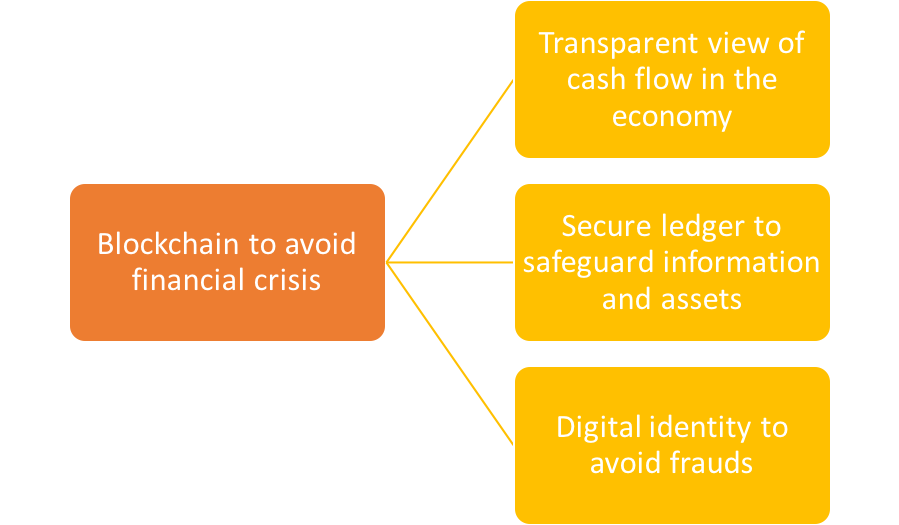

The global economy can avoid a financial crisis with blockchain’s increased transparency, improved security, and decentralized ledgers for everyone on the network.

Blockchain, the underpinning technology for bitcoin, has attracted several organizations from multiple industries. In the last few years, blockchain has proved to be a disruptive technology for numerous industries. As blockchain offers transparency, security, and decentralized ledgers, it has succeeded in attracting numerous banks to support their online trading and banking activities. One of the reasons why banks are looking out to use this technology is because it can reduce financial losses due to lack of transparency. The financial crisis of 2008 had a significant impact on banks and the global economy. A primary reason behind the crash was the lack of transparency. As blockchain technology brings in transparency, it can help avoid a financial crisis. Banking authorities can dig deep into understanding on how blockchain technology can help in preventing the next financial crisis.

Maintaining Financial Security

When regulatory authorities or central banks get a clear view of the financial transactions going on in the economy, they can gauge any discrepencies if any. This tracking of cash flow assists in understanding if there are any threats to the economy because of a bank’s faulty policies or operations. Furthermore, regulatory banks can also understand whether a financial agency requires support in their operations or if they need to be brought under control.

With the help of blockchain technology, banking authorities can get a clear picture on the performance of their monetary policy. Moreover, regulatory banks will also get to understand if they should increase or decrease the lending rates at any point in time. Well thought through measures like these will help banks inspire confidence from the customers.

Prevent Frauds to avoid a Financial Crisis

Blockchain’s security is much talked about. The reason for this is the use of cryptographic ledgers with blockchain. With cryptographic ledgers, information is secured using cryptography. To access information you need the right key, which is available only to the owner of the information. If a hacker intends to attack a blockchain network and access classified information, she has to breach every system connected on the network. As this task is extremely difficult, blockchain is considered to be extremely secure. So, banking authorities can rest assured that no unauthorized individual can hack into the system and attack their resources.

Blockchain powers smart contracts and digital identities. A smart contract is an electronic agreement between two individuals. When used in the banking sector, a smart contract can be used to file an agreement or a deal between the various financial institutions and the central bank and between the banks and the customers. Moreover, to avoid loan frauds, financial firms can introduce digital identities to ensure that their customers are trustworthy and are eligible for a loan. This would drastically lower the chances of a bad debt.

Banking authorities can take a look at how Singapore’s regulatory bank is leveraging blockchain technology. They can also keep track of extensive researches being carried out in the banking sector to maintain economic stability. A financial crisis is a remote possibility with blockchain and the technology can help central banks withstand the storm if the need be.

Leave your comments

Post comment as a guest