Comments

- No comments found

A number of states have decided that it is important for high school students to have a class in economics, in personal finance, or both.

The Council for Economic Education does a survey of state rules along these lines once every two years. Here are some results from its most recent “Survey of the States” (May 2022).

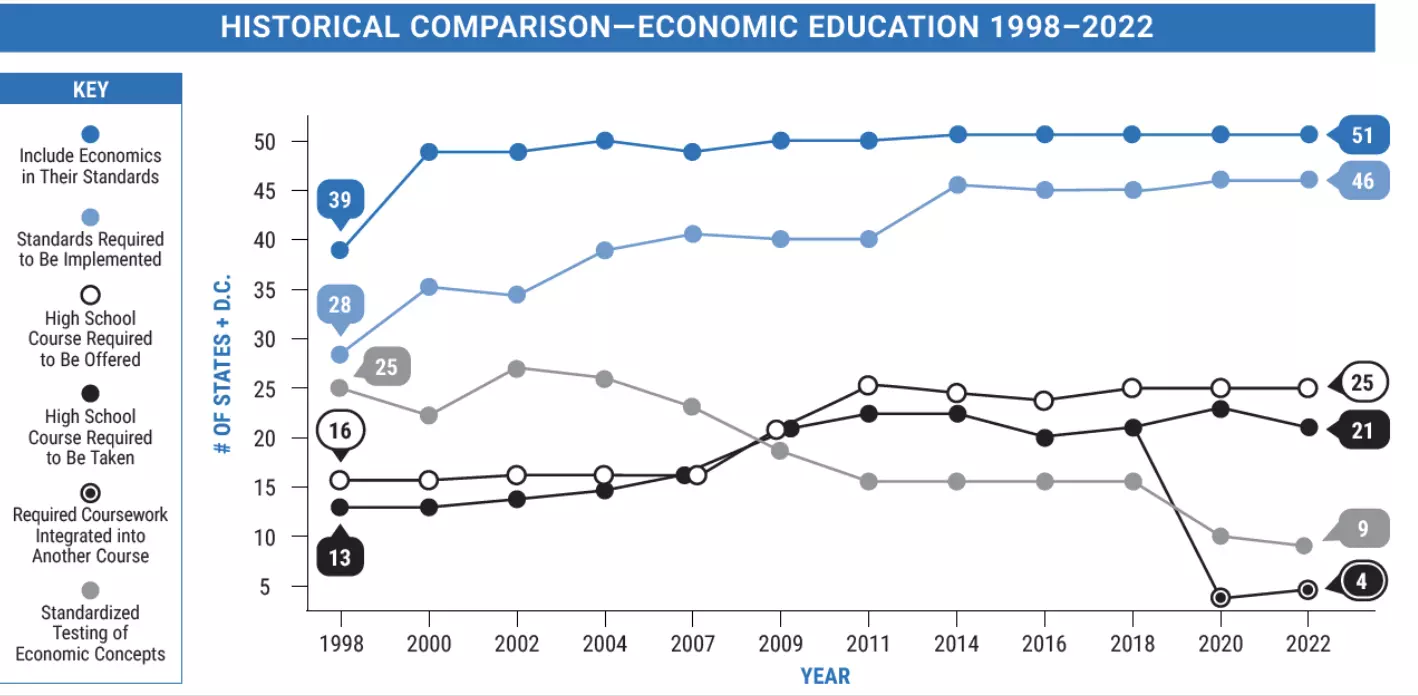

Here’s the pattern for high school coursework in economics. It’s easiest to read this graph from top to bottom. Every state, and Washington, DC, has economics in their high school standards broadly understood. However, five states don’t require the standards to be implemented. The standards can often be satisfied by incorporating some economics into a social studies class in, say, government or history. Half the states require that a separate high school economics course be offered, and 21 states require that all students take it. Nine states have standardized testing of the results.

