Comments

- No comments found

Trading in the financial markets has always been a highly competitive and fast-paced industry.

Traders are constantly seeking new ways to gain an edge over their competitors, and in recent years, deep learning has emerged as a powerful tool for achieving this goal. Deep learning, a subfield of machine learning, involves training artificial neural networks to learn from vast amounts of data and make predictions or decisions based on that learning. In the context of trading, deep learning algorithms can be used to analyze market data and identify patterns that are invisible to the human eye. This article explores the potential benefits and challenges of using deep learning in trading, as well as real-world examples of its application.

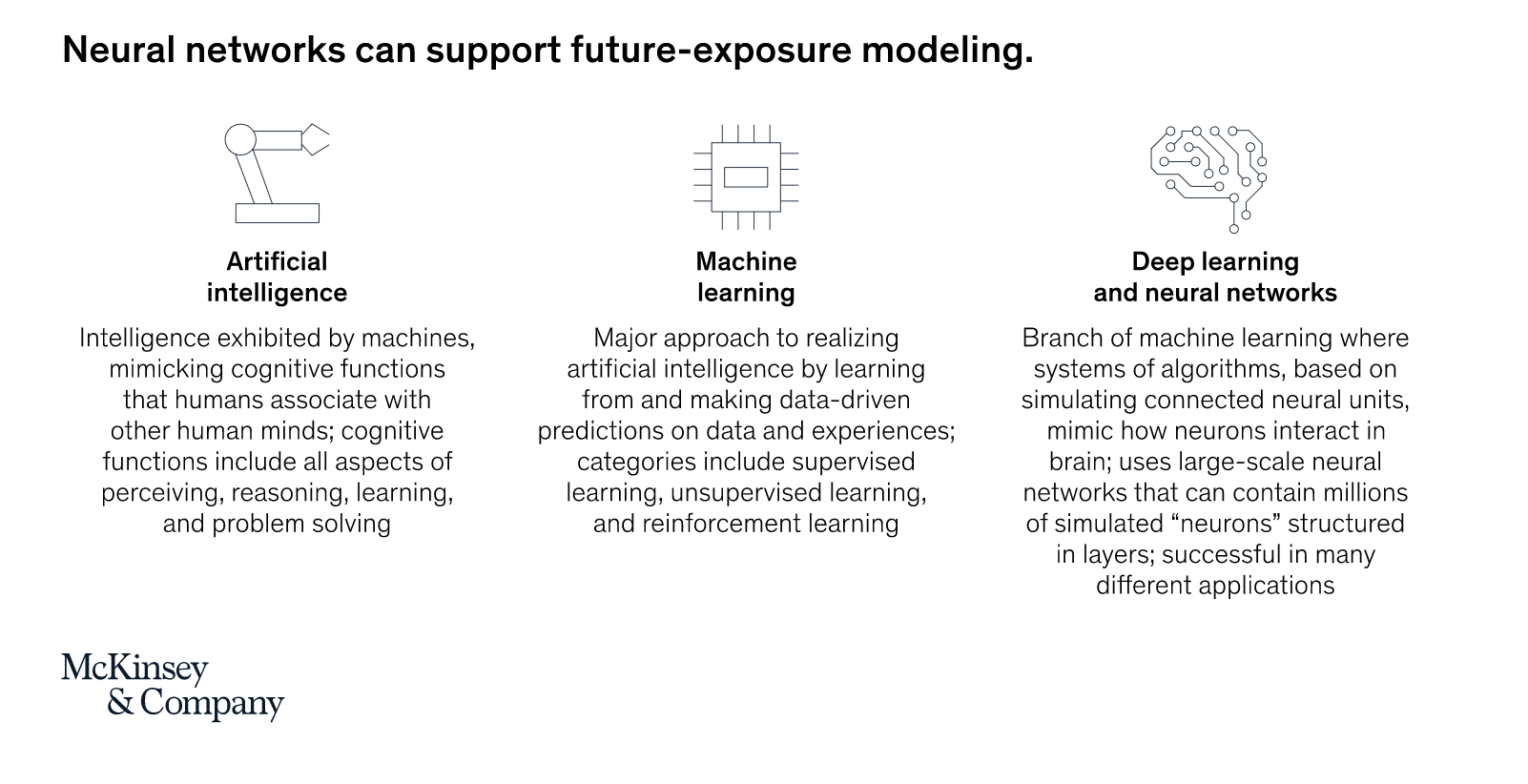

Source: McKinsey

Deep learning is a subset of machine learning that is modeled after the structure and function of the human brain. It involves the use of artificial neural networks, which are interconnected nodes that are designed to process and analyze large amounts of data. These networks are trained on vast amounts of data using sophisticated algorithms, allowing them to identify patterns and make predictions based on that learning.

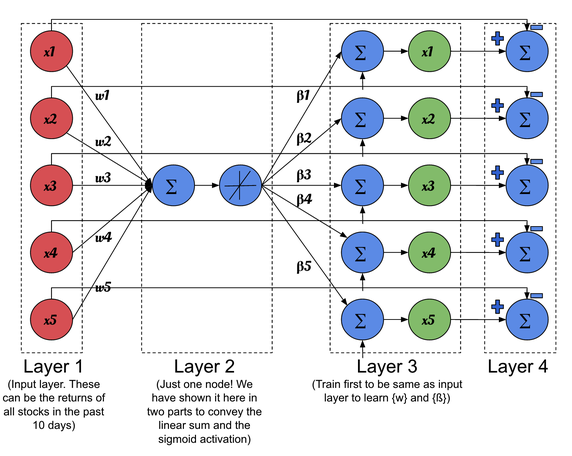

Source: Medium

One of the key advantages of using deep learning in trading is the ability to process vast amounts of data in real-time. This enables traders to make more informed decisions based on a more comprehensive analysis of market conditions. Deep learning algorithms are also highly adaptable, able to adjust to changing market conditions and evolving trading strategies.

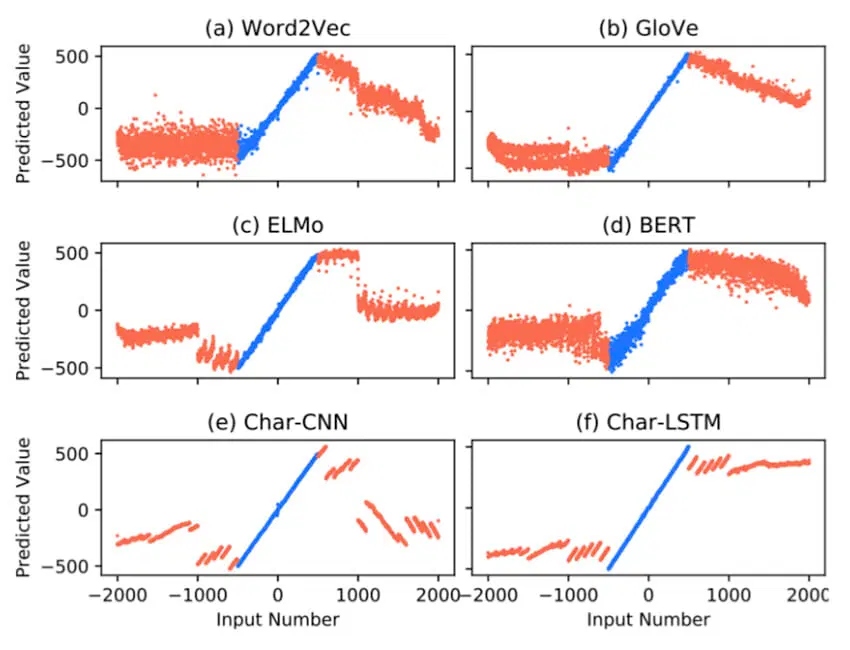

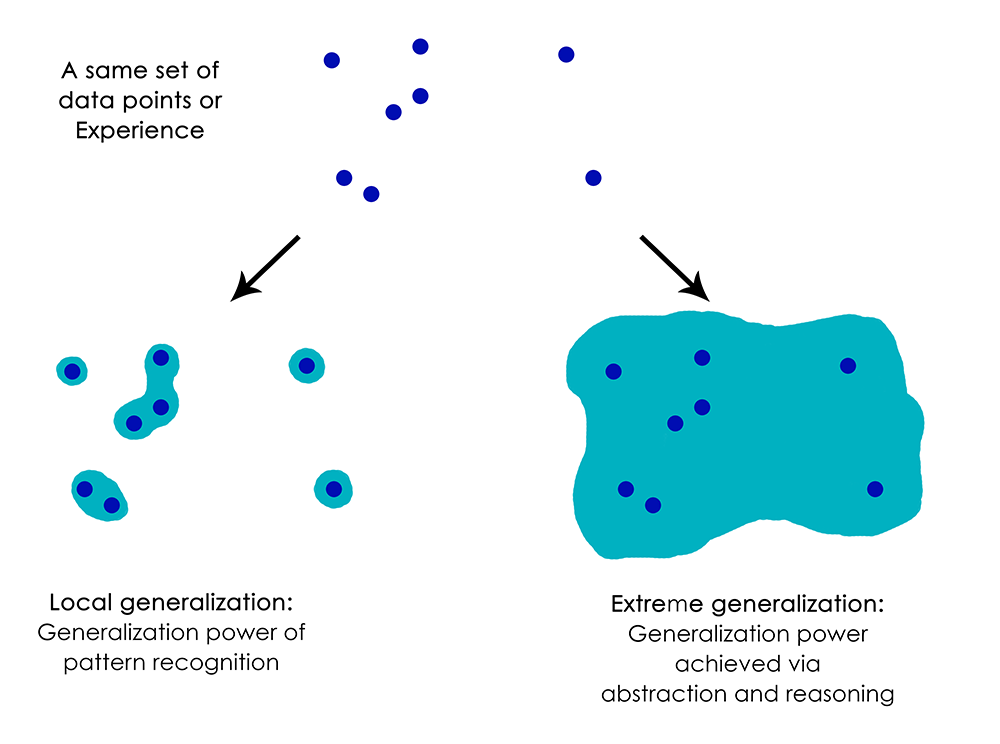

Another advantage of deep learning in trading is the ability to identify patterns and correlations that may not be visible to the human eye. By analyzing large amounts of historical market data, deep learning algorithms can detect subtle patterns and relationships that may be indicative of future market movements.

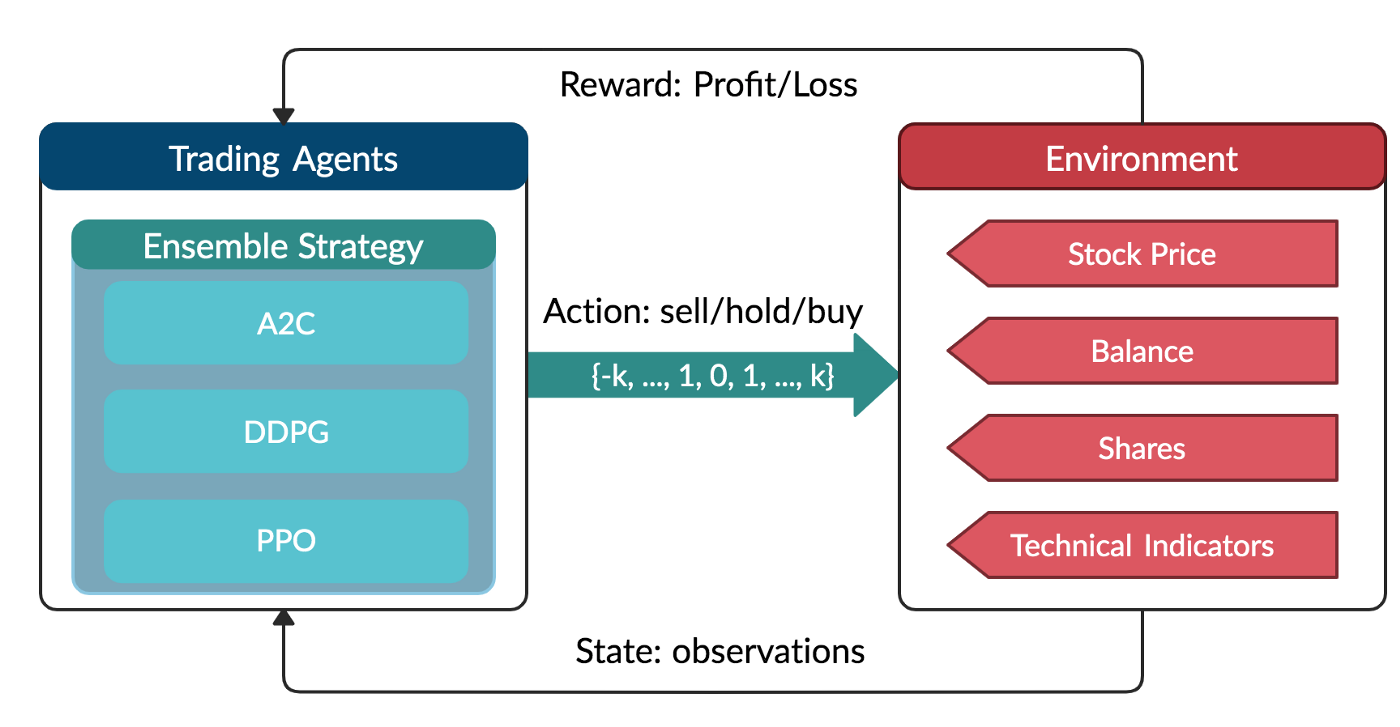

Source: Towards Data Science

Despite its many advantages, there are also challenges and limitations to using deep learning in trading. One of the biggest challenges is the need for large amounts of high-quality data to train the algorithms. In addition, deep learning algorithms can be highly complex and difficult to interpret, which can make it challenging for traders to fully understand the reasoning behind the algorithms' predictions.

An additional challenge of deep learning in trading is the potential for overfitting. Overfitting occurs when an algorithm becomes too closely tailored to the training data, which can lead to poor performance when applied to new data sets. To address this challenge, traders must carefully balance the need for complexity and accuracy with the risk of overfitting.

Source: Maven

There are numerous successful real-world applications of deep learning in trading. For instance, some hedge funds are using deep learning algorithms to analyze vast amounts of financial data in real-time, allowing them to make more informed investment decisions. Other companies are using deep learning to identify market anomalies and predict market trends.

Source: Keras

As with any new technology, there are also ethical considerations and future implications to be considered when it comes to deep learning in trading. One concern is the potential for deep learning algorithms to perpetuate existing biases in the financial industry. Another concern is the potential for deep learning to further automate trading, potentially reducing the need for human traders.

Deep learning has the potential to revolutionize the trading industry, enabling traders to make more informed decisions and gain a competitive edge. While there are certainly challenges and limitations to using deep learning in trading, the benefits are clear. As the technology continues to evolve, it will be interesting to see how it is integrated into the trading

Leave your comments

Post comment as a guest