Comments

- No comments found

It’s well-known that inequality of wages and incomes is greater in the United States than in many countries of Europe.

But does that happen because of a greater equality of wages themselves? Or does it happen because European countries are more active in redistributing from higher to lower incomes? Or some mixture of both? Thomas Blanchet, Lucas Chancel, and Amory Gethin tackle this question in “Why Is Europe More Equal than the United States?”(American Economic Journal: Applied Economics, October 2022, 14: 4, pp. 480-518, subscription needed; working paper version freely available here). Here’s the abstract:

This article combines all available data to produce pretax and post tax income inequality series in 26 European countries from 1980 to 2017. Our estimates are consistent with macroeconomic growth and comparable with US distributional national accounts. Inequality grew in nearly all European countries, but much less than in the US. Contrary to a widespread view, we demonstrate that Europe’s lower inequality levels cannot be explained by more equalizing tax and transfer systems. After accounting for indirect taxes and in-kind transfers, the US redistributes a greater share of national income to low-income groups than any European country. “Predistribution,” not “redistribution,” explains why Europe is less unequal than the United States.

In their data, Norway (5.4 million people and a lot of oil) and Luxembourg (650,000 people and a lot of banks) have higher average incomes than the United States. But when it comes to pre-tax income, the US stands out for the low share of total income going to the bottom of the income distribution. The authors write:

Of the 27 countries considered in this paper, the United States thus ranks third in terms of average national income per adult, but nineteenth when it comes to the average income of the poorest 50 percent. On average, pretax income inequality at the bottom is lowest in Northern Europe (with a bottom 50 percent share of 24 percent), followed by Western Europe (21 percent) and Eastern Europe (20 percent). With a bottom 50 percent pretax income share of only 11.7 percent, the United States is by far the most unequal of all countries, followed by a distant Serbia (16 percent) and very far from the values observed in the Czech Republic, Iceland, Norway, and Sweden (all above 25 percent). These differences appeared even more pronounced at the very bottom of the distribution: the average income of the poorest 20 percent was €11,600 in Northern Europe in 2017, more than 3 times larger than its counterpart in the United States (€3,800).

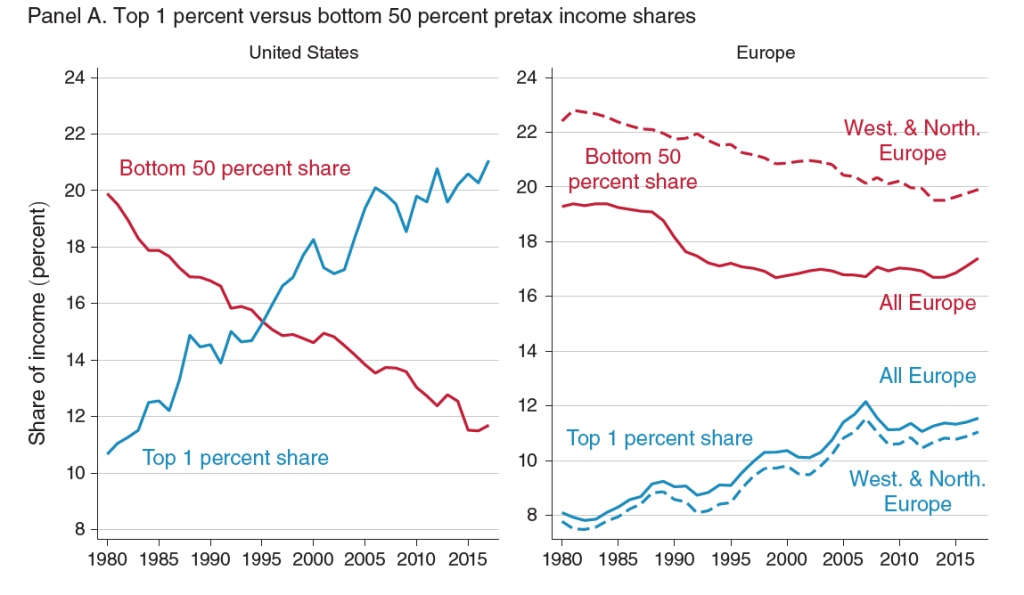

Here’s a figure to illustrate the theme. The left-hand panel is US data. It shows that the share of pre-tax income for the top 1% rising and the bottom 50% falling over time. The right-hand panel shows data for Europe. Again, the share for the top 1% is rising and for the bottom 50% is falling–that is, pretax inequality of incomes has been rising in Europe, too, But rising pre-tax inequality in Europe is substantially less.

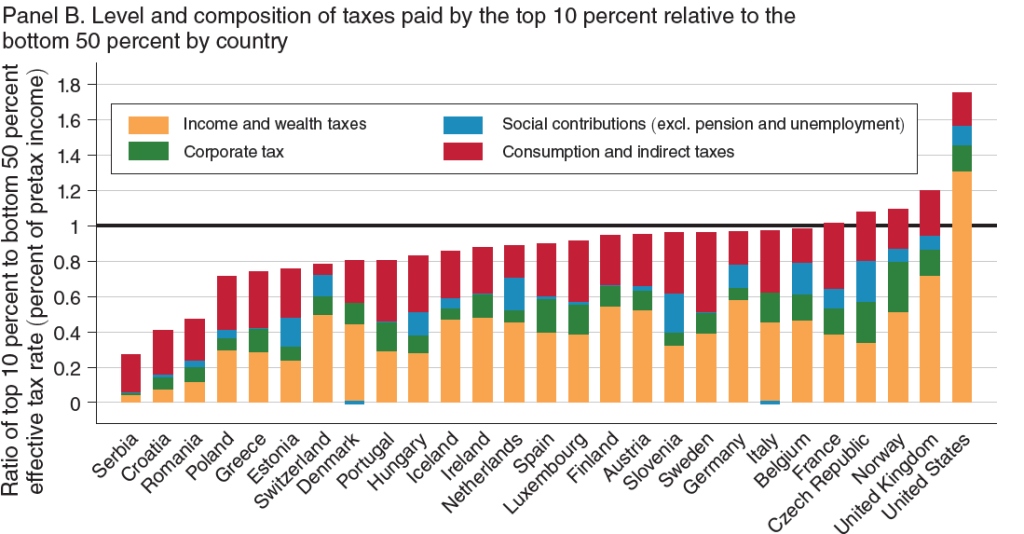

It’s true that the size of taxes and government in European countries is, on average, much higher than the United States. However, a lot of European countries both impose high taxes on the middle-class (for example, through a value-added tax) and then also provide a high level of social services for the middle class; that is, the amount of redistribution is less than you might expect.

As a simple measure of the tax burden across groups, the authors looked at the ratio of taxes paid by the top 10% relative to taxes paid by the bottom 50%. As the figure shows, the ratio is much higher in the United States. This perhaps not a surprise, given the greater inequality of the US pre-tax distribution of incomes. But again, the belief that European countries are using high tax rates on those with top incomes as a method for redistribution of income doesn’t seem correct.

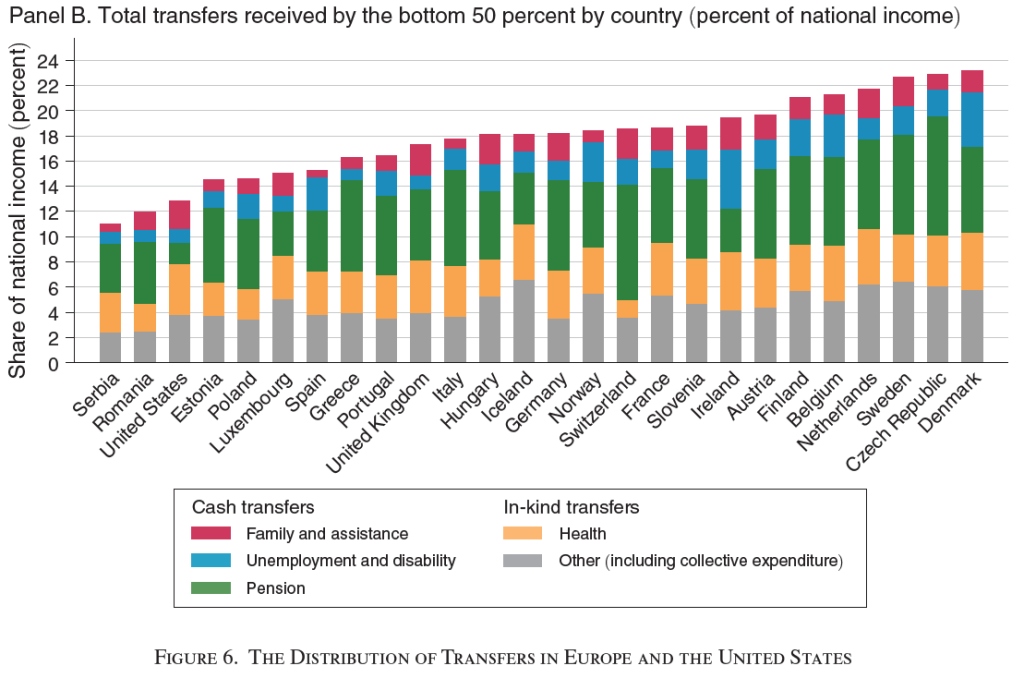

However, the US does transfer a smaller share of GDP to those below, especially in the area of pension benefits (green bars) and unemployment/disability payments (blue bars).

Overall, the authors conclude: “[P]retax income inequality appears to be considerably higher in the United States than in Europe, and accounting for redistribution only marginally affects the US- Europe inequality gap. If anything, taxes and transfers reduce inequality more in the United States than in Europe.”

These patterns suggest that, along with policies focused on post-tax redistribution of incomes, it’s legitimate to inquire into the much greater equality of Europe’s pre-tax predistribution of income.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest