Comments

- No comments found

Artificial intelligence is quickly changing the way fintech, insurtech and 5G operate during the covid-19 crisis and beyond.

Machine learning and artificial intelligence are improving Fintech by increasing the accuracy and personalization of payment, lending, and insurance services while also helping to discover new borrower pools.

Since that time the Covid-19 crisis and tragedy arose.

On the one hand Paul Clarke noted that UK fintech investment slumps by 40% amid Covid-19 crisis, whilst on the other Deloitte in Beyond COVID-19: New opportunities for Fintech companies note that "As the COVID-19 pandemic continues to create uncertainty, many fintechs are under stress on a number of fronts. But, as the broader economy shifts from “respond” to “recover”, new opportunities may be created for some fintechs. A key question is how fintechs may leverage their unique assets and skills to seize new opportunities in the future. It could be an opportune time to think big and act boldly."

Pavitra R considered the impact of Covid-19 and noted in 5 U.S. FinTech startups reimagining the healthcare industry notes that FinTech is undoubtedly shaping the face of the Health Care industry. "FinTech companies leverage powerful innovations blockchain, Artificial Intelligence, and Machine Learning to eliminate the inefficiencies and knowledge gaps endemic to most healthcare payment plans." The likes of Nigel Wilson (@nigewillson) and Brian Ahier (@ahier) have stressed the importance of applying AI to positive use cases such as preventative medicine and improved Health Care outcomes.

McKinsey in an article entitled AI-bank of the future: Can banks meet the AI challenge? state that (in order) "To compete successfully and thrive, incumbent banks must become “AI-first” institutions, adopting AI technologies as the foundation for new value propositions and distinctive customer experiences."

" The potential for value creation is one of the largest across industries, as AI can potentially unlock $1 trillion of incremental value for banks, annually (Exhibit 1)."

Source for image above: AI-bank of the future: Can banks meet the AI challenge?

"While for many financial services firms, the use of AI is episodic and focused on specific use cases, an increasing number of banking leaders are taking a comprehensive approach to deploying advanced AI, and embedding it across the full lifecycle, from the front- to the back-office (Exhibit 2)"

Source for image above: AI-bank of the future: Can banks meet the AI challenge?

The Covid-19 crisis is a challenge both in terms of human health and also to the Fintech world. However, it also is likely to lead to an acceleration of Digital Transformation as many people, even those in the more elderly segment become increasingly accustomed to digital services. I don't believe that the physical world will go away completely (albeit digital will continue to expand faster and physical decline further from where it used to be pre-crisis), and rather suggest that we'll experience an acceleration towards merging physical and digital once 5G networks scale and AI combined with Augmented Reality (AR) and Mixed or Extended Reality (XR) will lead to a range of completely new services and products.

The Covid-19 crisis also illustrates the need to deal with preventative medicine (see section below in this article) as the Covid-19 crisis places additional stresses on our Health Care systems around the world and also preventative medicine can help keep us all healthier!

Moreover, the technique of Federated Learning with Differential Privacy will have a major impact on the scaling of Machine Learning across the Financial Services sector including Insurance (and Health Care too). The challenge of data privacy and data security has at times been a barrier for scaling Machine Learning across the Finance Sector. However, the potential for Federated Learning to enable secure collaborative learning will enable the growth of Machine Learning over the next few years including as we go into the 3ra of 5G and Edge Computing, for example with AI deployed on the mobile device or in future smart glasses of the customer, with increased personalisation of service.

Brendon Machado in Federated Machine Learning for Loan Risk Prediction observes that "Federated learning can be used to pursue advanced machine learning models while still keeping data in the hands of data owners. Through Federated Learning, the data can be kept in the hands of financial institutions and the intellectual property of data scientists can also be preserved."

Source for Federated Learning Pipeline Image above Federated Machine Learning for Loan Risk Prediction

"PySoft, an open-source library created by OpenMined, enables private AI by combining federated learning with two other key concepts: Secured Multi-Party Computation (SMPC) and Differential Privacy." TensorFlow Federated is another open source framework for machine Learning on Decentralized Data.

Intel Analytics explains in How Federated Analytics Can Help Banks to Share Data Securely that "Using federated analytics, businesses can carry out analytics on data without having to move it, reducing the risk of it being hacked or leaked, and the cost of moving huge quantities of data."

2020 has been and may well remain a challenging year across the world. I wish all who follow me and anyone who reads this article that they remain safe and well, including their loved one and also in relation to their work or studies. 2021 will be a year of accelerated Digital Transformation and increased adoption of AI in Financial Services and across Health Care.

AI in Security will also be key across Fintech and the Banking sector. I have discussed this at length with Aghiath Chbib (@AghiathChbib) about the increasing sophistication of Cyber attacks on corporates including the financial sector. A report by Microsoft shows increasing sophistication of cyber threats:

This is an area that Sally Eaves (@sallyeaves) Paula Piccard (@Paula_Piccard) and Pierre Pinna (@pierrepinna) have also expressed concern in terms of the potential to cause server damage across the system or even take down a company.

Shuman Ghosemajumder in How AI will automate cybersecurity in the post-COVID world states that "For many years now, online theft has vastly outstripped physical bank robberies. Willie Sutton said he robbed banks “because that’s where the money is.” If he applied that maxim even 10 years ago, he would definitely have become a cybercriminal, targeting the websites of banks, federal agencies, airlines, and retailers. According to the 2020 Verizon Data Breach Investigations Report, 86% of all data breaches were financially motivated. Today, with so much of society’s operations being online, cybercrime is the most common type of crime."

Shuman Ghosemajumder also notes that many of the attacks are now automated and observes "So how can we protect against such automated attacks? The only viable answer is automated defenses on the other side. Here’s what that evolution will look like as a progression: (see image below)"

Source for image above Shuman Ghosemajumder, VentureBeat in How AI will automate cybersecurity in the post-COVID.

In relation to support services such as Accounting Tripp Braden in How Do You Reinvent Accounting Technology For 2020 And Beyond? states that in order "To reinvent accounting technology, we need to increase our collaboration capabilities...For example, I’ve added a data science team who can help clients evolve and leverage more data driven decision making capabilities."

Without personal interactions, the relationship between customer and bank withers, or worse, becomes toxic.

Karen McDermott (@KMcDTech) noted that about "70% of customers who leave the bank say it was many minor expectation failures that triggered their decision." AI can be applied to enhance the Customer Experience and make it a more pleasant and personalised journey for the customer as stressed by Jim Marous (@JimMarous) who is a strong advocate for the era of frictionless banking and Spiros Magaris (@SpirosMargaris)

The era of 5G that combined with AI will enable Augmented Reality and Mixed Reality to work with holographic technology with "mass hyper personalisation at scale" is an area that I have discussed with my friends Pierre Pinna, Nicholas Babin, Harold Sinnott, Theo, Danielle Guzman, Karen McDermott and Jean Baptiste ( respectively @pierrepinna, @Nicochan33 ,@HaroldSinnott, @psb_dc, @guzmand, @KMcDTech and @jblefevre60). It is also an area that I have discussed with April Rudin (@TheRudinGroup) as an area that will transform WealthTech.

The arrival of 5G enabled smart glasses in the period 2021-2023 from the likes of Apple, Facebook, Microsoft and many others will lead to a period of innovative product development and entirely new customer experiences beyond those that are smart mobile enabled.

Source for the image above Ben Lovejoy Patent describes Apple Glasses using eye tracking to video AR experiences

Financial technology (FinTech) is the area where technology meets financial services. The area includes established financial companies, large technology companies and startups.

Finance and Insurance are fundamentally about the pricing of a risk for taking the given risk at an appropriate return. Maybe sight of this fundamental rule was lost in the period that resulted in the financial crisis. The FinTech scene grew in momentum in the aftermath of the financial crisis as Financial Institutions retreated and former bankers teamed up with technologists to create a wave of startups within the area of Financial Services.

An example of the rise of new entrants within Financial Services around the world is the China based Alibaba affiliate, Ant Financial whose $14Bn funding round was reported to value it $150Bn, greater than the value reported for Goldman Sachs of $88Bn at the time.

As the chart above illustrates, a great deal of money has flowed into Fintech in recent times with CBinsights reporting a global Fintech investment of $39.57Bn across 1,707 transactions in 2018.

The FinTech scene has grown rapidly in Europe with London, Berlin, Dublin and other cities in the region emerging as his for FinTech startups. The graphic above from insights.invyo.io lists the top 50 most valued FinTech in Europe (thanks to @ipfconline1 for the share).

InsurTech can be viewed as a sub-sector of FinTech that focusses on the application of technology to the insurance sector with an objective to result in cost savings and drive efficiencies. There is a view amongst those advocating InsurTech that the Insurance Sector is appropriate for disruption. S

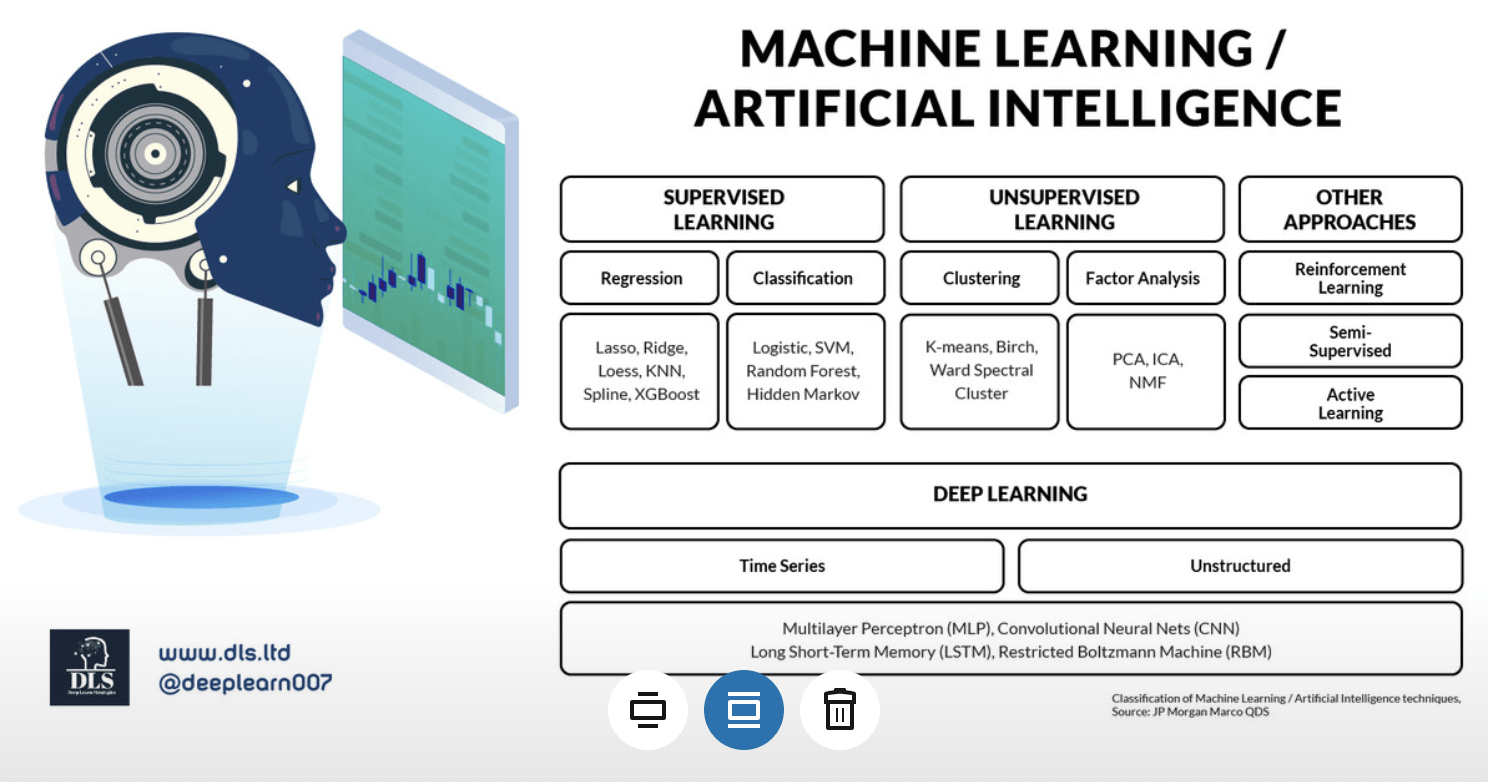

For the avoidance of doubt, I refer to AI in this blog as covering Classical AI techniques, Machine Learning and Deep Learning algorithms. I also wish to thank Paolo Malaguti, Xavier Gomez, Dr Anna Becker, and Dr Mark Jackson for their contributions in the interview section further below.

An example of a FinTech startup working with retail banks is London based Bud. Their technology underlies HSBC’s AI artha app. It allows First Direct customers to analyze their spending across all their accounts. It has been reported that a group of investors, including Goldman Sachs, HSBC, ANZ Investec and Spain’s Banco Sabadell, invested $20 million into the startup’s Series A funding round.

Moven, founded by Brett King, @BrettKing, a pioneer of Mobile Banking, have been reported to be applying AI to leverage the data of the bank and apply its own algorithms for personalised banking experiences that enable the customer to receive the appropriate advice at the appropriate time and improve their financial lifestyle.

AI has also been applied by banks for credit scoring to speed up loan approvals and risk management of credit. Furthermore, AI has also been applied to open up access for banking services to the under banked sections of society. For example, Lenddo apply AI to evaluate individuals who lack a formal credit history with a variety of data points to assess the financial responsibility of that person.

AI also plays a major role in digital marketing for banks as noted in an article that I authored for the Financial Brand:

"AI will assist financial marketers in making sense of the data deluge and promising access to insights on demand. With the use of expanded data and technology, bank and credit union marketing teams will be able to uncover customer needs based on real-time activities and behaviours."

"Beyond traditional data that is housed in multiple silos within a financial institution, AI will be capable of analyzing huge amounts of structured and unstructured content from outside the organization. Examples include data like pictures, videos and emojis. This will enable a deeper understanding of consumers as they continue engaging with your products and services."

"One of the most powerful capabilities of AI is that it will also be capable of scoring customers in an intelligent manner based on algorithms that can predict the customer’s propensity to buy, and the likelihood of being loyal. In other words, instead of only knowing what a consumer has done, AI can help predict the next most likely actions that can help financial marketers communicate based on customer needs and activities."

Automated personal assistants (bots) and voice have become popular in the banks. Whilst some heralded the arrival of voice based AI technology in Financial Services and other sectors, a number of customers have been disappointed by the experience to date and challenges remain. For example, The Information reported that in 2018 only 2% of those who own Amazon Alexa-enabled devices actually used them to make an online purchase and of that group 90% failed to buy anything further via Alexa.

There are challenges for voice and the expectations are high. It will take some time yet to get voice to the level that we as humans expect it to be as the search space is vast and issues such as dialect and accent are part of the challenge. The AI that underlies voice technology today is based upon narrow AI. This is very good at performing specific tasks efficiently and hence limited to the specifics that the AI algorithm has been trained for. Over time the voice assistants are expected to improve given the amount of developmental work and research going on in this field. However, don’t expect generalised human level conversation and abstract reasoning at a human level anytime soon as Artificial General Intelligence (AGI) is expected to take sometime to arrive. Perhaps the most appropriate approach today for those seeking to adopt voice based solutions is to apply it across plenty of narrow settings in situations where the user wants to undertake simple tasks. For this interest in the research into AGI, Google Deep Mind have published Pathnet a network of neural networks potentially describing what AGI will look like.

Cybersecurity and AI is an area that banks are also investing into. Cybersecurity is an area of concern across the Financial Services sector, for example it was reported that Equifax suffered security breach in 2017 esulting in the exposure of details of in excess of 143 million Americans, and HSBC stated that some US customers' bank accounts were hacked between 4 and 14 October 2018. This is an area that

Furthermore, two of the largest banks in Canada, Bank of Montreal and the Canadian Imperial Bank of Commerce’s Simplii Financial were reported to have suffered security breaches that affected an estimated 90,000 customers in 2018.

Cybersecurity Ventures predicts cybercrime damages will cost the world $6 trillion annually by 2021, up from $3 trillion in 2015 and that global spending on cybersecurity will exceed $1 trillion cumulatively over the next five years, with a business will fall victim to a ransomware attack every 14 seconds in 2019.

Examples of ransomware threats include WannaCry and Petya. Banks have been working with AI based tools to assist against the threats of real-time fraud and threat detection.

Gil Press, @GilPress, has authored a comprehensive overview of 60 Cybersecurity Predictions For 2019 with a broad range of contributions from many across the CyberSecurity sector whereby it was observed that Machine Learning will assist in reducing noise and enable the practitioners who are limited in number to improve their efficiency, however, the article also cited the need for caution before engaging in an AI for Cybersecurity policy by undertaking a proof of concept before proceeding.

An article in the Verdict noted the challenges inherent in Cybersecurity due to the variations in the different types, motivations and types of assets targeted in cybercrime and that AI journey into Cybersecurity is driven in part due to the lack of availability of Cybersecurity experts, the high number of fake positives and the growth in well funded and smart hackers.

A relatively early and prominent example of a successful FinTech company is PayPal founded by Elon Musk and others. It was reported in 2018 that Paypal was acquiring AI anti-fraud company Similty for $120m in order to help protect its 237m users. Payments company Stripe is another example of a prominent payments company who have $450 million in funding and are using AI for fraud detection with their Machine Learning models trained on datasets that comprise hundreds of billions of points and have helped decrease incidents of fraud by 25%.

An area in payments that has been reported as taking off rapidly is payment with face. For example, startup Face++, who are reported as being valued at around $1Bn, have been enabling users to use just their face with the Alipay mobile app in China to transfer money by over 120m people. TechCrunch reported that in 2018 Alibaba transacted $30.8 billion in a single day with 60.3% of the Chinese customers using a selfie or fingerprint of payment.

The lead in AI for payments technology by Chinese FinTech companies is something that Brett King has observed along with the need for US, Canadian, European countries and others to reconsider policies and support for development of AI in particular for the new era of 5G (for example education system, training and reskilling experienced staff, incentives). I believe that payment by face will become more widespread in the next decade and take us in the direction of the world of invisible banking whereby customers will enter a store or sit in an autonomous vehicle with face detection and recognition applied for personalised experienced experiences and payments. This will also lead to targeted offers personalised to the needs of the customer.

Convolutional Neural Networks (CNNs) are used in payment by face technology and it has been a rapidly growing area in recent years for practitioners and researchers. For example for an overview of different network architectures and loss functions proposed in the rapid evolution of the deep Face Recognition methods see Mei Wang, Weihong Deng, Deep Face Recognition: A Survey.

J.P. Morgan published an extensive guide to Machine Learning and Big Data jobs in Finance.

Set out below are some of the fundamentals of Machine Learning.

Supervised Learning: a learning algorithm that works with data that is labelled (annotated). For example learning to classify fruits with labelled images of fruits as apple, orange, lemon, etc.

Unsupervised Learning: is a learning algorithm to discover patterns hidden in data that is not labelled (annotated). An example is segmenting customers into different clusters.

Semi-Supervised Learning: is a learning algorithm only when a small fraction of the data is labelled and the rest is unlabelled.

Reinforcement Learning: is an area that deals with modelling agents in an environment that continuously rewards the agent for taking the right decision. An example is an agent that is playing chess against a human being, An agent gets rewarded when it gets a right move and penalised when it makes a wrong move. Once trained, the agent can compete with a human being in a real match. A useful overview of Reinforcement Learning and Deep Reinforcement Learning has been authored by Skymind.

Active Learning: is a particular field of Machine Learning where the algorithm interactively queries the source of information with the objective of obtaining desired outputs for the new points of data. It has been referred to as optimal experimental design in statistics research. Stefan Hosein has authored a helpful blog on Active Learning: Curious AI Algorithms.

Deep Learning: refers to the field of Neural Networks with several hidden layers. Neural Networks are biologically inspired networks that extract abstract features from the data in a hierarchical fashion. Such a Neural Network is often referred to as a Deep Neural Network and can be supervised or unsupervised. Nvidia have published a helpful paper by Michael Copeland on Deep Learning and produced the image shown below:

Applications of AI for automated trading is an area that is of growing interest to Investment Banks. JP Morgan adopted a Deep Reinforcement Learning based trading application LOXM that was trained on billions of historical transactions so as to enable it to execute trades in equities markets with optimal price levels and at very high speed. Furthermore, it was able to sell large positions whilst avoiding it’s activities from resulting in substantial market swings. It was reported to deliver significant savings relative to both manual and existing automated tools. Research into applications of Deep Reinforcement Learning Approaches to Financial Trading as a Game continue.

Another area of interest to Investment Banks is reducing legal and contracting costs. JP Morgan developed Contract Intelligence (COIN) that was reported to complete the equivalent of 360,000 hours of lawyers time in seconds. It was also reported to result in a reduction of loan servicing errors across 12,000 new annual wholesale contracts.

Morgan Stanley has been reported to be using Machine Learning to better understand client needs. The firm noted that the sheer number of investment options available for their Financial Advisors to keep track of were too vast and used AI to match the potential investment opportunities to the preferences of the client.

Banks are using AI for Sentiment Analysis of stocks with applications of Natural Language Processing (NLP) to evaluate and score sources of information for example posts on social media, news articles and blogs. An example of a FinTech startup in this space is Sentifi’s Sentifi Maven that determines which topics are obtaining the greatest attention by gathering information from in excess of 13 million sources. There has been extensive research in recent years on the applications of sentiment analysis to Stock market prediction, for example Sohangir et al Big Data: Deep Learning for financial sentiment analysis.

In terms of the impact on M&A Digital Technology, Deloitte reported that 63% of the respondents to its survey were using automation tools to assist them on tasks such as integration and cost reductions.

Deloitte also observed applications within M&A of AI in relation to Diligence to assist with the analysis of cash flow, assets and operations of a potential target and deliver insights faster. They also noted the potential for AI to assist in the negotiation and post merger integration process.

Cameroon Koo, a co-founder at SiteFocus, reported how The Hurtington bank and FirstMerit merger deal noted the benefits of using AI to assist with automated research on target segment activity, intelligent risk reward of the Customer Experience and intelligent collaboration. They used an Autonomous Learning System Approach (ALM) in relation to textual information so as to discover relationships that mattered and to assist in the due diligence process and enhance the post merger integration process.

It is also likely that we will see greater adoption of AI in relation to primary and secondary capital markets going forwards. One example is Toronto based Overbond, founded in 2015. Its initial focus was on enabling price discovery in primary markets for target terms between bond investors and potential issuers and an application of predictive analytics for new issue pricing. It has also since developed AI tools to provide indicative price levels for secondary markets and also new issuance for particular bond issuers in different market conditions including in cases where there is a lack of observable pricing information.

Robo-advisors are an area of WealthTech that have drawn a great deal of attention in recent years. Examples of automation with AI techniques with Robo-advisors for passive investment management include stock index tracking and replication with Exchange Traded Funds (ETFs) that track a given stock market with reduced costs. Robo-advisors have the advantage of lower fees but some have questioned how well they would weather a market crash in light of limited track records to date.

In terms of active fund management it has been reported that New Aberdeen fund will run on AI for the selection of equities assessed upon risk factors that include momentum, size, value, quality and low volatility.

AI has potential across the asset management sector due to the existence of historical data being recorded and Raghav Bharadwaj has authored a useful overview of Machine Learning in Investment Management and Asset Management – Current Applications.

A couple of examples of AI algorithms that are used in WealthTech area include the following:

Evolutionary Genetic Algorithms: these are biologically inspired algorithms that are inspired from the theory of evolution. They are frequently applied to solve optimization and search problems by application of bio-inspired concepts including selection, crossover and mutation. Evolutionary Genetic Algorithms have been used in this field in relation to trading and portfolio management techniques for sometime now.

Long Short Term Memory Cells (LSTM): are part of the Deep Learning family and work well for Time Series with large data sets. The advantage of an LSTM over other Recurrent Neural Network (RNN) techniques is their ability to work with sequence prediction as they are able to selectively remember patterns for a prolonged period of time. LSTM introduces the memory cell, a unit of computation that replaces traditional artificial neurons in the hidden layer of the network. With these memory cells, networks are able to effectively associate memories and input remote in time, hence suit to grasp the structure of data dynamically over time with high prediction capacity.

For the avoidance of doubt, I am not recommending any approach above that will generate enhanced market returns for anyone nor provide investment advice! The papers and blogs are shared purely from an informative perspective.

Some additional information about Evolutionary algorithms within AI is the field of Neuro-evolution. It is an area of research where Neural Networks are optimized through evolutionary algorithms. There is ongoing research in relation to Financial Trading and Neuro-evolution.

For more on Wealth Tech news in general see April Rudin (@TheRudinGroup).

This has been a rapidly growing area in light of stricter regulatory requirements that have existed since the financial crisis. Biometric technology with AI can be utilised to assist identity (ID) verification in particular in relation to requirements to facilitate the on-boarding of new digital bank accounts whilst ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) requirements. CNNs can be used for face detection from the passport, driving licence or national ID documents with research work in this field ongoing for sometime, for example Sicre et al.

There are other applications of AI to FinTech for example in relation to information. Thomson Reuters Uses AI to Increase Personalization and Bloomberg have been reported to use Machine Learning to obtain a competitive advantage from its Big Data sets. This blog is not intended to cover every AI based application in FinTech as the area is too vast, but rather to cover examples of the main applications. Another good source for an overall summary of AI & FinTech see the blog by Vinod Sharma, @Vinod1975.

Insurance underwriters have to deal with multiple new risks that can be sophisticated and not so well known to them. Furthermore they need to manage a vast amount of new sources of data that on the one hand is advantageous for them due to the insights that the data can provide into the management of the risk, but on the other hand managing the large amounts of data can be a challenge. Moreover, as John Cusano noted in an article published by Accenture many underwriters spend time on repetitive tasks such as manual data entry which could instead be spent on value adding tasks. AI can assist underwriters to manage the decision making process in terms of analysis of the large data sets and performing the repetitive data entry tasks. Matteo Carbone (@MCins_) has blogged extensively on the potential for InsurTech and I believe that AI will accelerate the pace of change that InsurTech will bring to the Insurance sector.

