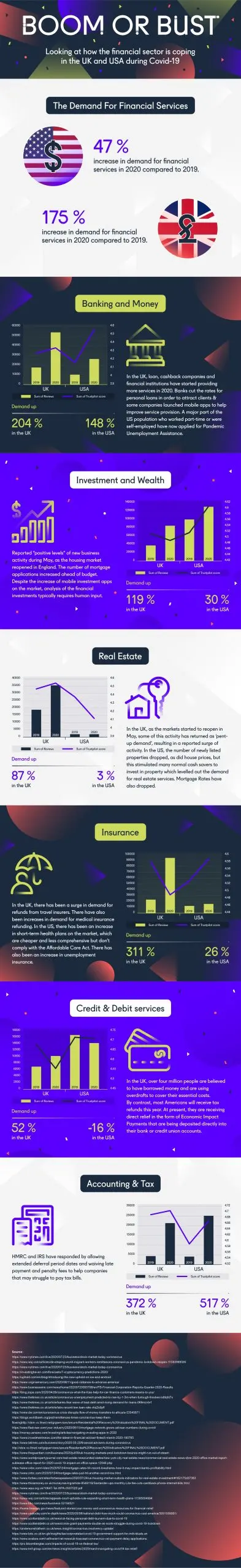

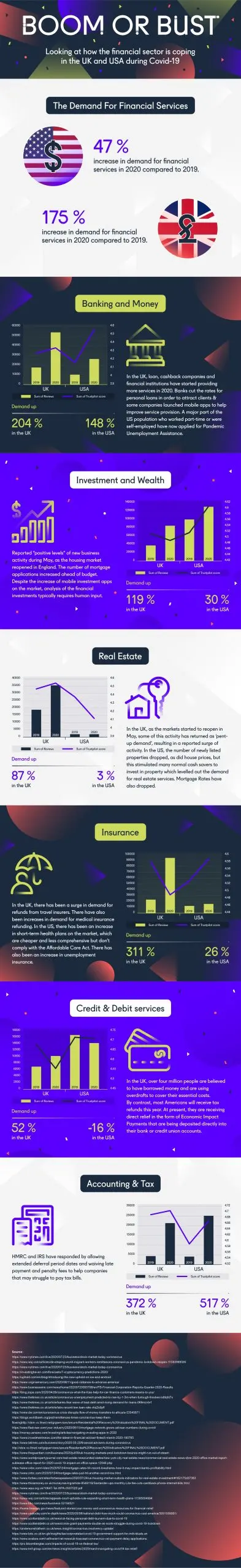

Every sector has seen a change during the pandemic, but is the devastation equal throughout all of them?

With the inescapable financial crisis, more and more are turning to financial providers for help.

Call centres have been inundated with high call volumes due to face-to-face services being postponed for the foreseeable future. Awaken’s voice analytics software are proving just one of the invaluable tools these contact centres have utilised during this time, to ease pressure on staff and retain high customer service levels.

With this in mind, Awaken collated data from Trustpilot to gain a better understanding of how demand has changed towards the financial sector during recent months, compared to the same period in 2019.

Trustpilot data was compared between those in the UK and the USA to see how demand was effected between the two nations.

Banking & Money

Banks will always be in demand, whether it be during an economic downturn or an economic boom.

Some personal and business account holders have been relying heavily on new systems and features created during the pandemic to steer them away from huge financial problems.

In the UK, loan rates have been cut, mortgage and loan repayment holidays offered and free financial advice for those who have lost their income has been provided.

This has resulted in a 204% increase in demand as customers often have to manually request these services and due to these being such a crucial element to their daily living, prefer to speak to a professional about their options.

Banks have been able to cope with this demand by allowing call centre staff to work from home but also with the introduction of these services on mobile apps and websites.

While the USA has also seen an increase, it is lower at just 148%. The USA has been slower to implement lockdown, while also lifting restrictions sooner than other nations.

This has led to fewer individuals losing out on revenue as work can still commence and the public still spending money within businesses.

Pandemic Unemployment Assistance is a new benefit being offered to US citizens which could be a reason as to why fewer people are requiring services from their bank in the states.

Investment & Wealth

Investment and wealth has also seen an increase in demand. The UK began to reopen the housing market in May, with completions and moving into new homes allowed in June.

Mortgage applications witnessed an increase and the over rise within the sector was 119%. While mortgage providers have been slowly turning to the use of online portals, it is still an industry that requires human input and interaction.

Especially now that individuals are having to be more careful with their investments than ever as we are unaware of where the economy is headed, help desks are seeing a huge demand for their services.

However, the USA has seen a 30% increase, meagre in comparison to the UK. This could be due to US citizens feeling uneasy about making investments or seeking expert advice as the country still struggles to control the first wave of the virus.

Lack of online and remote services could be a contributing factor to this lower percentage rise.

Real Estate

The UK reopened the housing market in May, seeing a backlog of eager buyers and sellers placing and accepting offers and speeding through the conveyancing process in order to complete before a potential second stop on these services, should a second wave hit the country.

Compared to 2019, the UK has seen an 87% increase for real estate services during the months of the pandemic.

The USA has seen a barely notable increase of just 3%, despite house prices dropping, the number of newly listed buildings significantly decreased. The USA has seen homeowners reluctant to sell at this time due to reluctance to see their homes sell below market value, leaving first time buyers with little choice.

Insurance

The insurance sector in the UK has seen a demand of 311% up. Businesses are calling service agents to scrutinise policies to see if they were covered for a pandemic and to seek a payout to cover financial losses due to business closure over the strict lockdown.

With most overseas holidays being cancelled, members of the public are seeking services to cancel travel insurance policies to receive a refund.

There have also been more people taking out medical insurance, despite access to free healthcare, some are wanting to ensure top-quality care should the virus be contracted.

The USA has only seen a 26% increase due to more short-term health plans, however, most US citizens who are able to already have medical insurance in place. It is likely that those who could not afford to before the pandemic are still facing the same financial difficulties.

Credit & Debit Services

There has been a 52% increase in demand for credit and debit services in the UK during the past few months.

It is estimated that over 4 million individuals have had to borrow funds in the way of overdrafts, loans and credit cards during the pandemic.

The USA actually saw a decrease of 16% compared to the same months last year. Financial relief has been provided to citizens in the form of Economic Impact Payments, meaning fewer people are required to borrow funds to cover essential expenses.

Accounting & Tax

The UK accounting and tax industry have seen a 372% increase, while the USA has seen a huge 517% increase.

Both are likely to be for similar reasons. HMRC and the IRS are allowing extended submission periods for tax returns and waiving any late penalties to help businesses and individuals who may be struggling.

Many businesses and investors are seeking advice from accountants to see where spending can be cut and take advantage of new practices and processes to see where cash can be protected.

In total, the demand for financial services in the UK has seen a 175% increase and the USA has seen a 47% increase.

While some services, such as accounting, will be seeing an increase in revenue due to this demand, others, such as banking, are simply witnessing an increase in service demands, while not always financially gaining from this.

This is why remote customer service is the key during the pandemic to alleviate disgruntled and panicked customers and retain this custom for when the crisis is finally over.

Leave your comments

Post comment as a guest