Comments

- No comments found

Wealth represents the accumulation of assets during a lifetime, and thus wealth gap are always larger than income gaps.

Nonetheless, the wealth gaps between black and white Americans are remarkable. Ellora Derenoncourt, Chi Hyun Kim. Moritz Kuhn, and Moritz Schularick have done a deep dive into historical record to develop some estimates in ” Wealth of Two Nations: The U.S. Racial Wealth Gap, 1860-2020″ (Federal Reserve Bank of Minneapolis, Opportunity & Inclusive Growth Institute Working Paper 59, June 10, 2022). There’s also a readable overview of the main findings by Lisa Camner McKay, “How the racial wealth gap has evolved—and why it persists: New dataset identifies the causes of today’s wealth gap” (October 3, 2022).

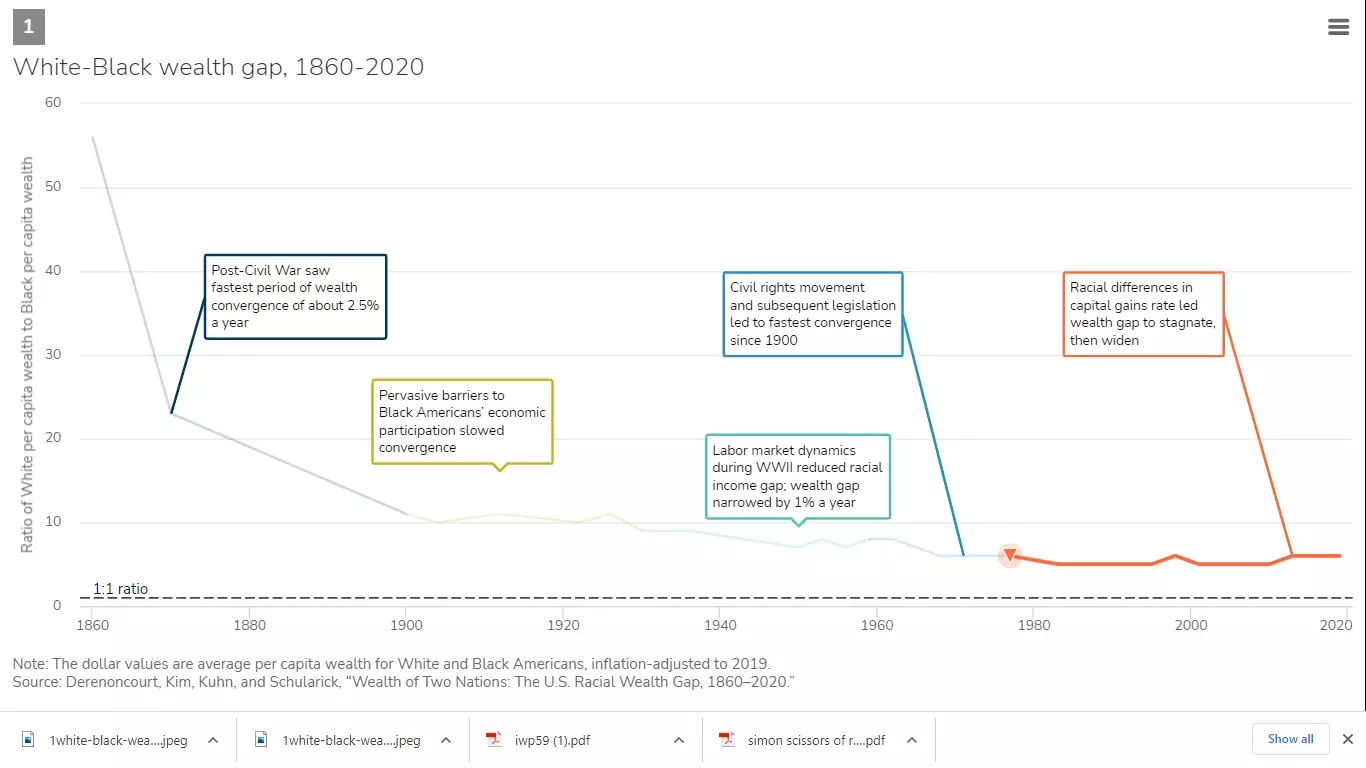

Here’s a summary figure. The vertical axis measures average per capita white/black wealth as a multiple: that is, back in 1860, the average white person had more than 50 times the wealth of the average black person on a per capita basis, but now the multiple is more like six time.

Clearly, the drop in the white-to-black wealth ratio was fastest back in the 19th century. About one-quarter of the convergence can be explained by the white slaveholders’ loss of slaves as part of their “wealth,” but the rest of the convergence happened as wealth of blacks grew relatively more rapidly than that of whites.

Then the white-to-black ratio levels out from 1900 up to about 1930, during a time of legalized discrimination and segregation for black Americans. There is some move toward greater equality of wealth after World War II, and an additional move after the passage of the Civil Rights Act of 1964. But there has been a move toward greater inequality since about 1980, which seems mainly due to the fact that those who already had the resources to own housing or to have stock market investments have done especially well since then, while those who did not already own such assets had no way to benefit from the capital gains that have occurred.

As Camner McKay summarizes the work:

The role of capital gains is particularly important here. The high rate of return to capital holdings over the last 40 years—economic parlance for “stocks have really gone up a lot”—is a leading cause of the wealth dispersion in the United States today. According to analysis by economist Emmanuel Saez and others, wealth has become significantly more concentrated during this period: In 1980, the richest 0.1 percent of Americans—about 160,000 households—owned 7.7 percent of national wealth. In 2020, they owned 18.5 percent. “Given that there are so few Black households at the top of the wealth distribution,” Derenoncourt and co-authors write, “faster growth in wealth at the top will lead to further increases in racial wealth inequality.”

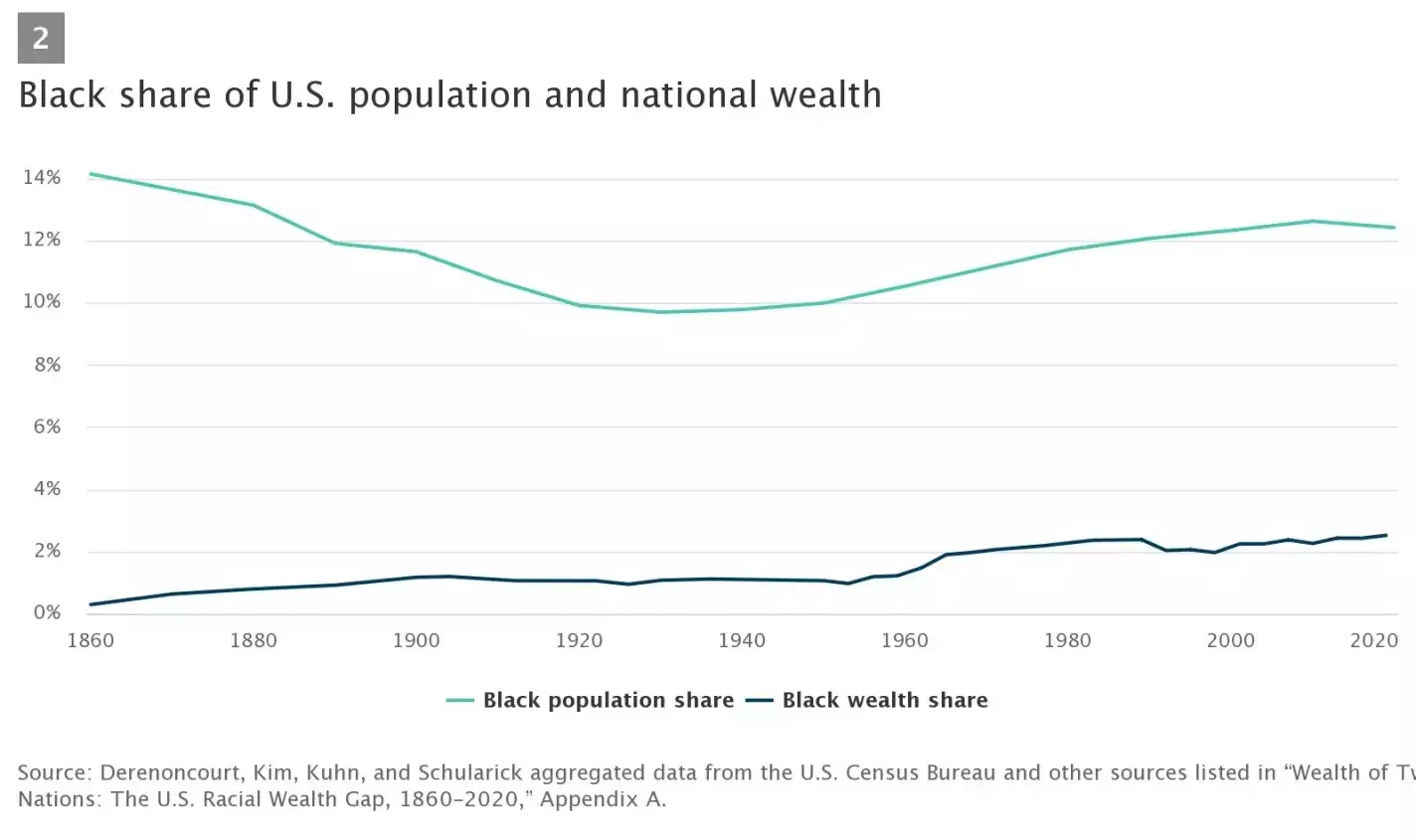

Here’s another way to slice the data, comparing the black share of the US population to the black share of total wealth.

One can of course raise a bunch of questions about the details, which in turn are addressed in the working paper. For example, where is the data from?

We do this by digitizing 50 years of data on Black wealth, from the 1860s to the 1910s, from southern state tax reports and combining this with information from the complete-count digitized censuses of 1860 and 1870. We extend this time series through the mid-20th century using historical estimates of total Black and national wealth, verified using the census of agriculture and population and household survey data from the 1930s. Finally, we draw on newly compiled data from historical and modern waves of the Survey of Consumer Finances to complete our coverage from 1949 to 2019 …

And yes, the data is publicly available here.

There’s a lot that can be said about all this, but I’ll limit myself to the obvious: Four decades–call it two generations–of no progress on the white-to-black wealth ratio is a long, long time.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest