Comments

- No comments found

Community colleges serve many functions: a terminal two-year degree leading to better job, a stepping-stone to a four-year college degree, a chance to brush up on needed skills while not necessarily completing a degree, and a chance to pursue interests to enhance one’s life.

Here, I focus on just one of these purposes: how does the choice of major in a two-year community college degree affect future earnings.

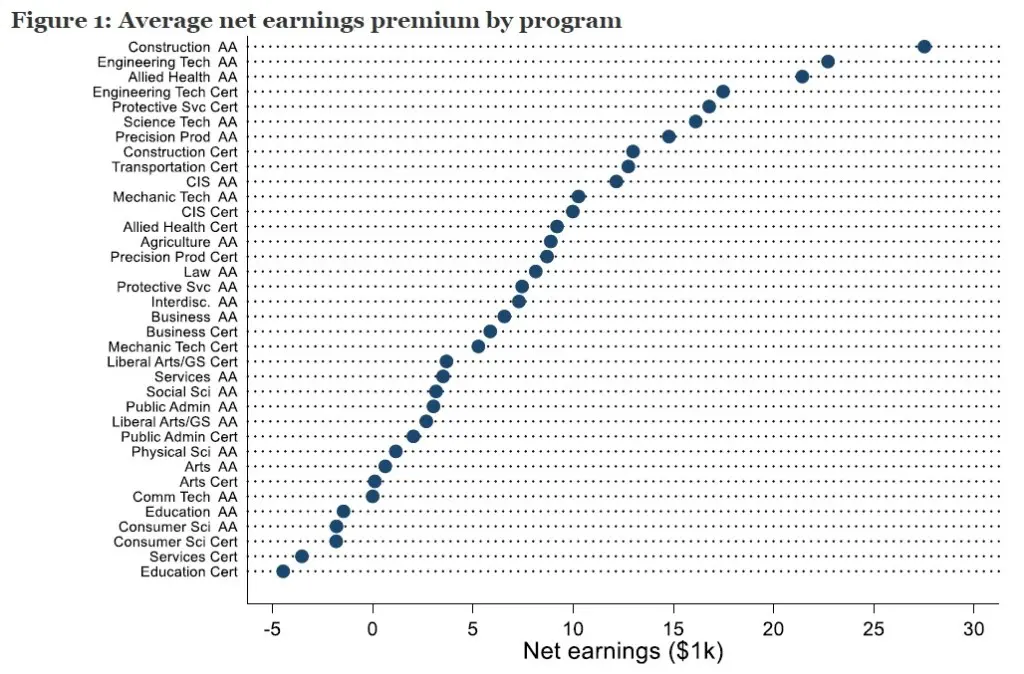

It turns out that the answer is mostly determined by the choice of major. Cody Christensen and Lesley J. Turner look at “Student Outcomes at Community Colleges: What Factors Explain Variation in Loan Repayment and Earnings?” (September 2021, Hutchins Center on Fiscal and Monetary Policy at Brookings). The horizontal axis of the graph measures “net earnings premium: “Generally speaking, a program’s NEP measures the extent to which former students’ earnings gains are large enough to cover the direct and indirect costs of attending the program.”

As you can see, most majors have a positive net earnings, but not all. The biggest gains seem to be for majors that teach technical skills. Of course, these figures represent average gains across majors, when in fact each major will produce a range of outcomes–some higher and some lower than the average.

When looking at the economic payoff of a community college degree, a common question is whether the differences shown here reflect choice of major, or whether they reflect the socioeconomic patterns of students choosing those majors. The answer seems to be that while socioeconomic factors do matter, choice of major is the big difference-maker. The authors write:

[W]e examine the program-, institution-, and state-level correlates of community college student outcomes, using program-level data on post-college earnings and loan repayment for more than 1,200 community colleges. We find that student demographics are correlated with net earnings and loan repayment, largely because programs that enroll more underrepresented minority and female students have worse outcomes. Student demographics explain a relatively small share of the variation in earnings and repayment. In contrast, the field of study explains most of the variation in net earnings across programs and much of the variation in loan repayment. Moreover, after controlling for the field of study, we find a positive association between the share of students in a program who are underrepresented minorities and net earnings, suggesting that programs that enroll more Black and Hispanic students are more likely to be in fields that lead to smaller earnings gains. Finally, we show that institutions that enroll the largest shares of minority students tend to offer fewer programs with high earning premia and more seats in programs that have lower net earnings, on average.

I’m a fan of expanding the governmental commitment to community colleges. A couple of years ago, I mentioned a more fleshed-out proposal for supporting community colleges that would cost $22 billion annually–which is more-or-less a rounding error to the spending totals being proposed in Congress these days. But this evidence emphasizes that it’s not just about getting more students through any two-year degree; it’s about being clear with students about the typical outcomes for different majors, and about increasing the support for students who might prefer a major more likely to raise future wages.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest