Comments

- No comments found

Is the ongoing inflation in the US economy more likely to be a temporary burst that will fade away, or a longer-term pattern that will require a policy reaction?

One way to get some insight into this question is to look at whether many prices are rising briskly or only a few. If inflation is being driven up by just a few prices–say, energy prices–then an overall inflationary momentum has not yet spread to the rest of the economy. However, if a wide array of prices have been rising, then a broader inflationary momentum becomes a more plausible story. Alexander L. Wolman of the Richmond Fed carries out the calculations in “Relative Price Changes Are Unlikely to Account for Recent High Inflation” (March 2022, Economic Brief 22-10).

Wolman breaks up the economy into roughly 300 consumption categories. For each category, there is data on the changes in prices as well as quantity of the goods consumed. Thus, one can look at whether overall inflation is emerging from relatively few or many categories of goods–and how this pattern has changed in the last year or so.

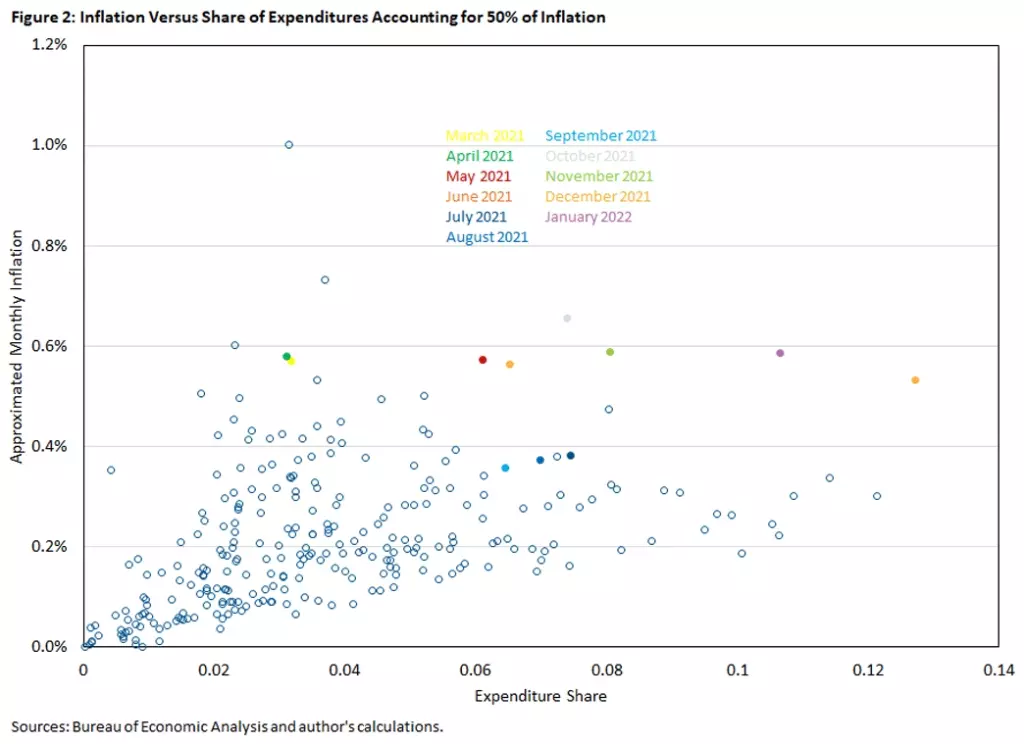

As one example, he calculates the share of expenditures, using the 300+ categories of consumption, that account for 50% of inflation: that is, does a relatively small or large share of expenditures account for half of the inflation? Each dot in the figure below is monthly data going back to 1995. As you can see on the vertical axis, monthly inflation rates were low during much of this time, often in the range of 0.2% or less. The horizontal axis shows that the share of expenditures accounting for half of this low inflation rate was also often quite small, often in the range of 2-4% of all expenditures.

However, the colored dots show more recent months from the start of the inflation in March 2021 (yellow dot) up through January 2022 (purple dot). As you can see on the vertical axis the monthly inflation rate has been substantially higher during this time, often at about 0.6%. But look at how the colored dots spread out horizontally. Back in March 2021 (yellow) and April 2021 (green) , half of inflation was coming from about 3% of expenditures, a common earlier pattern. But by December 2021 (orange) and January 2022 (purple), half of the higher inflation rate was coming from about 12% of expenditures. In other words, price changes across a much wider swath of the economy were driving inflation–a sign that inflation had become more entrenched.

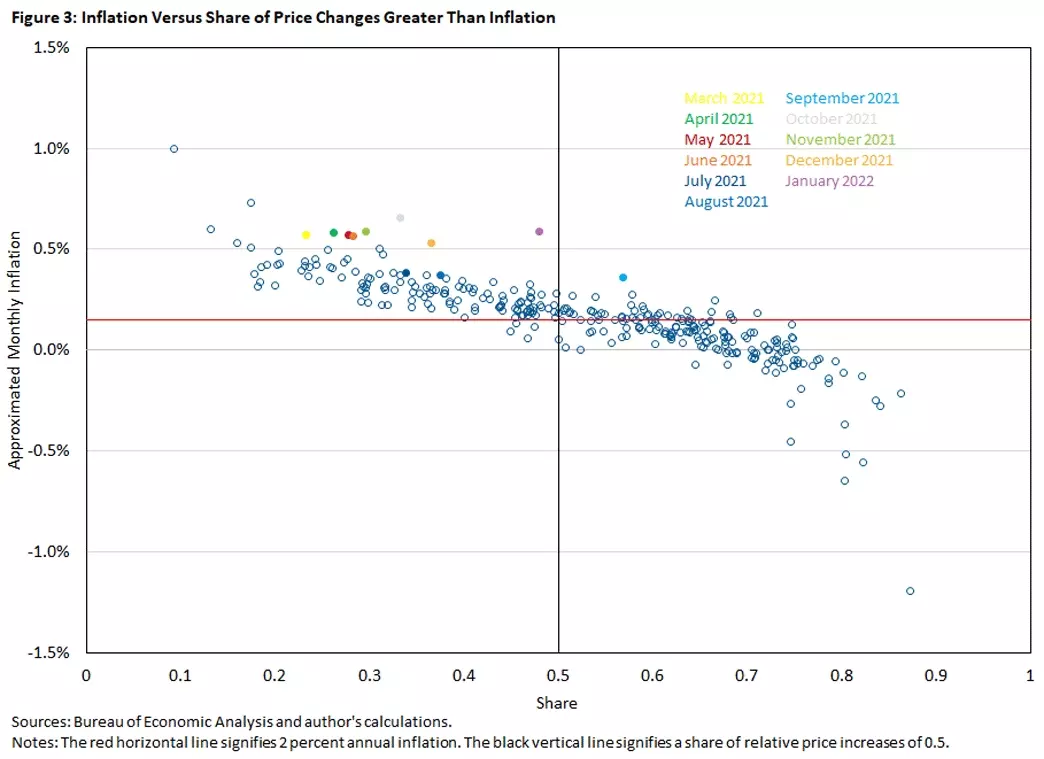

Here’s a different calculation reaching a similar conclusion. In any given month, what share of relative price increases are above or below the inflation rate? Again, you can see that in March 2021 (yellow) and April 2021 (green), a smaller share of price increases were above the overall inflation rate, but in January 2022, almost half the prices are rising at above the average rate.

The message I would take away from these calculations is that it was plausible in the summer of 2021 to think that inflation was mainly a few price changes, perhaps due to short-term factors and supply disruptions, that would fade. But the growing number of consumption categories with substantial prices makes that interpretation less plausible. In addition, this data doesn’t take into account the more recent disruptions and price hikes associated with the Russian invasion of Ukraine and the economic sanctions that have followed.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest