Comments

- No comments found

Most money is already digital: for example, my paycheck flows automatically into my bank account, my mortgage payments automatically flow out, and I authorize my bank to pay credit card charges online. So what would be different about a central bank digital currency?

Just to be clear, the idea here is not that the Federal Reserve, the European Central Bank, the Bank of Japan, and others would start up competitors for the cryptocurrencies like Bitcoin, Ethereum, or Dogecoin. Instead, a central bank digital currency would be a form of the nation’s existing currency. Like currency in the form of coins or paper money, you would be able to use the digital currency as a medium of exchange when buying and selling. However, unlike the examples of digital money I mentioned a moment ago, a central bank digital currency would not need to move through your bank.

Thinking about a central bank digital currency in this way raises obvious practical questions. What form would it take? How would it be accessed when buying or selling? What security would protect it? Would digital currency be anonymous, like physical currency, or could it be tracked? It also raises a bigger conceptual question: What benefits might result from central bank digital currency?

The subject is hot right now. For example, the Bank of International Settlements, in its most recent annual report, devotes a chapter to “CBDCs: an opportunity for the monetary system.” Randal K. Quarles of the Fed Board of Governors just gave a talk on the subject called “Parachute Pants and Central Bank Money” (June 28, 2021). A subcommittee of the Senate Committee on Banking, Housing, and Urban Affairs held hearings on “Building A Stronger Financial System: Opportunities of a Central Bank Digital Currency” earlier this month (June 9, 2021), including testimony from Neha Narula, Director of the Digital Currency Initiative at MIT, Lev Menand of Columbia Law School, and Darrell Duffie of the Stanford Graduate School of Business.

The main potential benefit claimed for a central bank digital currency is an improvement in “payment systems,” which is the jargon-heavy term for the idea that many of the current ways of making digital payments through banking involve fees of some kind. Current digital payments are mostly “bank-railed,” to use a term from Darrell Duffie–that is, they flow through connections set by banks. Sometimes the fees are explicit, from banks or credit card companies or payment services. Other times the fees are implicit, like when a financial firm takes a day or two or three before a payment clears–time when someone is potentially earning interest on that money. In many places, these fees for making payments can be 1% of GDP or more.

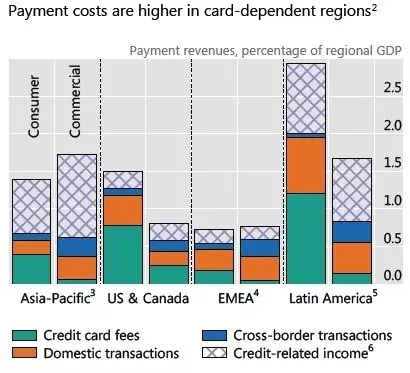

Here’s a figure from the BIS report on the size of payment-related fees around the world, where EMEA is an abbreviation referring to a selection of countries in Europe, the Middle East, and Africa.

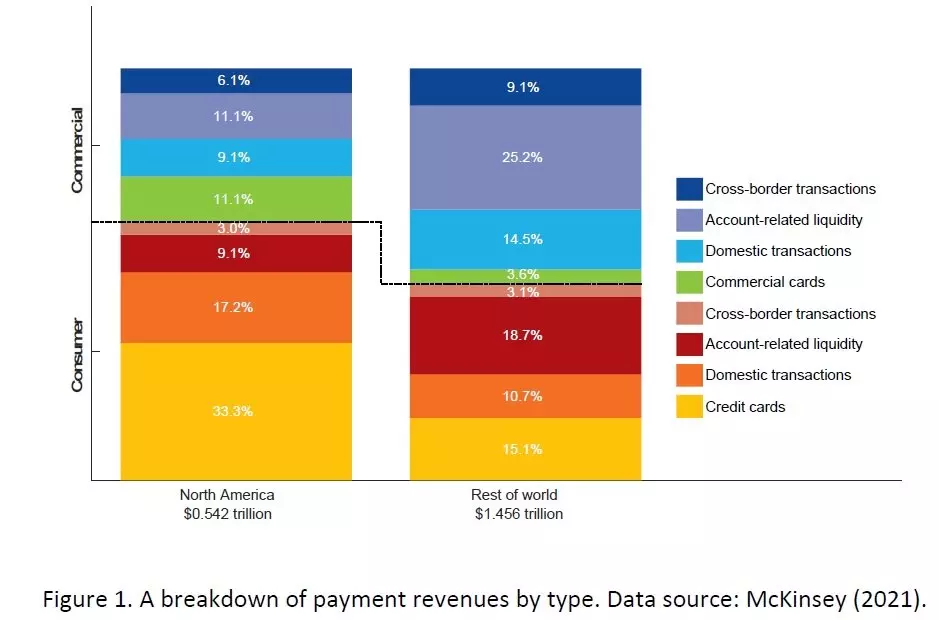

Here’s a similar figure from Duffie on costs of payment systems. Duffie writes: “It takes too long for U.S. merchants to receive their payments, often more than a day. Based on McKinsey data, moreover, Americans pay about 2.3% of GDP for payment services, far more than Europeans, particularly because of extremely high fees for credit cards, as illustrated in Figure 1. This is not because Americans are getting better quality service. Further, the primary payment instrument of Americans, their bank deposits, is compensated with extremely low interest rates.”

There are various concerns about these fees. If relatively few companies are providing payment services, the fees may be higher than they need to be because of lack of competition. In addition, a substantial number of people are “unbanked,” and without a bank account, the payment fees charged by nonbank payment service companies (say, those sending funds across borders) can be quite high. There are also questions about whether the current digital payment systems do a good job of protecting people’s personal information and privacy.

How would a central bank digital currency address the problem. For example, would people and businesses have individual accounts at the Federal Reserve? This would avoid banks, but it would also be a major change in the function of the Federal Reserve, which serves the function of coordinating payments across banks, but not being a bank itself. The BIS describes what a retail-level central bank digital currency might look like this way:

Retail CBDCs come in two variants. One option makes for a cash-like design, allowing for so-called token-based access and anonymity in payments. This option would give individual users access to the CBDC based on a password-like digital signature using private-public key cryptography, without requiring personal identification. The other approach is built on verifying users’ identity (“account-based access”) and would be rooted in a digital identity scheme. This second approach is more compatible with the monitoring of illicit activity in a payment system, and would not rule out preserving privacy: personal transaction data could be shielded from commercial parties and even from public authorities by appropriately designing the payment authentication process. …

From the public interest perspective, the crucial issue for the payment system is how the introduction of retail CBDCs will affect data governance, the competitive landscape of the PSPs [payment services providers] and the industrial organisation of the broader payments industry.

At least to me, other advantages sometimes cited for a central bank digital currency often miss the point. For example, one will sometimes hear claims that the Fed needs a digital currency to compete with the cryptocurrencies like Bitcoin and Ethereum. But it’s not at all clear to me that these cryptocurrencies are anywhere near unseating the US dollar as a mechanism for payments, and it’s quite clear to me that competing with Bitcoin is not the Fed’s job. Or one will hear that because other central banks are trying digital currencies, the Fed needs to do so, also. My own sense is that it’s great for some other central banks to try it out, and for the Fed to wait and see what happens. There is a hope that zero-cost bank accounts at the Federal Reserve might help the unbanked to get bank accounts, but it’s not clear that this is an effective way to reach the unbanked (who are often disconnected from the financial sector and even the formal economy in many ways), and there are a number of policy tools to encourage banks to offer cheap or even zero-cost no-frills bank accounts that don’t involve creating a central bank digital currency.

Quarles at the Fed sums up the current case against a CBDC in this way (footnotes omitted):

In brief, the potential benefits of a Federal Reserve CBDC are unclear. Conversely, a Federal Reserve CBDC could pose significant and concrete risks. First, a Federal Reserve CBDC could create considerable challenges for the structure of our banking system, which currently relies on deposits to support the credit needs of households and businesses. An arrangement where the Federal Reserve replaces commercial banks as the dominant provider of money to the general public could constrict the availability of credit, fundamentally alter the economy, and expose the public to a host of unanticipated, and undesirable, consequences. Among other potential problems, a dominant CBDC could undermine the consumer and other economic benefits that accrue when commercial banks compete to attract customers.

A Federal Reserve CBDC could also present an appealing target for cyberattacks and other security threats. Bad actors might try to steal CBDC, compromise the CBDC network, or target non-public information about holders of CBDC. The architecture of a Federal Reserve CBDC would need to be extremely resistant to such threats—and would need to remain resistant as bad actors employ ever-more sophisticated methods and tactics. Designing appropriate defenses for CBDC could be particularly difficult because, compared to the Federal Reserve’s existing payment systems, there could be far more entry points to a CBDC network—depending on design choices, anyone in the world could potentially access the network. Critically, we also would need to ensure that a CBDC does not facilitate illicit activity. … [I]t may be challenging to design a CBDC that respects individuals’ privacy while appropriately minimizing the risk of money laundering.

The Federal Reserve is preparing what it calls a “comprehensive discussion paper” on central bank digital currency, so the subject is sure to remain a live one. My own sense is that, at present, the proposal can be seen as a shot across the bow from US policymakers of US banks and the US financial system: basically, “help us figure out a way to make the payments system cheaper and more accessible to all, or we might do something drastic.” Duffie argues: “U.S. banks are capable of providing an effective low-cost payment system but have not done so. Regulations, network effects that limit entry, and profit incentives have not promoted an open, innovative, and competitive market.”

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest