Comments

- No comments found

Today, even people who are far from investing are interested in cryptocurrency.

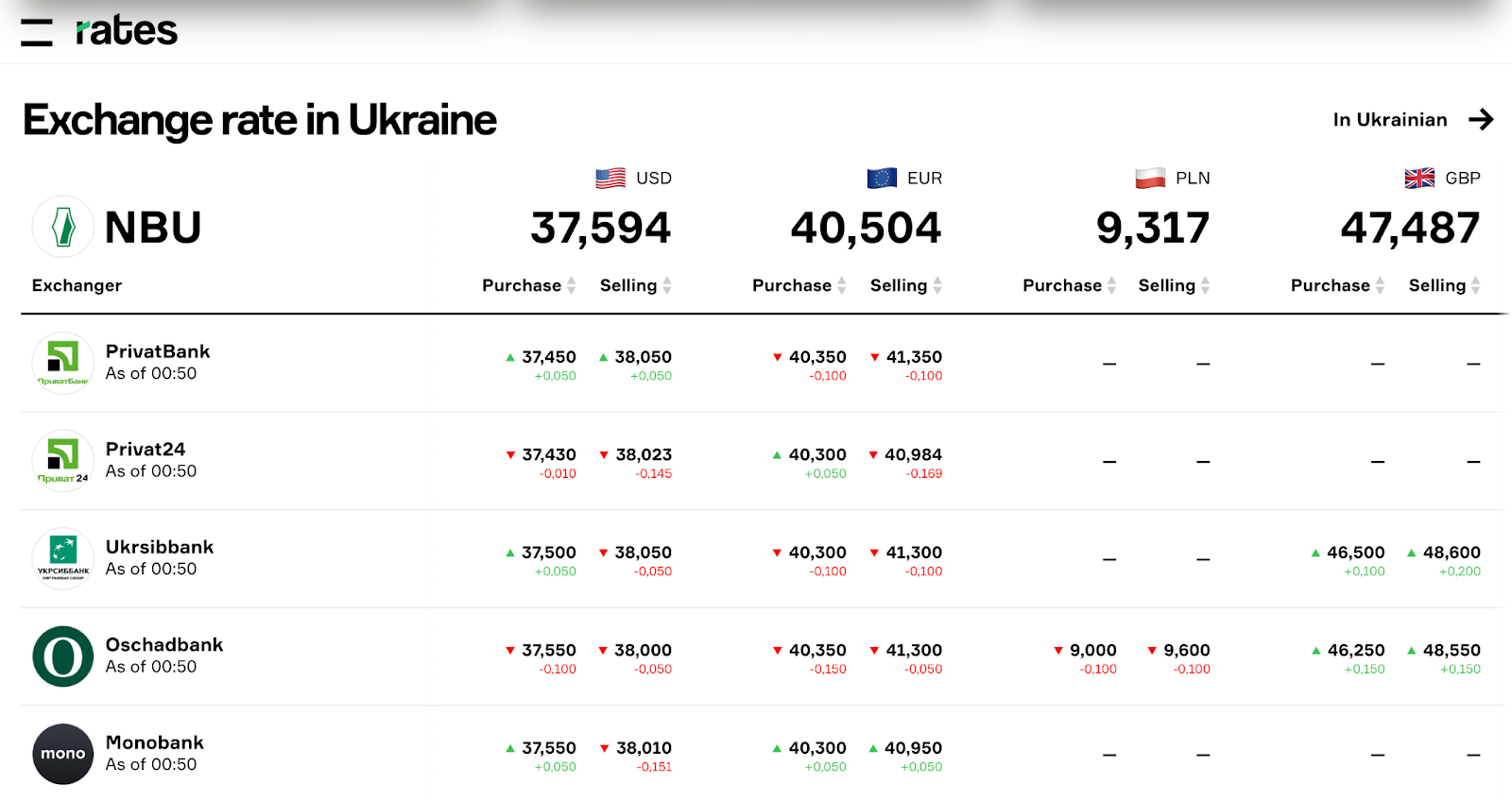

The cryptocurrency rate is now unpredictable, and therefore the issue of investing in this asset should be considered more carefully. This article is devoted to the features of investing in cryptocurrencies. To improve the experience of interacting with fiat currencies and cryptocurrencies, we recommend using Rates - all about finances service, available to users from Los Angeles, Toronto, Brussels, and other parts of the world (USA, Canada, and other countries).

This is a new form of asset that is very different from traditional financial models. A distinctive feature of cryptocurrency is its decentralized nature, which excludes the intervention of the Central Bank or other regulators. Another feature is that cryptocurrency exists exclusively in digital form.

