Startup Genome published the Global Startup Ecosystem Report for 2018 recently and I wanted to quickly summarise some of the key findings.

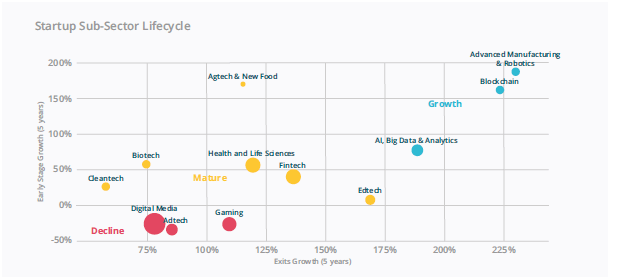

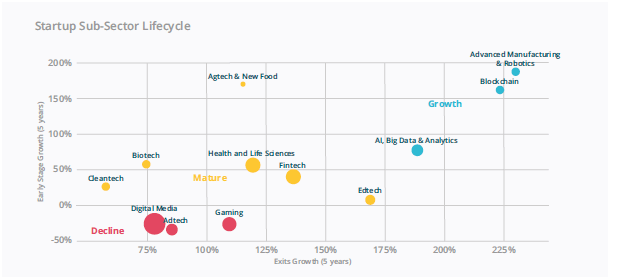

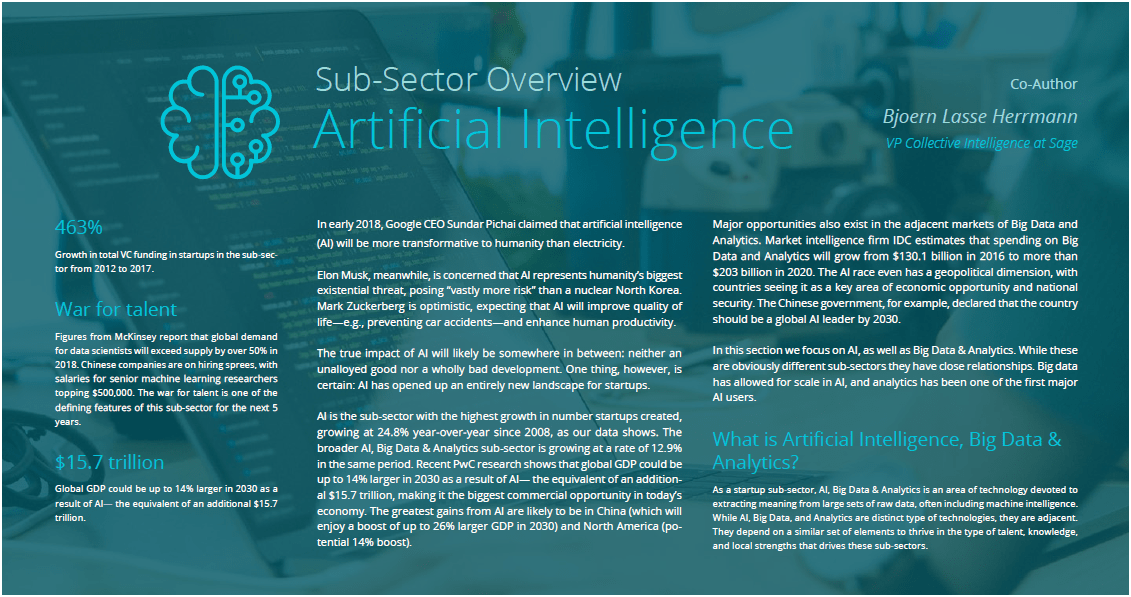

Top 4 Growing Sub-Sectors

- Adv. Manufacturing & Robotics (189% 5-year increase in early stage funding deals)

- Agtech & New Food (171% 5-year increase)

- Blockchain (163% 5-year increase)

- Artificial Intelligence, Big Data & Analytics (77.5% 5-year increase)

Top 3 Declining Sub-Sectors

- Adtech (35% 5-year decline in early stage funding deals)

- Gaming (27% 5-year decline in early stage funding deals)

- Digital Media (27% 5-year decline in early stage funding deals)

