Comments

- No comments found

Machine learning (ML) can quickly detect fraud, saving organizations and consumers time and money when implemented correctly.

As organizations grapple with how to keep up with consumers with the cost of living crisis, they are also dealing with an evolving digital landscape, with online payment fraud losses alone set to exceed $206 billion in 2025.

While machine learning can save organizations exponential amounts of time and money when implemented correctly, it can also come with some initial challenges. The key to any accurate machine learning model is the input data. Not only does enough historical data need to exist for the model to derive an accurate representation but the data also needs to be accessible.

Machine learning can be an invaluable tool in the detection and prevention of fraud.

Machine learning is a subset of artificial intelligence, and the key difference is the ‘learning’. With machine learning, we are able to give a computer a large amount of information and it can learn how to make decisions about the data, similar to a way that a human does.

Traditionally businesses relied on the following techniques to prevent fraud:

False positives

Rules based approach

Fixed outcomes

None of these methods were effective to prevent fraud, organizations have started focusing on ways to mitigate vulnerabilities within payment systems by leveraging machine learning and advanced technologies.

Machine learning does all the dirty work of data analysis in a fraction of the time it would take for even 100 fraud analysts. Unlike humans, machines can perform repetitive, tedious tasks 24/7 and only need to escalate decisions to a human when specific insight is needed.

Fraud detection is a challenging problem for organizatios during the Covid-19 pandemic. Fraudulent transactions have increased significantly due to lack of training, awareness and the rise of sophisticated cyberattacks. A small percentage of activity can quickly turn into big dollar losses without the right tools and systems in place. Criminals are crafty. As traditional fraud schemes fail to pay off, fraudsters have learned to change their tactics.

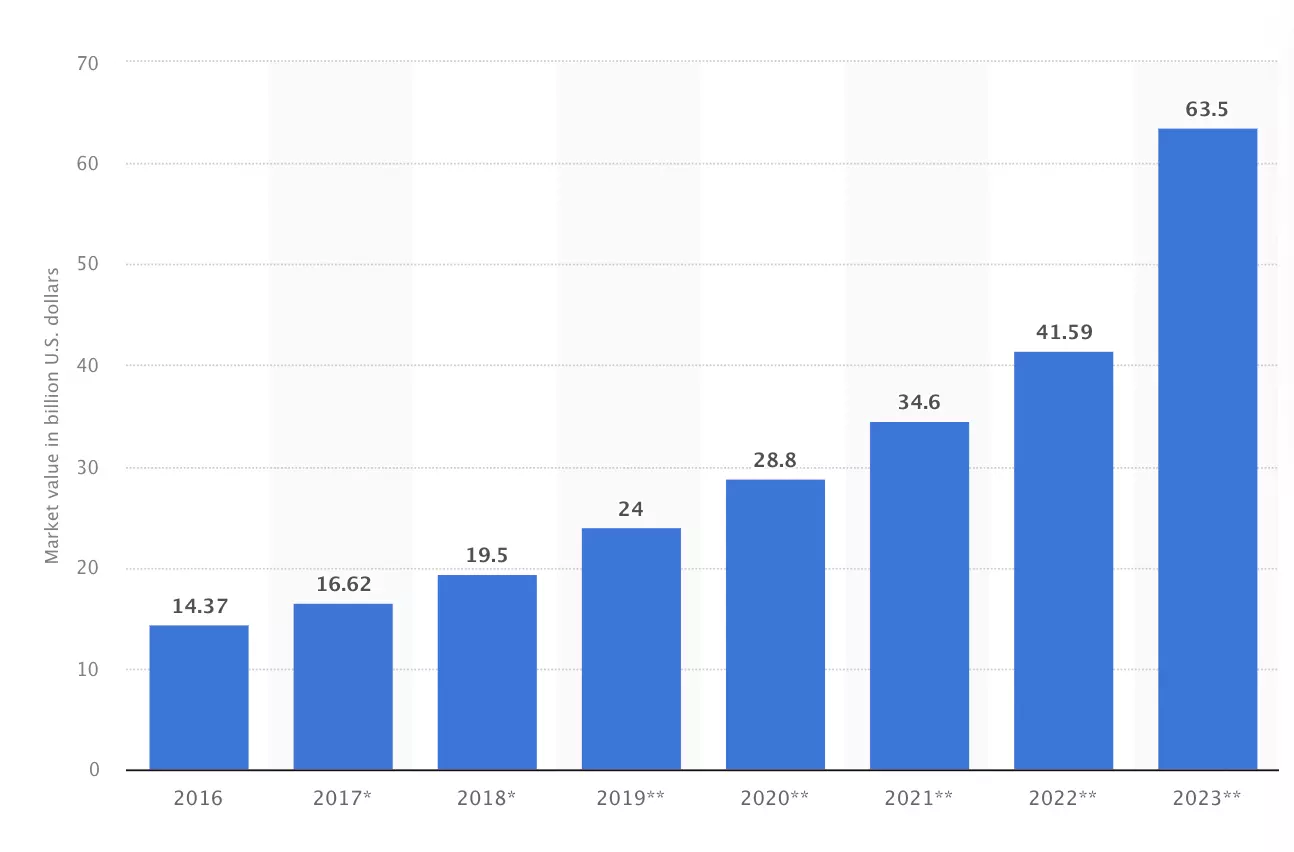

Size of the fraud detection and prevention (FDP) market worldwide from 2016 to 2022 (in billion U.S. dollars) | © Statista 2022

Machine learning can be used to analyze huge numbers of transactions in order to uncover fraud trends, which can subsequently be used to detect fraud in real-time.

Businesses may incur greater losses from false positives than from fraud itself. The involvement of machine learning in fraud detection can reduce the number of false positives from the process.

Organizations generally tend to spend thousands of dollars on preventing financial fraud from their digital transactions. While such measures may be useful for the purpose, there is another issue that needs sorting out: the number of false positives present amidst the fraudulent transactions detected. False positives are the legitimate transactions incorrectly flagged as fraudulent by your fraud detection tools. A surprisingly high number of credit card transactions are incorrectly labeled as illegitimate by fraud detection systems in businesses. As you know, every transaction flagged as fraudulent needs to be investigated thoroughly by your financial department. Such investigations are expensive, meaning that false positives may end up being more loss-making for businesses as compared to actual fraudulent transactions.

There are already ways in which machine learning impacts financial industries and operations. In the same vein, involving machine learning in fraud detection can prevent legitimate, legal transactions from getting flagged.

Machine learning can detect:

Machine Learning models have the ability to differentiate between actual and spam email addresses by analyzing the components of an email then classifying them either as good or fraudulent. Machine learning can prevent email phishing; a method in which an individual tries to con the recipient into responding with personal data which can then be used to access accounts.

Credit card theft and payment fraud are two other techniques in which the fraudsters use stolen information to make transactions, normally where the physical card is not required, such as online payments. Machine learning models can help prevent these cases by analyzing past actions of the customer including purchase amounts, location, and purchase types and flag a transaction that seems abnormal.

Fake applications and document forgery can also result in the creation of credit cards and accounts tied to the victim, who is then responsible for the payments. Neural network models can be trained to differentiate between these fake identities and require approval before the application is accepted.

Machine learning can be used to create fraud alerting systems. Such systems are configured to scan and identify behavioral patterns of payers from past transactions—known as "features." The algorithms in such systems can accurately detect abnormal transactions and features in a given transaction. Context-based filters in such systems enable you to receive alerts for only specific types of features. As we know, machine learning algorithms perform more and more accurately with time as the scope of their "knowledge" keeps increasing with each transaction

As a result, machine learning adopts behavioral pattern recognition to bring greater accuracy into your fraud detection processes.

Naveen is the Founder and CEO of Allerin, a software solutions provider that delivers innovative and agile solutions that enable to automate, inspire and impress. He is a seasoned professional with more than 20 years of experience, with extensive experience in customizing open source products for cost optimizations of large scale IT deployment. He is currently working on Internet of Things solutions with Big Data Analytics. Naveen completed his programming qualifications in various Indian institutes.

Leave your comments

Post comment as a guest