Comments

- No comments found

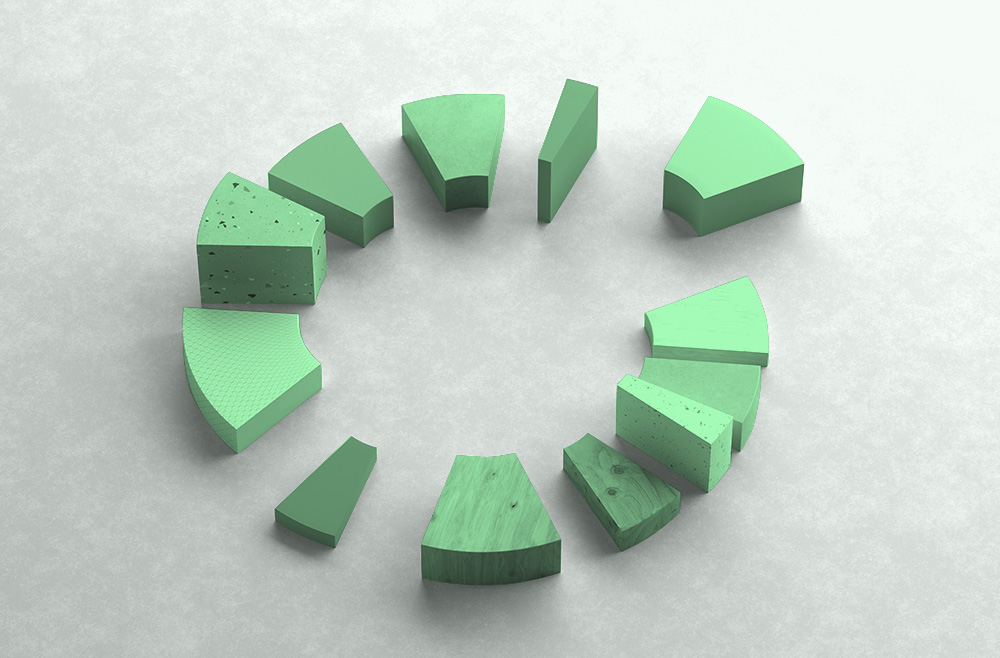

Investors take different approaches to maximize profit.

When you want to save money, there are so many things that you do in the process.

Some of it is - reducing expenses, using specific cards, utilizing coupons, billing, making notes of your income, and so much more. But what are the things that you would have to do in order to increase your profits with investments? Moreover, everyone invests in mutual funds, but there are some tips and tricks that you would have to keep up with - in order to maximize profits and grow more than you can expect. Start with a thorough investment manager selection.

Mutual funds have risen in popularity steadily over the years. Investing in mutual funds appears to be the greatest alternative for people trying to quickly build their wealth. Mutual fund investments carry a lot of hazards, although diversification helps to mitigate those risks to some extent.

Before learning how mutual funds might help you develop money or starting with your Mutual Funds investment, it is critical to understand why they are worth investing in.

A mutual fund invests in a diverse range of equities or bonds from various industries or issuers, thereby spreading the risk. Individual stock and bond risks are reduced by diversifying one's portfolio.

There are numerous mutual funds available to fulfill the investment needs and risk tolerances of investors of varying degrees of experience. Investing in equity funds is intended to fulfill long-term goals such as retirement, children's further education, marriage, and so on, but investing in debt funds is intended to satisfy short-term demands such as regular income or shorter investment periods. A hybrid mutual fund, which contains both equities and debt, is an option for investors with variable risk tolerance.

Professional fund managers are responsible for ensuring that mutual funds are managed in compliance with their investment objectives. Research teams aid fund managers in stock selection and portfolio management.

Mutual funds are an appealing investment option due to their tax efficiency. Short-term capital gains in stock funds (kept for less than twelve months) are taxed at 15%, while long-term capital gains are taxed at 10% (over Rs 1 lakh capital gains). Non-equity fund capital gains are taxed at your marginal tax rate, whereas long-term capital gains on non-equity funds are taxed at 20% after indexation. Traditionally, interest income from fixed-income investments has been taxed at the investor's marginal tax rate. Mutual funds provide significant tax advantages to investors in higher tax rates as compared to typically fixed-income investments.

There is no doubt that open-ended mutual funds are among the most liquid investments, second only to bank deposits, and significantly more liquid than investments such as life insurance policies, infrastructure bonds, and post office schemes. On the next working day, it is usually possible to redeem liquid, overnight, low duration, and ultra-short funds.

You can invest in ELSS mutual funds to take advantage of Section 80C tax benefits.

These are some tips and tricks you can keep under your sleeve for the best investment journey and the best to make out of it:

a) Utilize No Load

When it comes to improving the returns on your assets, costs must be considered. It needs to go without saying that no-load funds are preferable to load funds when it comes to lowering costs. You have more money working for you because you are not paying loads, which increases performance. All else being equal, the fund that does not impose a load will keep more money in investors' pockets than those that do.

b) Buy Aggressive

Many investors believe that investing in high-risk funds will provide them with larger returns. This is just partially correct. Yes, you must be willing to accept higher market risk in order to achieve above-average returns. However, by diversifying between several types of aggressive funds, you can reduce risk.

c) Make Use of Index Funds

Index funds improve returns in the same way that no-load funds do. By keeping costs low, you could keep more of the money working for you, increasing total returns over time. However, the benefits of index funds do not end there. These passively managed funds also eliminate manager risk, which is the risk that poor management decisions will have a negative impact on the fund's performance.

d) Go Sector - Specific

Furthermore, sector funds may be riskier than broadly diversified funds. Adding a sector fund to a portfolio, on the other hand, can assist lower overall market risk if the fund helps diversify the portfolio.

e) Allocation of Assets

You don't have to rely just on aggressive mutual funds to achieve higher long-term returns. The most important factor influencing a portfolio's results is asset allocation, not investment selection. For example, if you were fortunate enough to invest in above-average stock funds throughout the first decade of the twenty-first century, from the beginning of 2000 to the end of 2009, your 10-year annualized return would not have likely surpassed that of average bond funds.

Although stocks often outperform bonds and cash over long periods of time (particularly three years or more on average), stocks and stock mutual funds can nevertheless outperform bonds and bond mutual funds during shorter time periods.

So, if you want to maximize profits while limiting market risk, an asset allocation that incorporates bonds may be a good choice. Assume you wish to invest for ten years and want to maximize your returns with equity mutual funds.

Mutual funds are a great deal to grow your money, and the more you invest, the better your financial growth. The mutual funds you invest in also have to stay on your side to grow even more. These paths can also help you grow even more than you had already estimated too.

Disclaimer: This article is for informational purposes only and does not constitute a recommendation or investment advice. You should not construe any such information or other material as legal, tax, investment, trading, financial, or other advice. Please seek a professional financial advisor before making any investment decision. We are not responsible for and do not endorse or accept any responsibility for the availability, contents, products, services or use of any third party website as stated in our privacy policy.

Leave your comments

Post comment as a guest