How much money do major universities and colleges have in their endowments? How are they investing the money? What returns are they earning? The National Association of College and University Business Officers does a survey of these questions each year, and here are some results for 2018.

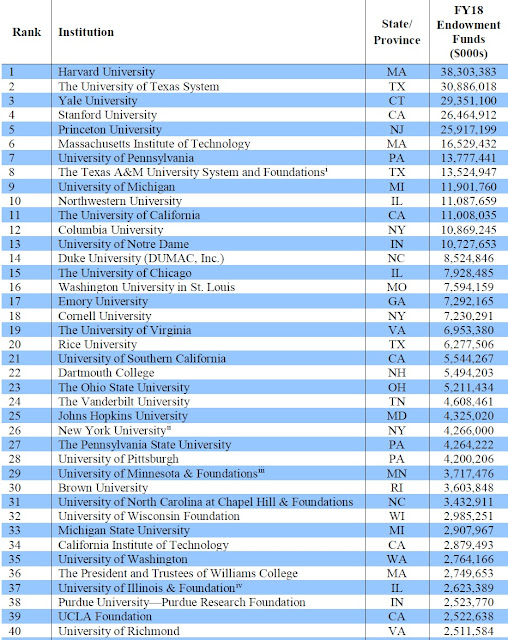

Here's a list of the 40 largest endowments for institutions of higher education. Harvard tops the list. It should be noted that these total endowments don't adjust for number of students. For example, the University of Richmond, which is #40 on this list, has an endowment of $686,000 per student, while the University of Pennsylvania, #7 on this list, has an endowment of $602,000 per student. Princeton has the highest endowment per student at $3.1 million.

How concentrated are endowments among the big institutions? Total endowments for all universities and colleges sum to $616 billion. The top 10 on the list above account for more than one-third of total endowments. The 104 institutions with endowments of more than $1 billion account for more than three-quarters of total endowments. More than two-thirds of all endowments are at private institutions.

How do these institutions invest their endowments? Institutions with big endowments are much more likely to use "alternative strategies," and less likely to be in domestic stocks. "Alternative" refers "Private equity (LBOs, mezzanine, M&A funds, and international private equity); Marketable alternative strategies (hedge funds, absolute return, market neutral, long/short, 130/30, and event-driven and derivatives); Venture capital; Private equity real estate (non-campus); Energy and natural resources (oil, gas, timber, commodities and managed futures); and Distressed debt."

On average, institution with endowments above $1 billion also earn higher returns. However, as the rows at the bottom show, any college which had invested its endowment completely in the S&P 500 10 years ago would have done considerably better than the average over any of the time horizons shown here.

Of course, it's always easy to note in retrospect that some alternative investment choice would have performed better. Back int 2008, it certainly wasn't clear to many investors how much stock markets would rebound if and when the Great Recession ended. Moreover, a number of large-endowment Ivy League school had had great success with alternative investment categories in the 1990s and into the early 2000s. For a useful discussion of college endowment returns from 1992-2005, I recommend Josh Lerner, Antoinette Schoar, and Jialan Wang on "Secrets of the Academy: The Drivers of University Endowment Success," which appeared in the Summer 2008 issue of the Journal of Economic Perspectives.

But it still seems worth noting that college endowments--which often hire high-priced talent to make these decisions--have substantially underperformed the S&P 500 benchmark for the last decade. If they had consistently overperformed the benchmark, I'm sure we'd be hearing a lot more about their investment strategies!

A version of this article first appeared on Conversable Economist.

Leave your comments

Post comment as a guest