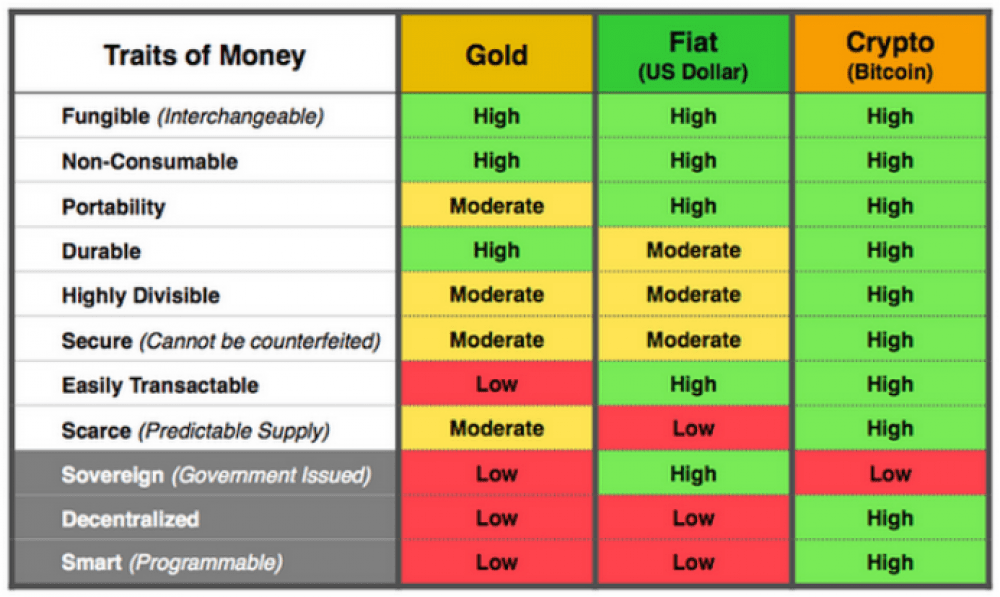

Bitcoin, like Gold is mined. There are finite amounts of each and there are costs of mining both. Gold is used as a trade currency, investment currency and a reserve currency. Bitcoin is rarely traded for real goods, barely classifies as an investment and is far from a reserve currency, despite what companies such as Magister Advisors would have you think.

Is there a market for Bitcoin? These are traditionally accepted to be key features of a well functioning market;

- Operational Efficiency (Internal) - Markets must be efficient internally for example transactions must be settled in a timely, consistent and integral manner

- Informational Efficiency (External) - Markets react quickly to new news; existing prices reflect all available information. There is very little private information that parties are allowed to trade on. New information is brought to the market in a timely and accurate way. There is very little delay or misleading information provided to the market

- Liquidity - Markets are liquid and as such, assets can be bought or sold easily and quickly. There are numerous buyers and sellers giving depth to the market and narrowness to the spreads which for the uninitiated, are the difference between bid and offer prices

- Continuity - In the context of liquidity, prices do not change substantially from one transaction to another unless significant new news arises. This is also known as gap risk and may happen if markets are closed overnight, some overnight trading off exchange does happen which improves price continuity.

While Gold does not exhibit all of these characteristics, for example it is not possible to know how much Gold all of the Central Banks have at any given time, it is true that one of the most important characteristics of the Gold market is its liquidity. As of writing, every day there are only 375,000 transactions, totaling USD 3bn in Bitcoin yet there are over 100 million transactions in Gold daily totaling USD 200bn. Gold is physical and many people need it for industrial, fashionable and wealth preservation purposes.

Bitcoin, while required for transactions is at present, primarily considered a store of wealth at best and a fraud at worst, to quote Jamie Dimon, CEO of JP Morgan. Bitcoin has very little industrial application, Blockchainhowever, has many practical applications and high utility. Bitcoin, like Gold may be considered fashionable to own.

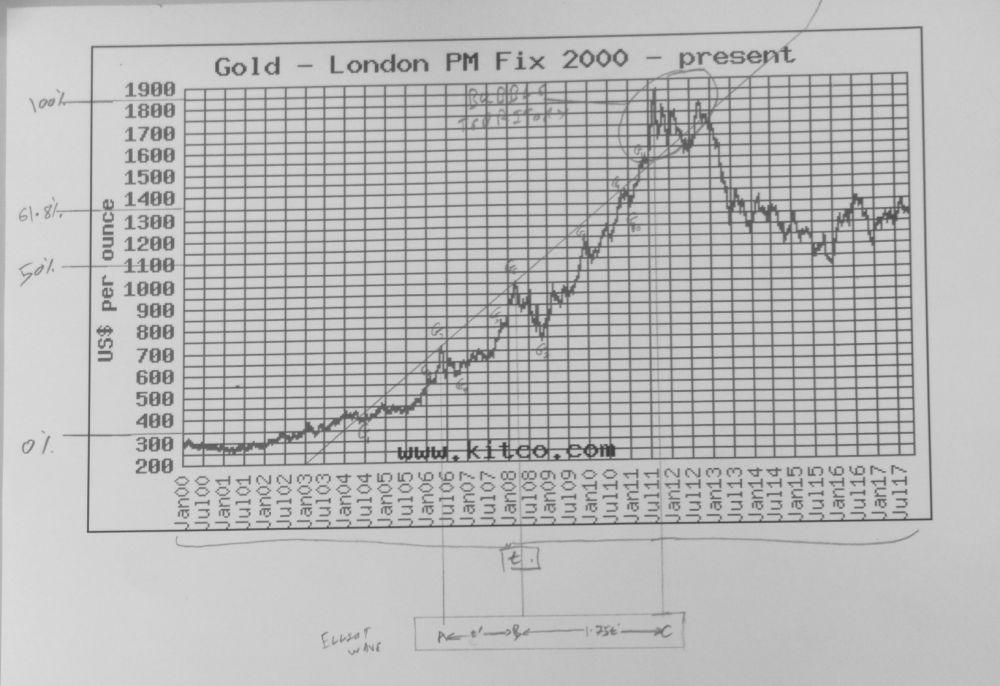

In addition to the fundamental aspects above which considered utility (trade, investment, reserves) and credibility (efficiency, liquidity and continuity) we will look at some technical aspects in the charts below.

