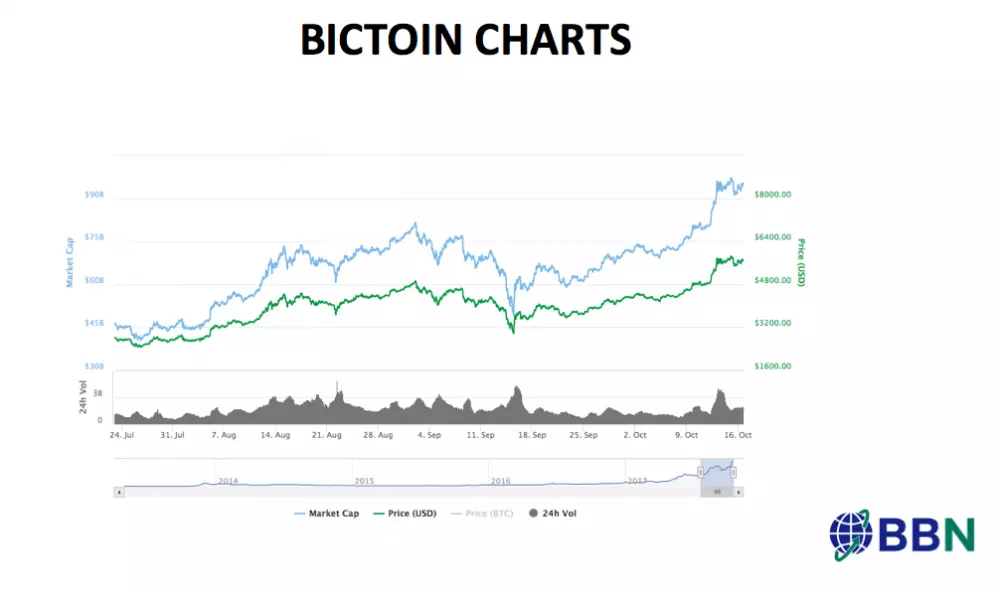

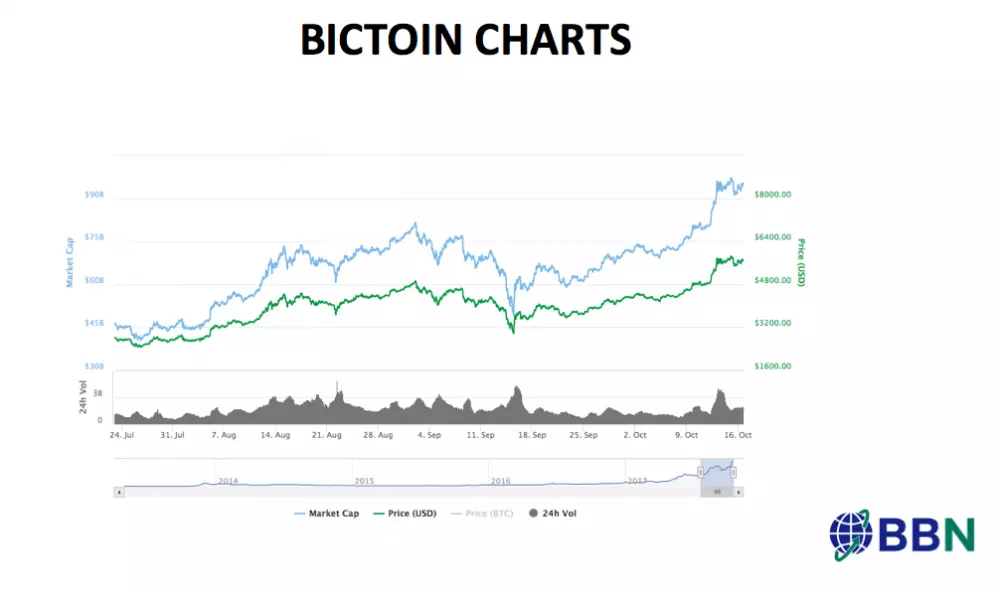

Bitcoin has recently hit a new all time high, shattering the $5,000 barrier climbing up to over $5800 before settling back in the $5500s. Only two months ago, bitcoin went through a fairly big hard fork, in which a second currency was created: Bitcoin Cash. If you held bitcoin before August 1st, then you technically also hold an equal number of bitcoin cash coins. Bitcoin Cash is an alternative currency, though, and does not share the same value nor market capitalization that bitcoin does.

What was this Hype About?

Since BCH hit the markets as it’s own currency less than a quarter ago, it quickly rose to an all time high over $900 USD, at a market capitalization of just over $15 billion dollars. The market cap is now a third of that, along with the individual coin value, but most importantly trading volume is down an entire order of magnitude from the all time high craze.

