Comments

- No comments found

Reporting on the Consumer Price Price Index numbers for June looked like this:

Is the spurt of inflation the last few months likely to be sustained, or to fade? Chair of the White House Council of Economic Advisers Cecilia Rouse, along with Jeffery Zhang, and Ernie Tedeschi last week offered a short rumination on the “Historical Parallels to Today’s Inflationary Episode” at the CEA website (July 6, 2021).

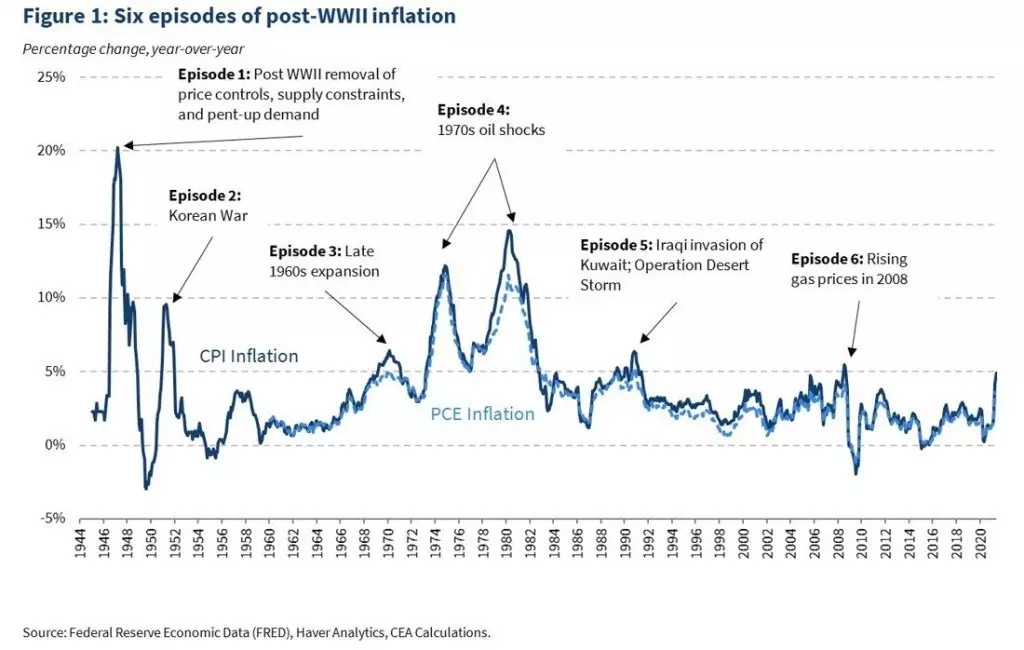

Here’s a figure showing two prominent measures of inflation: the Consumer Price Index and the Personal Consumption Expenditures Index. The CPI is better-known to the public, but the PCE index is the one on which the Federal Reserve actually focuses (for my quick discussion of the differences between them, see here). For practical purposes, they move together fairly closely over time. On the far right, you can see the recent jump of inflation up to an annual rate of about 5%.

As the authors note, this figure shows six previous periods in which CPI inflation topped 5%: 1946–48, 1950–51, 1969–71, 1973–82, 1991, and 2008. For the current episode, which parallel is most relevant? They argue that recent inflation spikes have been linked to rises in global oil prices, which hasn’t been happening, and that the inflation jump of the late 1960s was linked to an economy running white-hot with rapid growth and low unemployment, which isn’t the current problem, either.

The authors argue that the inflation of the 1970s was mainly the result of higher oil prices, as well, and while they are only writing a short piece, this seems to me like a significant oversimplification. There is sound evidence that in the lead-up to the 1972 election, the Federal Reserve under Arthur Burns responded to political pressure from President Richard Nixon by keeping interest rates very low in what was already an inflationary environment. There were also national wage and price controls first imposed and then removed by Nixon, and a later attempt to impose credit controls under Jimmy Carter. Of course, the 1970s spikes in oil prices didn’t help, either. But the inflationary period of the 1970s had number of contributing factors.

Ultimately, Rouse, Zhang, and Tedeschi argue that the most relevant parallel here is the post-WWII inflation episode. There are of course many differences. But as they point out, both the World War II period and the pandemic were times when savings rose substantially, suggesting the possibility of pent-up demand ready to surge into markets. Both episodes were also a time when economic dislocations meant that certain goods were not readily available; for example, the pandemic has been accompanied by shortages of durable goods like cars, in part because “manufacturing capabilities were temporarily shut down or reduced to avoid COVID contagion.”

It’s worth noting that in this short essay, Rouse, Zhang, and Tedeschi do not discuss the large and ongoing rise in federal debt. nor the role of the Federal Reserve in financing that debt, nor the potential for additional inflationary pressures from the existing spending proposals now before Congress. One can certainly sketch out a scenario along these lines where inflationary dangers look more severe. In particular, if consumers and firms expect a certain level of inflation, and then build that inflation rate into their expectations of future increases in prices and wages, then shorter-term inflation could build a longer-lasting momentum.

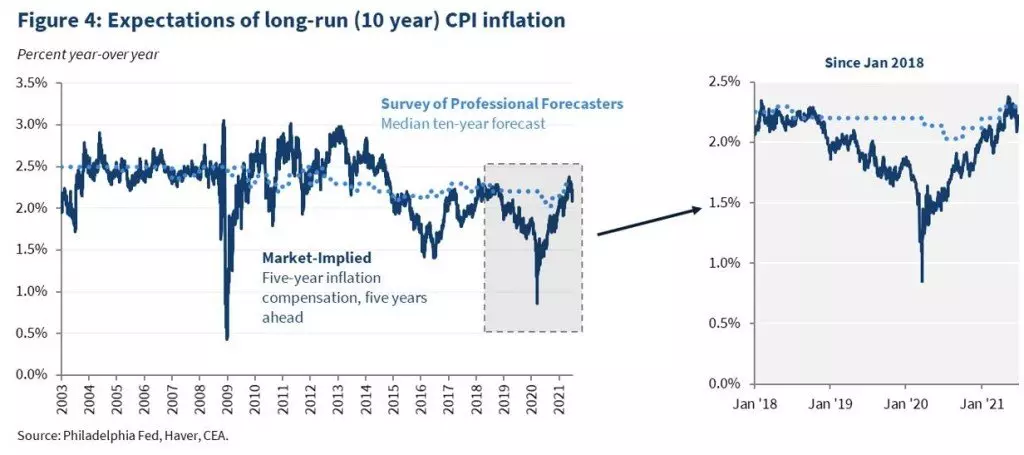

However, neither the markets nor the professionals seem to believe these scenarios. For looking at market expectations of inflation, you can compare two similar types of debt, one which adjusts for inflation and one which does not. For example, the US Treasury issues most of its debt in a way that does not adjust for inflation, but it also issues Treasury Inflation Protected Securities (TIPS), which adjust according to changes in the Consumer Price Index. Comparing these two will provide a market-based estimate of expectations of future inflation. Another measure of inflation looks at predictions from professional forecasters, which are tabulated in the Livingston Survey carried out by the Federal Reserve Bank of Philadelphia. Here are expectations of inflation from these two measures.

Those interested in some additional history of US inflation in the last 100 years or so might be interested in my post from a few years back, “100 Years of Consumer Price Inflation Data” (A[ril 30, 2014).The two measures as presented here are not exactly comparable, because the market-based inflation expectations are for five years ahead, while the Livingston survey is for 10 years ahead. But either way, it looks as if future inflation expectations are in the range of about 2%, which is often taken as a reasonable working definition of “price stability.”

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest