Comments

- No comments found

Companies that have additional cash in hand after paying their expenses and dividends have several choices.

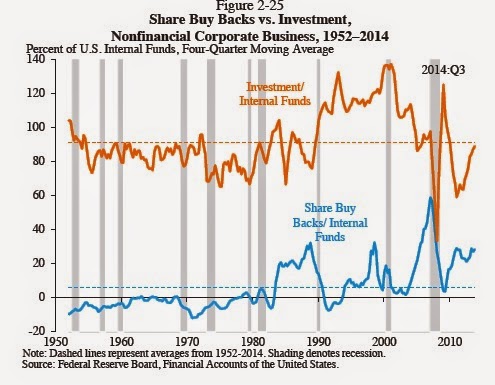

They can use the funds for investing to increase output or improve efficiency, or they can use the funds to buy back the company’s own shares. Here’s the pattern between these two choices over time. (Firms can also get funds for investment from other sources, like issuing bonds, so the two lines in the figure below don’t need to sum to 100%.)

And here’s the explanation from the Council of Economic Advisers:

Nonfinancial corporations spent a lower-than-average share of their internal funds (also known as cash flow) on investment during 2011 to 2013 (see Figure 2-25). Instead, these corporations used a good part of those funds to buy back shares from their stockholders. Share buybacks are similar to dividends insofar as they are a way for corporations to return value to shareholders. They differ, however, with regard to permanence: whereas dividend changes tend to persist, share buybacks are one-time events. (When firms raise investment funds by issuing new equity, the nonfinancial sector aggregate of share buybacks in the figures can be negative, as was common in the 1950s and 1960s.) The decline in the invested share of internal funds from 2011 to 2013, together with the rise in share buybacks, suggests that firms had more internal funds than they thought they could profitably invest. As can be seen in Figure 2-25, the investment outlook appears to have improved in 2014, and the investment share of internal funds has rebounded to near its historical average. Share buybacks, however, remain high.

I’ll only add that one of the major conundrums for the U.S. economy during the slow recovery since the Great Recession has been the issue of ”Sluggish U.S. Investment”. Many firms were earning high profits, but as they saw it, the most productive option for using a substantial share of those profits during the last few years apparently was not to invest in the higher efficiency and output. If you want some help with your investment, be sure to check out bfinance.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest