Comments

- No comments found

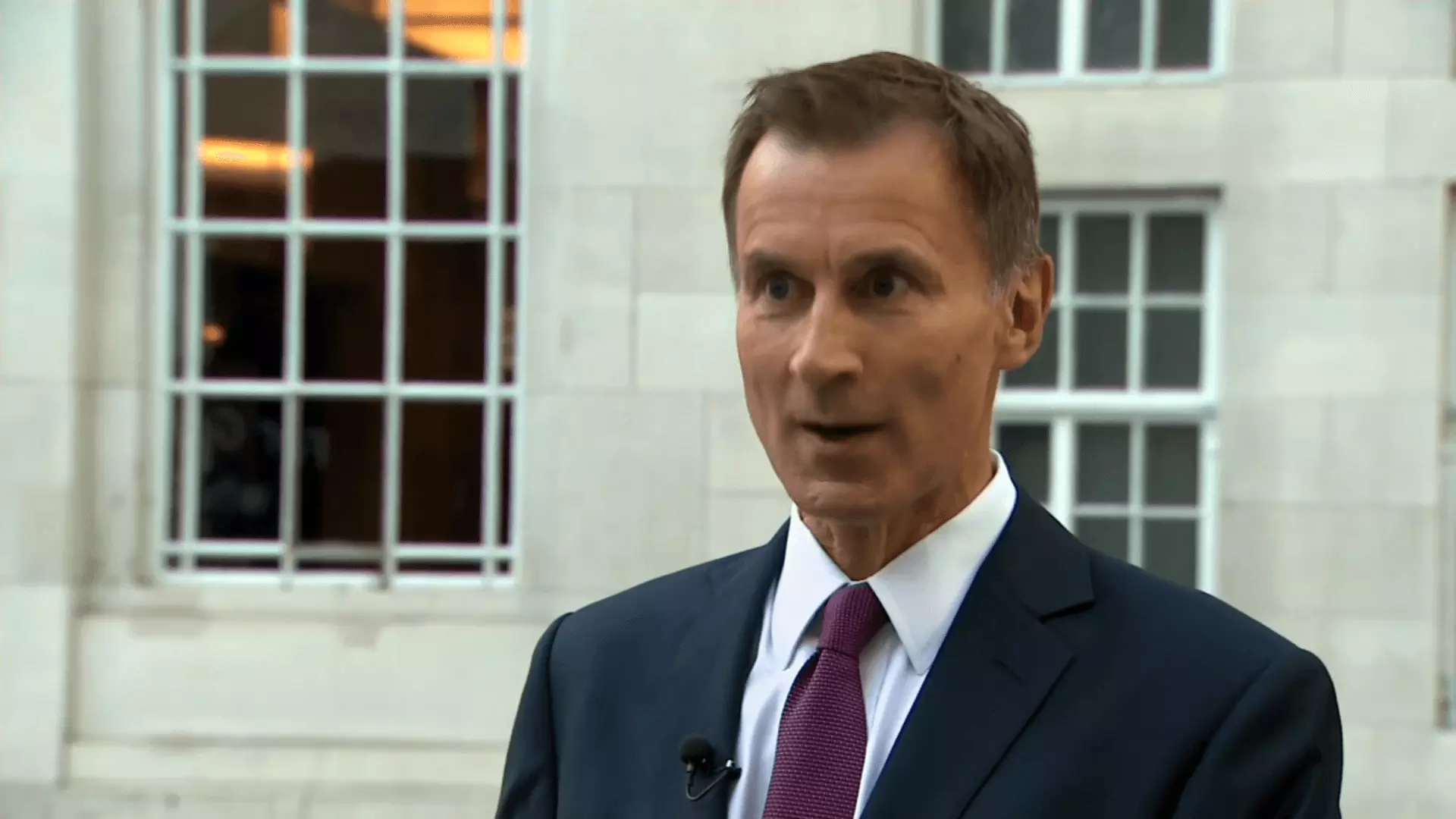

Jeremy Hunt is scrapping most of the previous tax measures set out in the government's mini budget three weeks ago.

The new Chancellor is reversing the plan to cut the basic rate of income tax from April next year, bringing forward measures from an economic plan due on October 31.

Jeremy Hunt has taken a wrecking ball to Liz Truss's tax-cutting plans as her leadership hangs by a thread.

Downing Street has insisted the Prime Minister is still in charge despite Jeremy Hunt tearing up her economic strategy.

The new Chancellor confirmed that he would axe all but two key measures from her calamitous mini-Budget.

On only his fourth day in the job, Mr Hunt picked apart the entire plan, scrapping almost all of the tax cuts except for those that have already been enacted and curtailing the energy price guarantee for households.

The Treasury said the screeching U-turns would claw back around £32 billion a year as the Government faces an estimated £60 billion black hole in the public finances.

Liz Truss and Jeremy Hunt briefed Cabinet ministers on a call at 10am where she bizarrely insisted she was still “committed to a growth agenda”, No10 said.

The massive package of support for households struggling with their energy bills has been watered down.

In his emergency statement, Mr Hunt said the energy price guarantee, which caps household bills, will now end in April - rather than running for two years.

After April 2023, the U.K. government will look to target help on those most in need.

Mr Hunt said it was critical to support millions of people through a difficult winter, but added: "Beyond that, the Prime Minister and I have agreed it would not be responsible to continue exposing public finances to unlimited volatility in international gas prices."

The decision to cut dividends tax by 1.25 percentage points from April 2023 will be reversed. The hike which took effect in April 2022, will now remain in place. This is valued at around £1 billion a year, the Treasury said.

Complicated IR35 tax rules had been due for the chop - meaning self-employed workers would be responsible for determining their own employment status. But reform to off-payroll working rules due in April will no longer take place. This will cut the cost of the government’s Growth Plan by around £2 billion a year, the Treasury said.

Kwasi Kwarteng cut stamp duty in his September 23 mini-Budget, reducing the tax paid on buying a property. The move, which came into effect immediately, will remain in place.

The cap on wealthy bankers' bonuses will still be axed, one of the few measures to survive.

Felix is the founder of Society of Speed, an automotive journal covering the unique lifestyle of supercar owners. Alongside automotive journalism, Felix recently graduated from university with a finance degree and enjoys helping students and other young founders grow their projects.

Leave your comments

Post comment as a guest