Another area where AI is of value to insurers is automation of the claims process so as to result in more efficient and quicker settlements and also to reduce the probability of fraud. Examples can include using CNNs to assess whether or not the make and model of a particular car matches the one in the claim relative to the one insured in the policy.

A prominent InsurTech startup that is leveraging AI is Lemonade. The company is reported to have raised a total of $180m including a $120m round from SoftBank. Lemonade, was founded in 2016 by entrepreneurs Schreiber and Shai Wininger with the aim of simplifying the process of taking out insurance by accelerating the process and reducing the paperwork needed. Lemonade have announced plans to expand beyond the US into Europe and it will be interesting to see what impact they will have in the European Insurance Sector.

Edmond Zagarin observed three key trends for AI in the Insurance Sector, namely Behavioral Policy Pricing due to the spread of IoT sensors gathering information, personalized interactions with improved CX, as well as quicker claims settlement.

I personally believe that the Insurance sector will be even more heavily disrupted than the banking sector with the arrival of 5G and continued adoption of AI. The summary section of this blog explains why.

The Healthcare sector is under pressure all over the world. We live longer and in much of the OECD and China too, we face a demographic pressure whereby the younger population (future tax payers and less likely to use Healthcare) are decreasing in number relative to the older population (more likely to use the Healthcare system). However, in parts of the emerging markets and developing world there remains a rapid population growth but scarce availability of resources for complex diseases and other medical matters. It takes to train doctors and nurses and the equipment tends to be costly.

An article by Forbes Insights, Can AI Cure What Ails Health Insurance? reported that in 2017 $3.5 trillion of payments were made between insurers and others within the US Healthcare system, up from $74.5 billion in 1970. It was noted that a study by Accenture estimated that the Insurance Sector could save up to $7Bn across an eighteen month period through application of AI based technology.

Furthermore, Krithika Srivats noted in the Becker Hospital Review that AI has the potential to enable significant cost reductions by reducing the number of improper payment claims that are reported to cost the Healthcare sector hundreds of billions of dollars on an annual basis.

Enabling better efficiencies in terms of payments will enhance the cost efficiencies. More fundamentally the Insurance sector for Healthcare plays a key role all over the world. We are likely to witness innovations across the Healthcare system with participants from within the Insurance sector keen to take advantage of the innovations that 5G will bring and future generations of wearable technology to help avoid an insurance claim or reduce the claim. The personal data would need to be protected from snooping and misuse.

Ultimately the objective of preventive medicine should be to result in quicker and more accurate diagnosis, along with reduced side effects (fatalities and serious adverse reactions) from drugs or medical procedures which in turn should reduce insurance claims and improve health standards for all of us. The potential for AI in personalised medicine, more efficient drug development, and real-time analytics with wearables, smart sensors and medical imaging should have a beneficial impact for all of us during the course of the next decade and result in a more efficient Healthcare and Insurance sector.

Examples of the application of AI for predicting health matters with the view to saving injuries and loss of life that have been reported include:

The Verge reports how the KardiaBand sensor works with the Apple Watch wristband and has been reported to diagnose hyperkalemia with 90 to 94 percent accuracy.

A paper by Vashistha et al relating to Futuristic biosensors for cardiac Healthcare: an Artificial Intelligence approach observed the scope for Big Data and Internet of Things (IoT) to be combined with AI and enable biosensors for assisting with cardiac care and as a result to reduce medical malpractice.

Health Insurance Daily article noted how a new technique known as Revolver developed by the University of Edinburgh and Cancer Research London to apply AI to predicting how cancer progresses by identifying cancer mutations in DNA patterns. In addition Science Daily reported how the University of Surrey is developing AI that is able to predict symptoms along with their severity during the treatment of a patient for cancer.

Applications of AI to Credit

Discussion with @Paolo_Malaguti Credit Vision CEO & Founder http://www.credit-vision.com

"Banks receive data from borrowers which means large amounts of data and in turn this data is needed to assess risk. The data is packaged in an unstructured format often not digital, is not homogenous and often a lot of the data is not utilised. Only a small amount of data is used and a lot of it is not captured. It takes work to extract the information and make it usable for lenders so they can utilise it effectively."

"Data is like oil and knowing the location of a source of a large oil reservoir is not in itself enough without the ability to extract, clean and refine it which is the same with data. Big data that is not usable is not helpful. In order to properly assess the credit information, technology skills and Data Science skills are increasingly essential. The lender needs to assess how much risk we can take and how much we can syndicate away."

"There is a suboptimal credit analysis as they don’t have the correct information or use it correctly which in turn will result in excessive loan write downs. Currently everything follows the market as a giant index with limited differentiation and credit risk details.

"A problem with pricing the credit risk is that currently the system is not taking into account the full extent of detailed data or most recent data available in the real world so as to efficiently capture the changing conditions facing the credit risk. Currently most credit models are backward looking models that were good in the world that existed 20 years ago but in the modern world where change is very rapid, digital and global markets and technological and market conditions can change very rapidly and be captured with near real-time data then there is scope for better models that apply Data Science and Machine Learning methods to the Big Data sets to become forward looking predictive models."

"In terms of FinTech, the impact upon capital allocation facilitated by technology will be huge. People don’t always fully know what they have in the books right now and a lot more transparency will result. "

"In the next 3 years more efficient capital allocation will be one of the major transformations to result from FinTech and impact the entire Finance Sector. In terms of AI, the medical and overall Healthcare sector will be most transformed by AI."

Discussion with a FinTech AI CEO: Dr Anna Becker of EndoTech.io (www.endotech.io) Dr Anna Becker possesses an amazing academic track record, having taken a degree in mathematics at the age of 16 and then completed an MSc at the age of 19. At the age of 23 she co-wrote a book about AI in Finance and got involved in an application for AI and Finance. Dr Becker also completed a PhD in Artificial Intelligence.

Dr Becker chose AI because she was intrigued by a visit to the lab that her brother took her to in 1989 and saw the theories about immortality and using computers to change humanity for the better. The opportunities arose in Trading & Investment where AI algorithms had scope for automation and went on to co-found a futures and commodities business that had over 10,000 clients and 100s of developers and was based on Chicago and London exchanges. The business was sold in 2011.

"The key lesson for the AI tech side was the ability to execute – this is what delivers value to a business more than a purely abstract model."

"The next venture, EndoTech.io, is focused on crypto and algorithmic trading. The rationale is that as crypto is highly volatile, Endotech.io recommends allocating between 5% to a maximum 10% of a portfolio weighting towards this asset class. "

"Crypto is a market where buy and hold is less attractive than an active approach given that it is not yet an efficient market. "

Will Crypto currency remain a niche illiquid asset class & What is the future of AI?

"In future certain crypto currencies will grow and become established as an asset class and gain acceptance across the economy. The future of AI used to be upcoming and now it is established practice to use algorithms across various sectors of the economy. It may not be AGI as AI today is more about applied algorithms, however, we will get closer in the next 5 years. The main barriers are that we still need the full understanding of the biological workings of the brain before we get there. "

"Fintech & AI and the future participation of women in AI FinTech fits AI like a glove. New algorithms will emerge with usage across all sectors as automation of processes grows. Women working and studying in AI are growing in number. Furthermore, there are an increasing number of apps developed by women. However, more role models are needed. Marie Curie is my own role model and as the number of women in AI increase, and more reach the level of CEOs of FinTech companies, then so too will this serve to inspire more women to realise that they too can achieve at the highest level."

Applications of Quantum Computing, AI & Fintech

Discussion with Dr Mark Jackson (PhD in Physics) of Cambridge Quantum Computing (CQC) founded by Ilyas Khan in the UK.

What Impact will Quantum Computing have in Financial Services?

Dr Jackson explained that Quantum Computing will impact Encryption: “It is estimated that in 5 to 10 years Quantum Computers will be able to decrypt existing security systems. Post quantum computing methods are not vulnerable because they use a different formula.” His company, CQC, advocates that companies make the transition now and not wait 5 years.

Dr Jackson stated that currently Machine Learning models are based upon probability, however, with Quantum Computing the notion of Amplitude will mean that one can identify patters in data that currently Machine Learning models may miss. This can have a major impact in the Finance Sector where for example a half-percentage increase in the accuracy of the model can have a huge impact. Close attention will be paid about it’s potential to impact AI models by enabling improved efficiency in model accuracy with the application of amplitude. Applications for crypto are focussed on encryption of bitcoins rather than mining.

A further example is the application of Quantum Computing to portfolio optimisation whereby management of the portfolio can be optimised more efficiently than is possible today.

Discussion with Xavier Gomez, @Xbond49 Co-Founder @invyo_analytics,

We discussed the importance of AI in enhancing the quality of the CX in Financial Services. Xavier explained, "At the end of the day it is not just about who possesses the most complex algorithms but rather all about who uses the AI technology most effectively to improve the CX and it is those in Fintech that maximise the CX who will in turn reap the benefits in the future of customer retention and growth."

"Instead of bombarding customers with promotions, AI allows Financial Institutions to personalise and target promotions to its customer base. Helpful advice is preferential to the impression of an invasion of personal space that customers feel in relation to their mobile device. In addition there is scope to use AI to automate certain administrative tasks that are repetitive and take up a lot of employee time that in turn would free the employees up to focus on more productive matters such as client relationships."

I was grateful to be invited to attend the session hosted by Fintech Power50 on the 14th Feb. The speakers on the panel included Brett King, CEO of Moven. Brett King pointed out the lead that Chinese companies have been taking in areas such as 5G and AI that are going to be of fundamental importance not just the financial system but also every sector of the economy over the next decade.

However, having AI technology alone is not enough as the business model is also key. JP Nichols (@JPNicols) noted that over time it will be those FinTech startups that have a proven model and customer traction who will prosper over time and 1during times of economic change. Jim Marous (@JimMarous ) was also a speaker on the panel and I refer to his article in the Financial Brand whereby point four in the article stresses the importance of the AI-Driven Predictive Banking:

“One of the most exciting innovation trends in 2019 will be the continued movement to predictive banking. For the first time, the banking industry can consolidate all internal and external data, building predictive profiles of customers and members in real time. With consumer data that is rich, accessible and financially viable to deploy, financial institutions of all sizes can not only know their customers, but also provide advice for the future.”

Edge computing enables the processing of data nearer to the point of creation rather than transmitting it on lengthy journeys to cloud servers. This in turn enables computers to work at the edge of a network in turn enabling near-real time analytics that are fundamental to many sectors such as finance, healthcare, manufacturing processes, and autonomous systems. Tractica forecasts that AI edge device shipments will increase from 161.4 million units in 2018 to 2.6 billion units worldwide annually by 2025.

