Comments (2)

Hussain Asim

Good article

Ankit Sharma

Insightful post, thanks for sharing your insights.

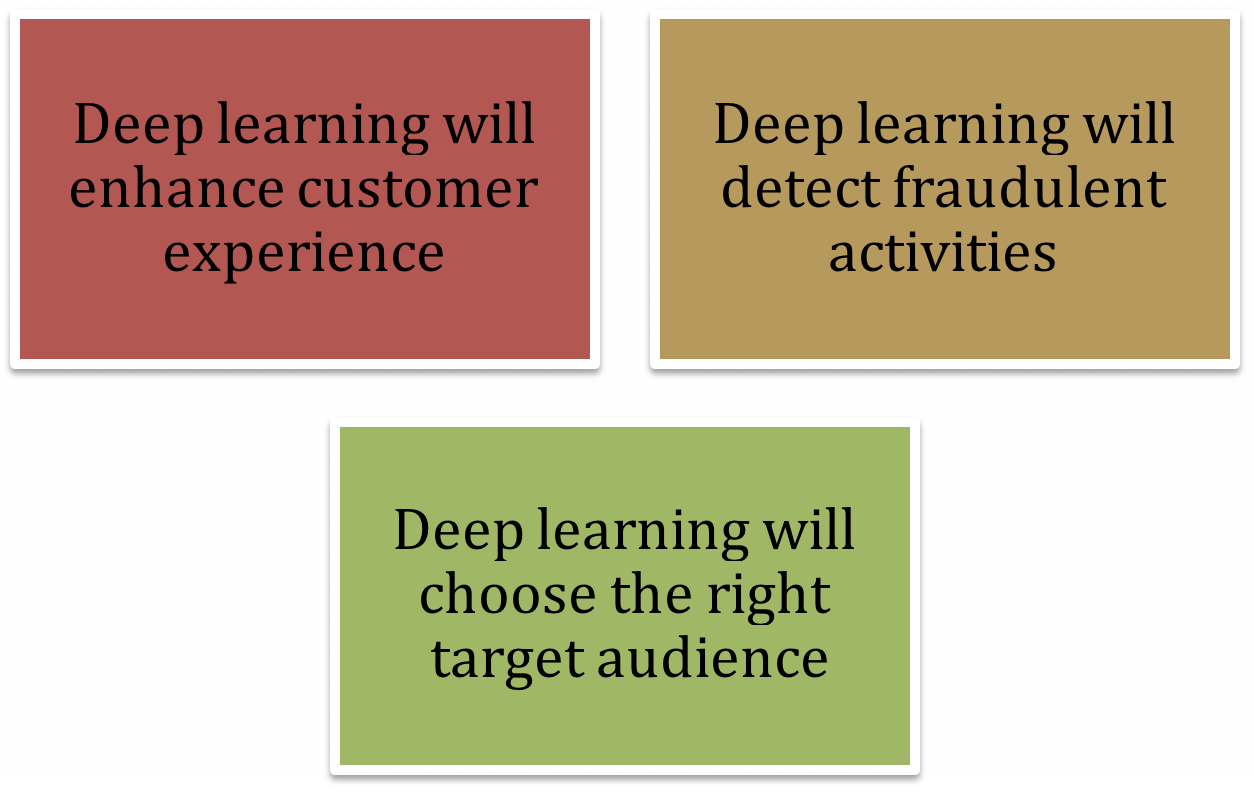

From processing claims to enhancing customer experience, deep learning in insurance offers numerous opportunities that can benefit the industry.

A couple of years ago, the insurance industry worked around legacy systems, having bookkeeping and conventional software for documentation. The legacy systems, however, failed to provide optimized outcomes when large chunks of data were poured into the industry, much of what we see today. With the advent of new and advanced technologies, various sectors, including the insurance industry, have begun seeing path-breaking innovation. The insurance industry collects and generates a large volume of data on a daily basis, including customers' health records, sensor data from vehicles, confidential legal papers, to name a few. The data, if analyzed thoroughly, gives actionable insights that the insurance industry can use to improve its services. Deep learning comes with neural networks that are capable of analyzing swarms of data and learning from it. Deep learning in insurance not only enhances customer experience but also helps the industry detect fraudulent activities.

Gone are the days when we had to meet an insurance agent in person to buy an insurance cover for ourselves or our prized possessions. The whole process of setting up an insurance account was stressful back then.

However, today's customers expect to avail a service with minimum hassle and maximum support. Deep learning is helping fulfill this expectation to a large extent. And no doubt, the insurance industry is already benefiting from the incredible applications of deep learning. For instance, chatbots are helping the industry offer customers 24/7 assistance without getting tired. But, it’s not just about applications like chatbots, that are already in use. Deep learning applications are about to revolutionize the insurance sector like no one ever imagined.

By integrating the Internet of Things (IoT) and deep learning, the insurance industry is reaching an altogether different level of sophistication. One such jaw-dropping innovation that will blow your mind is this U.S. based insurance solutions provider that uses deep learning and IoT to identify hail hits and missing shingles for roofs. With the help of drones, deep learning, and IoT, the solution makes informed decisions for customers on insurance claims, management, and roof inspection.

There is a common concern that autonomous cars will harm the car insurance industry in the future. However, the fact is that no matter the level of precision a technology scales, humans will always prefer prevention over cure. Absolute reliance on technology, without any precautions, does not come naturally to most of us, at least for now. Besides, deep learning is yet to go a long way before we hand over the reins completely. For instance, the Uber self-driving car incident, which killed a pedestrian is the first in a series of autonomous incidents that cannot be ignored entirely.

So, even though deep learning technology will offer automated services, people will opt for an extra measure of security, meaning that the insurance industry will never burn out. Top brands like Google, Mercedes, and Volvo, have insured their robocars. They are also ready to accept liabilities if their technology is at fault. So, deep learning in insurance is only going to benefit the sector and nothing else.

Good article

Insightful post, thanks for sharing your insights.

Naveen is the Founder and CEO of Allerin, a software solutions provider that delivers innovative and agile solutions that enable to automate, inspire and impress. He is a seasoned professional with more than 20 years of experience, with extensive experience in customizing open source products for cost optimizations of large scale IT deployment. He is currently working on Internet of Things solutions with Big Data Analytics. Naveen completed his programming qualifications in various Indian institutes.

Leave your comments

Post comment as a guest