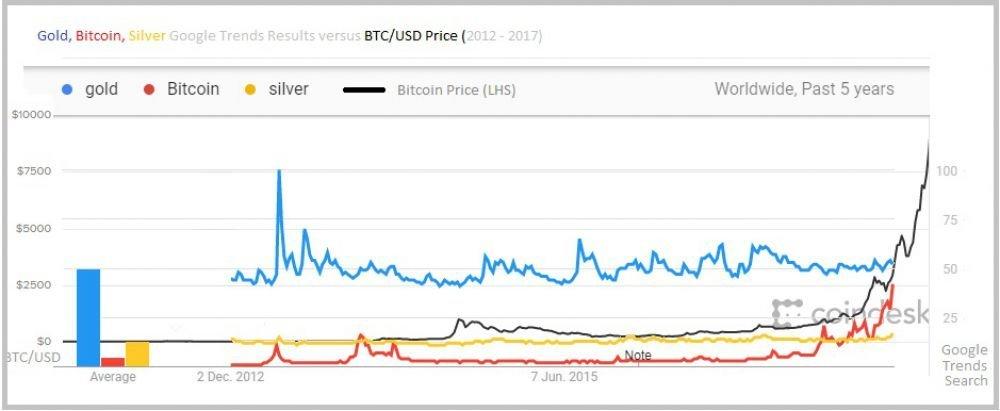

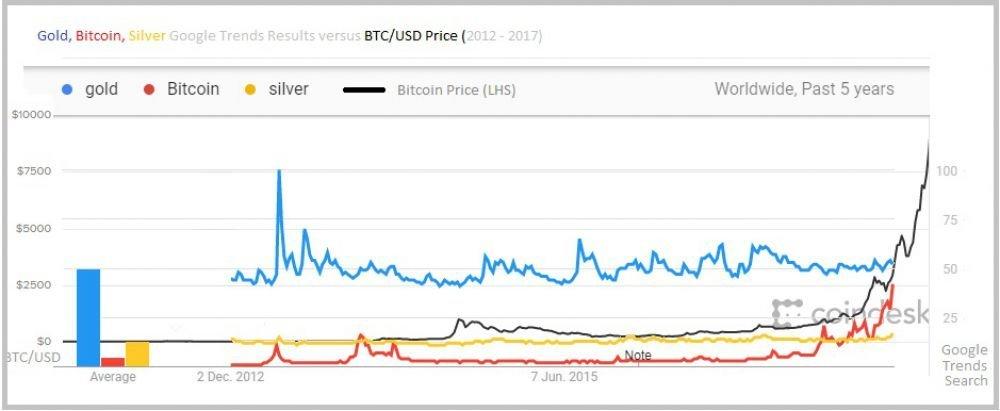

This chart shows the results from Google searches on Gold, Bitcoin and Silver using Google Trends overlaid on top of the Bitcoin price in US Dollars from December 2012 through to December 2015. It is difficult to say whether there are any consistent correlations, leading or lagging indicators.

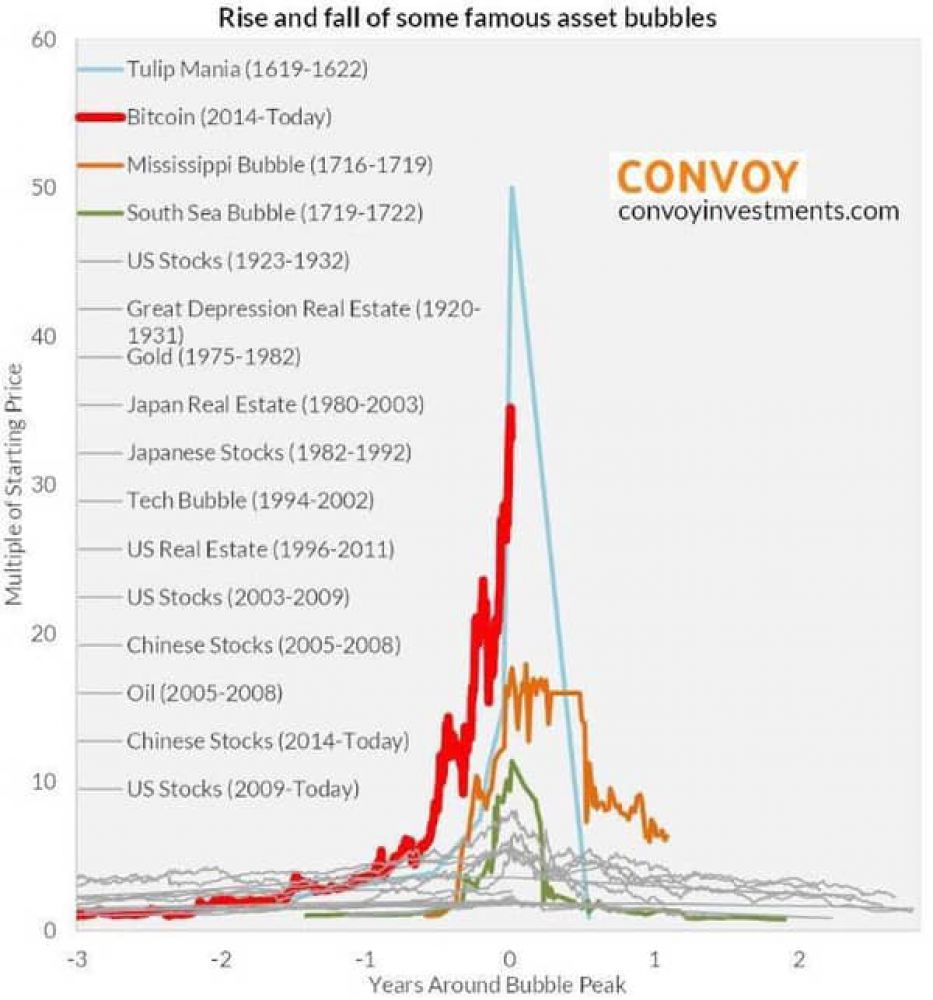

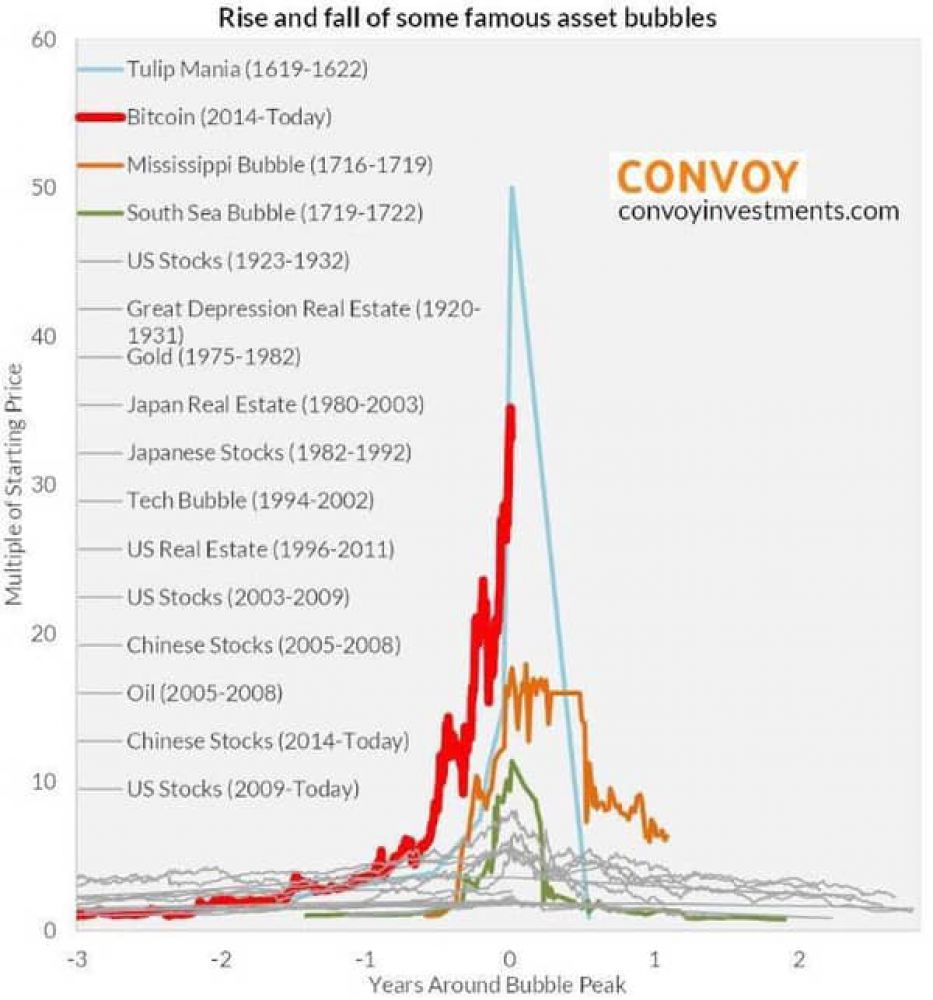

The next chart shows a history of some of the most famous asset bubbles from the early 17th century until present times. Convoy Investments believe that most of the bubbles take 3 years to peak and 2 years to deflate.

