Comments

- No comments found

When I hear or read that artificial intelligence (AI) is “disrupting” financial planning and analysis, I tend to challenge the premise.

The word “disrupt” means to me to interrupt, alter or destroy the structure of something. I look at AI (or really all technology for that matter) as having the potential to enhance and/or improve the financial planning & analysis (FP&A) function. Semantics? Maybe.

While AI is still a far-off concept for many companies, it is real and I truly believe it is the future of FP&A and really, Finance as a whole. While I am certainly no techie, I define AI as systems that are capable of ingesting information and instructions, learning from interactions with human beings and responding to new situations and questions in a human-like way. AI goes beyond technologies that merely automate rules-based activities – like Robotic Process Automation (RPA). AI can recognize patterns, learn and adapt to new situations.

Business partners want a better understanding of the analysis/information they receive from finance.

From the many discussions I have had with Finance leaders, there is overwhelmingly agreement that their business partners want a better understanding of the analysis/information they receive from Finance and they want and expect Finance to simplify it for them. There is constant pressure to provide accurate and timely analysis to support effective business decision making and AI, while not the complete solution, is a powerful tool to enable Finance to meet the business’s needs and expectations.

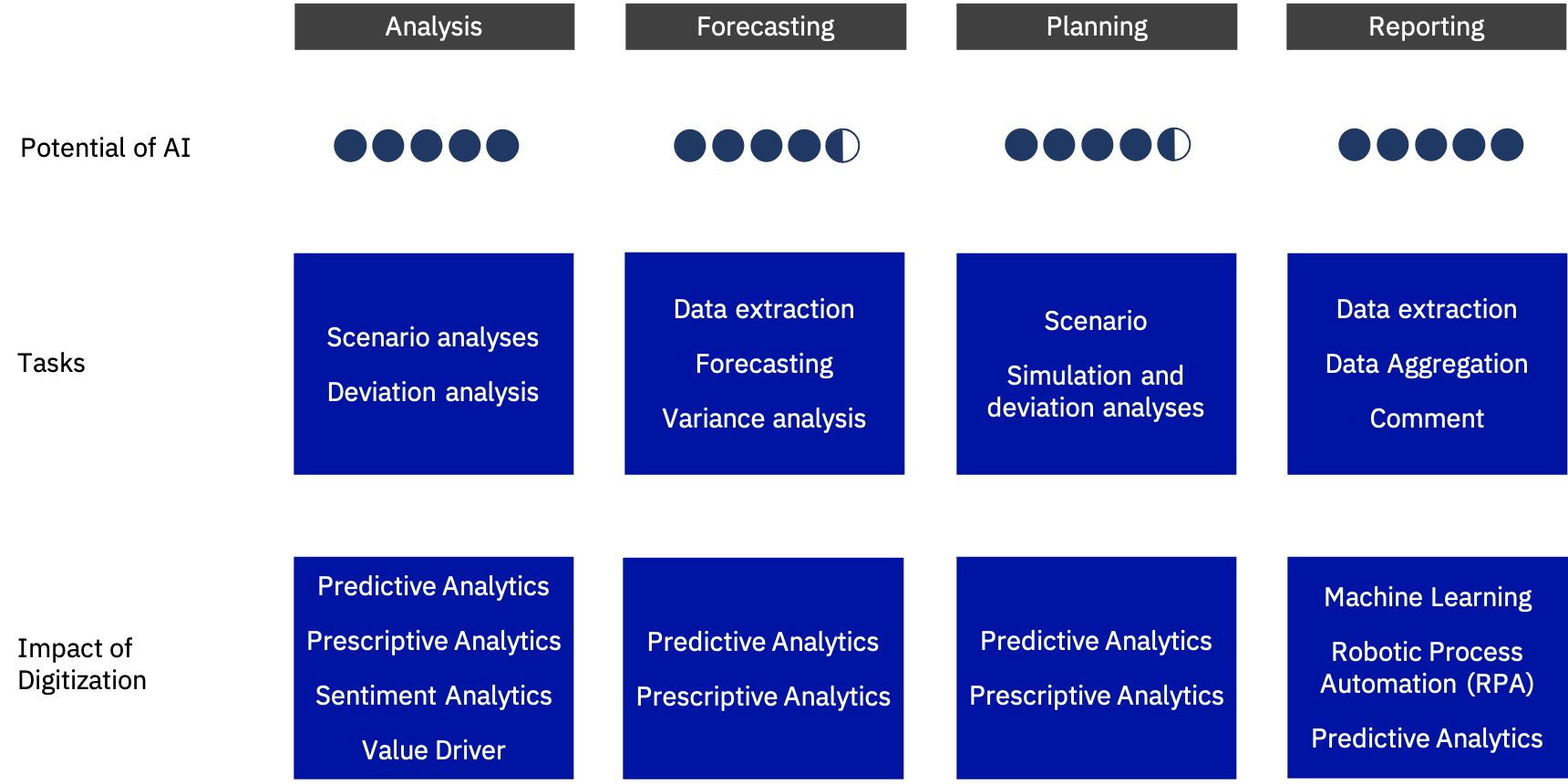

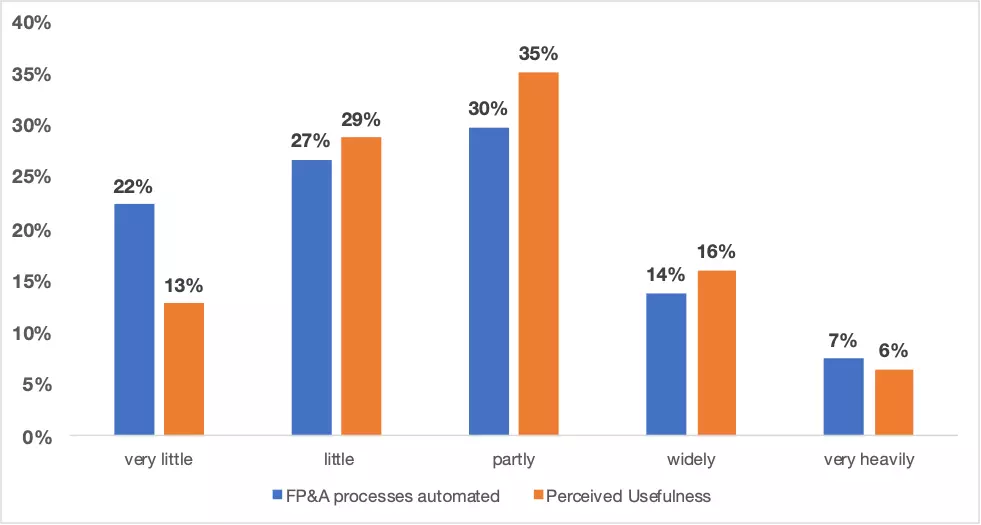

The benefits of AI are many-fold: it can help develop better real-time and accurate reporting; it can help automate trigger-based processes for compliance; it can help minimize manual interventions, increasing the accuracy of forecasts; it can help to optimize the use of resources and increase productivity; and it can help to expand the number of scenarios and simulations that can be run in the least amount of time.

