Comments (4)

Daniel Curtis

No wonder Google, Facebook and now MSN banned ICO advertising.

Thomas Frankenberg

Good stuff

Lucy Howell

Everyone needs to read this.

Shannon Cassidy

Excellent stuff

Many readers may wonder now what the analogy or connection is with crypto and fake furs, and the quick answer to that is, that ICOs may appear to be “real”, but in the end are “fake”, in the sense that what appears to be real is in fact not the case.

The entire underlying idea of “decentralisation” and “inclusion of the masses” – the crowd investors of this world - is the impression given by ICOs when in fact, it is the unwitting crowd participation of a “closed-loop” eco-system, without any rights or participation to the startup ownership or revenues. Tokens – shortly defined as “digital rights” - are given in exchange for real cash at the “peril of the giver”, that is, the crowd investor. And many crowd investors ended up with worthless tokens and empty promises.

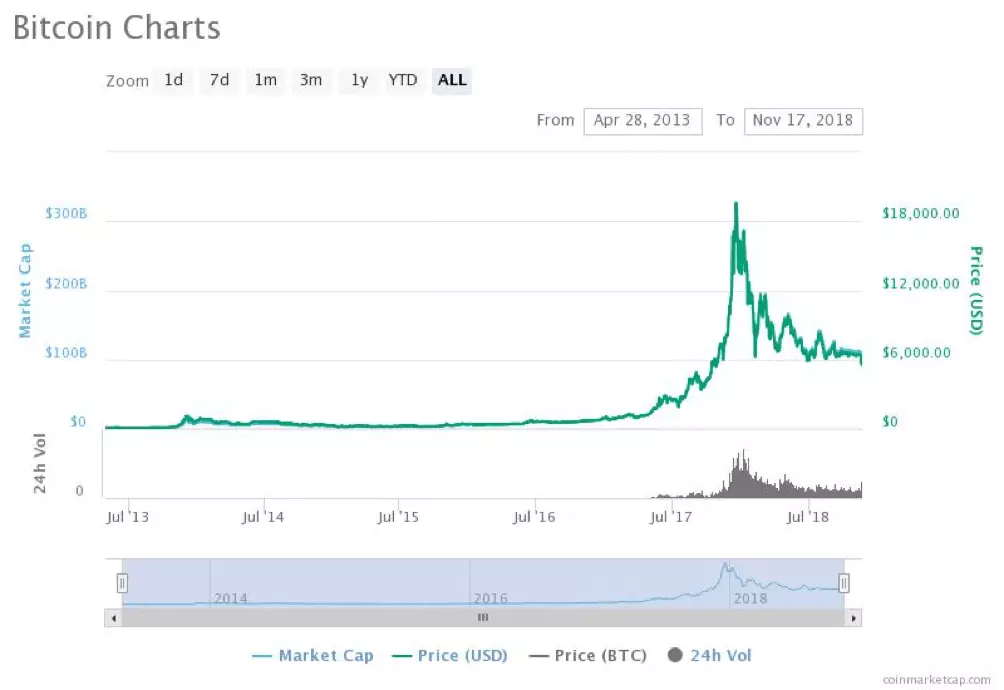

Source: CoinMarketCap (Nov. 2018)

All ICOs are crypto based with a fixed conversion from the quantified token issuance to BTC, ETH and a host of other crypto currencies (incl. fiat such as USD, EUR, GBP, JPY, etc.) that are well known and of which the market cap is significant, usually the top 10 crypto currencies of the world.

Bitcoin stands out, due to it’s - by now - “legendary” status of being the first crypto in the world that is directly linked to the transformative Blockchain protocol, however it’s not the main driver of ICO fundraising and tokenomics.

Ethereum has gained significant ground because of the ERC20 “smart contracts” concept and because of that, is the most used crypto in ICOs.

Bitcoin is devoid of monetary policy and Central Bank control, it’s pure dynamics of supply, demand and scarcity.”

Eleftherios Jerry Floros – co-author of The Paytech Book

When Bitcoin rose from obscurity to dizzying heights at the end of 2017, almost reaching the $20,000 benchmark in December of 2017, everyone wished they had bought Bitcoin when it was only at the $1,000 level in the beginning of 2017.

Going back even further to March of 2010, when Bitcoin was first traded and only valued at a mere $0.003 – that’s a fraction of a cent - the stratospheric rise to $20,000 within a relatively short time span of only 8 years is simply mind-blogging.

Let’s make a simple calculation of the buying and selling of 1,000 Bitcoins:

Bitcoin price – March 2010 – buying BTC 1,000 x $0.003 = $ 3

Bitcoin price – December 2018 – selling 1,000 x $20,000 = $ 20,000,000

Bitcoin price – December 2018 – selling 10,000 x $20,000 = $ 200,000,000

Bitcoin price – December 2018 –selling 100,000 x $20,000 = $ 2,000,000,000

(for clarity and easy understanding, all numbers/calculations are rounded up)

For anyone that had the opportunity to buy one thousand Bitcoins in 2010 for a mere $3 - the price of a cup of coffee - would in December 2018 be the lucky owner of a mind-bending $20 million, let alone the $2 billion BTC value calculation.

Speaking about hindsight and FOMO in full effect.....

As a direct result of the ascent of Bitcoin unto the world stage and the sudden highlighted buzz & hype of Crypto in the financial sphere, investors of all size and shapes wanted to create a similar “financial trajectory success story’’ in the form of an “undervalued token”, priced at least 5 digits behind zero – when paired with BTC or ETH - and issue a billion tokens or more to ensure a price trajectory of epic proportions.

The whole idea was that you could buy any token at “negligible cost”, way below the unit account of one and a couple of decimals past zero, so that it could have the same price rise trajectory as “Bitcoin to the moon”, a common expression in the Bitcoin world.

And by all means, most ICOs initially succeeded in this premise, tokens that were paired in fractions with either Bitcoin or Ether, would become multiples of 1 and give the early investors incredible returns of x10, x100 or even x1000 and more. Only the sky was the limit.

However, the ICO party extravaganza did not last and usually died out shortly after the ICO end when the hype, buzz, “pump & dump” of tokens subsided, leaving token holders with worthless and highly illiquid tokens.

Let’s call these unfortunate crowd investors “tokenites”, suffering from a crypto hangover of epic proportions.

Initial Coin Offerings have evaded or avoided being regulated or scrutinised for too long now and the time has come for regulation at the global level.

Perhaps China and South Korea were right to ban all ICOs within their borders, perhaps not, but in the process, many Chinese and South Koreans have been spared financial disaster and even destitute.

In the US, the SEC has taken more of a random and selective approach, cracking down on some while letting others “slide” without any apparent regulatory logic, depending mostly on state and applicable local jurisdiction.

After all, when applying the famed “Howey test”, the litmus test of whether an ICO “utility token” is a security or not, by determining if the profit motive is applicable, an incredible 99% of ICOs fail this test. This is simply because all tokens are eventually sold and traded on the secondary markets – the 24/7 “crypto casinos” of the world – for profit (or loss) by thousands of crowd investors to speculate or capitalise on their ICO investments.

Being in “denial of ignorance” may be a short term strategy, but the SEC will soon start cracking down on the thousands of ICOs that have already launched in the US but have not registered themselves as a security offering in the form Regulation D – the most common exemption applied for.

Securitisation by financial institutions around the second half of 2008 reached an astronomical $10 trillion in the US alone, followed by a massive $2.25 trillion in Europe.

After the financial crash of 2008, securitisation almost completely disappeared due to the widespread use of CDOs – Collaterised Debt Obligations – that pretty much caused the financial collapse and ensuing global economic crisis.

CDOs were issued with repackaged non-performing subprime mortgage loans that were simply lumped together with AAA+ rated loan portfolios. These financial products where than rated by the reputable Fitch, Moody’s and Standard & Poor’s rating agencies, and through the use of mathematical formulas that even the bank’s “quants” couldn’t really grasp or understand, were then sold on to other unwitting banks and financial institutions as top rated AAA+ loan portfolios, usually in combination with a “doctored” but matching “Credit Default Swap”, a kind of a high-tech financial insurance.

And as always, as soon as the disappearance of one financial instrument becomes reality, a new financial “weapon of mass destruction” is created.

Although ICOs cannot be categorised as failed financial instruments, it did leave many investors out-of-pocket, broke and disgruntled.

This however, was not due to the inherent nature of risk taking, but more driven by greed and ignorance.

Greed usually manifested when incredible large amounts were raised by the likes of Tezos and Filecoin though their own Initial Coin Offerings to the tune of $250 million or more, followed by “complicit ignorance” of the founders.

Tezos in the end got sued by many disgruntled investors but easily managed to settle all lawsuits because of having a massive amount of cash to do so. Others were less lucky, and these ICOs either went into administration, insolvency or outright bankruptcy.

Many ICO founders simply didn’t have a clue of running a business, let alone a totally over-capitalised enterprise, clearly visible in the public spotlight.

Even well meaning founders with brilliant ideas and great teams failed miserably, because the focus was not on the business but rather on “divvying up the loot”, that is, the massive amounts raised during the ICO.

ENVION, another successful ICO turned scam (or so they say), which raised an astonishing $110 million, currently has a market cap of only $4.4 million (as of November 2018). The former CEO and original founders are currently battling out in court and in the process, an estimated 30.000 crowd investors – some grouped in the “Envion Investor Group” - are hoping for the best, but in all likelihood, are quietly aware and slowly realising, that they have lost all of their invested money.