Bitcoin Cash came about because of core disagreement within the bitcoin community. Bitcoin has a somewhat fuzzy beginning, thought to have been invented in 2007 by a mysterious Satoshi Nakamoto. The white paper that started the current white paper ICO trend was published by this Satoshi Nakamoto in October 2008, describing bitcoin as a solution to the double spending problem such that digital currency could not be copied. The first transaction occurred on the network between Satoshi and Hal Finney in 2009, and the rest is history.

With the hard fork that occurred in August, the community had to deal with a problem fundamental to the original bitcoin code. It was locked into 1 megabyte blocks. When combined with the hash difficulty completion rate of 10 minutes per block, this makes for a slow network at scale.

When considering that a 1 MB block on average holds 1500 to 2000 transactions, it’s immediately visible the problem Bitcoin Cash is attempting to solve. If at the high end of that range the network is handling 2000 transactions every 10 minutes, that comes out to only 3 transactions per second.

When you compare that to Ripple’s network, and most importantly Visa’s current transaction volume, Bitcoin pales in comparison to the thousands of transactions per second XRP & Visa can handle. Bitcoin Cash, though, is a possible solution: it raises the block cap from 1 MB of transaction data to 8, essentially adding an order of magnitude to the number of transactions held per block.

At the peak of Bitcoin Cash on August 19th, the USD trading volume was $4.3 billion. To get a picture of this in the transaction per second metric, some more math (assuming an average daily price of $750 for the peak day):

At it’s peak, BCH saw about 65 transactions per second, a lot better than the 3 of BTC, but still a far cry from Ripple and the credit card giants of today. The hard fork was definitely successful in accomplishing it’s goal of increasing transaction resolution speed, but that was not necessarily ever part of the core purpose of bitcoin. Currently BCH is handling ~7 transactions a second as the volume has dwindled significantly since August.

Any hard fork is a decision by the development community to not decide: instead, let markets decide. It seems pretty clear so far that BCH is not doing so hot marketwise, albeit accomplishing real goals. Those goals, though, are the problem. Bitcoin was never meant to be a replacement for Visa. Making that comparison is equivalent to comparing transactions handled by Ripple’s XRP to trading silver. Bitcoin has a finite total number of coins, unlike fiat currency.

When a US dollar bill becomes too old to be used in circulation, it stops circulating. Our government’s treasury oversees this circulation, appropriately removing currency unfit for use, printing new bills in exchange. Printing money is a dangerous game, do it too much and the value of each note drops to nothing. This is often reasoned about in terms of the metric of inflation.

Bitcoin is different because there is a maximum amount of Bitcoin to be had. One day not too far from now, BTC will have 0% inflation, because it will have hit its cap of 21 million coins. Like silver or gold, there is a finite amount of it to be had, but it’s not all been had yet. Unlike raw physical materials like precious metals, however, there is a definite time at which we will know no more Bitcoin will be minted. We may always find more gold in various environments, albeit less and less since the gold rushes of our forefathers. Currently there are about 4 or 5 million Bitcoins left to be mined, with more than 15 million coins already in circulation. It'd be silly to ever expect instant gold transaction handling, but that is exactly what BCH tries to do for Bitcoin.

So what is happening with the upcoming hard fork of Bitcoin, then? Why is it called contentious?

After almost no time at all since Bitcoin Cash forked into it’s own currency, a consortium of organizations have decided to go for another hard fork of the core bitcoin blockchain in November. Again trying to increase the core maximum block size from 1MB to 8MB, this move is once again against the core principles of bitcoin, just like BCH.

The danger here is that this hasty second attempt at a hard fork has major risks. Many believe that such a hard fork needs at least a year to prepare, not only to properly verify the code that will be handling billions of dollars of transactions, but also to understand if the change is fundamentally going to work for the benefit of Bitcoin. As of right now, it seems like it will not, and that instead this hard fork would directly benefit those supporting it, and not many others. The proposed changes puts more power into big mining pools’ hands. This moves the currency away from its decentralized goals by centralizing control of the blockchain into these big mining operations.

Without going into more technical debate, I personally strongly side with the bitcoin core group, represented by the original bitcoin site at bitcoin.org. Published just over a week ago, they have publically denounced the Bitcoin Gold contentious hard fork, and explicitly listed its supporters. Instead, the SegWit2X upgrade fork, planned for November, is what is under current preparation. I have already begun the process of moving my Bitcoin away from those exchanges, since I do not want to be stuck with Bitcoin Gold (or Unlimited, whichever it ends up being named) if they choose to forcefully honor their own fork.

Check the blog post yourself, and see if your exchange is on the list. If it is, be warned.

Ask around about the hard fork, and make sure you are protected. Cryptocurrencies are as secure as you are with your information, and it is unwise to blindly trust that cryptocurrency is by default safe since it has cryptography in the name. Keeping encryption keys secure is actually quite difficult to do robustly, much more so than password security which we already all struggle with.

In short, be wary, a new bitcoin ticker is coming to cause some confusion. The original ticker BTC is where I'll be placing my faith, where will you place yours?

Leave your comments

Post comment as a guest