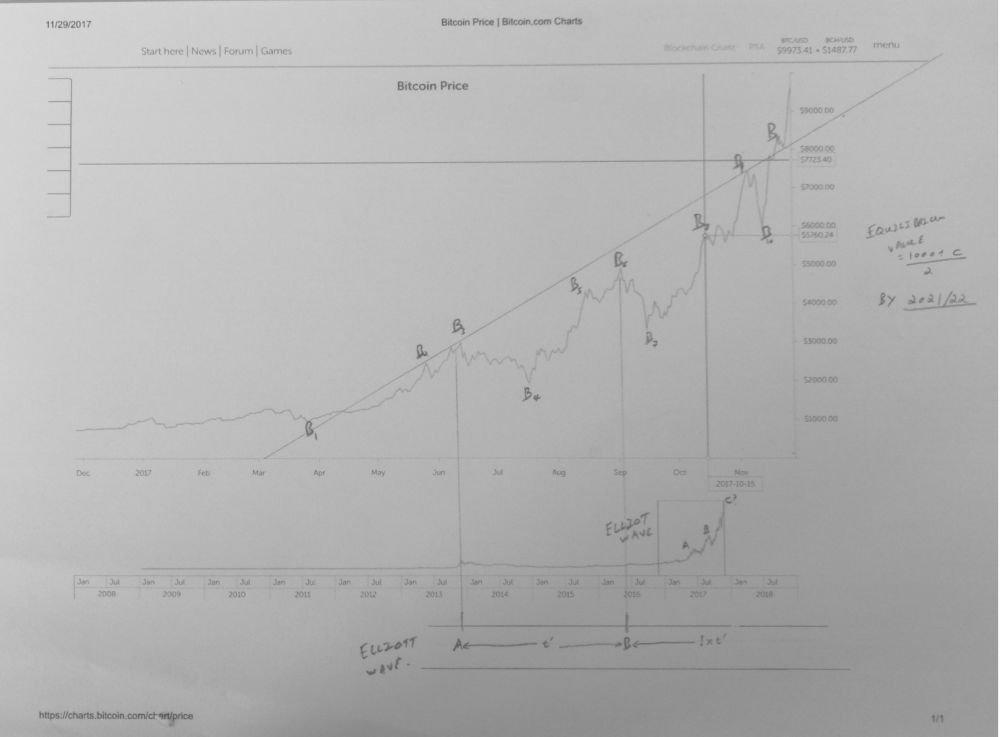

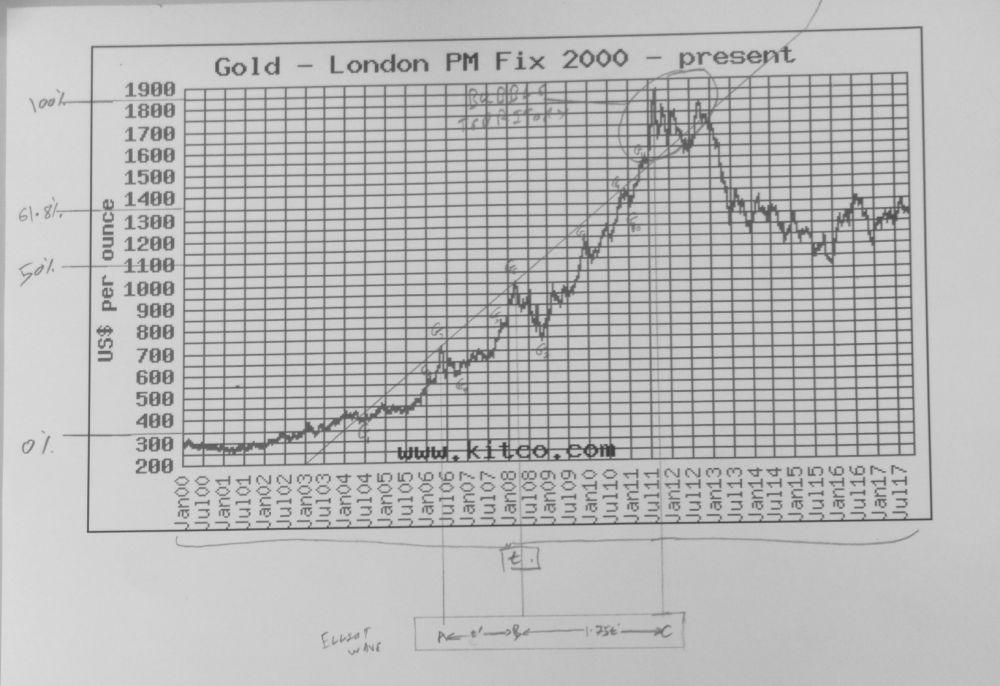

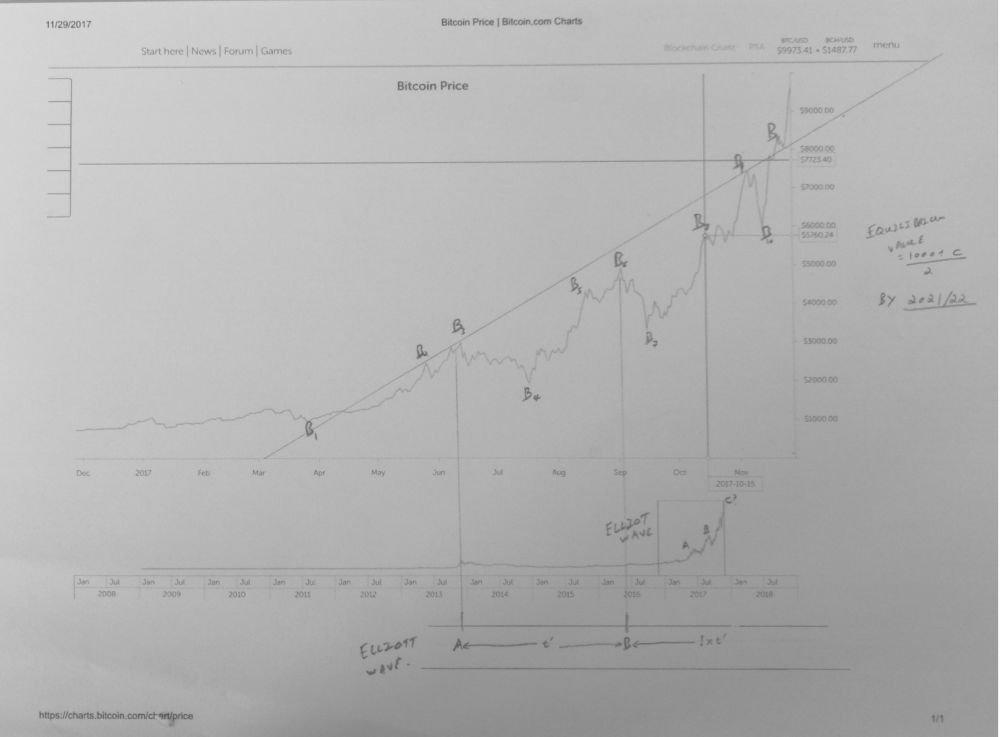

The two images below show two charts;

- The first with the Gold (XAU/USD) price from Jan '00 - Jul '17 with two peaks in 2011 and 2013, known in technical analysis parlance as a `double top` before stabilizing to a price range between 1100 and 1300 from 2014. The chart is annotated with markers G1 – G11 which aim to cross-reference against the markers on the second chart labelled B1 – B11

- The second with the Bitcoin (BTC/USD) price from Dec '16 - Nov '17 has a number of peaks and troughs but the trand is clearly upwards. A linear trend line is drawn through, intersecting with the x-axis in Mar '17 and the y-axis at just over $8,000. One could draw the trend line slightly lower with the same gradient to intersect the y-axis at USD 6,000 or slightly higher with the same gradient to intersect the y-axis at USD 10,000

So while it is possible that Bitcoin is fairly valued, one can, in a rational and level headed way assess the technical, fundamental and sentimental aspects before diving in!

Leave your comments

Post comment as a guest