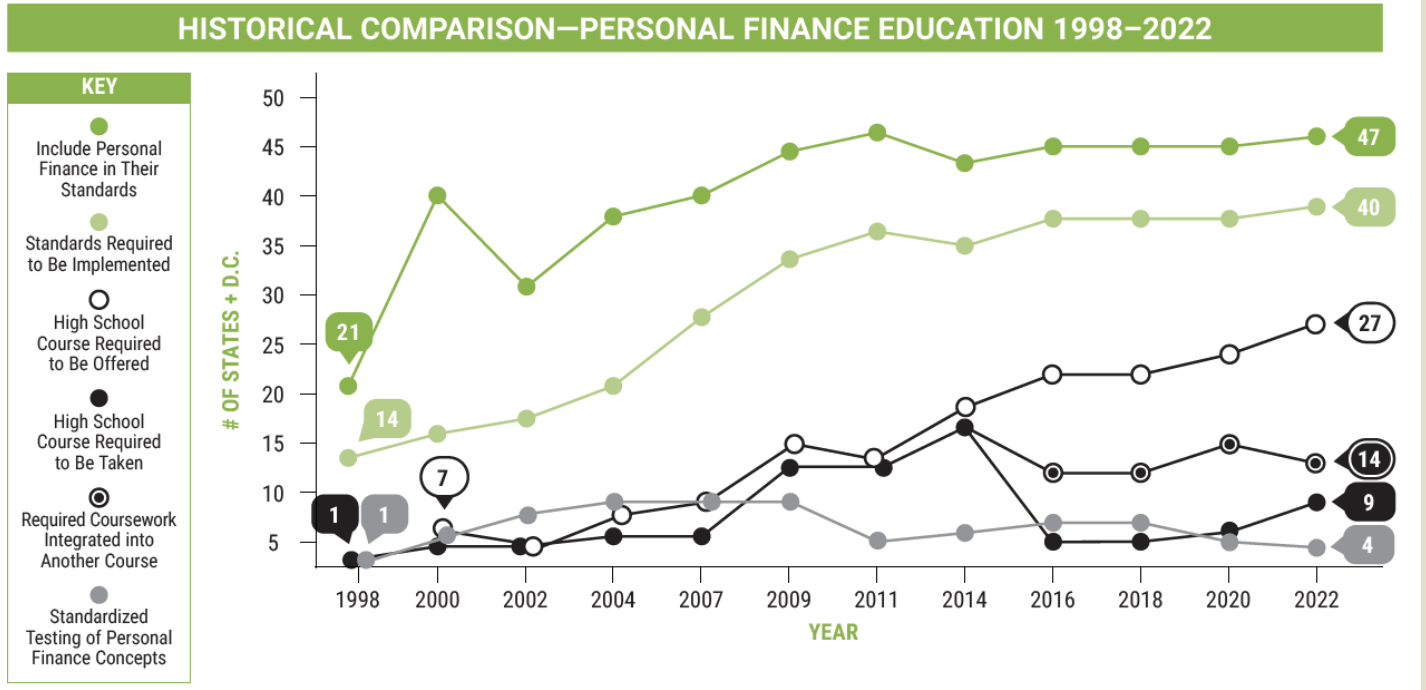

Here’s the parallel figure for a high school course in personal finance. In this case, 47 states include some personal finance in their standards, and 40 require that school districts implement this standard. As the figure shows, 27 states require that high schools offer a personal finance course, but only nine require that students take such a course, while 14 more require that personal finance coursework be integrated into another course. Four states have standardized testing of personal finance concepts.

Given that I work as the managing editor of an academic economics journal, I suppose I should be in favor of continued growth in high school classes in economics and personal finance, but I admit to being a little dubious about both. There’s a real challenge in thinking about what economics should be required as a graduation requirement for every student, and what should be offered as an option to college-bound students. Many high school economics teachers don’t have a strong background of their own in economics, but instead focused on government or history when getting their education credential. Such teachers can be shaky on the difference between teaching the structure of economic reasoning and making economics-related assertions about how history and government work.

Similarly, a personal finance class for 17 year-olds faces some challenges, as well. In my own high school econ class, many years ago, we spent a few periods learning to fill out the one-page 1040EZ form, which came in handy when I had to file taxes on my earnings from Arby’s and a newspaper delivery route. But it didn’t go much deeper. We certainly didn’t get into practical issues like thinking about credit card use, or choices of deductibles and copays in auto or health insurance, or how to think about loans for college or a car, or saving for short-term goals or long-term retirement. As I think back on myself and my classmates as high school students, I’m not sure those subjects would have meant much to us, either.

There’s also the basic problem that high school has a limited number of courses, so adding economics and/or personal finance requirements will necessarily take a bite out of something else. One option is to find a way to combine the two classes. I suspect that it would be quite possible to put together a reasonably required single course for all high school students that combined elements of personal finance and economics. But such a course would, given time constraints, have less economics than a pure economics course and less personal finance than a pure personal finance course–and thus is likely to rattle the cages of current teachers and supporters of these classes.

So yes, I would like to see more high school students graduate with some basic knowledge of economics and personal finance. But I’m very aware that drawing up state-level requirements is relatively easy, and figuring out how it works in actual classrooms is not.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest