Robots are coming, immigrants are taking over our jobs, outsourcing, lazy Millennials - the number of factors being blamed for the current (real) economic malaise are varied, some with a certain justification (automation is affecting employment) and some without (there is no evidence that immigration negatively takes jobs that would otherwise be filled by US citizens). However, there is almost certainly one group that is affecting the economy negatively: Boomers.

Most people do not appreciate just how huge the boomer population (those born between 1944 and 1962 +/- a year) really was. Natural population growth (due to US Citizen births) had been rising and declining in fairly regular patterns since the inception of the country, driven primarily by agricultural patterns in the West where having 10-12 children working on the farm was very common. Infant mortality rates were much higher, however, so that the number of children that actually reached the age of eighteen was lower.

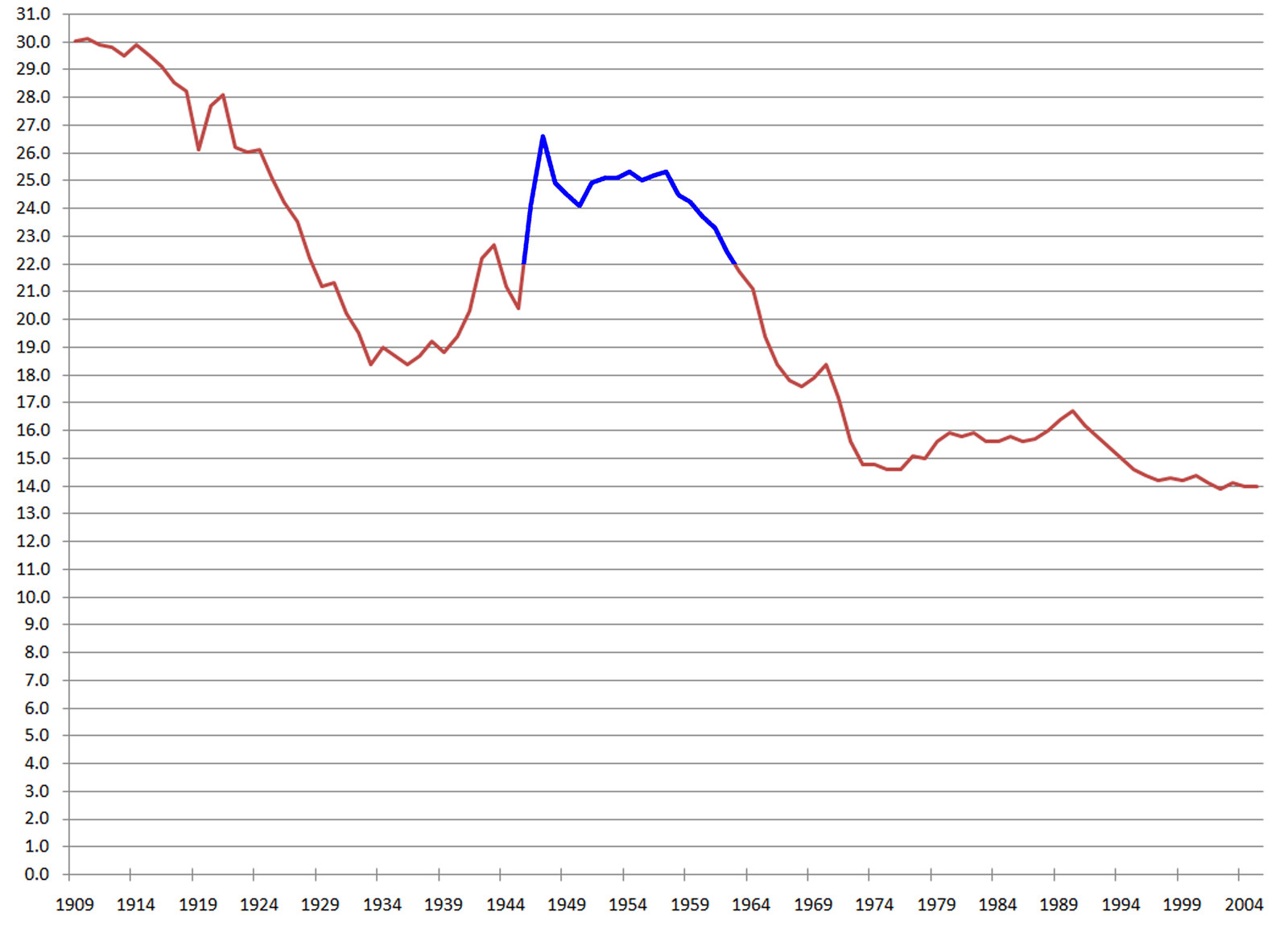

United States birth rate (births per 1000 population). The United States Census Bureau defines the demographic birth boom as between 1946 and 1964 (blue). I would argue that, for many reasons, it should be 1944 to 1962.

The Great Depression bottomed out in 1936, coinciding with a shift from a mostly agricultural focus to a more industrial one (what I've referred to as the shift from the second, coal-based, industrial age to third, oil-based one). When the US entered World War II in 1941, there was a major drop in the rate because one in twelve Americans (mainly men) were in uniform, with the bulk of those in the critical 18-35 year old demographic. When the war ended, the fertility rate spiked (lots of welcome home babies) and then settled back into the broader rise that held until the mid-1950s.

On June 10, 1957, the FDA approved the first pill-based contraceptive, Enovid, though it would take another four years before it was formally considered a contraceptive. The Pill was highly controversial at the time, but it had the effect of letting a woman choose when she was fertile. There's some evidence that without the advent of the pill, the baby boom would have continued for at least a few more years, but instead it went the other direction, dropping from a high of 25.2 births per 1000 in 1957 to a low of 14.8 births per 1000 in 1974 (what I believe should be the real definition for GenXers). There was another rise to 16.8 bpk in 1991, then a drop from 1992 on, with a more pronounced tail after 2008 (not shown here) to a rate of 12.8 or so bpk.

So what does this have to do with the economy today? The baby boom peaked in 1953. In 2018, people born in this peak year will be 65 years old. They retire, and this is a big problem. From the time they were twenty to the age of sixty five, Boomers have been investing into retirement vehicles - pensions, IRAs, social security, investment funds, stocks, bonds, municipal funds, land. That's forty five years of investment by the one of the largest generation of people the world had ever seen, relative to the size of the population.

In 2018, half of all Boomers will be moving from income earned largely by working into fixed income that comes from savings. That investment has essentially fueled economic growth through most of the 20th century. It has been the foundation for credit (along with fuel sales when the US was still a net supplier of oil). The investments should have been allowed to grow, but periodic recessions, a great deal of mal-investment, inflation and outright institutional theft has meant that these funds have generally performed poorly, perhaps only a couple of percentage points over having those funds poured into a hole.

Now this engine is going in reverse. Money is being drawn out of these accounts, and in general the generation afterwards, the GenXers, is both smaller and poorer. The economy has been slowing gradually due to this drag, reducing growth perhaps as much as 1.5% of GDP today, with about 40% of Boomers now in retirement. By mid-2018, 50% of Boomers will be pulling on fixed income resources. Most generations are considered about 9 years from a peak or trough (eighteen years total). This means that this drag will reach about 2.7% in in 2023. That means that when an economy would normally be growing at a rate of 4-5% a year, it will be growing at 1.3% to 2.5% per year. When an economy is in recession at 4.3% a year, it will be at 7% negative growth, even while the population is still growing.

So why did I choose 2023? In that year, the leading edge of the baby boomers reach 78 years of age, which is the median life expectancy in the US for a white working class male (white women are at 79, professionals and above are at 80 or so because of better access to health care). This is offset somewhat by the fact that health expenditures rise dramatically after 75 (another reason, though not the only one, why health care is so expensive right now). This means that, statistically, this is the most likely age at which a Boomer dies, and hence is no longer drawing either on his or her own savings or on government funds.

This average death age will happen for the fifty percentile boomer in 2032. This implies several things. First, the most massive draws against these funds will occur by 2027 when most boomers are retired but relatively few are dying, even as the the next demographic groupin the pipeline, the GenXers, are just entering the pipeline .Fortunately, this group decreases rather than increases over time, but the benefits this brings really doesn't kick in until well into the 2030s.

This window between retirement and death translates into a full decade and a half of significantly sub-par growth coupled with at least a couple more outright recession.

It suggests that those most hard hit will be working class and lower middle class boomer workers, and is just really beginning to be a factor now. Pension funds, often poorly managed or outright raided during corporate acquisitions, will be overwhelmed long before peak demand occurs, and the number of companies that go into bankruptcy in order to shed pensions fund demands will skyrocket. This in turn will drive politics in a huge way. As most of these companies are third industrial age in origin, the 2020s will most certainly see the end of whole swathes of iconic companies that really got their start around the time boomers were born.

This will be exacerbated by the rising tide of automation and autonomous systems. It's worth noting that once a factory or similar facility has been built, it is rare for that factory to be reconditioned. Far more common is for new factories to be built. Companies will have less money from which to draw for capital investment (as much of this capital is now servicing fixed income obligations), which means that they will likely choose to start out with highly automated factories with small maintenance labor forces, rather than upgrade existing facilities, phasing out old factories in the process.

Because there is less ability for such companies to claim tax benefits from municipal leaders (they are not significantly increasing the number of jobs) these companies will tend to cluster around technical centers that contain the specialists they need for advanced facilities. They will work with much smaller supply chains, and these in turn will be managed largely by mixed traditional and 3d printing, coupled with clustering around urban hubs. This will likely only increase urbanization during the next twenty years - with only a minimal stream moving back to more rural areas and working remotely.

The upshot of this is that the balkanization of the US will likely continue - with wealth producing activities occurring in the urban coastal regions (and to some extent the inland seas of the Great Lakes) at a reduced level, and a general depression settling into the inland regions.

To counter this, it will require a commitment at all levels to start decentralizing many of the stronger features of the tech hubs. Rethinking education has to be part of this. Today, education is still largely physically tied to campuses, meaning that they tend to become hubs for fourth industrial growth, and most of those campuses are tied too closely to urban areas. Perhaps it is time to break the link, to make education (and certification) a virtual activity. While there are arguments for bringing people in contact with one another physically for education, they are for the most part the same reasons given for making work tied to a physical location.

Seeding many third industrial age communities with physical fourth age centers - educational, administrative, research, distribution, additive manufacturing - could go a long way towards equalizing these regions, as would breaking away from requiring employees work on site. Minneapolis should be seen as a good example of this - it is a heartland community that is nonetheless becoming a major center of biomedical research, as well as a player in healthcare and insurance; many of the people that work in it do so remotely. But this is something that both companies and government policy needs to shift on.

Longer term, past 2032, the outlook improves considerably. The contributions of Millennials refortify pension systems (which will likely have evolved considerably from when they were first implemented), the demands on government decrease as the age pyramid begins to shift from being slightly top-heavy back to being more bottom oriented. The economy at that point should also have adjusted to a more sustainable basis, meaning that it is more resilient in the face of stress while better distributing the resources of an economy than third industrial economies did. Additionally, US population will be leveling off at around 420 million people by 2050, not counting immigration.

Economic growth and population growth are loosely coupled - this means that economic growth will likely also level off. This isn't a bad thing - we have likely already pushed the limits of what the planet can reasonably handle even given technology. It requires that we rethink the nature of business, of education, of the responsibilities of the state.

It will be a rocky period, but if we can get through it, we'll have a better world overall.

Leave your comments

Post comment as a guest