East vs. West: The Rise of China and Diminishing U.S. Dominance

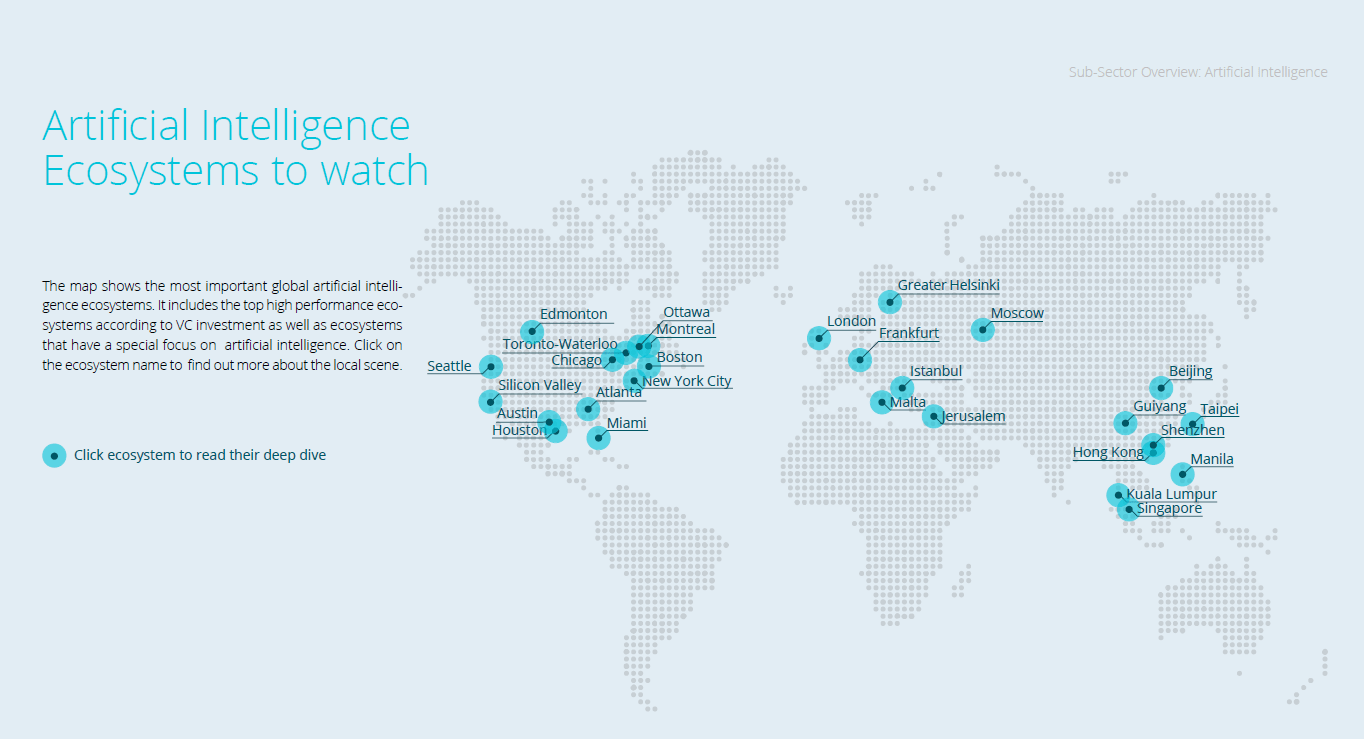

A major way we see the map of entrepreneurship changing globally with new hubs of excellence is the increase of activity in Asia and the decline of U.S. preeminence. The United States and Silicon Valley are still the top value creators in the global startup ecosystem—but their dominance is not as sharp as it once was.

For the past six years, the share of funding going to Asia-Pacific countries grew, while the U.S. share declined. In 2017, VC funding for startups in the United States compared to the Asia-Pacific region were even, with each accounting for 42% of investment value. The USA is still a bit ahead but China is the primary growth driver in this shift. In 2014, only 13.9% of current unicorns were from China. In 2017 and 2018 so far, that number has grown to 35%—while for the United States it has decreased from 61.1% to 41.3%.

Top 4 Countries for AI-Related Patents in 2017

- China

- United States of America

- UK

- Australia

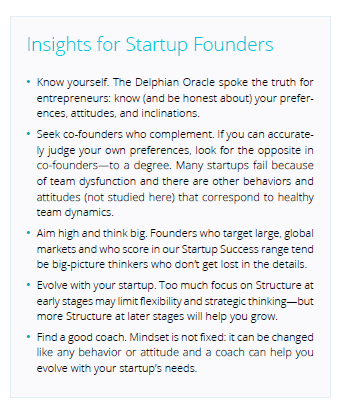

Here are the startup success factors:

Founder

This Success Factor—which we started defining in 2011 and recently returned to complete its DNA—looks at issues intrinsic to the founding team and that are under their control. These are internal Success Factors rather than ecosystem Success Factors, which are external. Sub-factors include:

- Mindset and Ambition: a set of metrics based on cognitive science research, as well as separate measures of ambition and motivation.

- DNA: demographics, economic and educational data, and influencing factors on the choice to become an entrepreneur.

- Startup Strategy: the company’s go-to-market strategy, the markets it is targeting, the international experience of its leader, and the global deployment of the team.

- Know-How: knowledge of the Customer Development and Lean Startup methodologies and other knowledge keys to early-stage success.

Talent

This is one of the most difficult Success Factors to quantify, in part because talent must be defined differently from conventional wisdom when talking about early-stage startups. While sheer engineering quality matters, the best local engineers are mostly out of reach for early-stage startups and therefore what most matters to early-stage startups is engineers with prior experience in a startup, and secondarily, scaleup experience along with attraction of foreign engineers. Talent Sub-factors are:

- Access: we aim to capture the ability of early-stage startups to hire and attract engineers and growth employees, particularly those with prior startup experience, recognizing that access varies substantially by ecosystem stage and the quality of local educational institutions. More metric validation is required here

- Quality: we currently measure this by a mix of raw talent and scaleup experience in the community

- Cost: requisite compensation for hiring software engineers

Funding

Data on funding is widely available and is therefore overused in trying to explain startup and ecosystem performance. As a result, it becomes the main culprit in the conclusions of much research. Yet funding is only part of a complex system of resources across the lifecycle. Funding data is also misused—we have come to realize that much of the “current” funding data is later changed because it can take 6 to 12 months for funding rounds to enter the relevant datasets. The Funding Success Factor very closely correlates with our Ecosystem Performance Model (correlation of 87%).

- Early-Stage Funding Per Startup. Together with Startup Output, this is the first test of a potential gap. We combine global databases with local data, applying a set of correction mechanisms to account for missing rounds and differential coverage. We then break down any funding gap into four actionable issues:

- Proportion of startups obtaining seed funding, which varies widely and is a key challenge for Activation phase ecosystems

- Attrition rate from seed to Series A, frequently a gap issue.

- Median seed amounts—because investors believe that a minimum funding level is needed for a startup to succeed, but that too much money can lead to harmfulpremature scaling, comparative interpretation of these results needs to account for differences, including insalary costs.

- Median Series A amounts—our experience shows that these are more likely to be an issue because the purpose of this round is to fund growth.

- Early-Stage Capital Invested—a measure of overall funding and, as a leading indicator, its growth.

- Experienced VC Firms—their number and proportion provides an indicator of quality.

Startup Experience

Measuring the diversity and complexity of experience in a community is difficult. We have developed a set of metrics that capture experience and are validated against ecosystem performance. These include:

- Giving equity to advisors and employees, which is linked with success.

- Scaling experience through exits.

- Experience with growth in a fast-growing startup or unicorn

Along with Funding, Startup Experience has the highest correlation with the Ecosystem Performance Model (correlation of 85%). The fact that those variables are very much independent from the Ecosystem Performance Model variables makes this correlation quite striking. We developed a solid Startup Experience model and solidified the Factor’s position in the Lifecycle Model as the X axis, with ecosystem Size & Resources a function of Startup Experience.

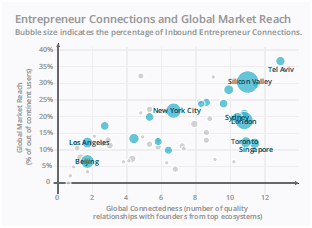

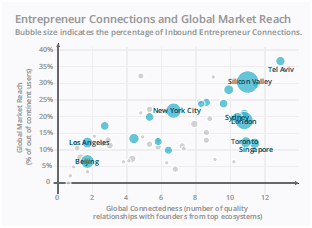

Global Connectedness

Defined earlier in this article along with a chart showing its close relationship with Global Market Reach below.

Local Connectedness

Our new Local Connectedness Success Factor is defined earlier in this article and is the object of its own article later in this report. It has a correlation of 46% with the Ecosystem Performance Model. It includes the sub-factors:

- Sense of Community: how founders and investors help each other

- Local Relationships: the number of quality relationships between founder and other founders, investors, and experts

- Collisions: participation of founders in community activities and events

- Density: the prevalence of co-working spaces and how many startups use them, the physical proximity of startups to each other, and how far founders live from where they work

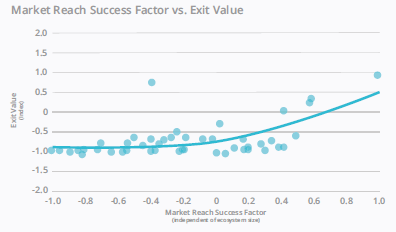

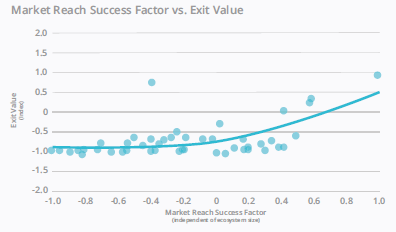

Global Market Reach

As explained above, we measure the extent to which startups sell to customers not only outside their home country but also outside the immediate continental region. The latter, captured as Rest of World customers, filters out geographic bias. In most Canadian ecosystems, for example, startups report a high percentage of foreign customers. But, when North America is removed, the Global Market Reach of Canadian startups falls sharply. Most of them are selling into the United States, but not elsewhere. As explained earlier, Global Connectedness leads to Global Market Reach and the production of scaleups. The Global Market Reach Success Factor is therefore closely related to the Ecosystem Performance sub-factor Exit Value, as the chart below demonstrates. The exponential relationship between the two factors is very noticeable.

Organizations

Measurement of the quantity and quality of organizations, programs, events, and other activities is being conducted with support from the Kauffman Foundation.The result will be a prioritized list of programs and characteristics that have the most impact on increasing of the number of startups, activating investors, and building a highly-connected local community.

Economic Impact

Equipped with seven years worth of performancedata on startups plus the data of our partner Orb Intelligence, we are currently developing this new factor to support governments in particular. Each of these seemingly independent success factors correlate highly with the performance model and with each other. This is a complex system where parts reinforce each other as size drives resources, resources drive other resources and performance, whichin turn drives more activation of local resources and attraction of external resources, leading to yet higher performance in a cycle of success. This further validates our Lifecycle Model, showing that many resources improve together while only a few factors really changed over the lifecycle.

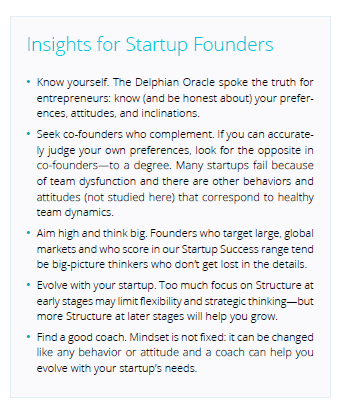

- Initiation - this indicates a proclivity and energy level to start new things, to turn ideas into action. Research has found a high score on Initiation is positively correlated with startup venture success (see below).

- Reflection + Patience - a high score on this variable indicates someone who pauses and waits before taking action.

- Breadth - a preference for abstraction, general overviews, and “big picture” thinking. Research finds a high score on Breadth to be positively correlated with startup success.

- Depth - indicates a preference for details, specification, and concrete thinking. A high score on Depth is found to be positively correlated with startup venture failure.

- Structure - preference for planning and organizing before starting on a task. Research finds a high score here to be correlated with startup venture failure, although it is also positively significant for later-stage “business builders” (see below).

The incumbent wall. Major tech companies—for example Microsoft, Google, Amazon, Baidu, and Alibaba—are all investing heavily in AI, creating in effect an incumbent wall that can make it increasingly hard for startups to compete against. Amazon effectively re-designed a lot of its businesses around artificial intelligence, creating what Wired labels an AI Flywheel—connecting learnings from voice-activated software, buyer behavior, and its massive cloud business—and has built an AI-as-a-service offering on top of Baidu and Google spent between $20 billion to $30 billion on AI in 2016, with 90% of this spend on R&D and deployment, and 10% on AI acquisitions. Google’s team has also published nearly 1,000 research publications on Machine Intelligence. Apple has made AI a clear priority in its acquisition strategy. Since acquiring Siri in 2010, the company has made several other speech acquisitions in recent years, including Vocal IQ and Novauris Technologies.

Thus the incumbents confronting startups. Competing specifically in AI and big data-focused products like AWS, Google’s BigQuery, and Microsoft’s Azure ML is incredibly tough because of the economies of scale those businesses have and the tremendous knowledge and teams behind their offerings. Conversely, these companies have gone on acquisition sprees, and can be key targets for startup exits. War for talent. Figures from McKinsey report that global demand for data scientists will exceed supply by over 50% in 2018. Chinese companies are on hiring sprees, with salaries for senior machine learning researchers topping $500,000. And while open machine learning libraries like TensorFlow by Google have been a boon for startups that can use them, they also mean that big tech has a clear advantage in the talent pipeline, by being able to track top contributors and scoop them. This makes the war for talent fierce, especially for cash-strapped startups.

Leave your comments

Post comment as a guest