ideal conditions for those engaged in a carry trade. A falling cost of funds boosts profits and thus incentivizes lending. Cheap liquidity forestalls the necessity to undergo painful deleveraging to address lending mistakes. Rather, the eventual impact is not only delayed, but compounded. Given that the financial system can be thought of as a carry trade, it’s possible that the Fed’s proclivity for providing cheap liquidity encouraged debt growth.

After going through this excruciating, bottoms-up exploration of money and banking I began to piece together the puzzle.

Banks are levered entities. They obtain assets by borrowing. Failures typically arise from a lack of liquidity, often due to credit losses. Liquidity shortfalls force deleveraging since assets must be sold to meet liability payments. Thus, the remedy for a banking problem is a liquidity injection. Liquidity forestalls deleveraging and instead encourages a re-leveraging despite economic conditions dictating otherwise.

The Fed is a banker’s bank. It can only swap reserves with member banks for USTs and MBSs. Hence, it is simply a liquidity provider. Fiat currency regimes bestow a competitive advantage to the central bank since it has the sole legal authority to create bank reserves out of thin air. By no means does the Fed create money, but it can create liquidity at a zero cost! As a result, it’s always “profitable” for the Fed to provide liquidity.

A costless base-currency creates perverse incentives. There is little economic reason to judiciously distribute it. If capital is abundant, why not save “bad banks”? This significantly elevates moral hazard. Not all banks should be saved.

In a decentralized banking regime with an economically derived base currency (such as gold), such decisions are dictated by economic realities. Financial aid rests upon profits and losses; solvency and insolvency; prudence and recklessness. While far from perfect, incentives are clear and understandable. In a central banking regime bureaucrats and politics dictate decisions. Why was Bear Sterns saved while Lehman Brothers was sacrificed? Why was AIG charged a usury rate for its bailout while Goldman Sachs and Morgan Stanley were given access to low-cost liquidity? We’ll never know. Walter Bagehot would be irate!

“First. That these loans should only be made at a very high rate of interest. Lend at a punitive rate of interest. … Secondly. That at this rate these advances should be made on all good banking securities, and as largely as the public ask for them.”

Walter Bagehot, Lombard Street: A Description of the Money Market

In this era of increased central bank activism, there is a policy bias towards interventionism. When economic hiccups develop, the Fed reflexively provides liquidity. This not only prevents required deleveraging from occurring, but encourages re-leveraging as a remedy. The “invisible hand” of markets is arrested in order to perpetuate the financial markets’ carry trade. Think I’m crazy? Look no further than the situation in Greece.

Despite it all, by no means does the Fed control outcomes. Its consistent failure to hit its inflation target despite unprecedented policy interventions serves as evidence. As always, markets and individuals will have the last say. The Fed is just one actor among many in a diverse and dynamic economy.

I hoped to establish a connection between central banks, fiat currency, and elevated leverage levels in the economy. I don’t expect this article to serve as definitive proof, but hopefully I demonstrated the existence of a logical connection.

In this era of increased central bank activism, I found it worthwhile to explore the micro-economic workings of the monetary system. Many take the Fed’s actions for granted. While this had been profitable thinking, past performance is no guaranty of future success. Strategies should change with the facts. Investing requires induction and deduction.

Interest rate “normalization” is proving to be more difficult than envisioned. Why? I contend that higher rates would catalyze the deleveraging of the banking system and investment markets. Thus, cutting rates became self-reflexive for policymakers lacking any skin in the game other than reputation. While delaying the inevitable may sell books, the Fed’s control over markets and the economy may very well be illusory. The encouragement of leverage likely forestalled “creative destruction” and the arrival of an even brighter future.

The next time markets stop to receive the Fed’s interest rate decision, ask yourself: What choice does Powell really face? The way I see it, it’s between facilitating the continuation of a leveraged carry-trade or its unwind; crafting a popular reputation with investors (rightly) concerned with compounding their gains, or maintaining his self-esteem by addressing the situation at hand.

If only the decision were truly his to make.

A version of this article first appeared on the Integrating Investor.

Very interesting, thanks for sharing

Good analysis

Must read

Seth Levine is a professional, institutional investor focused on selecting high yield bond positions for a financial services company. He is also the creator of The Integrating Investor where he blogs about macroeconomic and investment strategy related themes. Seth holds a Bachelor of Science degree in Mechanical Engineering from Cornell University and is a CFA charterholder. You can learn more about Seth at www.integratinginvestor.com and follow him on Twitter at @SethLevine2. Please note that any opinions and views he expresses are solely his own and do not reflect those of his current or former employers.

Leave your comments

Post comment as a guest