The basis of operation is blockchain - an innovative technology that unites decentralized nodes into a common network for encrypting and storing data. This unified register of transactions guarantees transparency and security of transactions, eliminating the possibility of manipulation and falsification.

Cryptocurrencies act not only as a means of investment but also as a way to preserve and increase capital. Today there are more than 10,000 types of cryptocurrencies.

Among the most common cryptocurrencies, along with Bitcoin, are Ethereum, Tether, Ripple, Litecoin and Dogecoin. Their popularity testifies to the dynamic development of the cryptocurrency market and the attractiveness of this new form of financial relationships.

Experts call investments in digital currencies promising. A number of factors contribute to this:

Expansion of scale. Increasing use and adoption across various industries is helping to bolster the reputation of digital currencies. User trust strengthens support from large companies.

New participants from China and India. An additional impetus for the development of the sphere and an increase in deposits in cryptocurrency was the emergence of new players in the market. Global companies are becoming more interested in finding alternative means of financing that are not dependent on political events.

Accepting cryptocurrencies for payment. The largest online stores and companies are starting to use cryptocurrency (in particular Bitcoin) as a means of payment.

Investing in cryptocurrency is becoming more popular as experts predict further growth in asset values. However, periods of stagnation or falling prices cannot be ruled out.

Long-term investments are considered promising - from a year. Such investments are beneficial because they allow you to avoid short-term market fluctuations.

The value of digital currency is formed taking into account many factors. Among them:

Transactions of the largest investors. Decisions and statements of major players in the cryptocurrency market can have a significant impact on the value of the coin. Any action causes both a sharp rise and fall in prices.

Regulatory actions. Regulatory statements have an important impact.

Infrastructure changes. New technologies or improvements to existing ones increase the confidence of market participants, which attracts new assets.

The fall and rise of cryptocurrencies occur due to events that affect the blockchain network. A decrease in the exchange rate is often observed in situations related to the security of wallets and crypto exchanges. It should be understood that investing in cryptocurrency today has its own risks and prospects.

Digital currencies are high-risk assets, so investors should be prepared for possible price fluctuations. Among the most popular currencies among beginners:

Bitcoin (BTC). Bitcoin remains the most liquid and stable cryptocurrency. Investing in Bitcoin has a high level of liquidity, so you can expect your capital to grow over time.

Ethereum (ETH). Ethereum is a platform for creating decentralized applications (DApps). It is characterized by stable development, and the ability to create your own blockchain applications makes such a crypt attractive for financial transactions.

Monero (XMR). This cryptocurrency is distinguished by the anonymity of transactions, which makes it attractive to those who value privacy.

Ripple (XRP). Ripple is designed for venture operations and has low fees for making payments.

Counterparty (XCP). Counterparty provides a blockchain-based financial platform that uses its own currency, XCP. Transactions are carried out using Bitcoin addresses.

Factom (FCT). Factom uses blockchain technology to ensure data security, which is important for various businesses.

Most often, professionals in the field of digital currency advise a beginner to invest in Bitcoin, since this cryptocurrency is considered the most widespread and stable. Portfolio diversification will help reduce risks in conditions of high market volatility.

How to successfully invest in cryptocurrency? This process requires careful planning. It is also worth being aware of possible risks and using only free money to form an investment portfolio.

Where to start:

Before you start investing, decide on the cryptocurrency in which you plan to invest. Study the basic operating principles of each digital coin, its technological features, and development prospects.

Create a reliable and secure wallet for storing cryptocurrency. If you plan to buy crypto using traditional currencies using Visa and Mastercard, you will also need to register with the exchange. Popular ones include Binance, Huobi, and Coinbase.

After choosing an exchange and creating a wallet, you can start buying cryptocurrency. First, study current quotes, analyze the market, and find the optimal time to buy.

To invest wisely in crypto and start earning money, it is first of all important to ensure the safety of existing assets. It's best to use two-factor authentication and update your wallet software regularly. Also, do not use public Wi-Fi networks to access your wallet, as this increases the risk of losing your investment.

Cryptocurrency requires long-term investments. The fact is that the crypto market is subject to strong fluctuations, so asset growth can only be achieved with long-term investments. There are many effective strategies for investing in cryptocurrencies; we recommend consulting with professionals on this issue. To diversify risks, it is best to include several assets in the portfolio; to form a financial cushion, you can use not only available funds but also an Aetna or Aflac insurance policy.

Cryptocurrency is an interesting asset that, with the right approach, can bring profit to investors. It is important to choose the right strategy depending on your goals, as well as a safe way to buy and store cryptocurrency. To study the best financial solutions, we recommend using the Rates.fm service, which also allows users to track currency exchange rates (dollars, euros, etc.) in financial institutions in Ukraine.

Leave your comments

Post comment as a guest