Comments

- No comments found

Council Tax is the money that you pay to your local authority to fund the services and facilities that allow our communities to function.

The amount of Council Tax you pay is based on the value of the property you live in.

The Office for Budget Responsibility estimates that between 2021 and 2022 a total of £40.1 billion was raised in Council Tax contributions, which represents around 5% of the total tax receipts for that period.

Although Council Tax usually rises each year, the UK government is offering most households a Council Tax rebate in 2022 to help tackle the cost of living crisis.

We are going to take a look at the 2022 Council Tax rebate, what it is, why it has been brought in, who it is for, and how to claim it.

From April 2022, UK households in the Council Tax bands A to D can claim £150 in council tax rebate. Unlike the energy bill rebate, recipients of the Council Tax rebate will not need to repay it at any point.

The Council Tax rebate was introduced as part of the UK government's effort to tackle the cost of living crisis that is forecast to make millions of households worse off than they were last year.

All households in England, Scotland, and Wales are eligible for the Council Tax rebate if the property they inhabit on April 1st 2022 is within the Council Tax bands A to D. This also includes households that receive Council Tax Support even if their council tax bill is less than £150 per year.

If the occupants of a property within the bands A to D are already exempt from paying Council Tax on April 1st 2022, they are still eligible for the rebate if they fall into one of the following classes of exemption:

Class N (students – other than HMOs for council tax purposes).

Class S (under 18s).

Class U (people with a severe mental impairment).

Class W (annexes occupied by a dependent relative).

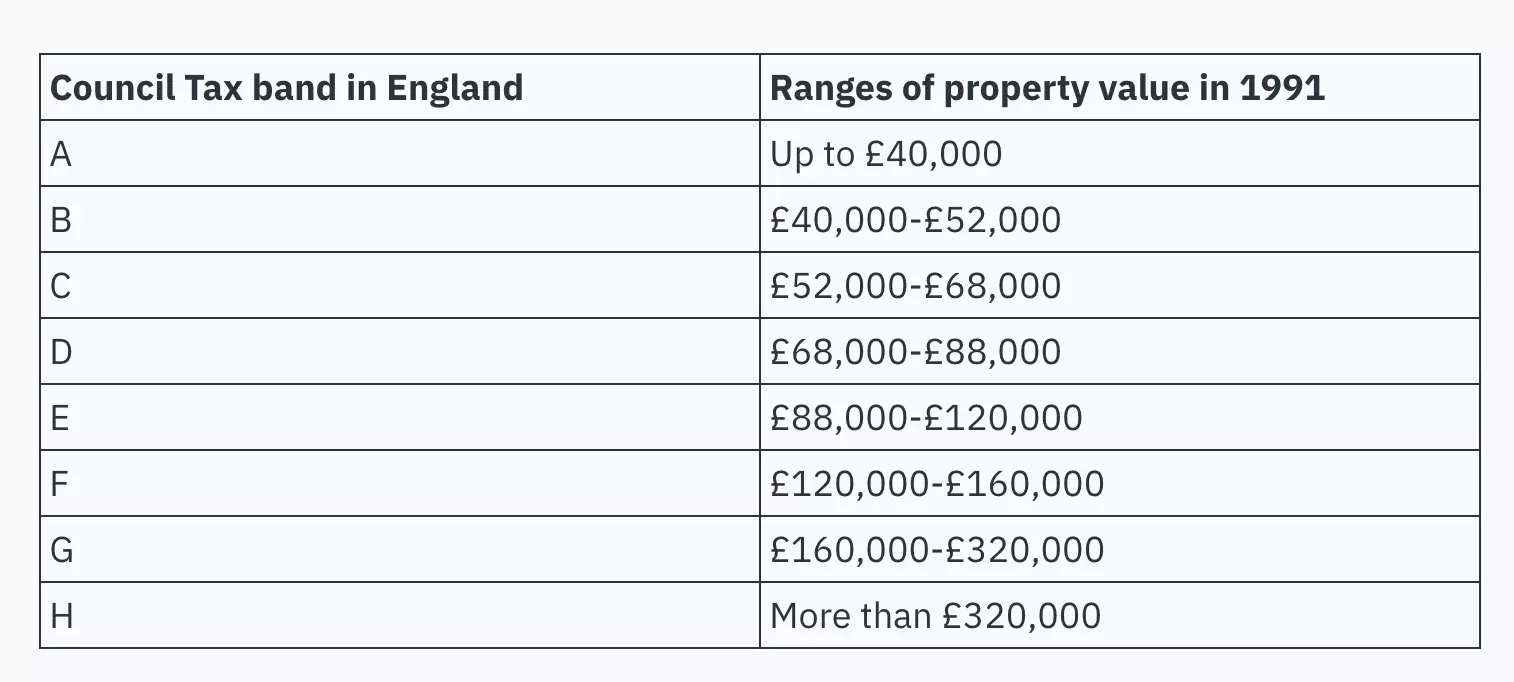

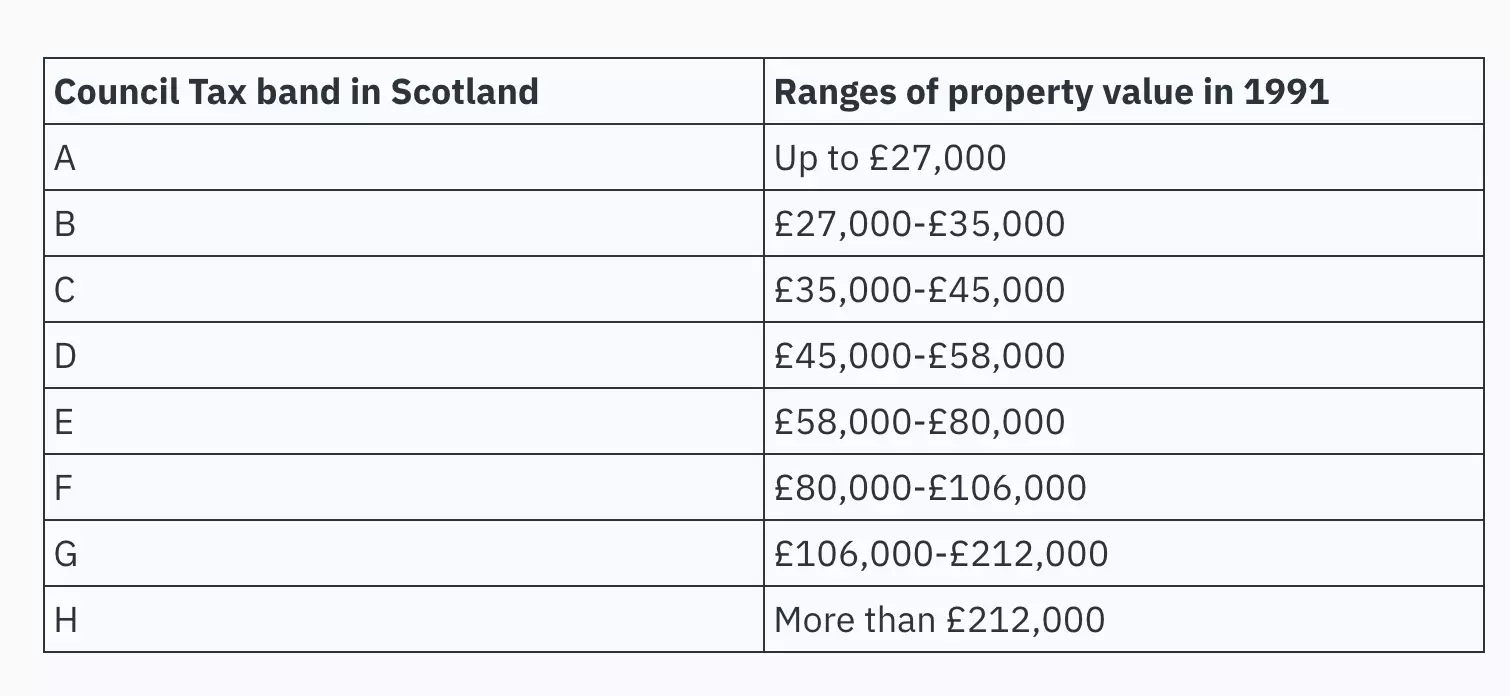

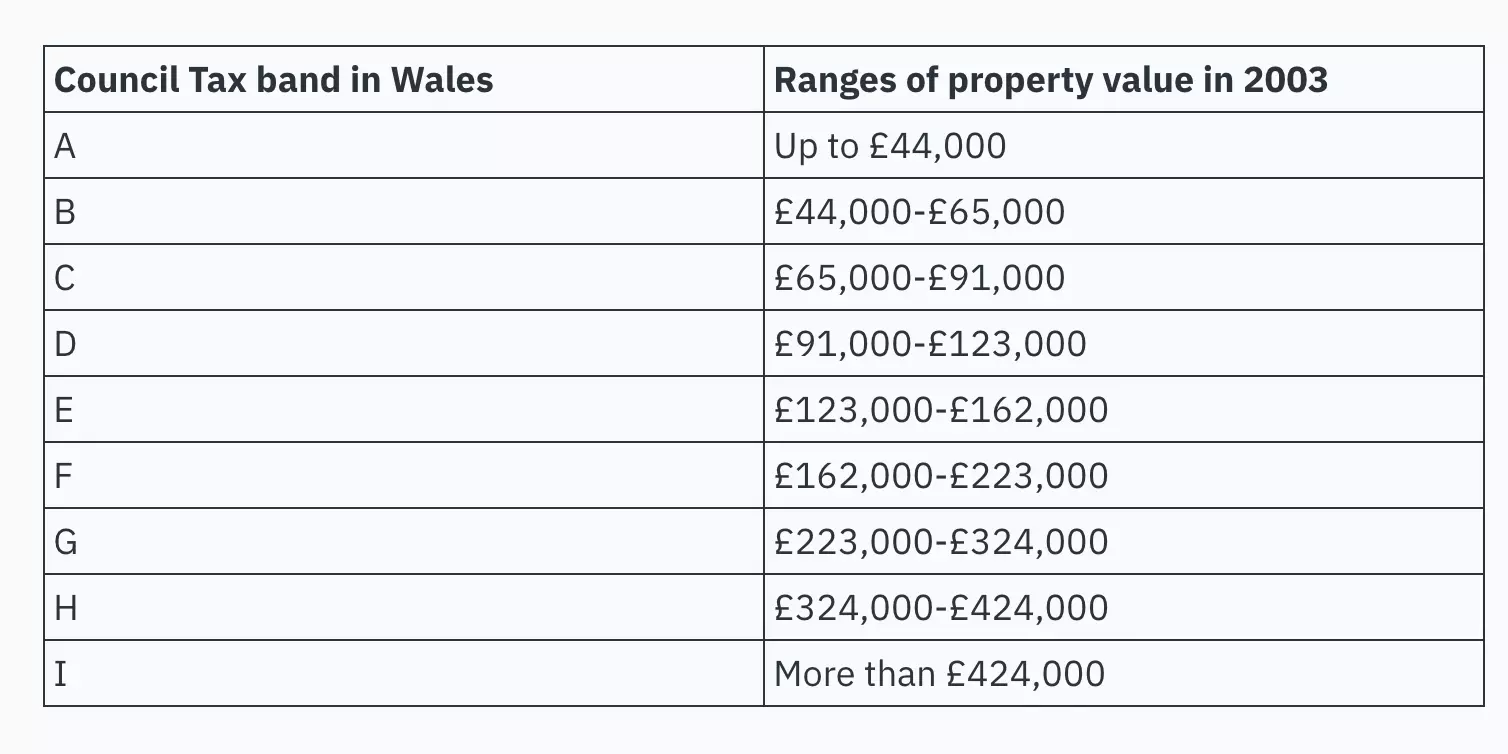

Council Tax bands refer to the tax category that the property is in. This then determines the amount the inhabitants must pay the council in tax. The bands have different thresholds in England, Wales, and Scotland. Northern Ireland uses a different system altogether and announcements of a similar rebate there are forthcoming.

In England, the Council Ttax bands range from A to H and are based upon the value of your property in 1991. They are as follows:

In Scotland, properties are also placed in bands between A and H which are determined by the market value of the property in 1991. However, there are different thresholds from those in England. They are:

In Wales, properties were revalued in 2003, meaning they are categorised by their market value in that year. The bands range from A to I and the thresholds are:

If you live in England or Wales you can find out what band your property is in on the government's webpage. If you live in Scotland, you can find out by using the Scottish Assessor's website.

Council Tax rates vary from council to council, but the average band D Council Tax in England for 2021-22 is £1,898 per year.

If the property you live in is eligible for the Council Tax rebate and you currently pay your Council Tax by direct debit, your local council will automatically make the payment directly into your bank account. This will happen at some point between April and September 2022. You do not need to do anything to receive this payment.

If the property you live in is eligible for the Council Tax rebate and you do not currently pay your Council Tax by direct debit, you will be contacted by your local council to arrange a method for collecting the rebate.

Claims for the rebate can be processed up until 30 September 2022.

Inflation rates across the world have rocketed since the loosening of the lockdowns that were brought in to deal with the coronavirus pandemic. The price of goods overall has gone up, but the price of energy has risen especially sharply.

Although the government has promised a £200 interest-free loan to help cover the rising cost of energy bills, recipients will need to pay that loan back over time. However, the £150 Council Tax rebate does not need to be repaid at any point.

The Council Tax rebate means that Council Tax will not rise between 2022 and 2023 for most households. It is part of a government package worth nearly £20 billion that aims to tackle the cost of living crisis in the UK. The Chancellor's Spring Statement also introduced changes to the Income Tax system in a long term effort to take the burden off low and middle-income earners.

When you pay Council Tax to the local authorities, your contributions go towards many of the services that are local to your community. For example, Council Tax may pay for public spaces such as libraries, parks, or museums. They may also contribute to leisure and sports facilities like swimming pools, football pitches, or community gyms. Council Tax is also used to pay for social care for older people, children, and adults with special needs. There are also practical things that Council Tax is spent on such as waste collection, road repairs, and street lighting.

The 2022 Council Tax rebate has been introduced to help combat the cost of living crisis caused by rapid inflation and rising energy bills. All households in bands A to D will receive £150. You can find out what band your property is in by searching for it on the UK government's website or on the Scottish equivalent.

Felix is the founder of Society of Speed, an automotive journal covering the unique lifestyle of supercar owners. Alongside automotive journalism, Felix recently graduated from university with a finance degree and enjoys helping students and other young founders grow their projects.

Leave your comments

Post comment as a guest