Comments (1)

Kumar Mohit

Winter is coming with more houses sold !

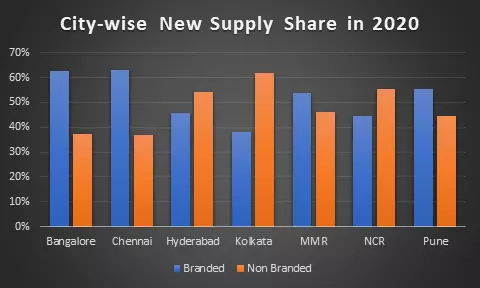

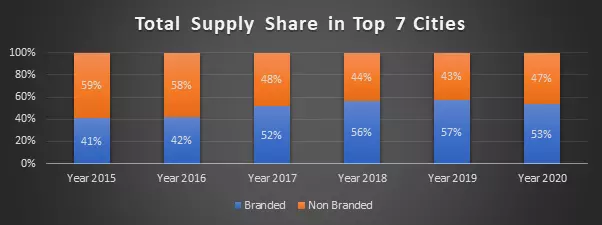

With consumer preferences tilting towards branded products over the last few years, the share of homes by branded players is on the rise across the top 7 cities.

As per ANAROCK data, out of the total new housing supply in year 2015 (approx. 3.90 lakh units), branded players’ share accounted for 41% while the remaining 59% of housing supply was by non-branded players.

In 2020, the overall share by branded players has increased to 53% of the total supply (approx. 75,140 units in 2020 till September) across the top 7 cities. This clearly indicates that branded players have been increasing their supply to tap into the growing demand from homebuyers.

Another reason could be the liquidity crisis which the real estate sector has been grappling with over the last two years. Smaller players have had the short end of the stick – many of them face challenges with raising funds from banks and other financial institutions.

Approx. 2.37 lakh housing units were launched across the top 7 cities in 2019, out of which nearly 57% (over 1.35 lakh units) were by branded developers and the remaining by non-branded players.

In 2020 (up to September), approx. 75,140 units have been launched, of which more than 53% are by branded developers. While the overall share in 2020 against 2019 declined marginally, the fact is that 2020 has seen a drastic reduction in the total number of overall housing units launched.

When the entire 2020 supply data becomes available by the end of December 2020, the share of branded players is very likely to have increased.

Notable trends between 2019 vs 2020:

(Note: ‘Branded’ developers include listed players, developers who have been operating for a decade and more, even newly-formed entities of large conglomerates and also those with sizeable areas under development either locally or Pan-India)

Winter is coming with more houses sold !

Anuj Puri, Chairman of ANAROCK Group is a highly respected industry authority and thought leader with 30 years' experience in leveraging Indian and global real estate opportunities. His company ANAROCK has a staff complement of over 1800 qualified and experienced professional, with offices in all major markets in the country, dedicated services in Dubai and a global footprint with over 80,000 preferred channel partners.

Leave your comments

Post comment as a guest