Edge computing will be of particular importance to applications in IoT where smart devices will amass a huge amount of data. Device to device communication will become more commonplace. AI will exist on the edge with inferencing enabling intelligent applications. Smart cameras and sensors with machine to machine communication between computers at the edge will in turn enable the rise of invisible banking for example payment by face, more stores without having to queue to pay such as Amazon Go, and a radical disruption for the Insurance sector including Healthcare related Insurance.

The Joint Photographic Experts Group (JPEG), announced a new format known as JPEG XS. This will enable an image-compression process that uses lower amounts of energy, and allows for better quality images to be transmitted with reduced latency over broadband networks such as 5G. JPEG XS will have applications in VR, AR, autonomous vehicles.

As noted above, AR is an area that I have discussed with my friends Pierre Pinna, Nicholas Babin, Harold Sinnott, Theo, Danielle Guzman and Jean Baptiste ( respectively @pierrepinna, @Nicochan33 ,@HaroldSinnott, @psb_dc, @guzmand and @jblefevre60 ). We all believe that AR and Mixed Reality will play a key role across all sectors of the economy post adoption of 5G mobile and perhaps become the dominant form of interaction for the end user across mobile and other devices such as smart glasses and lead to entitle;y new customer experiences and opportunities in the future of work too.

Currently AR and VR have limitations due to the constraints of the existing networks in terms of latency and other issues such as network performance in terms of connections and reliability. However, there is the potential for the JPEG XS combined with 5G should allow for mobile and other digital interfaces (wearables, smart devices) to combine with AI (for example smart mirrors with personalised recommendations in store and payment made on the smart mirror via the face of the customer) and open up new experiences and exciting new opportunities that we have yet to imagine that will impact Financial Services and all other sectors.

The spread of smart sensors, smart cameras and other connected devices across the Edge will mean near real-time analytics all around us that will enable us to predict and deal with issues much earlier in the process before they become a major problem, or even ideally mitigate problems before even arise.

In the event that autonomous vehicles (and I believe that they will) result in a significant reduction in fatalities and injuries on the road then this will have a massive impact on insurance companies. Furthermore, it is widely predicted that the number of cars on the road will decrease substantially by 2030 according to Credit Suisse as people go more towards car-pooling and ride sharing services rather than owning a vehicle meaning less cars to insure.

Once autonomous vehicles do take off, the passengers will be able to do their banking, shopping along with the relevant payments, and leisure activities in the car with facial recognition used to identify and personalise the experience for the occupants of the vehicle with AR used as the interface within the vehicle.

Areas such as automated defect analysis in the industrial sector and improved supply chain logistics should result in not only a more efficient and safer manufacturing sector but also one with reduced claims. It may be that the insurance companies will need to reconsider their business model in the next few years.

I also discussed with Spiros Magaris (@SpirosMargaris ), Jim Marous and Brett King on @Breakingbanks1 about how the financial sector will be disrupted by AI. My personal view has been and still remains that the vast majority of financial institutions view technology as a cost centre and not a potential revenue centre. Many banks are still operating with antiquated legacy systems that are suboptimal for the adoption of new technologies. Spiros made a useful observation that whilst the innovative technology will be developed outside of the Financial Services space and then it is all about the Financial Services participant then applies the technology successfully for the customers. It is true that ultimately Banks and Insurance companies may lack the culture and resources to rival the tech majors and so the innovation may arise elsewhere, but there may need to be a shift in culture within Financial Services to view AI technology less as a pure back office activity and more as a potential for competitive advantage, or even survival as the world of industry 4.0 emerges with 5G from 2021 onwards in many parts of the world.

The relevant Breaking Banks episode is available at the following link: https://breakingbanks.com/episode/deep-learning-goes-public/

We will see the continued adoption of AI across Fintech & Insurtech. In fact I believe that upon the adoption of 5G all Fintech applications will have an AI aspect to them as automation and predictive processes spread across the entire sector.

I personally believe that the Insurance sector will be affected even more than the Banking sector by the arrival of 5G, continued adoption of AI and other emerging technologies that will evolve rapidly with the onset of 5G such as AR and VR and also the growth of Edge Computing resulting in an Intelligent Internet of Things (IoT) meaning that over time the amount of risk that we face in our daily lives will reduce and thereby impact Insurance companies business models directly.

We are also likely to continue to witness the likes of Google, Amazon, Facebook and Apple (GAFA) continuing to make inroads around the FinTech space, however, I personally believe that with the advent of 5G that maybe we'll also see the Telecoms companies enter the FinTech space even more directly as they are used to operating within the regulated environment and will seek to find ways to monetise the costs of the 5G licences or perhaps a visionary retailer aside from Amazon and Alibaba (as retail gets transformed by 5G and AI).

Imtiaz Adam is a Hybrid Strategist and Data Scientist. He is focussed on the latest developments in artificial intelligence and machine learning techniques with a particular focus on deep learning. Imtiaz holds an MSc in Computer Science with research in AI (Distinction) University of London, MBA (Distinction), Sloan in Strategy Fellow London Business School, MSc Finance with Quantitative Econometric Modelling (Distinction) at Cass Business School. He is the Founder of Deep Learn Strategies Limited, and served as Director & Global Head of a business he founded at Morgan Stanley in Climate Finance & ESG Strategic Advisory. He has a strong expertise in enterprise sales & marketing, data science, and corporate & business strategist.

Leave your comments

Post comment as a guest