As organizations strive to implement an analytics culture for data-driven decision making, AI can be an important component in that process. AI can help us provide predictive and prescriptive analysis on past, present and future performance. AI can assist in developing a common strategic vision and help the FP&A function develop a better understanding of the business’s key metrics. We can look forward to operating in a world where we have access to instantaneous and continuous insights in a low or zero-touch environment.

AI can enable the FP&A function to flourish and thrive by supporting the development and improvement in our people, data, processes, technology and performance indicators.

In an AI-enhanced FP&A operation, our people are highly-skilled, they have the resources available to them to not only perform effective root cause analysis, but to offer actions that can influence and impact the organization, all while minimizing the total amount of resources required.

We will have well-managed big data and real-time data along with complete and accurate data in a timely fashion, and we will have it available from both external and internal databases on a real-time basis.

Our processes will be standardized at a global level and our reports will be automated and mimic human actions through existing user interfaces based on pre-defined rules. The ability to integrate the perspective of past, present and future performances will lead to better decision making and improved benchmarking capabilities.

Our technology will be automated tools, with guided interactivity and machine learning (ML) capabilities and cognitive tools with predictive and proscriptive insights. These new tools will support ad-hoc reporting that can leverage unstructured data.

Our performance indicators will be low cost, with real-time business insights, with the ability to provide customized services, provide decision support and value-enhanced advice.

Now, I freely admit that to many Finance professionals, all of this sounds like science fiction. But consider that not too long ago, the concept that I would be able to “talk” to a machine and it would respond to my questions or requests (think Natural Language Processing, i.e. Siri and Alexa), would have been considered in the realm of sci-fi.

