Comments (3)

Romain Ranjith

This is not an ideal period of collectibles

Harry P

Good analysis

Stuart Pearce

Thoughtful read. Thanks for sharing.

Collectibles is the broad name given to ownership of goods including fine art, antiques, watches and jewellery, wines classic cars, luxury handbags, and even musical instruments.

Credit Suisse gives some insights into the market for collectibles among the very rich in "Collectibles: An integral part of wealth" (October 2020, available at the website of the Credit Suisse Research Institute). The report has separate chapters on the collectibles mentioned above. Here, I'll jus focus on some "Collectibles Facts and Figures" from an opening chapter by Nannette Hechler-Fayd’herbe and Adriano Picinati di Torcello.

They carry out a small-scale survey of 55 ultra-high-net worth individuals, defined here as households with net worth of more than $30 million, and then do some extrapolating:

However, from a collectibles standpoint, individuals or families with wealth above USD 30 million are a more relevant segment to consider. Based on the Credit Suisse Global Wealth Report 2019, we estimate that people with net worth exceeding USD 30 million accounted for USD 26.3 trillion of global wealth prior to the outbreak of the COVID-19 pandemic. ... Conservatively estimated, an approximate share of 3%–6% in collectibles would bring the value of collectibles owned by private individuals to around USD 1.2 trillion.

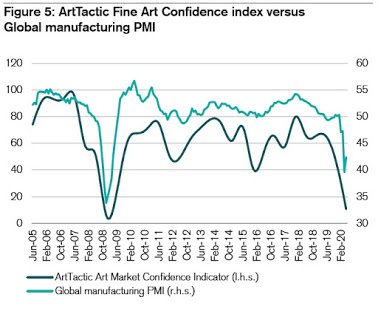

They point out that "the collectibles market has been deeply disrupted by the COVID-19 outbreak. For example, major events like the Pebble Beach Concours d’Elegance for classic cars or the Art Basel Hong Kong for fine art, as well as high profile marquee auctions like Sotheby’s Asia Week Series in New York have been cancelled or postponed." In general, prices in collectibles markets seem to be pro-cyclical--that is, they boom when times are good but suffer when times are bad. For example, here's a graph comparing an Art Market Confidence Indicator to a Purchasing Managers Index (PMI), which is often used as a leading indicator in studies of business cycle movements.

What about longer-term returns on collectibles? The authors write:

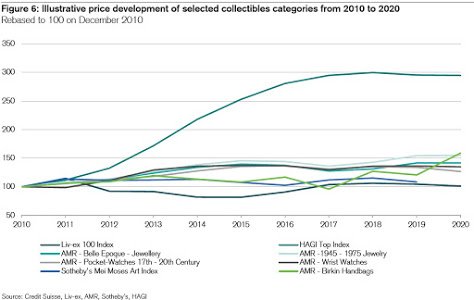

In Figure 6, for illustrative purposes, we compare the historical evolution of the Sotheby’s Mei Moses index for fine arts with the Liv-ex Fine Wine 100 Index, the HAGI Top 100 Index for classic cars, the AMR indices for watches and jewellery, and a luxury handbag index, all rebased to 100 in 2010. Over the last ten years, most collectible categories have gained in value, but with substantial differences from one to the other. On aggregate, wines and fine art have returned the least. Watches and jewellery have been effective stores of value, with cumulative 10-year returns between 27% and 61%. Classic cars were by far the best-performing collectibles category (see Figure 6). Naturally, this trend is time- and index-dependent, and other periods will show different developments. Nevertheless, it does give an indication of how the last decade panned out for various categories of collectibles.

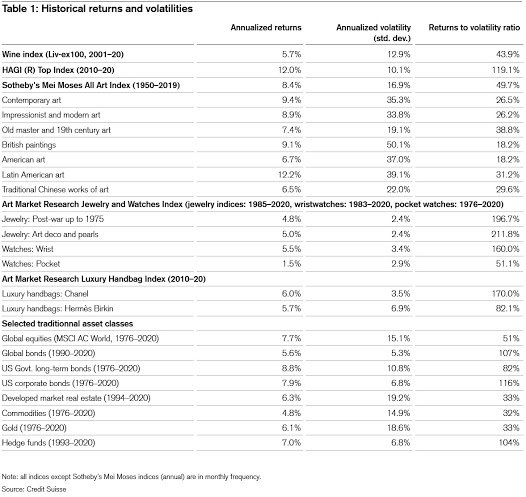

Or here is a more detailed table of returns to various collectibles over differing time frames. The table shows the returns and the standard deviation of the returns, to give a sense of how some of the prices in the collectibles markets can be quite volatile.

The topic of collectibles poses both analytical and public policy challenges. On the analytical side, the authors of the Credit Suisse report are quick to caution that indices of asset market prices pose all kinds of issues. They write:

Compared to liquid financial asset indices, however, collectibles indices face considerable challenges as to how relevant they are as a reflection of financial performance and risk. Besides being mostly non-investable, collectibles indices are made up of assets that, in contrast to financial assets, are non-fungible, unique/heterogeneous, item-by-item, and not particularly liquid as transactions only occur from time to time. Additionally, while public auction data are available, private sales data are not, which means that a significant number of transactions are unavailable for observation and inclusion. In turn, transactions included in public auctions are typically subject to significant selection bias Hence the construction of these indices nearly always means compromising on at least one.

of the above-mentioned aspects, such that the indices can only be taken as rough indications of performance, volatility and correlations.

On the public policy side, collectibles pose some hard questions if one is thinking about taxes based on wealth. To what extent should measures of wealth created for purposes of thinking about inequality or a possible wealth tax include collectibles? If you don't include the $1.2 trillion in wealth from collectibles and the return on those investments, it seems an obvious loophole to be exploited by those seeking to avoid wealth taxes. But placing a clear value on the changes in the value of collectibles from year-to-year--say, for purposes of a wealth tax-- is very hard. Many collectibles also have a value in terms of being used or appreciated for themselves, which goes beyond their market value. When it comes to fine art or antiques, one might argue that incentives to gather collectibles have social value, because such items are a preservation of the past that often end up in museums, eventually.

For those who want more, Benjamin J. Burton and Joyce P. Jacobsen wrote an article some years back on "Measuring Returns on Investments in Collectibles" in the Fall 1999 Journal of Economic Perspectives (13:4, pp. 193-212). The specific examples in that article are of course somewhat outdated, but the underlying issues remain much the same.

This is not an ideal period of collectibles

Good analysis

Thoughtful read. Thanks for sharing.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest