Comments

- No comments found

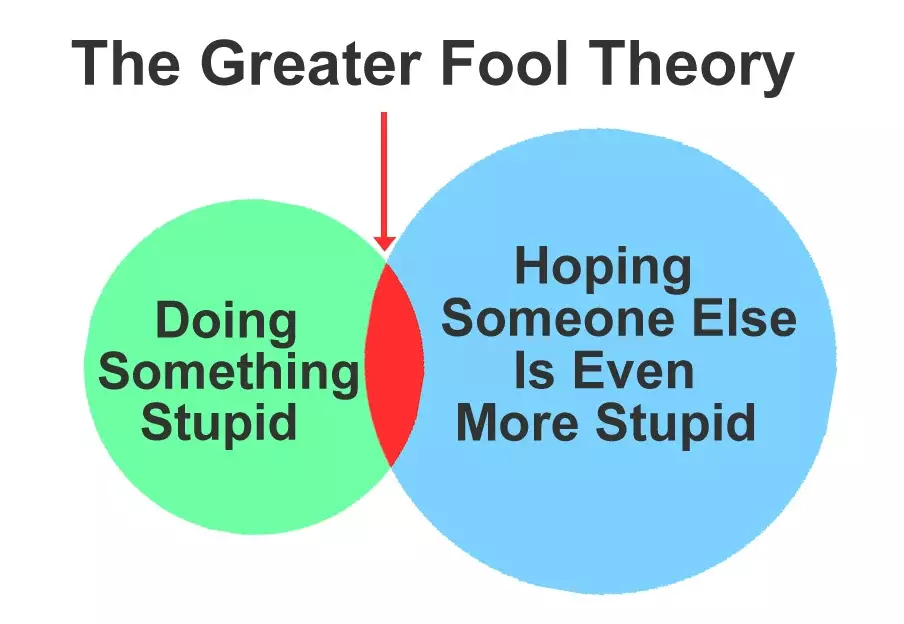

The Greater Fool Theory is a term that is used in investment circles.

It is the idea that there will always be someone willing to pay more for an investment than you paid for it. This person is known as the greater fool. Many people believe that this theory applies to the cryptocurrency market and that prices will continue to rise even if there is no logical reason for them to do so.

Many people are investing in cryptocurrencies without understanding the technology behind them. They are simply hoping to sell their investment at a higher price than they paid for it. This is what makes the cryptocurrency market so risky. The prices can go up or down rapidly, and it is difficult to predict which way they will go next.

Some people believe that the theory will eventually lead to a cryptocurrency bubble. When this happens, the prices will crash, and many people will lose money. However, others believe that the cryptocurrency market is still in its early stages and that there is still plenty of room for growth. Only time will tell which of these theories is correct.

So far, the cryptocurrency market has been incredibly volatile. The prices of Bitcoin and other cryptocurrencies have been going up and down rapidly in recent months. Many people are investing in cryptocurrencies without understanding the technology behind them. They are simply hoping to sell their investment at a higher price than they paid for it. This is what makes the cryptocurrency market so risky. The prices can go up or down rapidly, and it is difficult to predict which way they will go next.

If you want to make money in the stock market, you need to understand the Greater Fool Theory. This theory is based on the idea that there will always be someone willing to pay more for a stock than you paid for it using the following methods:

By understanding and utilizing the theory, you can make money in the stock market! One of the easiest ways to profit from the Greater Fool Theory is to invest in penny stocks. Penny stocks are stocks that trade for less than $5 per share. Many penny stocks are overvalued, so you can make money by buying them and selling them when they become undervalued. In addition, penny stocks are often not as closely followed by Wall Street analysts, so they can be more volatile and provide more opportunities for profits.

High-yield stocks offer a higher dividend yield than the average stock. Many of these stocks are overvalued, so you can make money by buying them and selling them when they become undervalued. In addition, high-yield stocks are often not as closely followed by Wall Street analysts, so they can be more volatile and provide more opportunities for profits.

Growth stocks offer a higher rate of earnings growth than the average stock. Many of these stocks are overvalued, so you can make money by buying them and selling them when they become undervalued. In addition, growth stocks are often not as closely followed by Wall Street analysts, so they can be more volatile and provide more opportunities for profits.

Another way to use the theory to make money in the stock market is to invest in companies experiencing financial problems. Many of these companies are trading at a discount, so you can buy them and sell them when they become overvalued. However, keep in mind that investing in companies with financial problems is risky, so you should do your homework before making any investments.

Finally, you can profit from the theory by investing in growth stocks. Growth stocks offer a higher rate of earnings growth than the average stock. Many of these stocks are overvalued, so you can make money by buying them and selling them when they become undervalued. In addition, growth stocks are often not as closely followed by Wall Street analysts, so they can be more volatile and provide more opportunities for profits.

You can make money in the stock market regardless of whether the market is going up or down. By investing in penny stocks and companies with financial problems, you can take advantage of the opportunities when the market is moving down. And by investing in high-quality companies when the market is moving up, you can protect your portfolio from significant losses.

Remember, the theory is not a guarantee of success in the stock market, but it can be a helpful tool to use when making investment decisions. By understanding and utilizing the theory, you can make money in the stock market and reduce your risk of losing money.

Leave your comments

Post comment as a guest