Comments

- No comments found

Artificial intelligence (AI) is reshaping the insurance industry by verifying data, assessing risk, detecting fraud and lowering human error.

Insurance protects individuals and businesses from losses and damages. There are several types of insurance, including health insurance, car insurance, life insurance, and homeowners insurance. Insurance can help protect against a wide range of risks and losses, and it is an important financial tool for managing risks and protecting your assets.

Source: McKinsey & Company

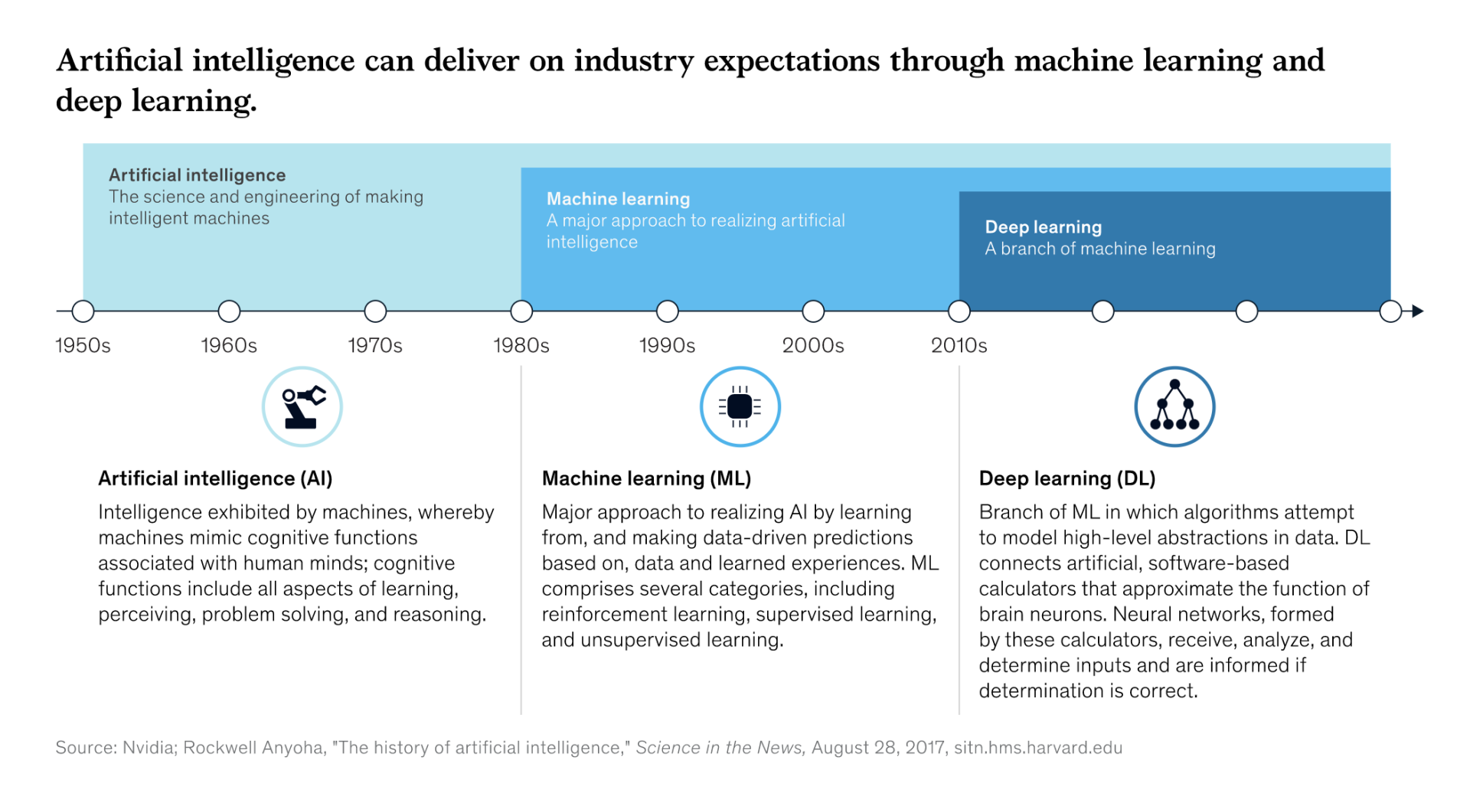

AI technologies, such as machine learning and natural language processing, can be used to analyze large amounts of data and make more accurate risk assessments. This can help insurers to more accurately price policies and reduce the risk of fraud.

AI can also be used to improve customer service by providing personalized recommendations and assistance to policyholders. For example, insurers may use AI-powered chatbots to answer customer questions and provide information about policies and coverage.

In addition, AI can be used to automate certain processes, such as claims adjustment, which can improve efficiency and speed up the claims process.

AI has the potential to transform the insurance industry by improving risk assessment, customer service, and operational efficiency.

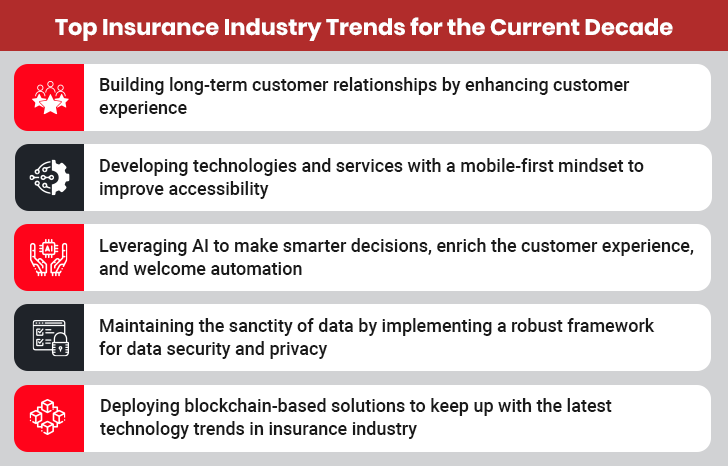

The latest trends in the insurance industry include:

The use of technology: Insurers are using technology, such as data analytics and artificial intelligence, to improve underwriting, risk assessment, and customer service.

The rise of insurtech: New insurance startups, or "insurtech" companies, are using technology to disrupt the traditional insurance model by offering innovative products and services, such as peer-to-peer insurance and on-demand coverage.

The growth of digital channels: Insurance companies are increasingly using digital channels, such as online portals and mobile apps, to reach and interact with customers.

The focus on customer experience: Insurers are placing a greater emphasis on improving the customer experience, including by using customer data to tailor products and services to individual needs.

The increasing use of telematics: Some insurers are using telematics, or the collection of data from vehicles, to offer personalized pricing and incentives for safe driving.

The use of drones for claims adjustment: Some insurers are using drones to assess damage and facilitate claims adjustment, particularly in the case of large-scale disasters.

The increasing importance of sustainability: Insurers are becoming more aware of the risks associated with climate change and are beginning to offer products and services that support sustainable practices.

It is difficult to predict exactly how the insurance industry will evolve over the next few years including 2023, as it is influenced by a range of factors such as economic conditions, technological developments, and regulatory changes. However, it is likely that the insurance industry will continue to adopt new technologies and data analytics to improve underwriting, risk assessment, and customer service.

The rise of insurtech companies may also continue to disrupt the traditional insurance model, leading to the introduction of new products and services. In addition, it is likely that insurers will continue to focus on improving the customer experience and using digital channels to reach and interact with customers. The increasing importance of sustainability may lead to the development of more environmentally-conscious insurance products and practices.

The future of artificial intelligence (AI) is difficult to predict with certainty, as it depends on a range of factors such as technological advancements, economic conditions, and societal attitudes. However, it is likely that AI will continue to play an increasingly important role in many areas of society, including business, healthcare, transportation, and entertainment.

Some potential developments in the future of AI include:

Continued improvements in machine learning algorithms, which could lead to more advanced and capable AI systems.

The development of AI systems that can perform tasks that currently require human intelligence, such as creative problem-solving and decision-making.

The integration of AI into a wider range of products and services, leading to more widespread use of the technology.

The emergence of AI-powered assistants and personal assistants that can perform tasks and provide information on demand.

The use of AI to address societal challenges, such as improving healthcare and addressing environmental issues.

It is important to note that the future of AI will depend on how the technology is developed and used. It is up to society to shape the direction of AI and ensure that it is used ethically and responsibly.

The future of insurance is likely to involve the continued adoption of new technologies and data analytics to improve underwriting, risk assessment, and customer service. The rise of insurtech companies may continue to disrupt the traditional insurance model, leading to the introduction of new products and services. Insurers may also increasingly use digital channels, such as online portals and mobile apps, to reach and interact with customers. The focus on customer experience is likely to remain a key trend in the insurance industry, as insurers seek to tailor products and services to individual needs and preferences. It is also possible that the increasing importance of sustainability will lead to the development of more environmentally-conscious insurance products and practices.

Leave your comments

Post comment as a guest