Comments

- No comments found

The role of NLP in the finance sector is undeniable. It extracts desired patterns from unstructured data to transform raw data into insightful explanations.

The use of NLP for finance has changed the industry, especially in data configuration.

NLP is an aspect of AI that enables computer systems to understand and interpret human language using machine learning techniques. It is frequently associated with projects that enhance human-machine interactions, including chatbots for customer service or virtual assistants. NLP-based applications are widely used, starting with chatbots and home assistants like Amazon Echo and Alexa.

While data drives finance today, we find the most critical information in text form in documents, books, websites, forums, and other locations. NLP has advanced more than any other AI subfield in the past three years. Apart from English, the feasibility of NLP models has expanded to many different languages, enabling nearly flawless machine translation algorithms on several platforms. Financial professionals take a significant time to analyze financial reports and methodologies manually. With the help of NLP for finance, this effort has been significantly reduced.

The advantages of applying NLP in the financial sector are numerous; however, they can be summed up as follows:

NLP can automate the conversion of enormous amounts of unstructured content into insightful data in real time, saving time and resources while producing reliable findings.

While the financial services industry requires going through several data documents, sometimes manually, this adds to days of manual analysis. Text analysis on a broad range of documents, internal procedures, emails, social media data, and more is achievable by utilizing NLP technology.

Human analysts may misinterpret content in extensive, i.e., unstructured documents. In this case, it is eliminated to a greater extent.

NLP has been a blessing in developing more rigorous, quick models for company protection. These models can see patterns, recognize dangers, save labor and provide better data for upcoming planning.

The entire process of scanning and obtaining insightful information regarding financial data has become much more streamlined because of NLP.

Financial services like insurance companies and banks are the first ones to use the feature of NLPs for risk analysis. Banks can now estimate the probability of the repayment of the loans by using the information on previous spending habits and repayment history. They also need to understand which bills to collect and which to ignore. Accordingly, they can find all crucial information about clients and claims using NLP.

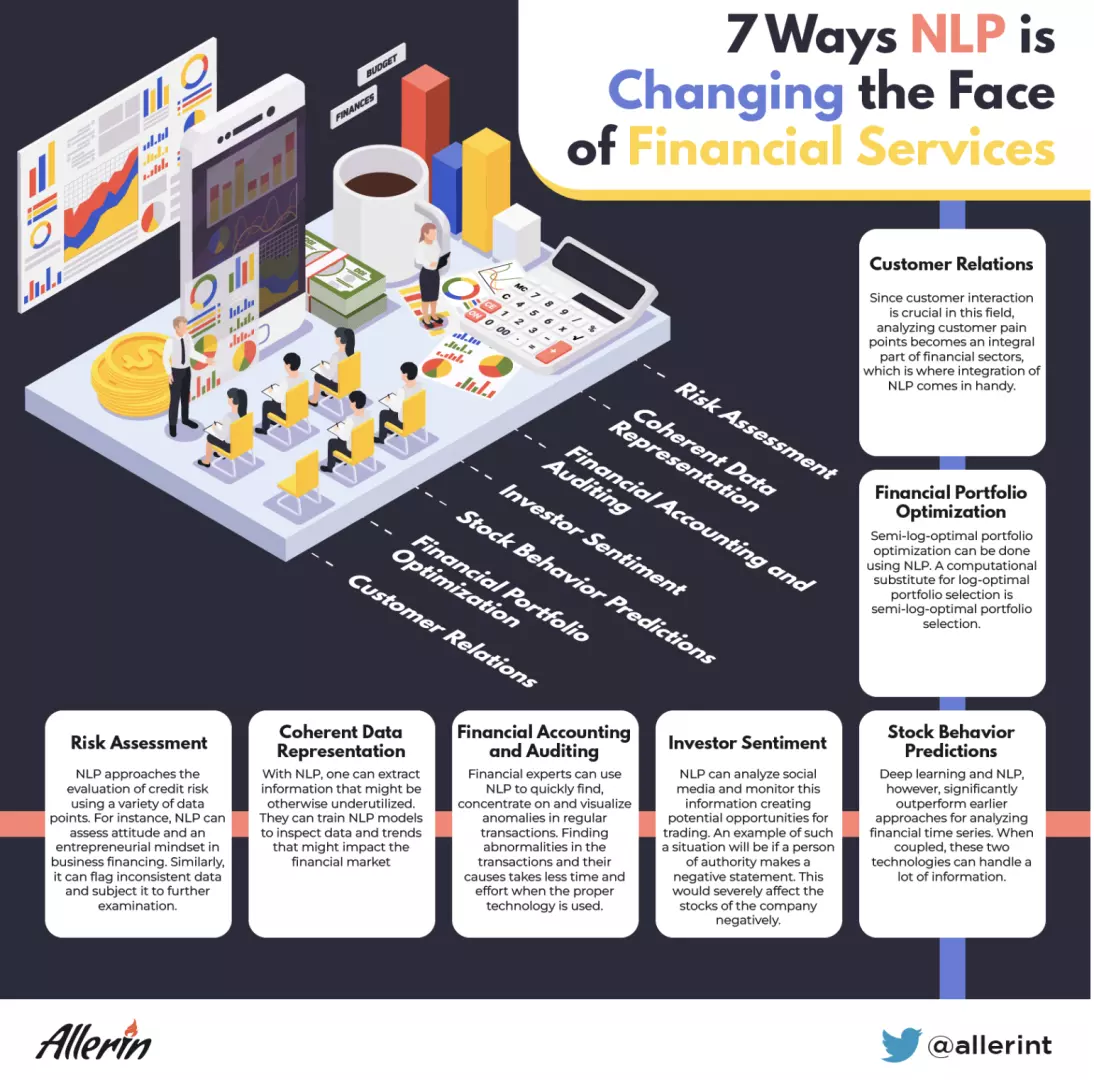

NLP approaches the evaluation of credit risk using a variety of data points. For instance, NLP can assess attitude and an entrepreneurial mindset in business financing. Similarly, it can flag inconsistent data and subject it to further examination. Even more, financial services can use NLP to incorporate delicate elements like the lender's and borrower's emotions during the loan procedure.

In most cases, businesses extract a lot of data from personal loan paperwork and input it into credit risk models for additional research. Poor data extraction can result in inaccurate evaluations even if the information gathered is used to evaluate credit risk. In these circumstances, the NLP technique known as Named Entity Recognition (NER) is helpful.

It's standard practice in the financial services industry to deal with excessive data. For their research and analytics, finance professionals go through various documents and financial resources daily.

This growth of unstructured data has complicated the analysis process and increased its time and labor requirements. Because of this, critical financial data that may provide an in-depth understanding to construct plans may be underused and affect decision-making.

With NLP, one can extract information that might be otherwise underutilized. They can train NLP models to inspect data and trends that might impact the financial markets.

After dealing with endless daily transactions and invoice-like papers for decades, businesses now understand how important NLP is to get a significant advantage in the audit process. Financial experts can use NLP to quickly find, concentrate on and visualize anomalies in regular transactions.

Finding abnormalities in the transactions and their causes takes less time and effort when the proper technology is used. The detection of critical potential dangers and probable fraud, including money laundering, can be aided by NLP.

Trading of any form depends on the information on the subject of investment. This knowledge can help traders decide whether this particular investment is worth it. Let's talk about stocks, for example. It is essential to know not only about stocks but also what the analysts are saying about the specific company one is planning on investing, and NLP can find this information.

The financial or investor sentiment analysis stands different from the routine analysis. For the standard analysis, the purpose is to find if the information shared is positive or negative. Meanwhile, in financial analysis based on NLP, one can see how the market reacts to that particular information.

NLP can analyze social media and monitor this information creating potential opportunities for trading. An example of such a situation will be if a person of authority makes a negative statement. This would severely affect the stocks of the company negatively.

With respect to the stock market, there can be several inaccuracies in data and analytics due to fluctuations or seasonal variations. Deep learning and NLP, however, significantly outperform earlier approaches for analyzing financial time series. When coupled, these two technologies can handle a lot of information.

Many deep learning algorithms have outperformed humans in the past five years at various tasks, including speech recognition and medical image analysis. Recurrent Neural Networks (RNN) are a highly successful technique for forecasting time series in the financial sector, such as stock prices. RNNs are naturally capable of identifying intricate nonlinear correlations found in financial time series data and accurately approximating any nonlinear function.

Because of the high precision level, these methods are feasible alternatives to the currently used conventional techniques of stock index prediction. In addition to being a beneficial tool for making stock trading decisions, financial services can use NLP and deep learning techniques to forecast the volatility of stock prices and trends.

Without being aware of the underlying distribution caused by stock prices, the main objective of any investor is to maximize their capital over the long term. The start of the trade period and a portfolio can be predicted using the historical data that has been gathered. Investors might use this data to allocate their present capital among the available assets.

Semi-log-optimal portfolio optimization can be done using NLP. A computational substitute for log-optimal portfolio selection is semi-log-optimal portfolio selection. When the environmental parameters are unclear, it aids in achieving the highest growth rate feasible. By separating good and unattractive equities, portfolio selection can be made using data envelopment analysis.

With so much data to take in regularly, tracking these transactions can be particularly challenging. Since customer interaction is crucial in this field, analyzing customer pain points becomes an integral part of financial sectors, which is where integration of NLP comes in handy.

The entire financial sector needs to provide excellent customer service and go above and beyond to understand the customer to serve them better. NLP plays a crucial role here by gathering information like social interactions and its customers' cultural backgrounds to customize their service.

Today, financial decision-makers understand the market entirely, thanks to NLP algorithms. NLP is now becoming more dependable and consistent and is being utilized to speed up the trade and identify risks. The financial sector is now integrating NLP for automatic audits and accounting, reducing the efforts put towards mundane day-to-day tasks. Hence, machine learning and NLP for finance have emerged as tools preferred for analytics, trading, and risk assessment, aiding in the industry's transformation.

Naveen is the Founder and CEO of Allerin, a software solutions provider that delivers innovative and agile solutions that enable to automate, inspire and impress. He is a seasoned professional with more than 20 years of experience, with extensive experience in customizing open source products for cost optimizations of large scale IT deployment. He is currently working on Internet of Things solutions with Big Data Analytics. Naveen completed his programming qualifications in various Indian institutes.

Leave your comments

Post comment as a guest