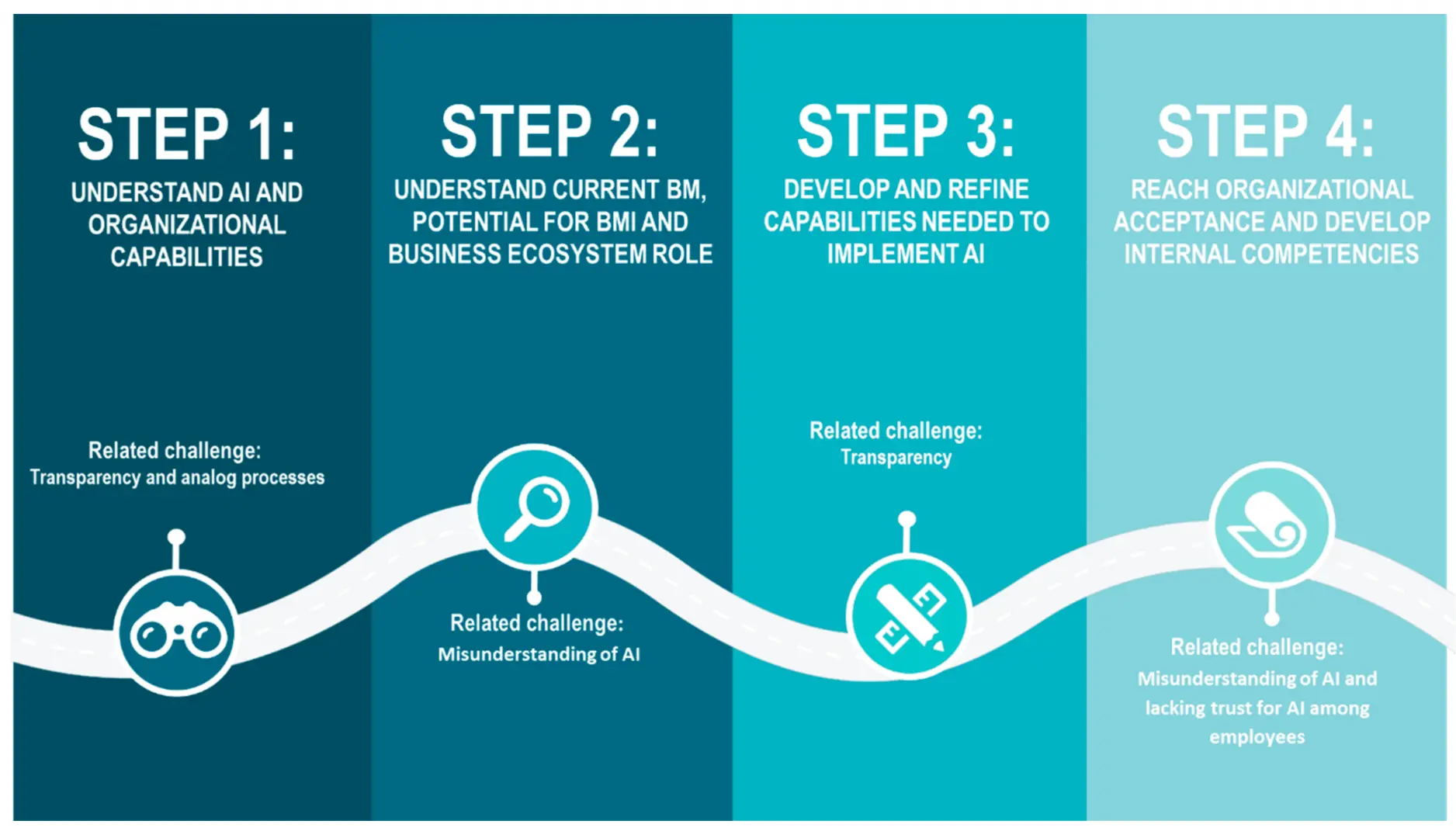

The current state of AI deployment can be fairly described as “developing”, with organizations making initial investments and developing practical applications. I believe there are four components to a successful AI application: a well-defined and desirable challenge to be solved, access to clean and well-labeled data (master data management), robust and scalable algorithms, and computing power.

I believe we, as a profession, are well on our way to developing, utilizing, and maximizing the power of AI. Change is often difficult, to quote Albert Einstein, “The world as we have created it is a process of our thinking. It cannot be changed without changing our thinking”.

Brian is Founder and Principal at Kalish Consulting. He is Former Executive Director – Global FP&A Practice at AFP. He has over 20 years of experience in Finance, FP&A, Treasury and Investor Relations. He previously held a number of treasury and finance positions with the FHLB, Washington Mutual/JP Morgan, NRUCFC, Fifth Third and Fannie Mae. He has spoken all over the world to audiences both large and small hosting FP&A Roundtable meetings in North America, Europe, Asia and soon South America. Brian attended Georgia Tech, in Atlanta, GA for his undergraduate studies in Business and the Pamplin College of Business at Virginia Tech for his graduate work. In 2014, Brian was awarded the Global Certified Corporate FP&A Professional designation.

Leave your comments

Post comment as a guest