Comments

- No comments found

As the world rises from the unprecedented challenges of the COVID-19 pandemic, economies are fiercely driving towards recovery.

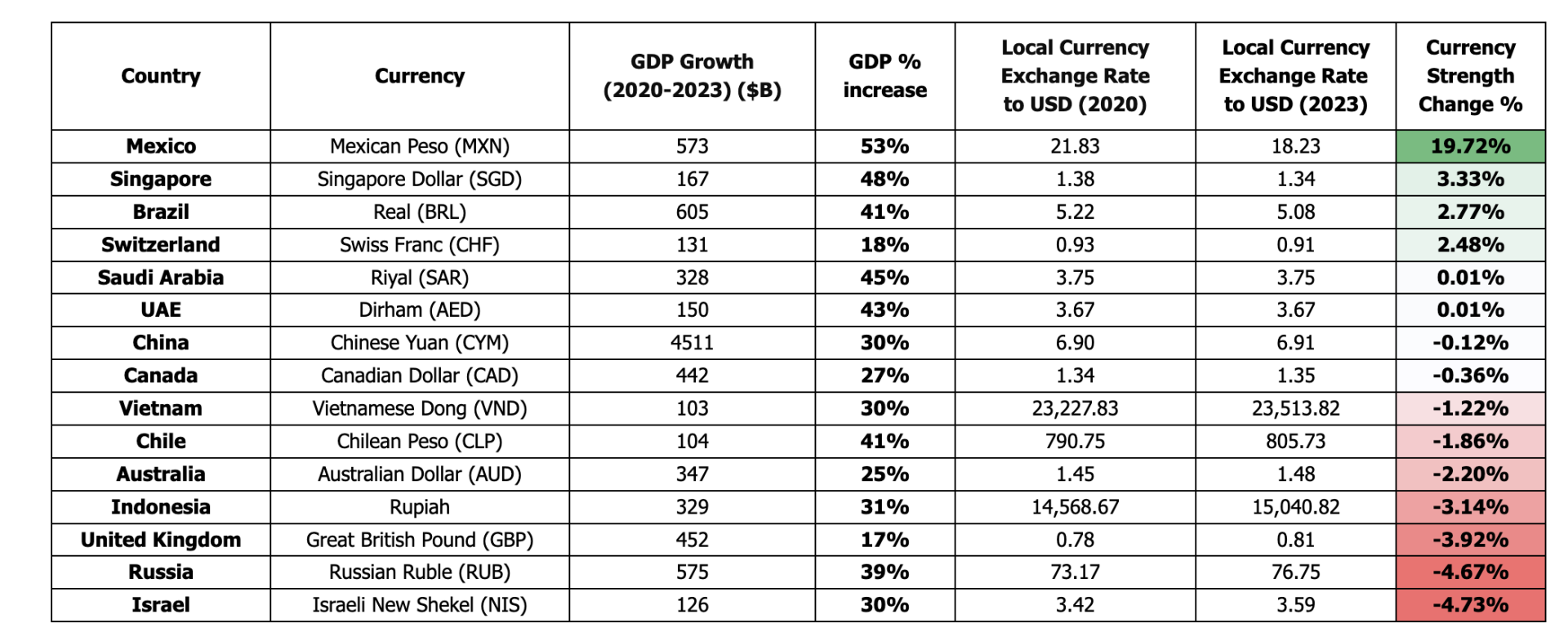

Remarkably, even amidst a 3.92% decrease between 2020 and 2023, the Great British pound still stands tall among the top 15 strongest currencies against the USD post-Covid.

That’s according to new research from the experts at City Index, who have analysed countries with the highest GDP and local currency strength against the USD to highlight which currencies have shown the largest growth following the economic disruption caused by the Covid-19 pandemic.

Key highlights include:

The UK has increased its GDP by $452 billion since Covid-19 broke out in 2020

The fastest recovering currency is the Mexican peso, with an increase of almost 20% post Covid, and a 53% increase in GDP

The Singapore dollar has increased by 3.33% post Covid (the second fastest recovering currency based on the exchange rate against USD)

Brazil’s Real places third, with a 2.77% increase in strength against the exchange rate to USD.

The UK (GBP) places 13th place in the data, with a decrease in currency strength of 3.92% post Covid, based on the exchange rate against USD. The UK’s low ranking can be due to the economy being held back by government spending and the Brexit aftermath. The strong trading frictions between the UK and the EU after Brexit increased the risk of uncertainty and political instability. Consequently, a decrease in currency strength in the UK meant that foreign goods, services and assets rose massively for residents, resulting in higher levels of inflation and a higher cost of living. In 2020, 78p was equal to one US dollar, but fast forward to 2023, 81p is required for a single USD.

The UK has however increased its GDP by $452 billion since Covid-19 broke out in 2020, according to the most recent data available, which displays economic growth. Fellow English-speaking country Canada in eighth place has a slightly lower currency decrease of 0.36% post Covid and increased GDP by 27% billion post Covid.

The experts from City Index commented:

“Now in 2023, the UK is bouncing back and has a GDP of $3,159 billion, a 17% increase from 2020. However, the UK’s economy is being held back by government spending and the effects of high energy prices due to larger shares of energy from natural gas. This ultimately has resulted in a stronger cost-of-living crisis in the UK, compared to other countries.

The data on currency strength against the USD also highlights that in the subsequent years, the UK economy is showing signs of upwards momentum. While not seeing a growth in currency strength as in countries such as Mexico (19.72%), Singapore (3.33%) and Brazil (2.77%), the decrease of 3.92% in UK currency strength can easily be improved over the next year. This is especially heartening to see when compared to economies such as Japan, who saw their currency strength decrease massively against the USD in the same timeframe.”

Mexico’s currency strength has increased by 19.72% post Covid. With an impressive increase in GDP of $573 billion from 2020 to 2023, and larger capital investment from the US and China, it is no surprise that the peso has managed to strengthen its currency by almost 20% post Covid.

Furthermore, its currency strength can be associated with a tighter monetary policy and expectations to grow at a faster rate than fellow Latin American countries. Pair this with cautious fiscal policies which differed from the majority of emerging economies, it is clear to see why the peso has become so strong.

Singapore’s currency strength places second in the data set, increasing by 3.33% since the pandemic. Currency strength can be affected by the overall economic health of a country, for example, factors such as GDP growth (in which Singapore increased by $167 billion from 2020-2023).

In addition, low inflation and high interest rates made its currency more attractive to investors, which led to an increase in demand for the Singapore dollar. In 2023, 1.34 SGD is equal to 1 USD, compared to 1.38 SGD in 2020.

In third place is Brazil’s real, which has increased its strength by 2.77% post Covid. The recent strength in currency and equity inflows is partially down to the rise in the price of industrial metals and agricultural products, contributing to a $605 billion increase in GDP between 2020 and 2023, which is $32 billion more than Mexico in first place.

Leave your comments

Post comment as a guest