Comments

- No comments found

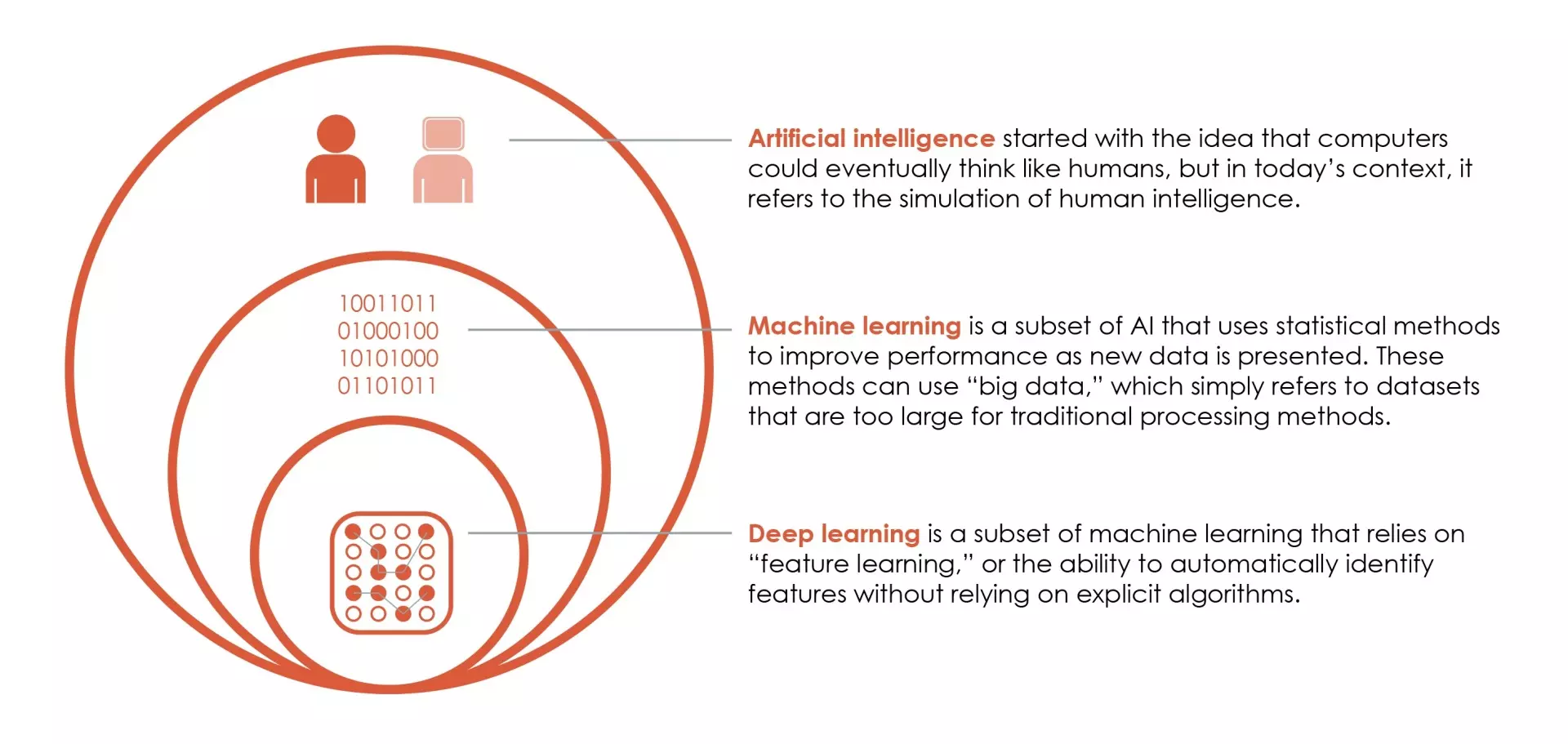

Artificial intelligence (AI) is the tech to watch.

IDC forecasts that spending on AI technologies will grow to $97.9 billion in 2023—more than two and a half times the spending level of 2019.

Where is AI’s growth coming from?

On my show CXO Spice Talk, I chatted with Kevin Levitt, Global Business Development Lead - Financial Services from NVIDIA. He says AI’s explosive growth is happening in consumer finance and capital markets.

Banks, insurance companies, payment firms and others are investing in AI Centers of Excellence (CoE). His point: if you want to compete for best-in-class customer service, embrace customer-centricity. Beyond personalization, AI is impacting underwriting, fraud detection and every critical application. AI CoEs are the source of expertise and infrastructure necessary to bring enterprise AI strategies across financial services to fruition.

AI is also being used for investments in algorithmic trading platforms powered by accelerated computing infrastructure to uncover Alpha across thousands (kind of mind boggling, right?) of real-time data sources to either execute trades algorithmically or deliver signal to the human trader.

Just a month ago, the Chicago Board of Trade opened two floors for trading. The crossroad of #humanity and #tech further unfolds as AI fills in the gap on uncovering insight from geospatial data, audio files (i.e. earnings calls, CEO presentations/interviews, etc.).

Again, we see being in the winner’s spot driving AI to frame out market leading high performance computing environments to tackle risk management, predict credit risk, and more within banks, insurance companies and other industries to maximize investment returns and protect the firm from systemic risks.

NVIDIA’s State of AI in Financial Services 2022 Trends Report explores how AI is transforming the industry in massive ways. It’s easy to think that customer relations is the primary use for AI in industries like retail banking, investment banking, asset management, insurance and fintech. However, NVIDIA’s report shows the AI-driven innovation is much more expansive.

The NVIDIA report reveals that “some 91% of financial services companies are driving critical business outcomes with investments in AI. First and foremost, 43% of respondents state that AI is yielding more accurate models. Along with model accuracy comes a host of other benefits.” Enterprise AI strategies and infrastructure is impacting fraud detection, algorithmic trading, recommender systems whereby customers are given next step actions and compliance.

When AI understands the nuances of language, we will have taken the next big leap. Intuitive, empathetic AI is upon us. Innovators like NVIDIA play a major role in making it happen.

Dive deeper into the future of AI. Watch the latest CXO Spice Talk episode featuring Kevin Levitt from @NVIDIA AI. Here is the link to explore more:

Learn more about NVIDIA’s solutions for the financial services industry.

Helen Yu is a Global Top 20 thought leader in 10 categories, including digital transformation, artificial intelligence, cloud computing, cybersecurity, internet of things and marketing. She is a Board Director, Fortune 500 Advisor, WSJ Best Selling & Award Winning Author, Keynote Speaker, Top 50 Women in Tech and IBM Top 10 Global Thought Leader in Digital Transformation. She is also the Founder & CEO of Tigon Advisory, a CXO-as-a-Service growth accelerator, which multiplies growth opportunities from startups to large enterprises. Helen collaborated with prestigious organizations including Intel, VMware, Salesforce, Cisco, Qualcomm, AT&T, IBM, Microsoft and Vodafone. She is also the author of Ascend Your Start-Up.

Leave your comments

Post comment as a guest