Snapped up like hot cakes by investors in previous years, luxury housing sales are still in the doldrums and hinging largely on end-user sales.

Even after three years of demonetization, despite having the lowest share of overall unsold stock in the top 7 cities, it remains the worst-performing of all budget categories.

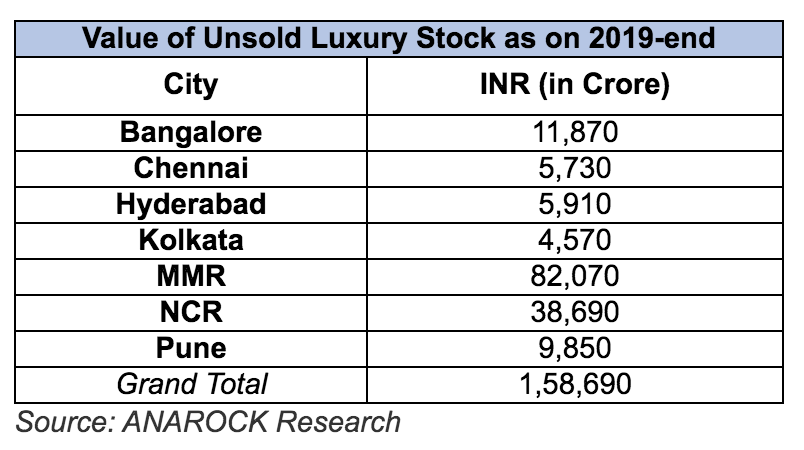

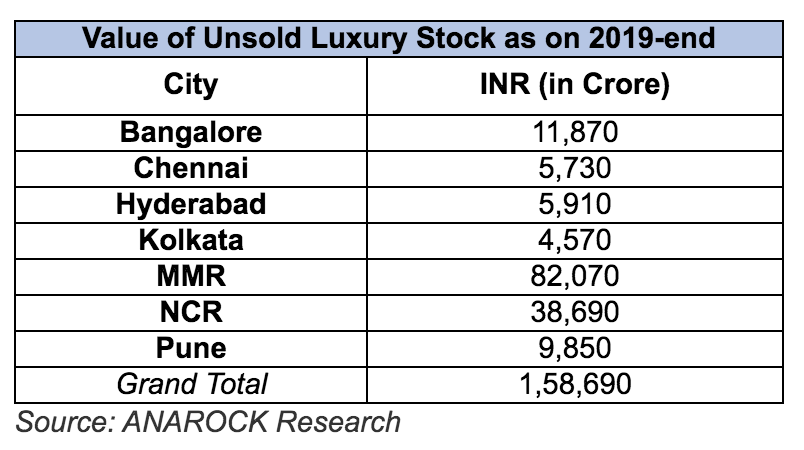

Unsold luxury stock had increased by 10% y-o-y in the top 7 cities by 2019-end, reveals ANAROCK data. There were 89,200 units of unsold luxury stock (homes priced >INR 1.5 Crore) by 2019-end as against 81,290 units in 2018. Overall value of unsold luxury stock as on 2019 is estimated to be nearly INR 1.59 lakh crore, which is 34% of total unsold stock value.

Overall unsold housing stock across different budget segments stood at 6.48 lakh units worth INR 4.64 lakh crore in top 7 cities by 2019-end, declining by mere 4% since 2018. On breaking down the unsold stock at the two extreme ends of the budget spectrum, it emerges that affordable homes comprised the maximum share at 36% while luxury homes had the least, with less than 14% share. Luxury developers have severely curtailed the supply pipeline, primarily due to the absence of investors in this segment.

Mid-segment homes priced between INR 40-80 lakh shed the maximum unsold stock in 2019 by 15% - from nearly 2.27 lakh units in 2018 to approx. 2.02 lakh units in 2019-end.

Except Kolkata, all cities saw their unsold luxury stock increase in 2019:

- Kolkata - in sharp contrast to other cities - saw a 10% decline in its unsold luxury stock, from 2,265 units as on 2018-end to approx. 2,050 units by 2019.

- MMR did reasonably well - despite adding almost 11,250 luxury units in 2019, the region saw a mere 2% y-o-y increase in unsold luxury stock – from 48,040 units in 2018 to 48,970 units by 2019-end.

- Hyderabad and Pune saw unsold luxury stock increase by a whopping 58% and 56% respectively during the period. Hyderabad's pent-up luxury stock rose from 3,000 units in 2018 to nearly 4,740 units in 2019; in Pune, it increased from 2,750 units in 2018 to 4,290 units in 2019.

- In Chennai, unsold luxury stock increased by 33% in a year – from 2,480 units in 2018 to nearly 3,300 units by 2019-end.

- NCR saw its unsold luxury stock increase by 17% in the period. The unsold luxury stock here was the second-highest after MMR with around 18,400 units by 2019-end.

- Bangalore’s unsold luxury stock also increased by 6% - from 7,010 units in 2018 to 7,470 units by 2019-end.

Unsold Housing Stock: Budget-wise Performance

Of the total current unsold stock of nearly 6,48,400 units in the top 7 cities, affordable housing (priced <INR 40 lakh) comprised the maximum share at about 36%, followed by 31% in the mid-segment (INR 40-80 lakh). The share of unsold premium homes priced between INR 80 lakh and INR 1.5 Cr was 19%, while luxury accounted for 14%.

- Mid-segment homes shed over 15% unsold stock during the year – from 2,36,600 units in 2018-end to approx. 2,01,670 units by 2019-end. Bangalore and Hyderabad saw the maximum yearly stock decline of 37% and 34% respectively.

- Affordable housing, with the highest new supply in 2019, affordable homes saw unsold stock reduce by a marginal 1% - from 2,38,750 units in 2018 to 2,36,640 units by 2019-end. Hyderabad, Kolkata, Chennai and NCR shed maximum unsold affordable stock - by 28%, 11%, 10% and 9% respectively.

- Unsold stock of premium homes priced from INR 80 lakh to INR 1.5 Cr increased by 4% to 1,20,900 units as on 2019-end.

Leave your comments

Post comment as a guest