Comments

- No comments found

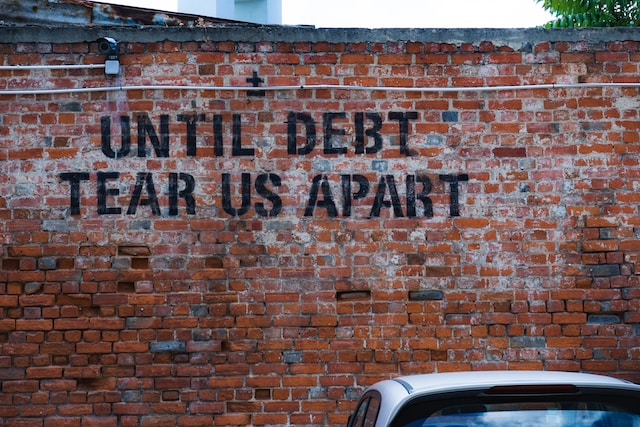

As we enter a brave new world of stubbornly high inflation, geopolitical strife, divisive politics, and a seemingly never-ending erosion of the quality of life, there is a high chance that anyone reading this will become saddened with debt at some point in their life.

Debt can be a terribly scary thing, and those who have found themselves weighed down by it will often tell you that there is a particularly awful sensation of drowning while on dry land. However, you don't need to suffer alone, as there are numerous options at your disposal that could throw you a lifeline and drag you out of the swirling gyre of debt and back ashore.

Your first step is making the conscious choice to tackle your debt issues head-on. This might be scary initially, but it's invariably the correct choice. The next step is examining what services are available in your vicinity. For instance, if you live in the Saint John area of New Brunswick, your first port of call will be contacting a local debt relief agency capable of handling your situation. This will be true regardless of where you live, but the key is to choose a service nearby. This will help expedite the process and facilitate a smoother path forward.

Unfortunately, everyone is shackled by their credit score, and that little number can have an enormous effect on your life. Therefore, any form of debt relief you opt for could have an adverse impact on the score. However, you will fare far worse if you leave it to fate and allow your debt to spiral out of control. Consequently, taking action will be the lesser of two evils regarding your score, but it will dramatically improve it in the long run.

Some methods might help right now, but they could end up hurting you in the long term. For instance, if the interest rates on a consolidation loan are too high, you might wind up paying more than you would have otherwise. Nonetheless, you need to weigh up your options and select which is best for your situation. In almost all cases, leaving your debt to accumulate and burying your head in the sand will be the worst choice. Moreover, many dedicated relief services are willing to discuss your circumstances and tailor plans to help you deal with them.

Depending on where you live, you might find luck by contacting organizations expressly set up to help those in need. You may get free advice and assistance from these groups, and they may even be able to get your interest rates lowered, your payments reduced, or your debts written off entirely. If you're worried about getting into debt again, they can assist you with making a budget and teaching you about personal finance.

The burden of debt is awful, but as you've seen throughout this post, you have plenty of options to remedy it. From using debt consolidation services to understanding that there are people out there willing to help, you are never alone, and there is always a path back to black.

Leave your comments

Post comment as a guest