Comments (8)

Frank Delon

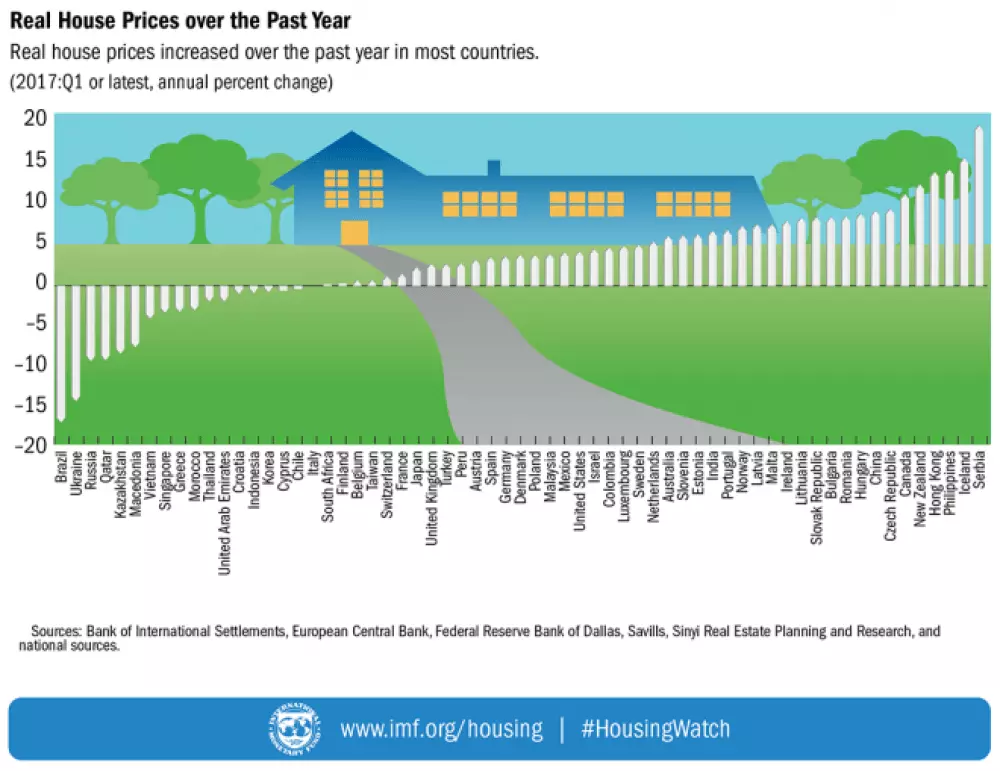

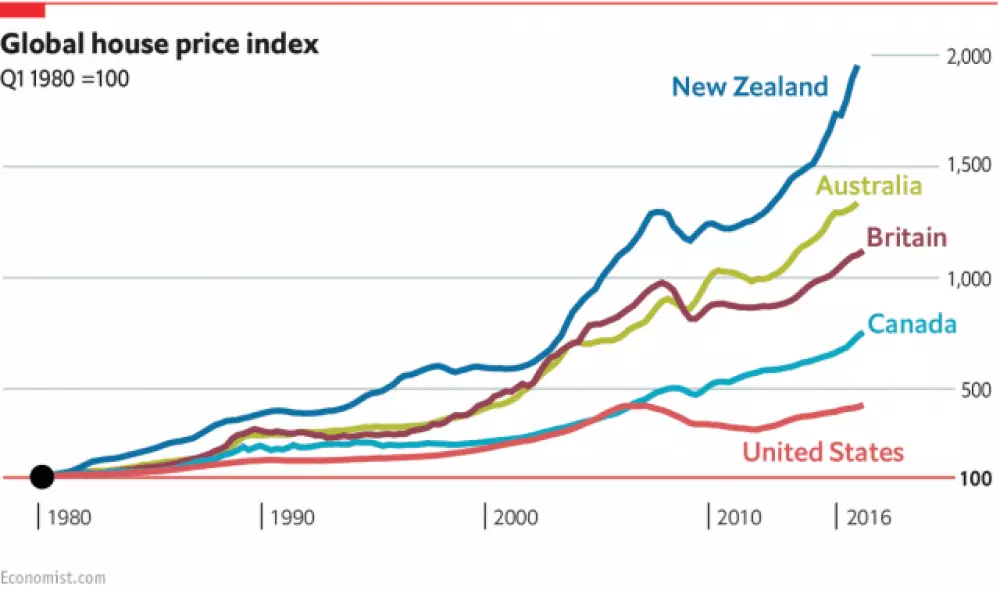

Based on a recent report that I have read, house prices in the city of London are expected to fall 1.5% in 2017 and 2% in the following year. The capital is forecast to lag well behind other regions over the next five years.

Kobe Pierce

Good post, enjoyed reading your latest macro analysis.

Amy Lowis

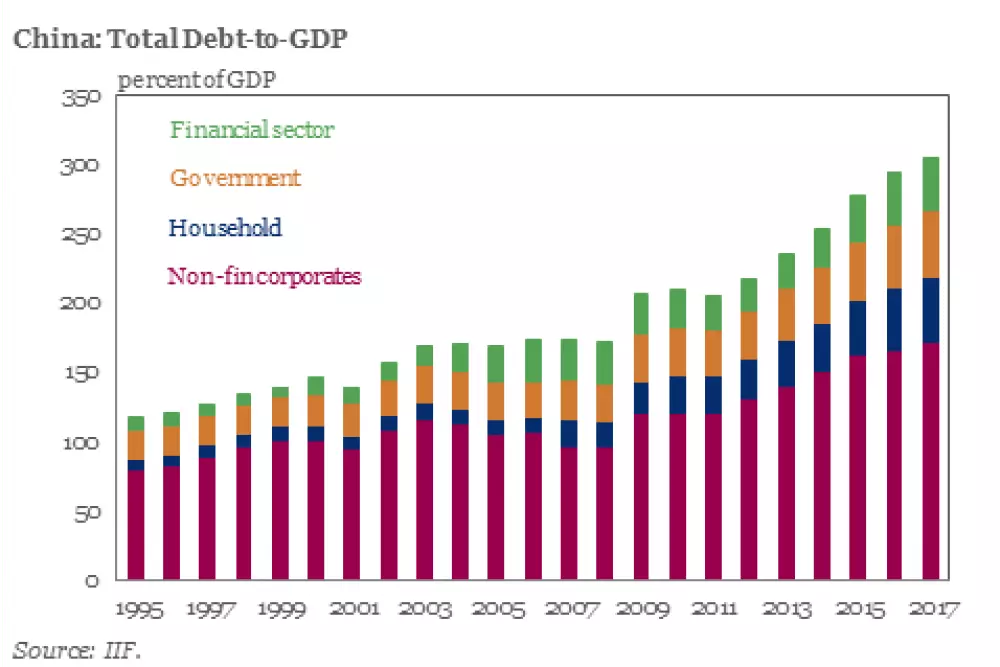

China’s outbound investment is behind South Korea and Japan, with only about 4% of its total wealth being invested in foreign nations. The country still has more room to grow. Any monetary changes that will occur are most likely short term.

John Hann

Interestingly, Germany has leapfrogged the U.K. to become investors' favourite European real estate investment location, pouring in €54 billion.

Yorkshire Lad

Real estate investments have fallen from £58 billion to £56 billion. London is the only city in Europe in which rent prices are likely to continue to fall this year.

Kirill Kondrachov

Keep up the good work

Deepak Sethi

Thanks for sharing your knowledge with us sir.

Samantha

Brillant

Leave your comments

Post comment as a guest