Comments

- No comments found

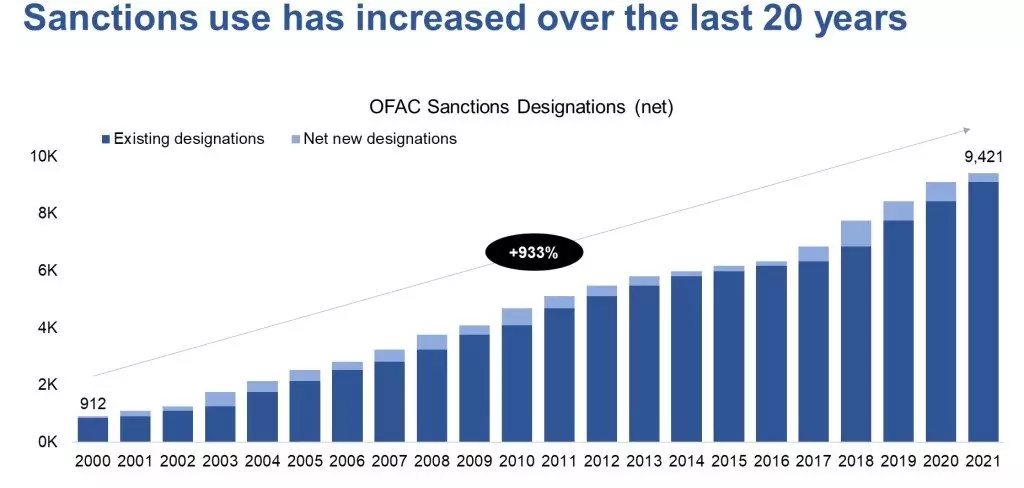

The use of economic sanctions by the United States has increased tenfold in the last 20 years.

Is this because sanctions are working so well as a foreign policy tool? Or is it because imposing economic sanctions feels like a cost-free non-military response when there is a demand to “do something”? The Treasury 2021 Sanctions Review (October 2021) doesn’t seek to answer the big picture questions, but it provide some useful background on the current status of US economic sanctions and what steps could help to make them more effective.

Here’s a figure showing the rise in US use of economic sanctions since 2000 as tallied by the US Treasury’s Office of Foreign Assets Control (OFAC)’s List of Specially Designated Nationals and Blocked Persons:

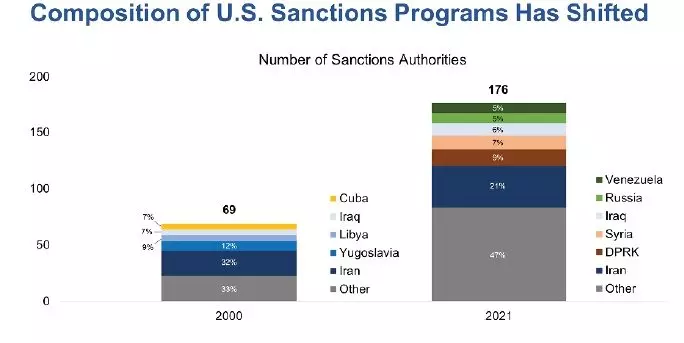

Here’s a figure showing how the countries affected by sanctions have shifted over time.

The total count here is 37 existing sanctions programs administered and enforced by the Office of Foreign Assets Controls (OFAC). The 9,421 total sanctions at present includes over 12,000 OFAC designations and nearly 3,000 OFAC delistings, As the report explains, being listed means that “their property and interests in property are blocked.

When property is blocked (or `frozen’), title to the blocked property remains with the owner of the property and any funds constituting or arising from blocked property must be placed into a blocked, interest-bearing account at a U.S. financial institution. Blocking immediately imposes an across-the-board prohibition against transfers or dealings of any kind with

regard to the property.”

In other words, if you are under these sanctions you still own your assets (at least for the present), but you can’t do anything with them

The Treasury report describes what it views as some success stories of economic sanctions: freezing and seizing billions of dollars from front companies controlled by the Cali drug cartel, which contributed to breaking the organization up in 2014; preventing tens of billions of dollars from being taken by local officials in Libya after the fall of the Qaddafi regime in 2011; and the designations of over 1,600 terrorist entities and individuals, which have impaired their ability to raise money through front groups. But as the number of economic sanctions has proliferated, it’s natural to wonder if they are working.

There’s a skeptical case to be made here. A 2019 report from the Government Accounting Office found that the government rarely does any asssessment of whether sanctions have worked. Daniel Drezner estimates that when studies are done of economic sanctions, they seem to work less than half the time. He writes that the US has imposed “decades-long sanctions on Belarus, Cuba, Russia, Syria, and Zimbabwe with little to show in the way of tangible results.” The US Treasury report is not in the business of criticizing past US applications of economic sanctions, but it does quote former Treasury Secretary Jack Lew: “We must guard against the impulse to reach for sanctions too lightly or in situations where they have negligible impact.”

Instead, the Treasury report suggests some guidelines to follow for applications of economic sanctions in the future. As you read them, they may seem obvious. But remember that the reason for the guidelines is that these steps have not been happening in any systematic way.

Treasury will adopt the use of a structured policy framework in order to inform its recommendations on the use of sanctions. This framework should reflect key policy considerations and ask whether a sanctions action:

a) Supports a clear policy objective within a broader U.S. government strategy

b) Has been assessed to be the right tool for the circumstances

c) Incorporates anticipated economic and political implications for the sanctions target(s), U.S. economy, allies, and third parties and has been calibrated to mitigate unintended impacts

d) Includes a multilateral coordination and engagement strategy

e) Will be easily understood, enforceable, and, where possible, reversible

Without this kind of process, economic sanctions will work in some cases, but much of the time will end up as just an exercise in unproductive political flexing.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest