Comments

- No comments found

There’s a puzzle in US labor markets, as well as in labor markets in a number of other countries.

On one side, the total number of US jobs is still lower than before the pandemic. Total US employment was 152.5 million in February 2020, but 150.9 million in March 2022.

But even though total jobs are down, the unemployment is back down to where it was before the pandemic. The unemployment rate was 3.5% in February 2020, and 3.6% in March 2022.

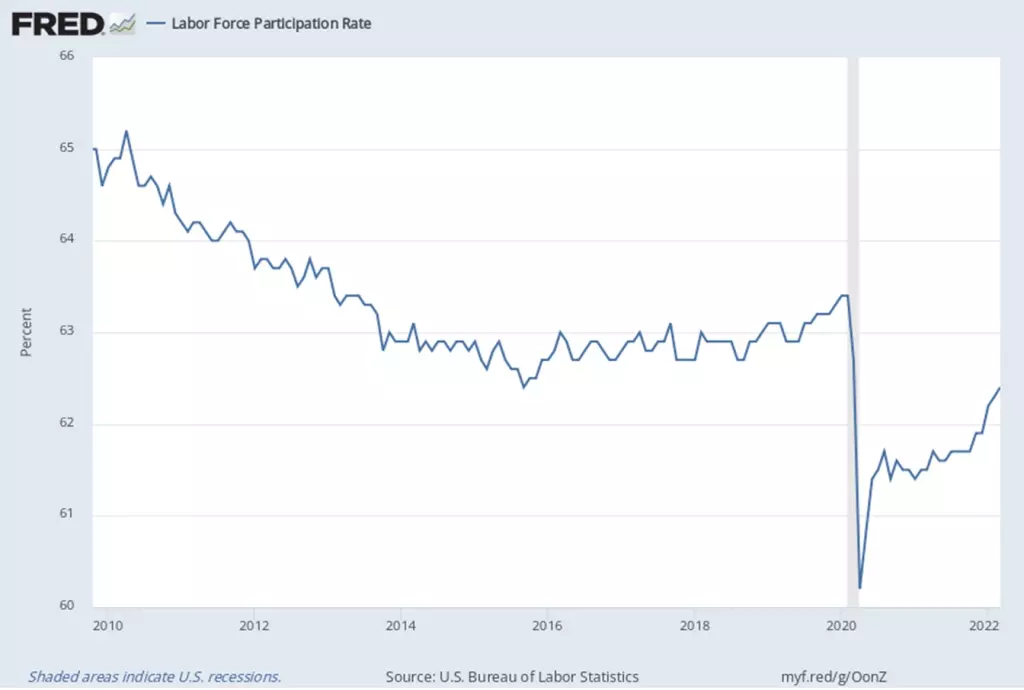

How can an economy have 1.6 million fewer jobs but (basically) the same unemployment rate? The answer is that the unemployment rate only counts people who are looking for jobs. If you are not looking for a job, then you are “out of the labor force”–and treated in the statistics like a retiree or a parent who is choosing to be home with children, not like someone who wants a job. Thus, 63.4% of adults were in the labor force (that is, employed or unemployed and looking for work) in February 2020, while only 62.4% were in the labor force in March 2022.

The most recent World Economic Outlook for April 2022 just released by the IMF has some evidence here, suggesting four possible hypotheses for the current labor market:So here’s the puzzle: Is the labor market “tight,” with relatively few workers looking for jobs openings, as shown by the low unemployment rate? Or is the labor market “loose,” in the sense that the total number of jobs is still below the peak and at least some of the workers now out of the labor force might re-enter if given the opportunity?

(1) labor market mismatch—discrepancies between the types of vacant positions and the skills of job seekers; (2) health-related concerns, which may be a strong driver of the withdrawal of older workers from the workforce; (3) changing job preferences among workers, which may account in part for historically high quit rates—a phenomenon sometimes called the “Great Resignation”; and (4) school and childcare center disruptions leading mothers of young children to exit the labor force—the “She-cession.”

The labor market mismatch refers to people with experience in one sector of the economy who then have trouble shifting to another area. Early in the pandemic this was surely a major factor. But the IMF estimates that “[a]s of the third quarter of 2021, labor market mismatch accounted for at most one-fifth of the shortfall in the employment rate …” A drop in the number of older workers, probably partly out of health concerns, can account for about one-third of the drop in employment. The US Bureau of Labor Statistics doesn’t produce a regular employment estimate for mothers of young children, but there is at least partial evidence suggesting this is a factor, too.

The shift in job preferences seems like a major factor. Here’s how the IMF describes it:

Rates of voluntary job quits have reached historic highs in both countries (the United States and the United Kingdom]. There is tentative evidence that, beyond seizing new opportunities to move up the job ladder in tight labor markets, workers’ preferences may have partly shifted toward jobs that bring not only higher pay but also greater safety and flexibility. In particular, several industries in which job quit rates have risen the most involve a disproportionate share of contact-intensive, physically strenuous, less flexible, and low-paying jobs, such as in accommodation and food services and retail trade.

Rising labor market tightness has spurred faster nominal wage growth, particularly for low-paying jobs. Since the start of the pandemic, the increase in tightness alone is estimated to have directly increased overall nominal UK and US wage inflation by approximately 1.5 percentage points. In low-pay industries, this impact has been much greater, reflecting both above-average increases in labor market tightness and a stronger historical link between tightness and wage growth in these industries. So far, overall implications of increased tightness for wage inflation have been muted, partly because low-wage workers account for a relatively small share of firms’ total labor costs …

The World Economic Outlook report draws upon an IMF Staff Discussion Note, “Labor Market Tightness in Advanced Economies,” by Romain A Duval, Yi Ji, Longji Li, Myrto Oikonomou, Carlo Pizzinelli, Ippei Shibata, Alessandra Sozzi, and Marina M. Tavares (March 2022). That report offers more detail across countries. Here are a couple of its conclusions:

Most labor markets are tighter that they were prior to COVID-19. These include English-speaking (Australia, Canada, United Kingdom, United States) and several northern and western continental European economies, while Germany and Japan still show lower vacancy-to-unemployment ratios than in 2019. Vacancies have risen steadily across all sectors, including those with more contact-intensive, less teleworkable, and/or lower-skilled jobs that were hit hard by the pandemic. Fears that COVID-19 might permanently destroy these jobs, including through automation, have not materialized so far.

Tight labor markets partly reflect reduced labor force participation, which has shrunk the pool of available job seekers. The main reason why employment remains subdued, particularly compared to precrisis trends, is that disadvantaged groups—including, depending on countries, the low-skilled, older workers, or women with young children—have yet to fully return to the labor market. Looking through cross-country heterogeneity, in the median country, low-skilled workers—about one-fourth of whom are older workers— account for more than two-thirds of the aggregate employment gap vis-à-vis its preCOVID-19 trend, while older workers as group contribute about one-third of the gap. In some cases, the decline in immigration also seems to have amplified labor shortages among low-skilled jobs.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest