Comments

- No comments found

Credit Suisse was founded in 1856, and then shut down earlier this month by Swiss bank regulators, who forced the sale of the firm to UBS.

Thus, there is some irony and even poignancy in looking at the just published 2023 yearbook of the Credit Suisse Research Institute, titled “Credit Suisse Global Investment Returns: Leading perspectives to navigate the future,” written by Elroy Dimson, Paul Marsh, Mike Staunton. A summary edition of the report is freely available online.

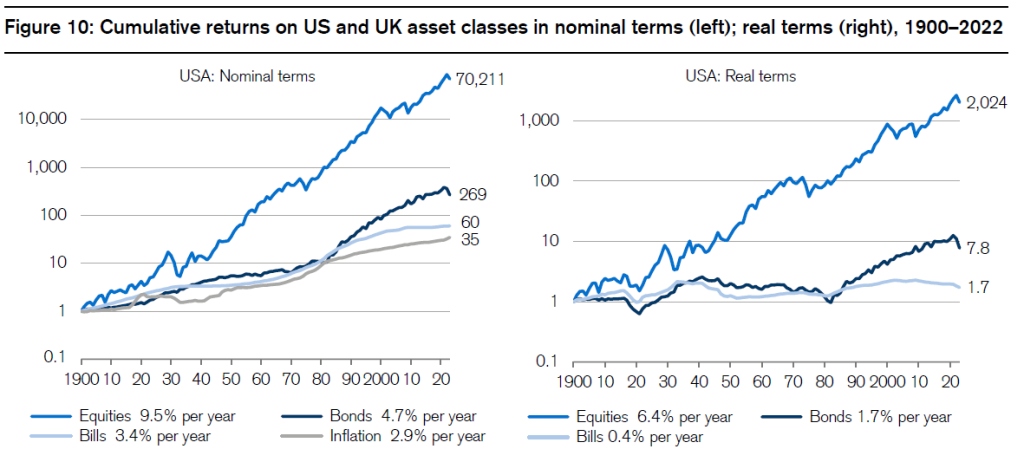

Each year, a main emphasis of the report is on long-term returns going back to about 1900. Here’s a graph showing nominal and inflation-adjusted returns for US stocks, bonds and “bills” (short-term government debt). Yes, investing $1 in a diversified portfolio of US stocks back in 1900 and reinvesting all dividends since then would have led to a real gain by a factor of more than 2,000 since then. (Notice that the vertical axis is logarthmic, rising by factors of 10.)

In addition, this long-term perspective–using annual data–puts some prominent events into perspective. The authors write:

The chart shows that US equities totally dominated bonds and bills. There were severe setbacks of course, most notably during World War I; the Wall Street Crash and its aftermath, including the Great Depression; the OPEC oil shock of the 1970s after the 1973 October War in the Middle East; and four bear markets so far during the 21st century. Each shock was severe at the time. At the depths of the Wall Street Crash, US equities had fallen by 80% in real terms. Many investors were ruined, especially those who bought stocks with borrowed money. The crash lived on in the memories of investors for at least a generation, and many subsequently chose to shun equities.

The top two panels of Figure 10 set the Wall Street Crash in its long-run context by showing that equities eventually recovered and gained new highs. Other dramatic episodes, such as the October 1987 crash, hardly register; the COVID-19 crisis does not register at all since the plot is of annual data, and the market recovered and hit new highs by year-end; the bursting of the technology bubble in 2000, the Global Financial Crisis of 2007–09 and the 2022 bear market show on the chart but are barely perceptible. The chart sets the bear markets of the past in perspective. Events that were traumatic at the time now just appear as setbacks within a longer-term secular rise.

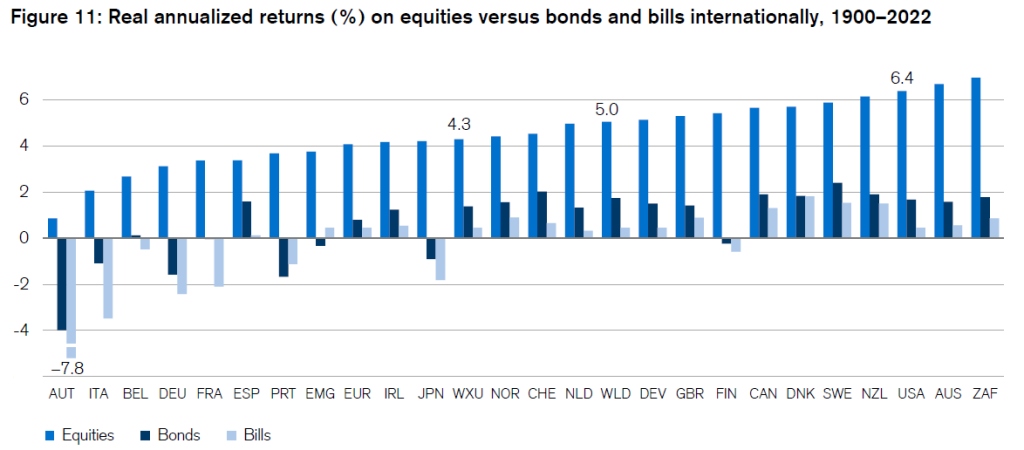

But it’s also worth remembering that the US investment experience is extraordinary. As the authors put it, it would be “unwise for investors around the world to base future projections solely on US evidence.” Here’s a figure with international comparisons. Although two tiny stock markets, South Africa (ZAF) and Australia (AUS), have outperformed the US stock market over time, the US market has dominated world returns. For the record, most of the abbreviation here are for countries, but WLD is the index for the entire world, WXU is the world leaving out the US, EUR is Europe, DEV is developed markets, and EMG is emerging markets.

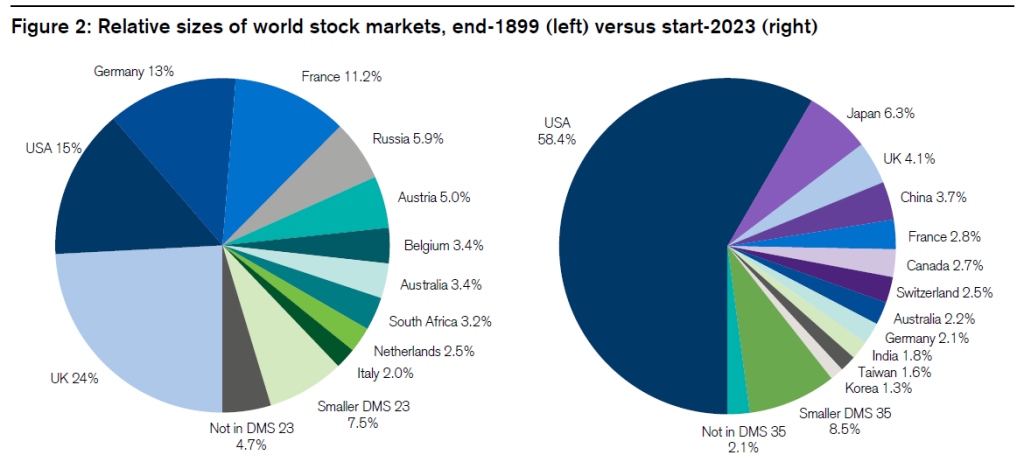

The extraordinary growth in the US stock market since 1900 means that, when it comes to global equity markets, the US stock markets dominate the world. Here are the sizes of stock markets around the world in 1900 and in 2022.

Timothy Taylor is an American economist. He is managing editor of the Journal of Economic Perspectives, a quarterly academic journal produced at Macalester College and published by the American Economic Association. Taylor received his Bachelor of Arts degree from Haverford College and a master's degree in economics from Stanford University. At Stanford, he was winner of the award for excellent teaching in a large class (more than 30 students) given by the Associated Students of Stanford University. At Minnesota, he was named a Distinguished Lecturer by the Department of Economics and voted Teacher of the Year by the master's degree students at the Hubert H. Humphrey Institute of Public Affairs. Taylor has been a guest speaker for groups of teachers of high school economics, visiting diplomats from eastern Europe, talk-radio shows, and community groups. From 1989 to 1997, Professor Taylor wrote an economics opinion column for the San Jose Mercury-News. He has published multiple lectures on economics through The Teaching Company. With Rudolph Penner and Isabel Sawhill, he is co-author of Updating America's Social Contract (2000), whose first chapter provided an early radical centrist perspective, "An Agenda for the Radical Middle". Taylor is also the author of The Instant Economist: Everything You Need to Know About How the Economy Works, published by the Penguin Group in 2012. The fourth edition of Taylor's Principles of Economics textbook was published by Textbook Media in 2017.

Leave your comments

Post comment as a guest