Comments

- No comments found

It felt back in September 2008, at least to me, as if the Great Recession erupted all at once.

Sure, there had been some earlier warning signs about financial markets and subprime mortgages in late 2007, but in spring 2008, the consensus view (for example, in Congressional Budget Office forecasts) was that these housing market blips were only a modest threat to the overall US economy. But by comparison with the pandemic recession, the Great Recession practically happened in slow motion.

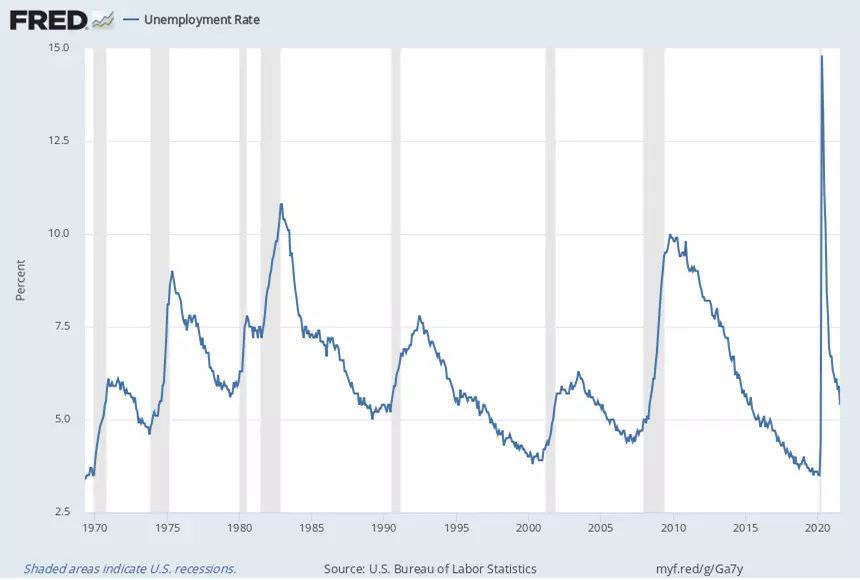

Here’s a figure showing the monthly unemployment rate since 1970. The shaded areas show recessions, and you can see the rise in unemployment during each recession. The rise during the pandemic is much higher and faster; conversely, the decline in unemployment from its peak was also much faster–indeed, unemployment in July 2021 was down to 5.4%, which is conventionally considered to be pretty good.

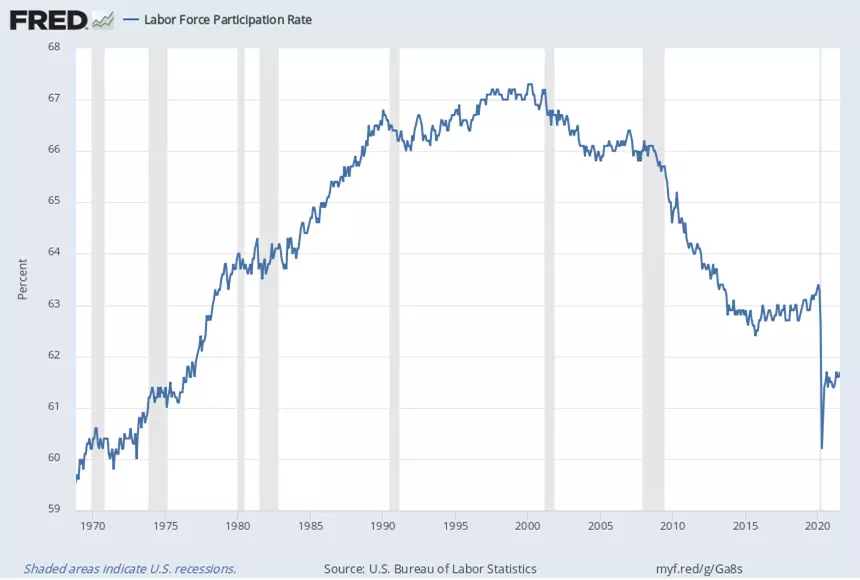

But the pandemic recession also had a shocking effect on labor force participation rates. To be counted as “unemployed,” you need to be “in the labor force,” which means that you either have a job or are looking for a job. If you aren’t looking for a job, you are “out of the labor force” and thus are not counted as “unemployed.” There are good reasons for this distinction about being in and out of the labor force: in conventional times, it wouldn’t make sense to count, say, retirees or parents who are voluntarily staying home and looking after children as “unemployed,” because they aren’t looking for work. (Over time, the big inverted-U shape of labor force participation largely reflects the entry of women into the (paid) labor force, which topped out in the late 1990s, and then a gradual decline for both men and women since then.) But the pandemic recession is not a conventional time, and the sharp drop in labor force participation–together with what is so far only a very partial recovery–raises the likelihood that at least some of these people do want to get jobs in the future, when the time is right.

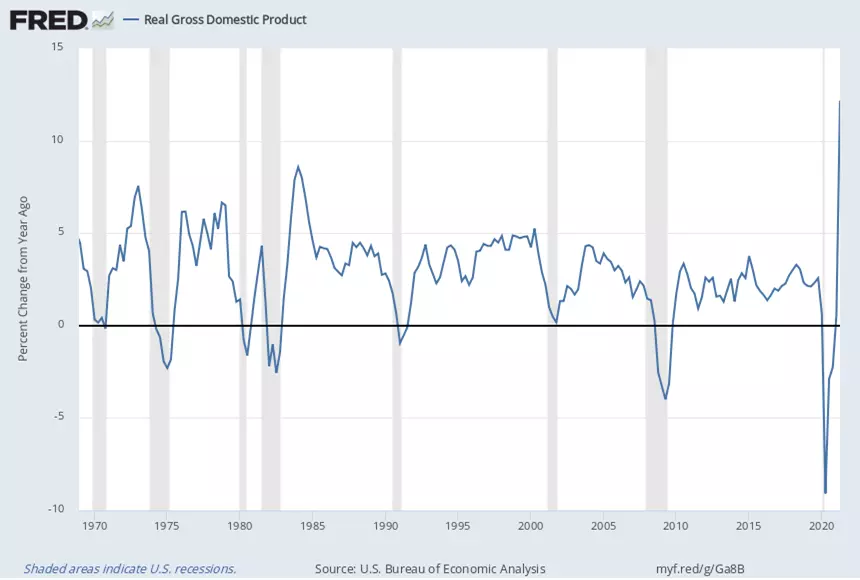

For completeness, here’s a figure showing the rate of real (that is, adjusted for inflation) GDP growth, measured as the change from 12 months earlier (with data through the second quarter of 2021). Again, the pattern of a remarkably sharp drop and then a sharp recovery is apparent.

In the Summer 2021 issue of the Journal of Economic Perspectives, Stefania Albanesi and Jiyeon Kim take a deeper dive into some aspects of the pandemic recession and the US labor market in “Effects of the COVID-19 Recession on the US Labor Market: Occupation, Family, and Gender.” (Full disclosure: I’ve been the Managing Editor of the JEP since the first issue in 1987.) They are focused in particular on what happened in 2020. But the evolution of the labor market at that time also suggests some of the future challenges. Here are a few themes that emerge.

In previous recent recessions, job losses for men tended to be greater than those for women. Indeed, married women usually increase their efforts in the (paid) labor market during recessions, which can be thought of as a way in which families adjust to the risk of income loss. But in the pandemic recession, women were more likely to lose jobs than men. For some discussion of this theme in earlier recessions in JEP, see Hilary Hoynes, Douglas L. Miller, and Jessamyn Schaller. 2012. “Who Suffers during Recessions?” Journal of Economic Perspectives, 26 (3): 27-48.

The types of occupations where jobs were lost were different in the pandemic recession. For example, back in the Great Recession there was a large loss of construction jobs, which disproportionately affected men. For some discussion of the job losses for men in the Great Recession in JEP, see Charles, Kerwin Kofi, Erik Hurst, and Matthew J. Notowidigdo. 2016. “The Masking of the Decline in Manufacturing Employment by the Housing Bubble.” Journal of Economic Perspectives, 30 (2): 179-200.

Here’s a sample of the discussion from Albanesi and Kim:

During 2020, women—especially those with children—experienced a substantial reduction in employment compared to men, contrary to the pattern that prevailed in previous recessions. Both labor demand and supply factors likely contributed to this behavior. Women are more likely to be employed in service-providing industries and service occupations. These tend to be less cyclical compared to goods-producing industries and production occupations that employ a larger share of men, and Albanesi and S¸ahin (2018) show that this accounts for most of the difference in the loss of employment during recessions since 1990. … However, during the COVID-19, infection risk was most severe in the service sector, leading to a large reduction in demand for services, due to government imposed mitigation measures and customer response to infection risk. The overrepresentation of women in service jobs likely accounts for a sizable fraction of their decline in employment relative to men.

Another unique factor associated with the pandemic recession was the increased childcare needs associated with the disruptions to school activities, which may have contributed to a reduction in labor supply of parents. Why was it mothers in particular who responded to the lack of predictable in-person schooling activities in households where fathers were also present? Gender norms likely played a role. But from the perspective of an economic model of the family, this response should also be driven by differences in the opportunity cost as measured by wages. In the United States and other advanced economies, there is a substantial “child penalty” that reduces wages for women when, and even before, they become mothers and throughout the course of their lifetime. The penalty is driven by a combination of occupational choices, labor supply on the extensive and intensive margin, that begin well before women have children (Kleven, Landais, and Søgaard 2019; Adda, Dustmann, and Stevens 2017). … In a recent sample of such work, Cortes and Pan (2020) estimate that the long-run child penalty—three years or more after having the first child—for US mothers is 39 percent, and they also find that child-related penalties account for two-thirds of the overall gender wage gap in the last decade. Given the child penalty, most working mothers at the start of the pandemic were likely to be earning less than their partners, and for those couples the optimal response to the increased child supervision needs was for mothers to reduce labor supply.

What do these patterns imply for the prospects of a more complete labor market recovery?

The US labor market is not just recovering from the pandemic recession, but along dimensions of occupation, family, and gender, it may also be reshaping itself in ways that are very much still evolving.

I should add that the Summer 2021 issue of JEP includes two other articles about the pandemic recession.

Marcella Alsan, Amitabh Chandra, and Kosali Simon discuss “The Great Unequalizer: Initial Health Effects of COVID-19 in the United States” (Journal of Economic Perspectives, 35:3, 25-46). Everyone knows that the pandemic hit the elderly harder. These authors point out that if you look at “excess deaths” by age group, the pandemic hit tended to hit hardest among those that were already disadvantaged–which is a common pattern in past pandemics, too.

Joseph Vavra writes about “Tracking the Pandemic in Real Time: Administrative Micro Data in Business Cycles Enters the Spotlight” (Journal of Economic Perspectives, 35:3, 47-66). His essay focuses on how economists have been making increasing use of private-sector real-time data. He writes:

Thus, a number of economists turned to private-sector micro data to try to understand the recession while it was still unfolding: for example, data on employment patterns from the payroll processing firm ADP and the scheduling firm Homebase, data on bank accounts and credit card payments from sources like the JPMorgan Chase Institute and firms that provide financial planning services like mint.com and SaverLife, and even data on locations of cell phone users from firms like PlaceIQ and SafeGraph. The use of administrative micro data from these and other sources allowed pandemic-related research to be produced in nearly real-time and the scope for analysis of individual behavior, which would be impossible using traditional aggregate data.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest