Comments

- No comments found

Like most economists, I’m not allergic to the idea of profits.

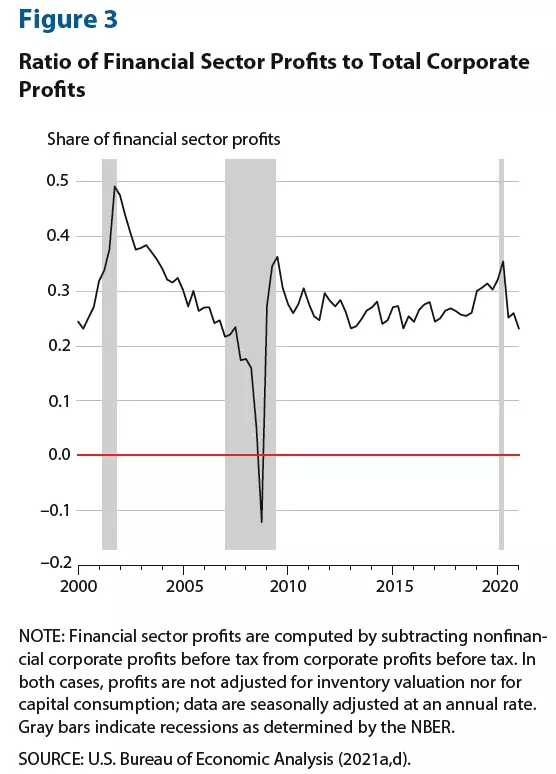

I view them as a signal that, in a certain area of an economy, the willingness of people to buy a certain product exceeds the costs of producing that product–thus, profits are a way to encourage additional production in that area. Still, it’s provocative even to me to observe that about one-quarter of all corporate profits go to the financial services sector. Here’s a figure from Paul W. Wilson in his article, “Turbulent Years for U.S. Banks: 2000-20” (Review: Federal Reserve Bank of St. Louis, Third Quarter 2022, pp. 189-209).

If you want to see the underlying data for this calculation, it’s available from the US Bureau of Economic Analysis at “Table 6.16D. Corporate Profits by Industry/.” Just to be clear, financial services includes a lot more than just banks: it’s “credit intermediation and related activities; securities, commodity contracts, and other financial investments and related activities; insurance carriers and related activities; funds, trusts, and other financial vehicles; and banks and other holding companies.”

What makes this interesting, is that financial services, as a share of the value-added in GDP, are about 7-8% of GDP in recent decades, according to the US Bureau of Economic Analysis (see the “Value added by Industry as a Percentage of Gross Domestic Product” table, line 55). Thus, the question is why financial services accounts for 7-8% of GDP, but about 25-30% of all corporate profits.

One possibility, as noted at the start, is that the profits are sending a signal that the US economy would benefit from a dramatic expansion of financial services. While I’m sure that financial services could benefit from innovation and entry, like other sectors, it’s not at all clear to me that, as a society, we are crying out for a much greater quantity of financial services.

Another possibility is that there is limited competition in financial services, perhaps due to difficulties of entry and costs of regulation, which leads to higher profits for incumbents. In the specific area of banking, Wilson notes:

The number of Federal Deposit Insurance Corporation (FDIC) insured commercial banks and savings institutions fell from 10,222 at the end of the fourth quarter of 1999 to 5,002 at the end of the fourth quarter of 2020. During the same period, among the 5,220 banks that disappeared, 571 exited the industry because of failures or assisted mergers,1 while the creation of new banks slowed. From 2000 through 2007, 1,153 new bank charters were issued, and in 2008 and 2009, 90 and 24 new charters were issued, respectively. But from 2010 through 2020, only 48 new commercial bank charters were issued. The decline in the number of institutions since 2000 continues a long-term reduction in the number of banks operating in the United States since the mid-1980s.

A lack of competition in the financial sector essentially implies that when financial transactions are involved–whether corporate or household–this sector is able to carve itself a bigger slice of the pie than would be likely if there were more competitors. A more subtle possibility is that at least some of the profits being attributed to the financial sector were actually created in other sectors of the economy, but through various accounting transactions these profits are being reported instead in the financial sector.

A final possibility is that the way in which GDP measures the value-added of the financial services sector may tend to understate the size of the sector. After all, it’s hard to separate out what the financial sector produces into changes in quantity of services produced, changes in the quality of those services (as financial technology evolves), and price for each service.

I don’t have evidence to back up my suspicions here. But when the share of profits for a sector is much larger than the value-added of that sector, on a sustained basis over several decades, something is out of whack.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest