The Tax Cuts and Jobs Act of 2017 largely eliminated taxes on US multinational corporations when they bring profits earned in other countries back to the use. As a result, there has been a dramatic rise in the dividends that U.S. parent companies received from their their foreign affiliates. Sarah A. Atkinson and Jessica McCloskey of the US Census Bureau offer some striking illustrations of this change, along with other data on international flows of investment in and out of the US economy, in "Direct Investment Positions for 2018: Country and Industry Detail," published in the August 2019 Survey of Current Business.

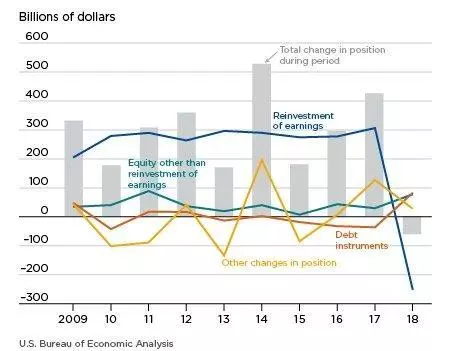

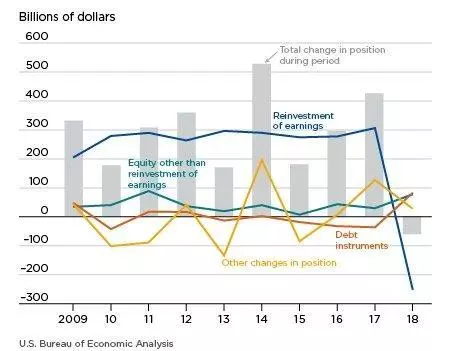

For example, here's a look at "outward direct investment" of US multinationals abroad. In any given year, the amount of outward direct investment can change for several reasons, but one key issue is whether earnings from other countries are reinvested abroad, or whether they are returned to the US. As the figure shows, US multinationals have been reinvesting about $300 billion per year in foreign earnings in other countries. In 2018, they instead brought almost $300 billion back to the US economy.

Change in the Outward direct Investment Position by Component, 2009-2018

Atkinson and Jessica McCloskey explain:

Reinvestment of earnings—the difference between the U.S. parents’ share of their foreign affiliates’ current-period earnings and dividends paid by the foreign affiliates to their U.S. parents—shifted to net inflows of $251.9 billion in 2018 from net outflows of $306.5 billion in 2017. The shift was largely due to the repatriation of accumulated prior earnings by U.S. multinationals from their foreign affiliates, largely in response to the TCJA [Tax Cuts and Jobs Act]. Current-period earnings of foreign affiliates of U.S. MNEs [multinational enterprises] can either be repatriated to the parent company in the United States in the form of dividends or reinvested in foreign affiliates. Dividends can be paid from either current-period earnings or prior-period earnings that had been reinvested. When dividends exceed current-period earnings, reinvested earnings (calculated as a residual) are negative, indicating a withdrawal of equity assets. In 2018, reinvestment of earnings of −$251.9 billion reflected the difference between direct investment earnings of $524.6 billion and dividends of $776.5 billion ..."

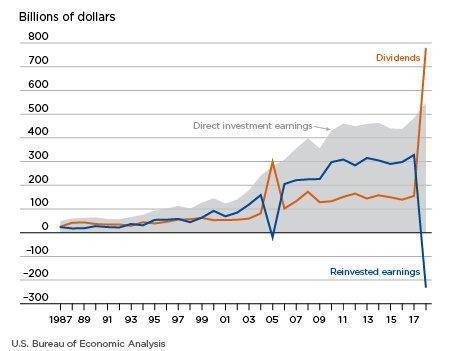

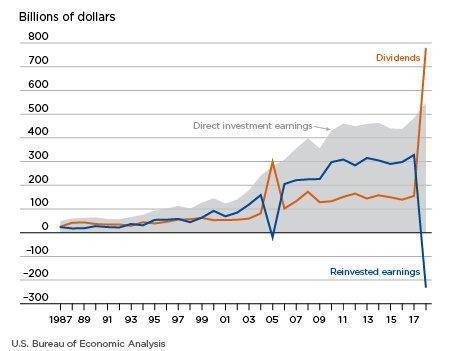

The figure below shows the pattern described in the previous text: that is, in 2018 total earnings of US multinationals on their foreign investments was $524.6 billion. However, total dividends paid to US corporate parents was $776.5 billion. Thus, the overall reduction in the stock of US foreign investment abroad was a drop of $251.9 billion.

Components of Outward Direct Investment Earnings, 2009-2018

The authors also point out the countries from which these repayments to US corporate parents are arriving. They add:

Almost one-half of the dividends were from affiliates in Bermuda and the Netherlands, and the next largest share of dividends was from affiliates in Ireland. The largest increases in dividends by industry of U.S. parent were in the chemicals manufacturing, computers and electronic products manufacturing, and information industries.

Of course, the actual physical location of US multinationals abroad is not mainly in Bermuda, Netherlands, and Ireland. Instead, these locations are where US multinationals have been holding large quantities of assets in an effort to reduce cases. For example, here's a discussion of the "Double Irish Dutch Sandwich" method for moving profits across international borders to reduce corporate taxes, and here's a broader discussion of "How US Multinationals Shifting Income to Foreign Countries Reduces Measured GDP."

As US multinationals bring home profits earned abroad, it will be interesting to track the results. Is some of the money paid out to shareholders? Will it be invested in new corporate projects, or will it be held as a liquid asset? Will this repatriation of profits affect stock market prices?

A version of this article first appeared on Conversable Economist.

Leave your comments

Post comment as a guest