Comments

- No comments found

Within the US, I often find a widespread sense that what happens in US (and perhaps also European) car markets will be the key factor in shaping world car markets.

But that’s highly unlikely to be true. The US accounted for 62% of all global car registrations in 1960. Even by 2000, the US included 22% of all global car registrations. But by 2018, the US share of global car registrations was 11% and still falling. The US and European car markets are essentially stagnant in terms of total quantity of cars, but rapid growth in cars is happening in the rest of the world, including in China.

The estimates of the US share of global car registration is from the latest version of the Transportation Energy Data Book, put together by Stacy C. Davis and Robert G. Boundy for Oak Ridge National Laboratory (vol. 39, updated April 2021). Here’s some other data from that volume.

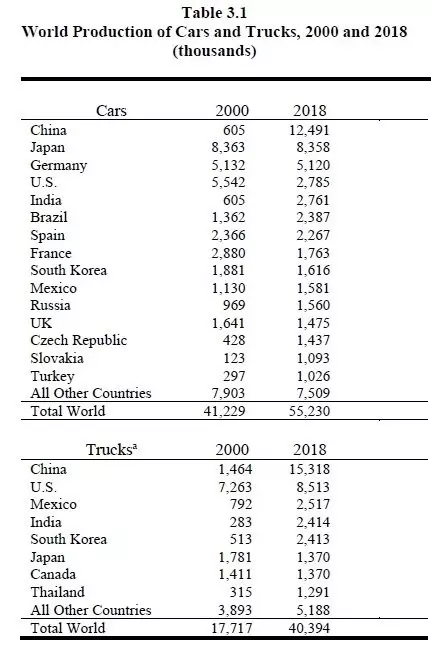

This table shows car production by country for 2000 and 2018. The US now runs a distant fourth, behind China, Japan, and and Germany, just ahead of India, Brazil, and Spain.

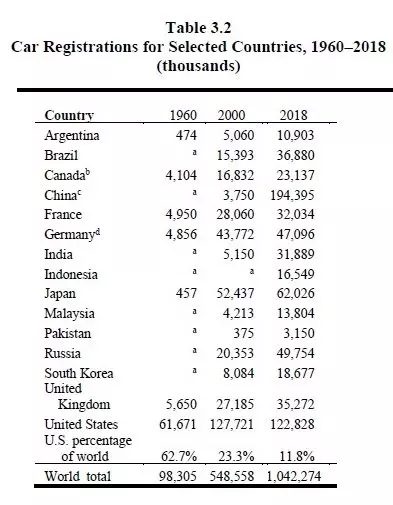

This figure shows total ownership of cars, comparing 1960, 2000, and 2018. Here, the US still runs second, behind China, but of course this is in part because of the much larger US population compared to most of the other countries listed here. It’s also true that US cars are lasting much longer, so the gap between annual production and total ownership has risen. For example, in the US back in 1970, half the cars on the road were four years old or younger, and only 2.9% of cars on the road were 15 years old or more. In 2018, only about one-quarter of the cars on the road were four years old or less, and 19% of the cars on the road were 15 years old or more.

Of course, the fundamental driver of the rising share of global car production and usage outside the US is a result of faster-growing economies in those places. How much farther do other countries have to go before they begin to approach US levels of car ownership?

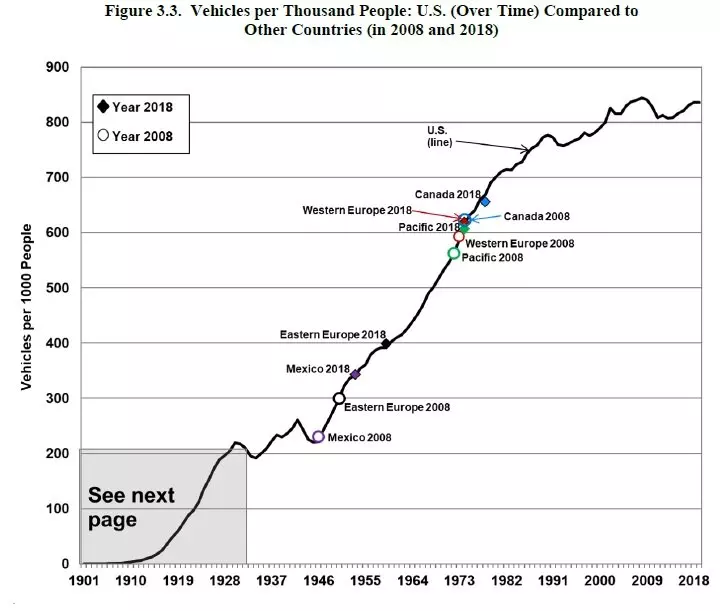

This figure helps put US car ownership in perspective with other countries. The dark line in the figure shows US vehicles per 1000 people over time from 1900 to the present. In the upper right, you can see how this measure flattens out for the US in recent decades. Then the car ownership of other nations per 1000 people is plotted on this same line. Thus, you can see that Canada in 2018, or western Europe in 2018, had about the same number of vehicles per 1000 population as the US had in the early 1970s. Further down the line, you can see that Mexico in 2018 had about the same number of vehicles per 1000 population as the US had in 1950.

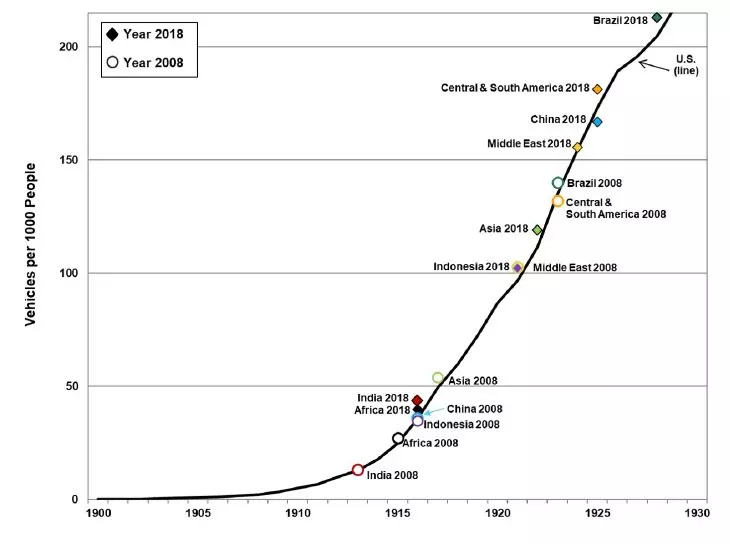

What about China and India and others? To see where they are on this line, the second figure is a blow-up of the bottom left corner of the above figure. Here, the rise in US car consumption goes only from 1900 to 1930. You can see that Brazil’s vehicle ownership in the 2018 was at about the same level (per 1000 population) as the United States in the late 1920s, while China’s vehicle ownership in 2018 per 1,000 people was at about the US level of the early 1920s.

In short, the future of the global car industry in terms of sales and technology and how automotive technology affects the world’s environment is going to be written largely outside US borders. A just-released study of demand for cars in China found an income elasticity of demand for cars in China of 2.5: that is, every 10% rise in incomes in China (roughly what has been happening every year or so) has been leading to a 25% rise in quantity of cars demanded.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest