Comments

- No comments found

In some countries, like Norway, your income tax forms are public information, so any one can look up what anyone else earns.

In a US context, income is mostly considered to be private information, unless you are a public employee or an executive at a public company. Would it be a good thing to have greater disclosure of what workers are paid? Zoë Cullen tackles this question in “Is Pay Transparency Good?” in the just-published Winter 2024 issue of the Journal of Economic Perspectives (38:1, 153-80).

(Full disclosure: I’ve worked as Managing Editor of JEP since 1986. Since 2011, all articles in going back to the first issue have been freely available online courtesy of the publisher, the American Economic Association.)

One reason against making pay public, at least in a US context without a tradition of doing so, is that it can put a sharp stake through employee morale. Most workers believe they are above-average. By definition, most workers will not be paid above-average. Lower earners will feel they deserve more. Higher earners will be believe that the gap over lower earners isn’t big enough. From this view, it’s better to keep pay behind the scenes.

But this secrecy can be a curtain for discrimination. Cullen mentions the famous Lilly Ledbetter case from the late 1990s, in which Ledbetter was one of 16 “area managers” at a company, doing the same job and with roughly similar levels of experience. However, she was the only woman in the job, and until a male colleague sent her a message, she did not know (and had no way of knowing) that she had been substantially underpaid compared to her male co-workers for years. In the last few decades, concern over this situation has led many US states and high-income countries to pass laws that seek to provide more information about pay in general, but typically in a way that continues to provide some secrecy about individual pay.

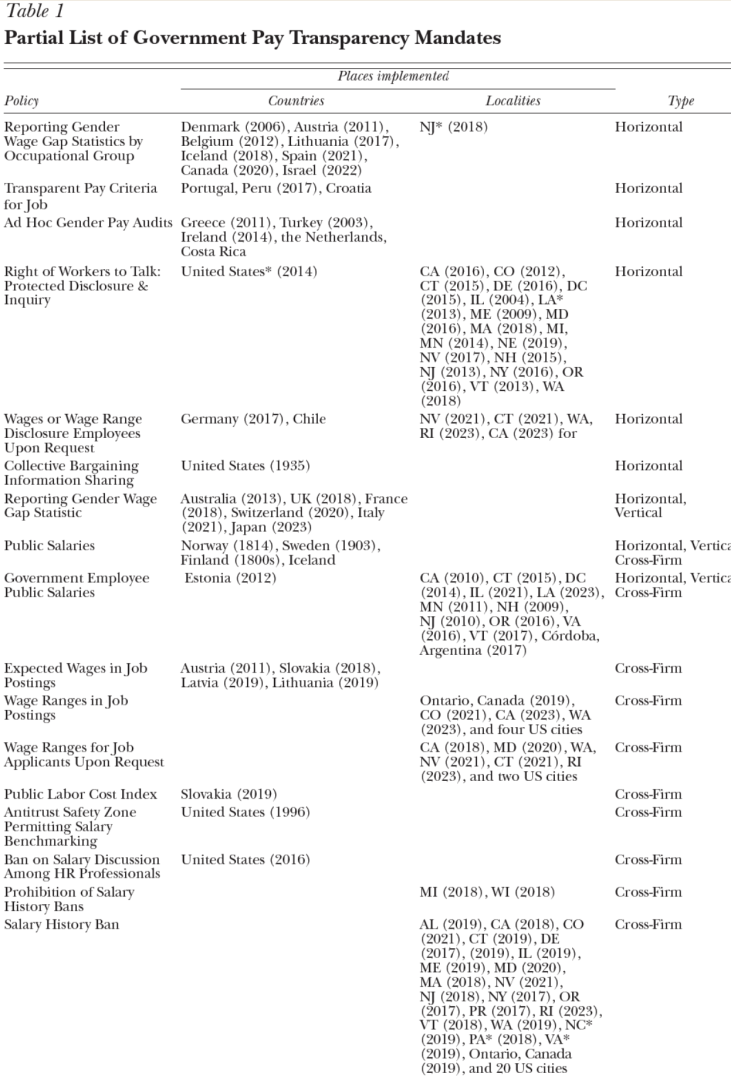

Cullen usefully identifies three types of pay transparency: horizontal pay transparency, which provides information of what people in the same job category at the same company are making (the Ledbetter situation); vertical pay transparency, which pressures employers to reveal the pay gap across different levels of seniority in a firm (like the pay raise you would get if you were promoted); and cross-firm pay transparency, in which companies are encouraged to put into public view what they are paying for various jobs (for example, by requiring that job ads include a salary range). She draws upon a wide range of empirical studies of the pay transparency laws and rules that have been passed, and finds that the effects are quite different.

It turns out that horizontal pay transparency has two issues. One is the morale issue mentioned above: in many places, workers get snippy about what their co-workers earn. The other issue is that horizontal pay transparency changes the dynamics when an employer and employee are negotiating over pay. When an employer knows that the ultimate pay decision will be known to all other workers, the employer has a strong incentive to push back against a pay raise for one employee, because the employer knows that it will lead to almost immediate pressure from all other employees. Cullen writes:

In the cases where transparency achieved greater pay equalization between men and women … the reduction in pay gap was accompanied by an overall reduction in wages. Economic theory offers an explanation. Horizontal pay transparency between coworkers within a firm created spillovers between negotiations; specifically, a $1 raise for one worker became more costly due to renegotiations with other workers who have the expectation of equal pay, causing employers to bargain more aggressively with each worker. Moreover, when wages were not equalized under horizontal transparency, research has shown that workers paid visibly less than some of their peers (which can be the majority of workers) felt disgruntled and exerted less effort.

In contrast, vertical and cross-firm pay transparency do not have these effects. As Cullen explains (with empirical studies to back it up):

In contrast, vertical pay transparency and cross-firm pay transparency, while less equipped to hold specific organizations accountable for discrimination, have proven capable of raising productivity and raising wages by reducing information frictions in the labor market. Vertical pay transparency increases workers’ information about what they could earn if they were to be promoted. Because employees typically underestimate the steepness of financial rewards from promotion, vertical transparency raises expectations about potential earnings and has proven to boost effort and productivity in meritocratic environments. Cross-firm pay transparency, achieved through salary benchmarks like Glassdoor or salary ranges in job posts, informs prospective candidates about which employers pay more than others and leads applicants, especially those underpaid, to redirect their search toward higher paying firms and more favorable pay negotiations. Cross-firm pay transparency policies have also informed firms what their competitors are paying, increasing competition and putting upward pressure on wages. These pay transparency policies shine the light outward, away from coworkers under the same employer, toward vertical and cross-firm pay differences.

Perhaps one lesson here is that when it comes to higher pay, most of us are not competing against our immediate coworkers in the same job at the same firm; instead, we are competing for the next promotion, or competing against our counterparts at other firms.

For a sense of the available experience and evidence on these points, I’ll append here a table from Cullen on the different types of pay transparency laws enacted across different countries and US states:

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest