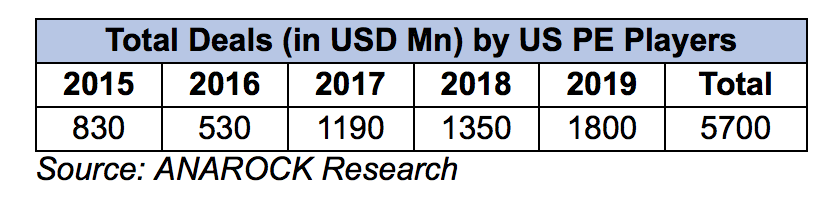

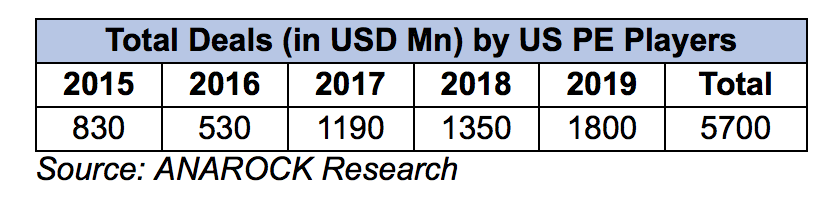

- US-based PE players top investors in Indian real estate; pumped in ~USD 5.7 bn between 2015-2019

- Top Indian cities on their radar include Mumbai, Bangalore, Hyderabad, Pune, & Chennai among others

- Of total USD 5 bn PE inflows in Indian realty in 2019, US firms accounted for significant 36% share (or ~ USD 1.8 bn)

- Since 2016, Indian real estate saw Y-o-Y rise in PE inflows by US PE funds – from USD 526 million in 2016 to over USD 1.8 bn in 2019

- With US becoming the new epicentre of COVID-19, PE funds could hold on to their India investment plans

- Some cash-rich players could scout for good bargains amid the carnage

- Major US-based private equity players include Blackstone, Hines, Warburg Pincus, Goldman Sachs etc.

With US becoming the new epicentre of COVID-19 and thus witnessing one of its worst economic blows, the economic repercussions may soon hit India, as well. As things stand now, US private equity funds which have been substantially active in Indian real estate since 2015 may reconsider their India investment plans, leading to a decline in total inflows in 2020.

However, some of the cash-rich funds could also leverage the COVID-19 fallout to optimal advantage. As and when they enter Indian shores (hopefully towards second half of 2020), they will scout for good bargains and value-pick options on their own terms. Indian developers may see reduced valuations.

In retrospect, US-based private equity players pumped nearly USD 5.7 bn into Indian real estate between 2015 to 2019, accounting for a nearly 29% overall share. On a y-o-y basis, PE inflows by US firms increased from a mere USD 526 million in 2016 to over USD 1.8 bn in 2019. Concurrently, their share has also increased – from 21% to 36% during the same period.

Other prominent PE players investing in Indian real estate are based out of Singapore, Canada, and UAE, among others.

Shobhit Agarwal, MD & CEO – ANAROCK Capital says, “India has been a major draw for US-based private equity players over the last few years. In 2019 alone, US-based firms comprised 36% share and pumped in ~ USD 1.8 bn out of the total USD 5 bn PE inflows in Indian realty. However, considering the rising pandemic fallout in the US, there is high possibility that inflows will drop significantly in 2020, thus impacting overall inflows into the country.”

Segment-wise Inflows

Notably, a major chunk of the US-based private equity inflows in India since 2015 focused on the lucrative commercial real estate segment, with Blackstone as the top investor.

- Of the total USD 5.7 bn PE funds pumped in between 2015 to 2019, close to USD 3.5 bn (61%) targeted commercial real estate

- The retail real estate segment came next, attracting nearly USD 1 bn

- Residential real estate drew close to USD 500 mn, and over USD 400 mn targeted mixed-use developments

- More than USD 300 mn were pumped into the logistics and warehousing sectors.

“Current estimates of the COVID-19 impact on Indian commercial real estate indicate net office space absorption across the top 7 cities will plummet by 13-30% in 2020 against preceding year, “ says Shobhit Agarwal. “This is because most multi-nationals and domestic businesses will re-strategize their expansion plans and optimize operational costs in the wake of the COVID-19 pandemic. All these factors will inevitably impact the Indian investment plans of US private equity majors as well.”

Leave your comments

Post comment as a guest