As a direct consequence of excessive ICO hubris and collateral damage, the ICO fundraising landscape has changed dramatically.

It’s not longer possible to raise tens of millions with a 30-page white paper and empty promises, only viability and substance is what matters these days.

After all, how can you get crowd investors interested and involved in a “closed-loop” utility token eco-system when almost all utility tokens - an estimated but incredible 99% of tokens - are currently either not functional, highly illiquid or both.

The fundamental reason, and at the same time problem, is that in order to participate into any “closed-loop” utility token system, one has to buy the “utility token” using crypto in the first place. Before this transaction, cryptos have to be bought on the financial markets by using fiat currencies. And in this time-consuming and very lengthy process, several AML/KYC hoops have to be jumped through before a crypto account can be verified and a crypto wallet can be utilised for buying or selling of tokens and coins.

One of the funniest parodies of this time-consuming process is best explained by a YouTube video about “Lemon Coins and Lemonade” that can be viewed by clicking on the following link.

The video is portraying the utility token system in a rather humorous manner, however reality is not much different, parallels can be made with the difficulty of setting up crypto accounts and wallets, as well as going through the arduous process of AML/KYC compliance before utility tokens can even be purchased in the first place.

Tokenisation of digital assets, products and services provides for great opportunity in wealth creation and prosperity, however the process involved must become more streamlined to ensure mass uptake and adoption.

Security tokens will be the transformational game-changer in startup fundraising as it will provide investors with security in the form of equity and revenue participation from the very start.

Source: Alex Randarevich – CEO of Aerum

Aerum – one of the hottest blockchain startups around – realised very early that it needed to expand it’s token offering to include a hybrid ICO/STO model that would please both crowd investors as well as accredited investors and institutional funds, and this formula is now taking off and being copied around the world. As the saying goes, It’s always better “to lead than to follow” and the “original is always better than copy”.

The reasons for this are numerous, however the 3 most common reasons that transpired at recent Blockchain events are credibility, viability and substance.

As popular as ICO fundraising may have been throughout 2017 and for most part of 2018, the amount of failed ICOs is staggering and many of the tokens issued have fallen significantly in value since their issuance.

There are many factors that converged to create this difficult circumstance in ICO fundraising but most will agree that it’s time for drastic changes.

Enter the STO – Security Token Offering – that is taking over the ICO industry by storm. And it’s not coincidence but rather good investment sense, as there have been just too many ICOs that did not deliver on their promise of a functional “utility token”.

Money will become a tool for prosperity instead of a weapon for power and greed.

Eleftherios Jerry Floros – co-author of The Paytech Book

Many factors contributed to the success of ICOs and even more negative factors contributed to the demise of the current ICO format as we know it today.

In the near future, ICOs will gradually progress to ICO 2.0, where regulation will play a big role in expanding the ICO market while at the same time evolving in a positive manner to include various formats and legal structures such as hybrid ICO/STO, DAICO or RICO (Reversible Initial Coin Offering)

Investors are now looking for promising projects, backed by solid teams to participate in the equity as well as revenues of the project instead of just participating in the “closed-loop” token eco-systems or expecting to capitalise on the secondary markets, hoping that the value might shoot up once listed.

Security tokens are the future financial instruments that will allow for the masses to participate in promising startups from the very beginning, that is the seed stage. Up and until now, this stage was mostly reserved for Angel investors and VCs that had the resources – business as well as financial – that enabled these investors to seek and discover investment opportunities at the earliest stage possible. These seed stage investments were usually followed up subsequent rounds of funding that raised the valuation substantially, which enabled the initial investors to exit and cash out early through a private buyout or later after an overhyped IPO.

Security token offerings function differently, the required funding is raised from the very start, thus allowing for the project team to focus and concentrate on the development of their product or service and achieve traction before additional funding is necessary or may even be required.

The combination of relative ease of fundraising and the gradual participation of institutional, VC and Crypto Funds, will fuel the growth of the ICO/STO market exponentially and allow for the mass market investor to participate in the high-tech world of finance and future of tokenisation.

No wonder Google, Facebook and now MSN banned ICO advertising.

Good stuff

Everyone needs to read this.

Excellent stuff

Eleftherios Jerry Floros is a FinTech Expert at Rethink Your Digital Future and founder of Elysian Impact Investing, a money super-app and impact investment platform powered by artificial intelligence, blockchain technology and data science. He is also an investor, entrepreneur, thought-leader, speaker and author with a 37 year diversified background in FinTech, finance, engineering, maritime and shipping. His main areas of interest are FinTech, impact investing, sustainable finance, entrepreneurship and digital disruption which is profoundly impacting the global economy as well as our personal lives. Mr Floros undertook studies at the University of Oxford, Wharton Business School of the University of Pennsylvania and the London Academy of Trading.

Leave your comments

Post comment as a guest